From everyone at MarketGauge, we hope you’ve had an enjoyable Thanksgiving weekend and that it kicks off a happy and healthy holiday season for you and the ones you love.

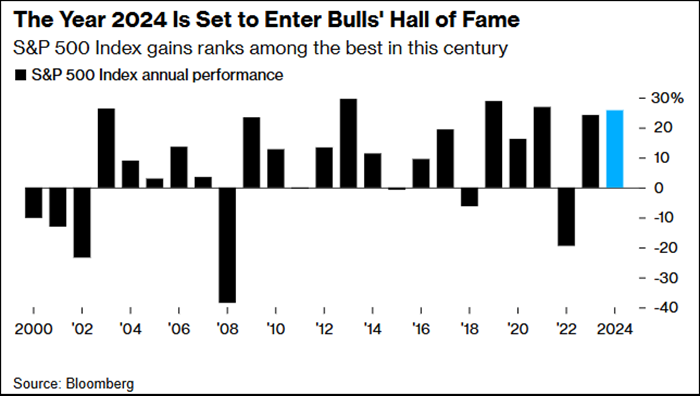

November closed with the distinction of being one of the strongest November’s in the last 20+ years and the best-performing month of the year in the

S&P 500

.

A Month That Sets The Stage For What’s Ahead

The month’s market action was greatly influenced by the elections and politics have since been setting the stage for what’s next for traders and investors.

While most of our analysis will consider the action of November to begin on its first trading day, readers and members of MarketGauge’s discretionary trading services will also consider many of the trends relative to the election range of November 5-6th (the election day and the reaction day).

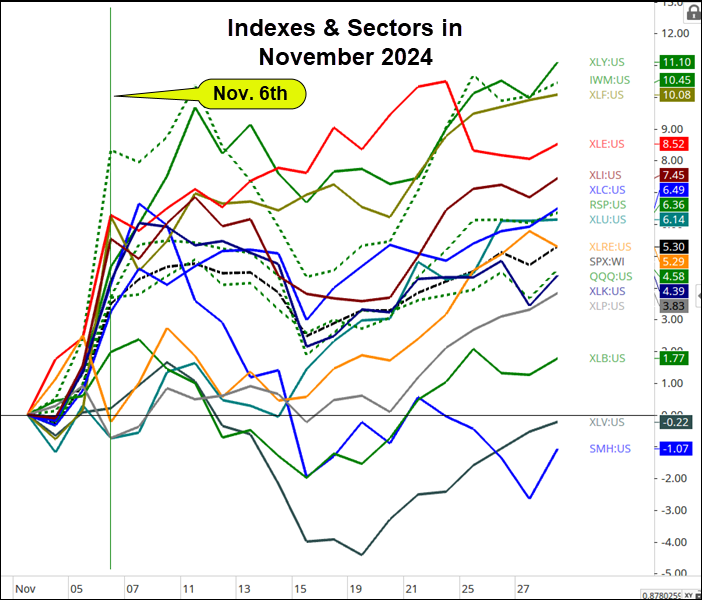

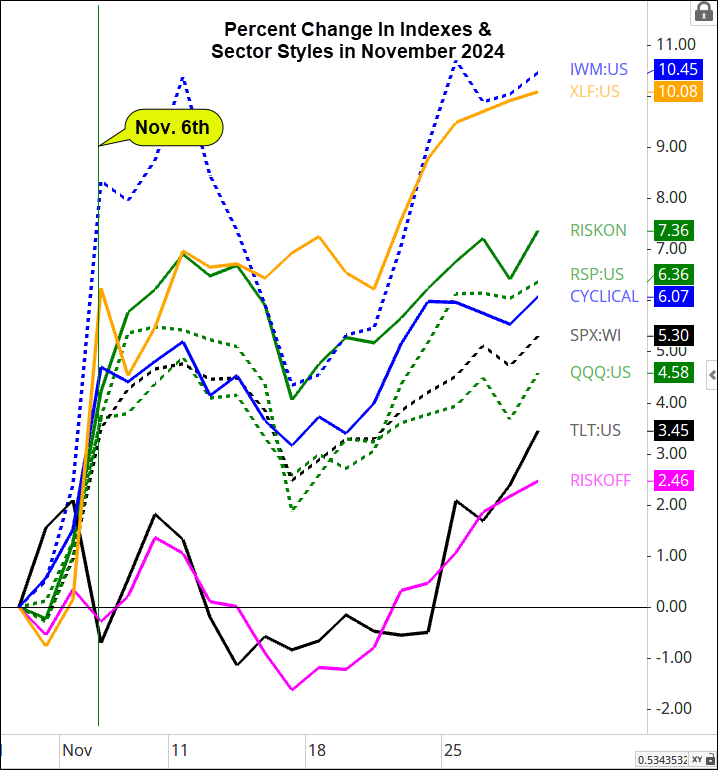

The chart below illustrates the strength through the day after the election (Nov. 6th) in the S&P 500 sectors and indexes.

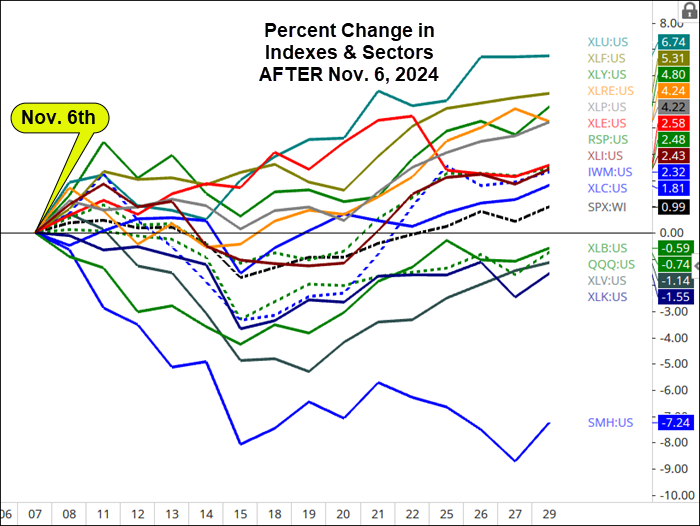

When measured from the close of Nov. 6th, shown below, the follow-through after the initial reaction to the election, the leaders and laggards looked quite different.

Sectors trading higher than their Nov 6th close are likely to be leaders going into the end of the year.

The notable standouts on the bullish side are Utilities ( XLU ), Financials ( XLF ), and Consumer Discretionary ( XLY ). The notable laggards are Technology ( XLK ) and Semiconductors ( SMH ), which isn’t an S&P 500 sector but is so widely followed it’s worth highlighting regardless.

Also notable is that RSP (S&P 500 equal weight) has outperformed the SPX and QQQ . This suggests a healthy broadening of the market along with sector rotation.

Weakness in the SMH and a lagging QQQ can be a warning sign, but as you’ll hear in the weekly video, this concern is premature until there is serious weakness relative to their respective trends.

The optimistic side of this situation is that the right rally in these weak areas could lead to a significant lift to the whole market.

Equity Investors Should Hope Trump Watches The Bonds

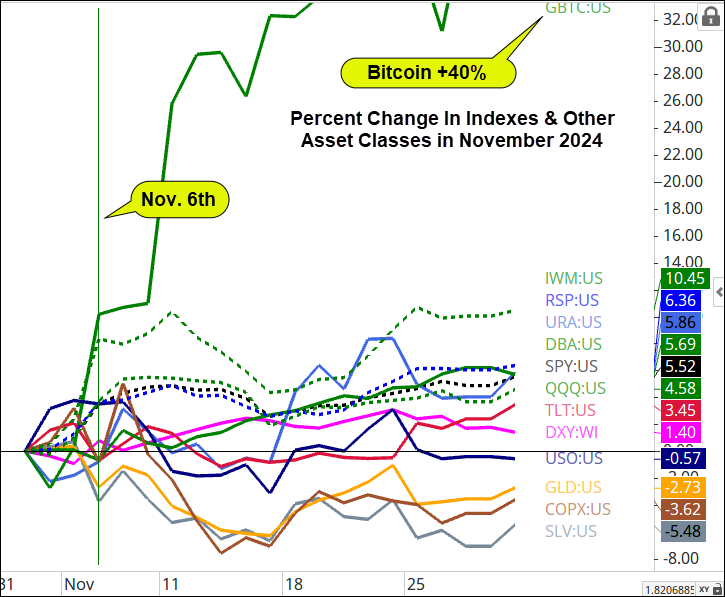

As shown below, the bearish reaction to the election initially by the bonds ( TLT ) weighed on all segments of the market, especially the defensive sectors. Then, the stabilization of the TLT’s downtrend and subsequent rally helped all areas rally into the end of the month.

Looking at other asset classes, Bitcoin is literally off the chart. Next (LON: NXT ), equal-weighted S&P 500 (RSP) led followed by Uranium ( URA ), and agricultural commodities ( DBA ). Note, everything, even the laggards in the chart below, bottomed with the bottom in TLT.

November In Perspective

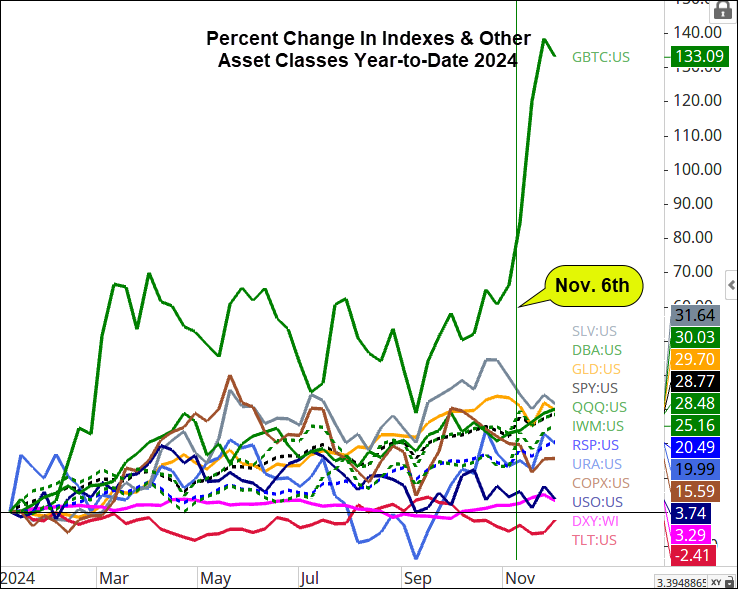

Bitcoin has had an extraordinary November, but it’s had an equally impressive year, as you’ll see in the chart below.

Another fact in this chart that doesn’t get enough attention is that looking at the performance year-to-date above, Silver ( SLV ), Commodities (DBA), and Gold ( GLD ) are all leading the stocks, even the SPY’s strong November.

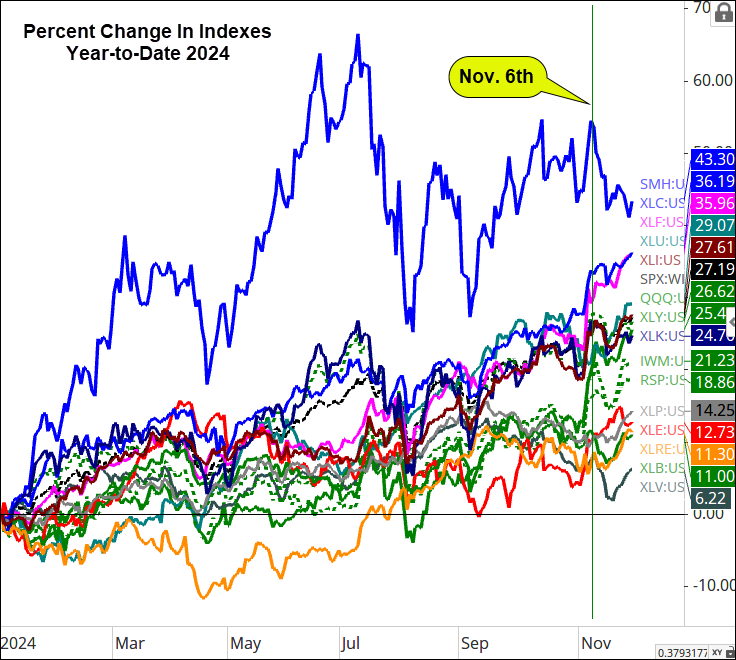

With respect to the sectors (shown below), the year-to-date perspective highlights how SMH has been off its highs for 5 months, and the market’s leadership has been solidly in XLC , XLF, XLU, and XLI . It’s notable that this list represents “Risk On” “Risk Off” and “Cyclical” sectors.

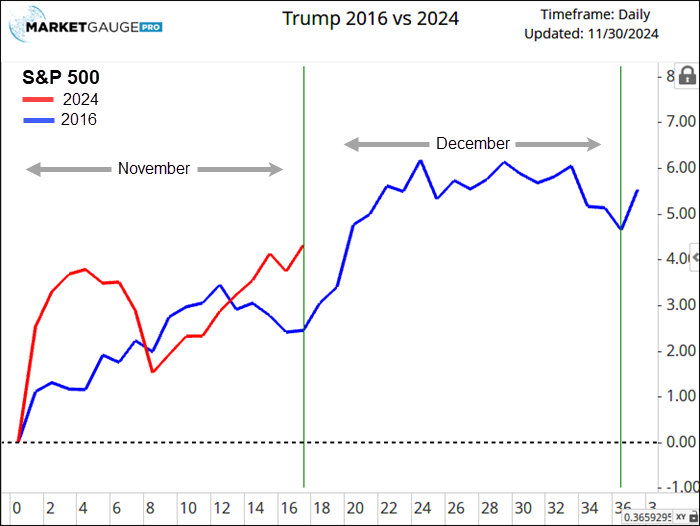

History Rhymes

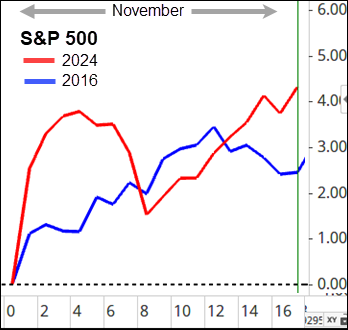

The market’s path since the election has been slightly different than Trump 1.0 in 2016, but as of right now, it’s holding the simple bullish pattern of an election range breakout.

The market’s resemblance to its 2016 trend is interesting, but we’ll be keeping a close eye on the trends in interest rates and leading sectors to anticipate future moves.

AI Influences Black Friday

With the election and earning season in the rearview mirror, the bulls will be looking for evidence that the economy remains strong, the Fed continues to accommodate, inflation stays calm, and interest rates cooperate.

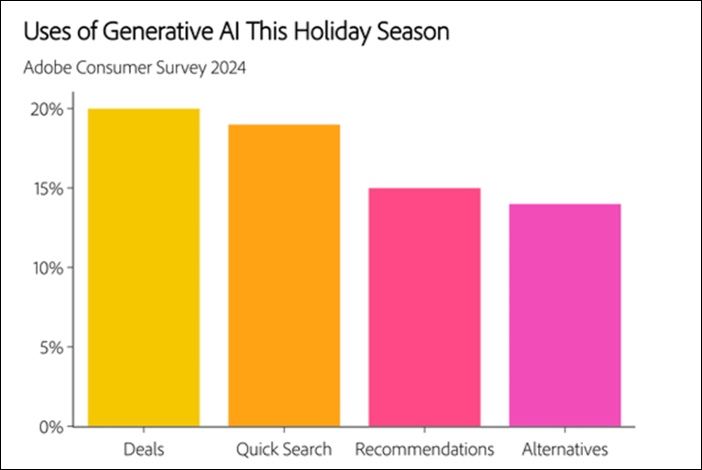

The annual question of, “How has online shopping changed Black Friday?” is now morphing into, “How has AI influenced Black Friday?”

Initial reports about Black Friday sales suggest that the consumer is not only in the buying mode but is also enlisting the assistance of AI to improve their shopping experience.

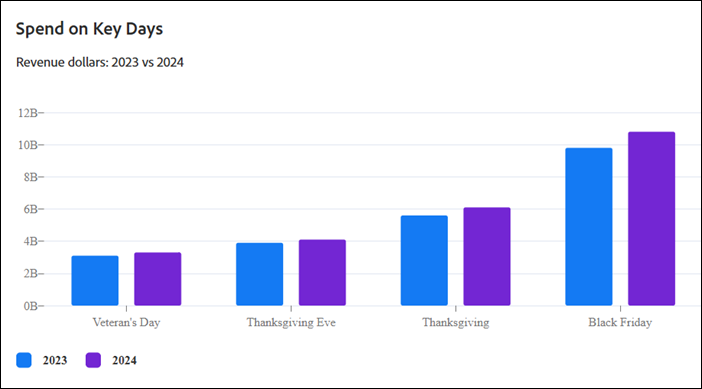

According to reports from Adobe (NASDAQ: ADBE ) Analytics, Black Friday online sales were up about 12% over 2023 and assisted by an 1,800% increase in AI chatbot related traffic to retail websites.

As you can see by the chart below, 2024 sales have been higher this year on each day of the Thanksgiving holiday, and Cyber Monday is expected to be higher, too.

Are you using AI to shop?

Surveys by Whoop.com and 40% of

shoppers will turn to generative AI tools this Black Friday and holiday shopping season to find deals, search for items, get recommendations, and find alternatives.

AI Will Be Life Changing In Ways (and Investments) We May Least Expect

While this application of AI isn’t necessarily the ‘life changing’ impacts that are often touted as the AI revolution it feels remarkably similar in the way that the progression of the ‘Internet’ and ‘online’ evolved from ‘new’ to ubiquitous.

Apple (NASDAQ: AAPL ) has been criticized for being behind in AI, and at the same time, one of its supporters in the analyst community Gene Munster has been vocal about how Apple will be a leader in the way AI becomes an integral part of our lives. He believes Apple + AI will drive changes in the way we live and work that will be bigger than the impact of the iPhone.

Considering this, it’s fitting that AAPL should choose Black Friday to break out of its 5-month consolidation that has followed its announcement of its AI initiatives. See the chart below.

A December to Remember?

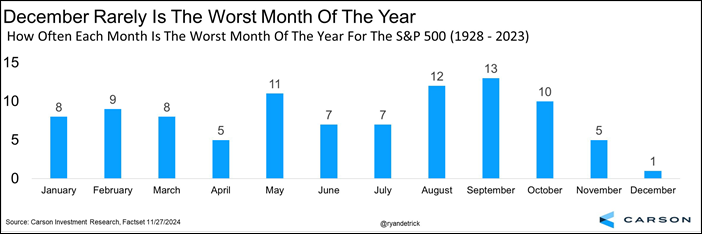

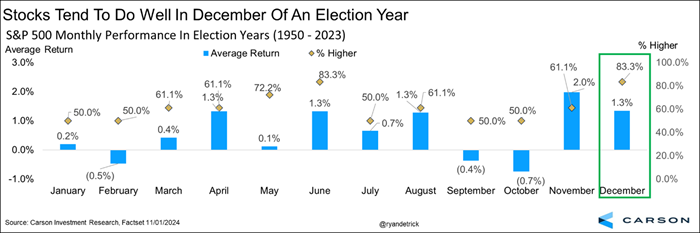

November’s performance would be hard to beat, and December is not historically stronger than November. However, December does have some very bullish stats.

One interesting way to look at it is that December is rarely the worst month for the year as you can see from the chart below.

Ryan Detrick at Carson points out that the worst-performing month this year was April, with a loss of 4%.

Looking at December from the positive side, you’ll see from the graph below that during the first year after an election, December has been up 83% of the time with an average gain of 1.3%

With a much-anticipated employment report, this coming Friday and an expected rate cut coming mid-month, there’s plenty to look forward to.

Stay tuned.

Summary: Mostly bullish indications from Big View with the exception of the risk gauges weakening, inflationary pressure persisting with NASDAQ100 /Tech lagging.

Risk On

- S&P and Dow made new all-time highs this week, indicating further bullish action. Both are not overbought on both price and real motion together.(+)

- Significant improvement in volume over the last two weeks with volume action confirming the new all-time highs. (+)

- 12 out of the 14 sectors were positive over the last 5 trading days led by retail and homebuilders which was helped by the drop in interest rates. (+)

- Alternative energy were the strongest performers over the last five trading day while fossil fuels actually sold off. (+)

- Market internals, viewed through the McClellan Oscillator is positive and confirmed price action for the NYSE and Nasdaq and the cumulative advance/decline line for the NYSE also hit new all-time highs. (+)

- The 52-week new high new low ratio improved for both the NASDAQ composite and the S&P. (+)but could be overbought shortly

- Volatility indexes are giving up some levels of pessimism and closed on new lows since the massive August spike. (+)

- The average of stocks above their key moving average (Color Charts) looks overall positive with the exception of the S&P which looks a little more muted. (+)

- The modern family collectively improved with Semiconductors and Biotech regaining their 200-Day Moving Averages while Retail closed very strong and Transports closed on new all-time highs. (+)

- Foreign equities still continue to lag U.S. equities by a wide margin. Although, on a positive basis, Emerging markets tested their 200-Day Moving Average and bounced. (+)

- Value continues to outperform growth and while both closed on new highs.(+)

- Bitcoins and Bananas went ballistic this week highlilghting the current speculative condition of the market that could persist and until that breaks, its bullish. (+)

- Despite the highs in soft commodities that could impact the consumer, the long-bond and interest rates across the yield curve eased which under most cases should be good for equities which is what we saw in the markets. (+)

- Regarding seasonal patterns, bitcoin is very strong in what is considered its strongest seasonal period while the Dollar could be underpressure from its seasonal trends and is already in overbought condition.

Neutral

- The percentage of stocks over their key moving averages show a potential overbought situation that could be subject to mean reversion. (=)

- Risk gauges are a weak-neutral due to the relative strength of the long-bond (TLT) outperforming the S&P. (=)

- As we suggested last week, Gold was a little oversold. By the end of the week it closed below its 50-Day Moving Average in a weak warning phase. Maybe geopolitical pressures are easing. (=)

- The Dollar backed off extremely overbought conditions. The equities market seems disconnected with price action in the Dollar. (=)

- Inflationary pressures persist with soft commodities closing at decade highs. (=)

- The NASDAQ 100 (QQQ) continues to lag the S&P 500 (SPY) and if the market corrects from here it should be first to fail. (=)