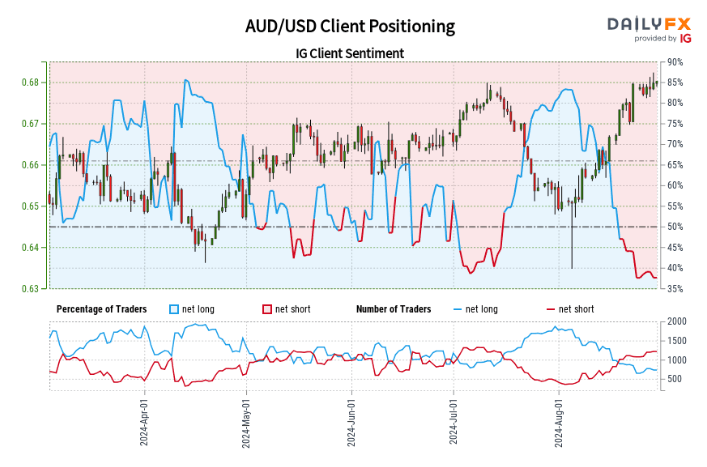

AUD/USD Overview:

- , with a short-to-long ratio of 1.64:1

- Long positions: ↑ 1.20% from yesterday, ↓ 12.53% from last week

- Short positions: ↑ 1.79% from yesterday, ↑ 15.53% from last week

Retail traders as a collective tend to be trend fighters, which is not optimal when markets are trending. The trend is your friend, as the saying goes, and this forms the basis of why it is often useful to adopt a contrarian approach to client sentiment positioning.

Retail trader data for AUD/USD shows a sizeable shift towards short positions over the past week. While long positions have decreased, short positions have increased notably. This change in sentiment, with traders becoming more net-short, suggests that AUD / USD prices may continue to rise based on contrarian analysis. The combination of current positioning and recent changes strengthens a bullish outlook for AUD/USD .

Richard Snow

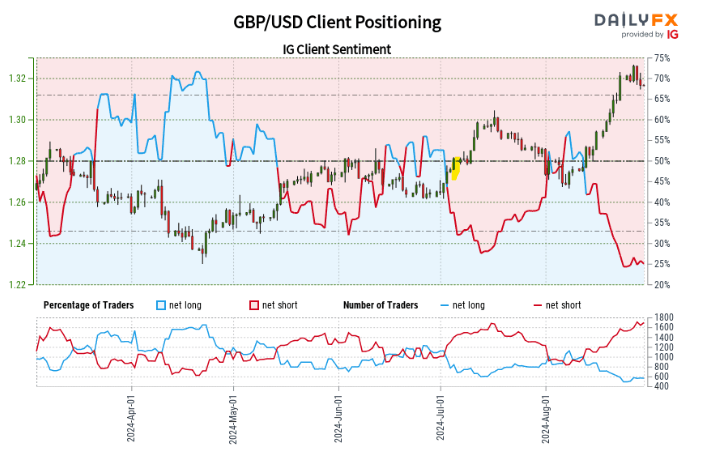

GBP/USD Overview:

- , with a short-to-long ratio of 3.01:1

- Long positions: ↓ 1.91% from yesterday, ↓ 5.04% from last week

- Short positions: ↑ 2.84% from yesterday, ↑ 8.96% from last week

For GBP/USD , retail trader data reveals an even more pronounced short bias. The number of traders going long has decreased both daily and weekly, while short positions have increased significantly. This growing net-short sentiment typically indicates that GBP /USD prices may continue to rise. The current positioning, combined with recent trend changes, reinforces a bullish contrarian trading bias for GBP/USD.

Richard Snow