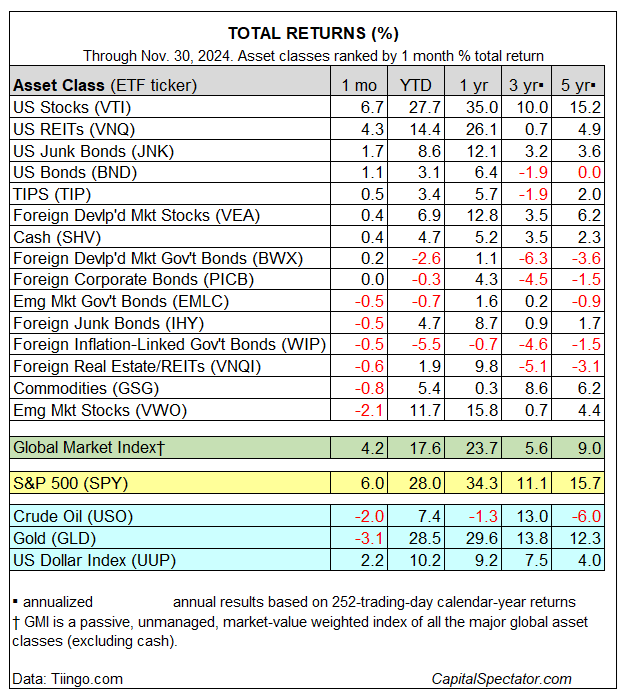

Global markets delivered mixed results in November. US stocks and real estate investment trusts led last month’s winners, rebounding with solid gains following October’s decline , based on a set of ETFs. Commodities and shares in emerging markets suffered the biggest losses in November.

The crowing performer last month: a 6.7% surge in US equites ( VTI ), marking the strongest gain for the major asset classes in November. For the year so far, American shares are up nearly 28%, leading the field by a wide margin in 2024.

US bonds ( BND ) in November recovered some of their losses from October, rallying 1.1%. US junk bonds ( JNK ), however, continued to steal the thunder for fixed income and rose 1.7% last month, recovering all of October’s loss and more.

November’s biggest loser: emerging markets stocks (

VWO

), which shed 2.1%. The decline marks the second monthly loss following eight straight monthly gains.

The Global Market Index (GMI) rebounded sharply in November, jumping 4.2%, which more than reversed October’s slide. GMI has rallied in nine of 11 months so far in 2024 and is currently higher by a strong 17.6% year to date. GMI is an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive benchmark for multi-asset-class portfolios.

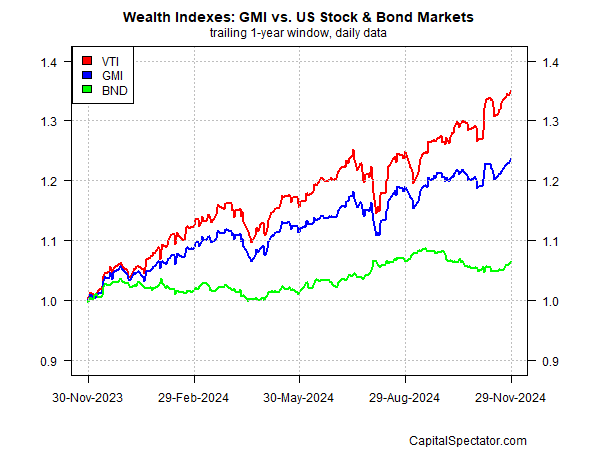

For the one-year window, GMI continues to reflect a middling performance relative to US stocks (VTI) and US bonds (BND).