This will be a full week of trading with significant market-moving economic data on the agenda. It begins Monday with the ISM Manufacturing report and concludes Friday with the Jobs report . However, this data is likely to have a greater impact on the dollar and interest rates than on the stock market.

RATES

Rates pulled back last week, with the

10-year

yield finishing at 4.18%. The move lower was driven by Scott Bessent’s nomination as Treasury Secretary. So far, the decline appears to be a standard 38.2% retracement, finding support at the lower Bollinger Band. Could the 10-year yield fall further? Certainly, the possibility remains with the 61.8% retracement level sitting at 3.95%.

Considering the state of the economy, current GDP estimates, and the likely neutral rate for the Fed Funds, it’s difficult to justify a significantly lower value for the 10-year rate than where it currently stands. With nominal growth running around 5% and the Fed’s neutral rate estimated between 3% and 3.5%, arguments can easily be made for higher interest rates. This, of course, benefits savers and those seeking income opportunities. Higher rates are not bad; in fact, for most, they are good .

FX

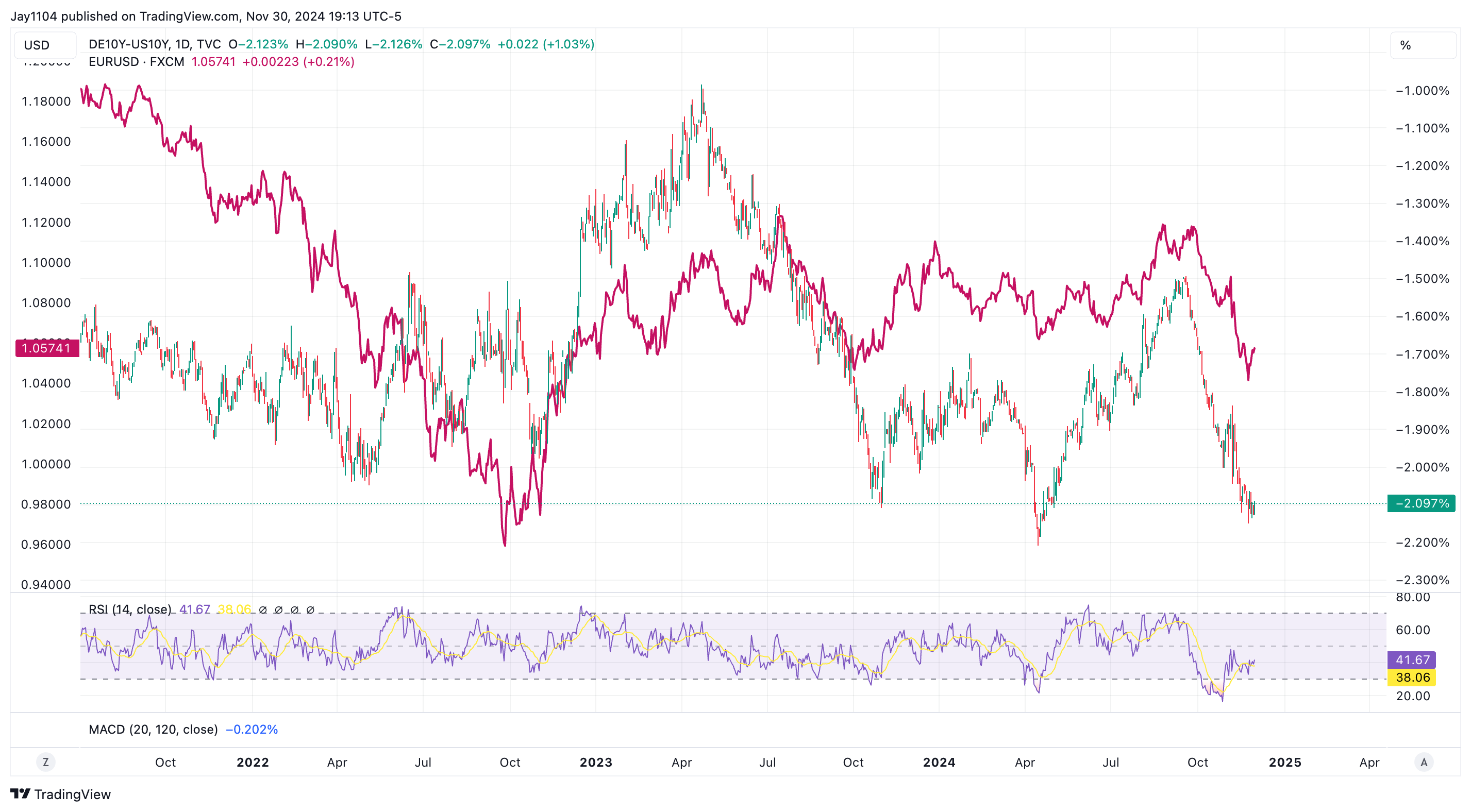

From this perspective, it makes sense for the dollar to continue strengthening against other Western currencies, such as the

euro

, the

pound

, and the

franc

. The widening spreads between the German and U.S. 10-year rates over the past few weeks further support this trend. A stronger dollar is

good

for the US because a stronger dollar simply means more purchasing power.

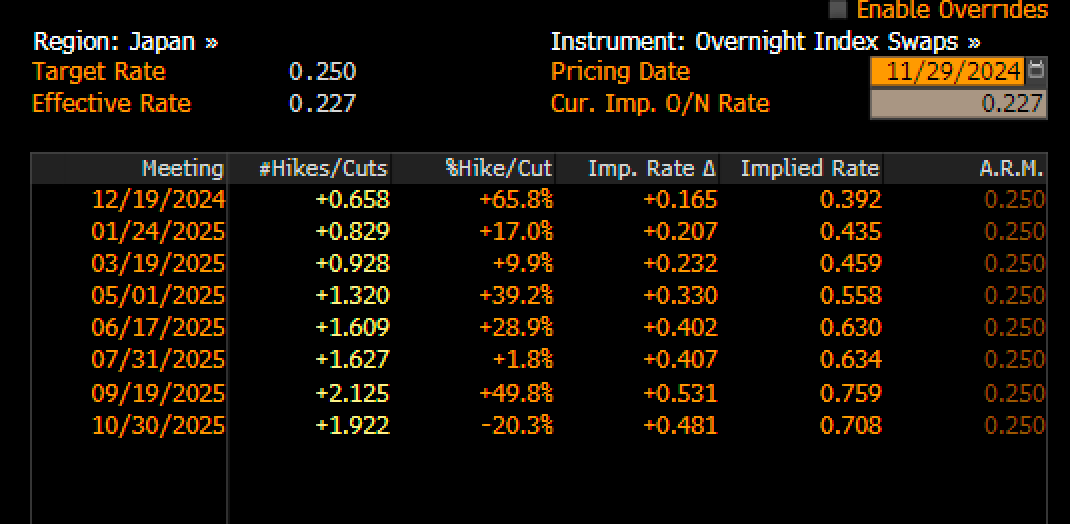

The only currency that might strengthen against the dollar is the

Japanese yen

, as the market currently assigns a roughly 65% probability of the Bank of Japan hiking its rate at its December 19 meeting.

BLOOMBERG

The USD/JPY has already been weakening and could be setting up a repeat of the movement seen in July. It is now back below the 150 level and may be heading toward 148.50, with much depending on the economic data released this week.

This movement also occurs in currency pairs like the AUD/JPY and EUR/JPY . The AUD/JPY, often viewed as a key risk-on/risk-off gauge, appears poised for a potential decline toward the 94 level based on the chart. When it is falling, it is a risk-off signal.

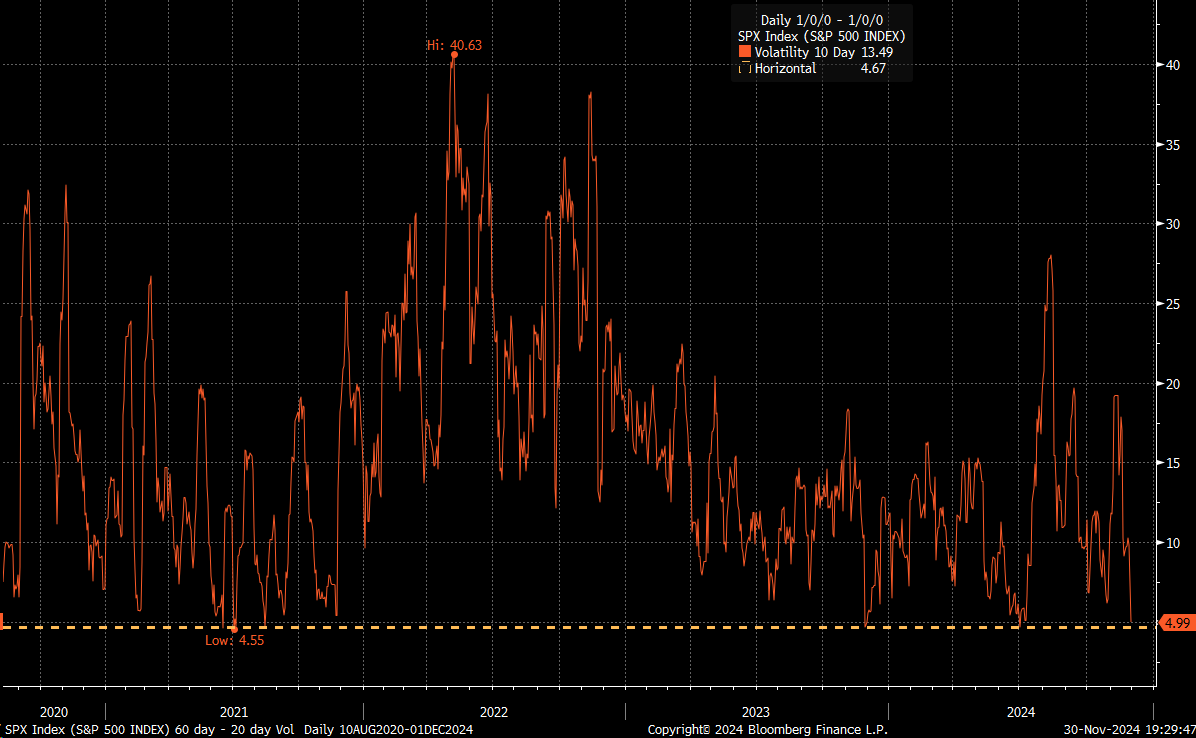

TO THE MAX

In the meantime, the 10-day realized volatility has dropped to an unusually low level, falling below five on Friday. The last time it was this low was in July. Based on the rule of 16, any move in the S&P 500 , up or down , of around 31 bps or more would cause realized volatility to rise.

Given the significant economic data due this week and the upcoming Fed and BOJ meetings mid-month, it seems unlikely that the market will enter a period of stagnation. As a result, the odds of volatility increasing from this extreme appear pretty high.

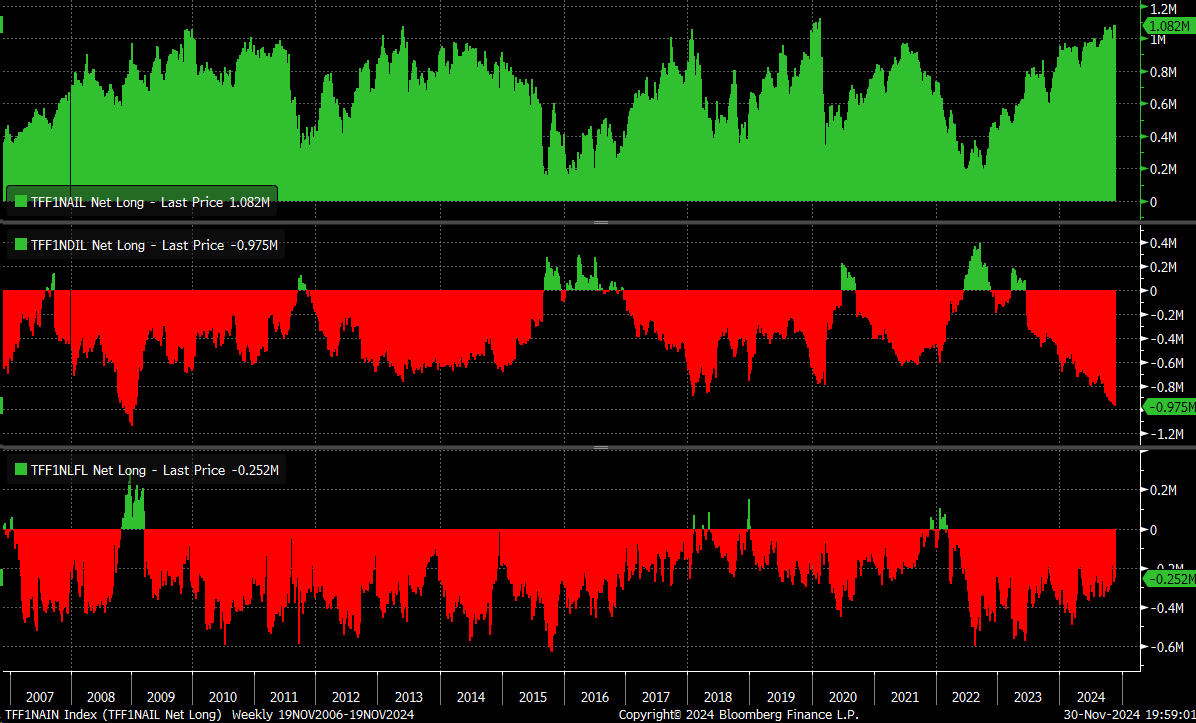

Another noteworthy extreme is that dealers haven’t been this short in S&P 500 e-mini futures contracts since the fall of 2008, while asset managers haven’t been this net long since February 2020. For asset managers, this positions them at the upper end of their historical range, while for dealers, this is undeniably rare territory.

Dealers typically take the opposite positions of asset managers and leveraged funds, so this dynamic reflects a significant divergence in market positioning.

The odd thing is that in the fall of 2008, the market was in freefall, with investors apparently trying to find a bottom, pushing dealer positioning to such an extreme. Today, the situation is quite the opposite, with markets climbing higher and investors betting on the continuation of the good times. It’s a polar opposite scenario—an extreme of optimism rather than despair—highlighting the conditions’ rareness.

So we have conditions where realized volatility seems destined to go higher, with extreme measures of bullishness and a USD/JPY carry trade that could be on the cusp of unwinding again. At the same time, the current PE makes this one of the most expensive markets since the mid-1950s, in what is probably a higher neutral rate environment that could spur a more robust dollar, while credit spreads are about as tight as they have ever been, as the Fed’s balance sheet continues to contract.

Remember, I am the messenger of information; how you consume and use it is your call. If you don’t like the message I deliver, don’t read me. It’s very simple.

Original Post