The coming Trump presidency is likely to be exciting, but a lot is unknown. Investors need solid tactics to handle commodities, the stock market, bonds, crypto, and of course supreme money Gold .

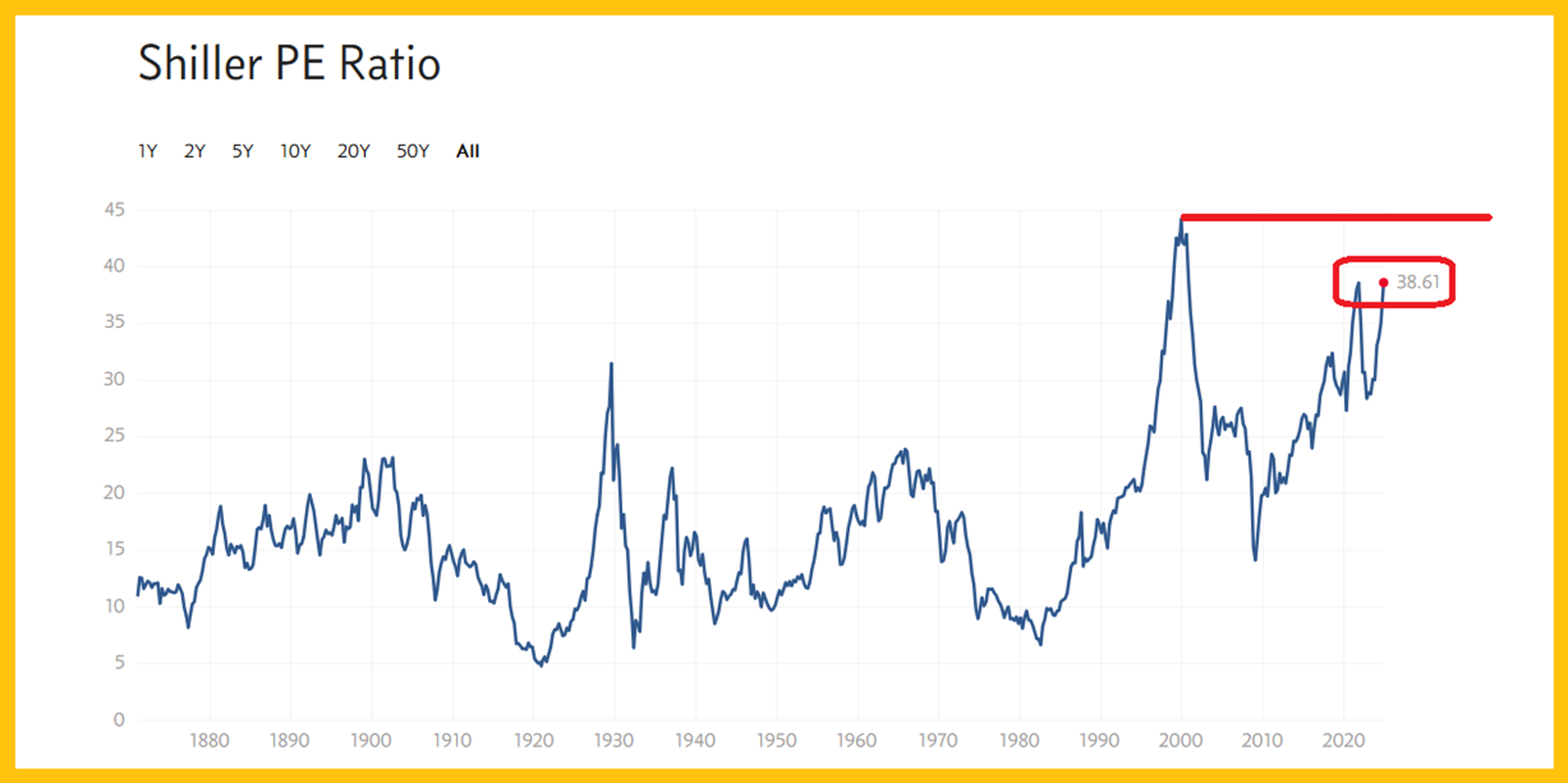

Basis the Shiller/CAPE ratio, the US stock market just became the second most overvalued in the history of the nation!

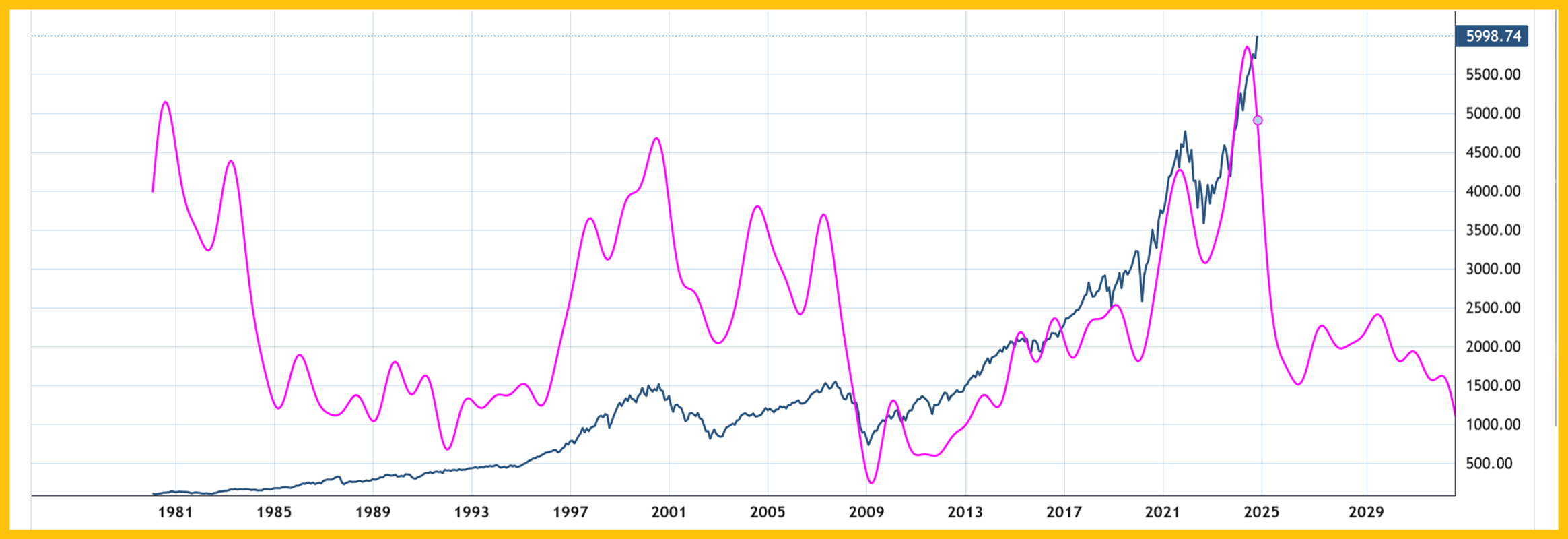

A look at the market from a cyclical perspective. Using a mix of more than a dozen long-term cycles, the S&P 500 is projected to enter a long-term bear market in 2025.

Crypto? The 6 month cycle chart for bitcoin. Cycle analysis tends to flounder in a sideways market, but it’s quite accurate at projecting major highs… and it’s projecting one for bitcoin is occurring now.

With Bitcoin ( BitfinexUSD ) near a key round number ($100,000), some “alt” coins are taking centre stage, while bitcoin itself maybe be making quite a significant top.

What could become to be viewed as a “chart of the decade” in the years ahead. Sugar is a key indicator of Mainstreet inflation, and basis this CANE ETF, a massive inverse H&S base pattern is in play. I’m a buyer, and with some decent size.

Palladium is another commodity in base pattern mode. I’m also a buyer of this mighty metal.

The base pattern suggests a 50% price surge is imminent.

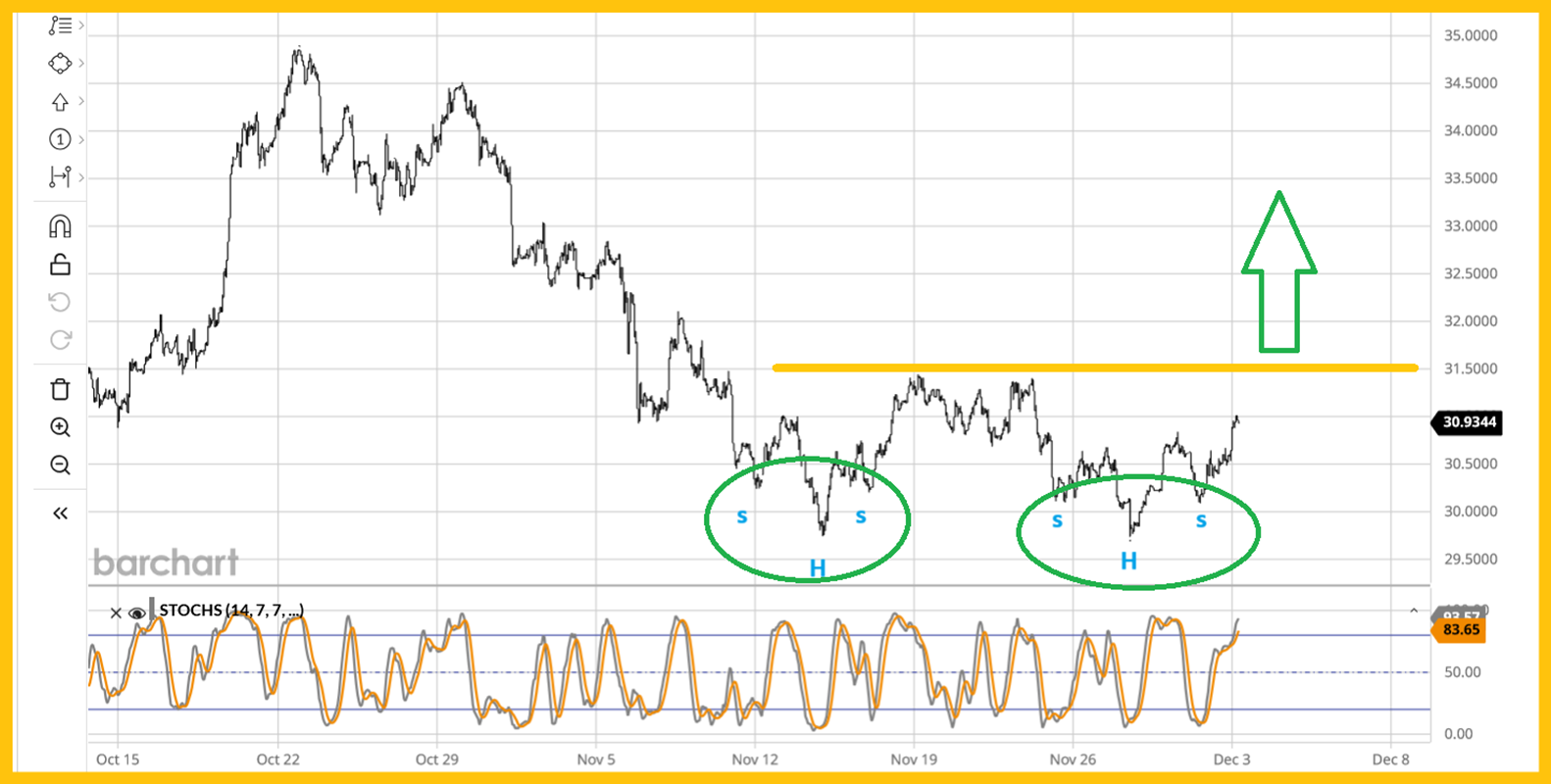

With palladium and sugar on the move, can Silver be far behind? The short-term silver chart, which looks phenomenal.

There are twin inverse H&S bottoms in play, as part of a larger double bottom set-up.

A potential tail wind is the US dollar. There’s finally some H&S top action in play on the daily chart.

In the short-term, the US jobs report on Friday could provide some dollar strength and weakness for gold, but as the ridiculously overvalued stock market begins to roll over, there could be quite a shocking institutional exit from the dollar.

Team Trump could try to halt the outflow with even bigger tariff taxes than he plans now, but that plan could backfire and help create a miniature 1929 type of situation.

Gold? Gold was technically overbought on this weekly chart at the recent high, but that’s no longer the case.

Elliott wave analysis is subjective, but one simple interpretation would have gold in the late part of a major C wave.

This wave could have ended at the $2800 area high, but it likely has a few smaller legs higher to go. From there, a D wave correction could see gold trade down to the decent support zone of $2450-$2300.

That pullback would also put gold at the neckline of the huge inverse H&S pattern that launched Wave C… and a glorious E wave would be launched from there!

The short-term outlook for gold depends a lot on how enthusiastic Chinese citizens are about celebrating the new year.

The good news is that the Chinese stock market (basis the FXI ETF) has pulled back to the base pattern breakout zone and looks set to surge. Why would this happen with the economy there in such rough shape?

Well, the stimulus (money printing) announced so far has been purposed towards out-of-control municipal debt. New US tariffs could convince the Chinese government to announce even more money printing… enough to create panic buying of the stock market.

The citizens would celebrate the rallying stock market and potential turn in the economy with hefty purchases of gold.

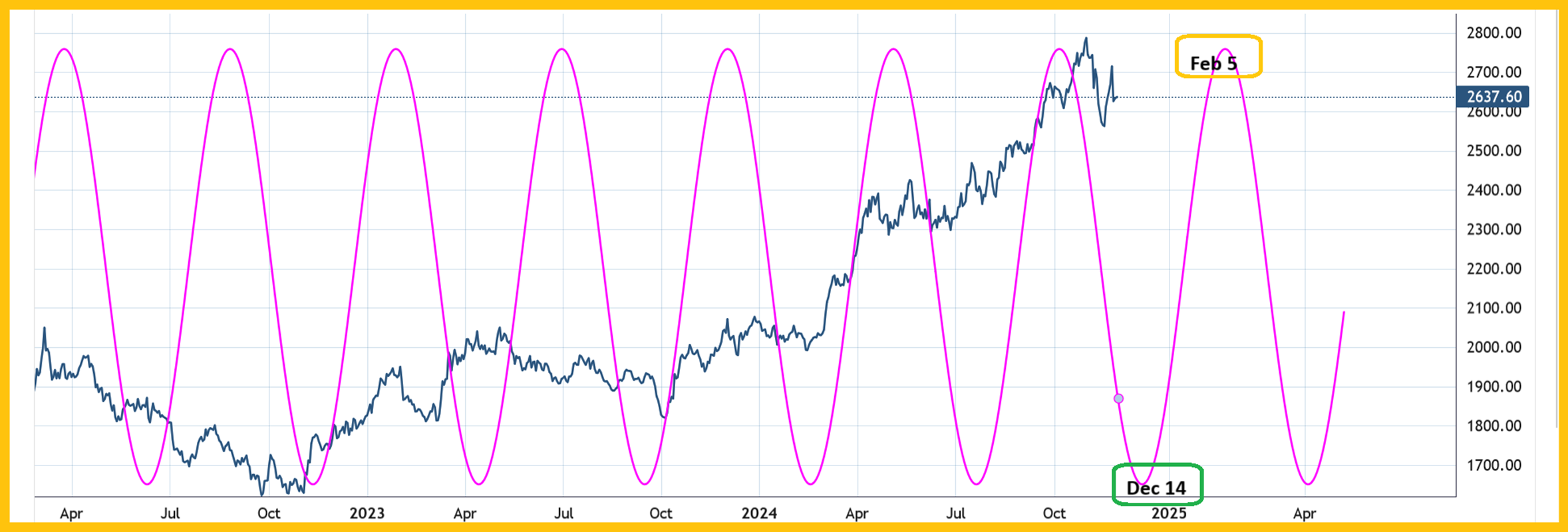

The four-month gold cycle chart. The next low in the cycle comes around Dec 14 and the next high comes near the Chinese New Year peak at about Feb 5, 2025.

A look at why this is important to gold and silver stock investors, and note the key 14,5,5 Stochastics action at the bottom the chart. It’s approaching oversold and likely gets there just as the 4month gold cycle low occurs. A turn should help launch GDX (NYSE: GDX ) out of the huge inverse H&S pattern… and usher in 12 to 24 months of outperformance against gold!