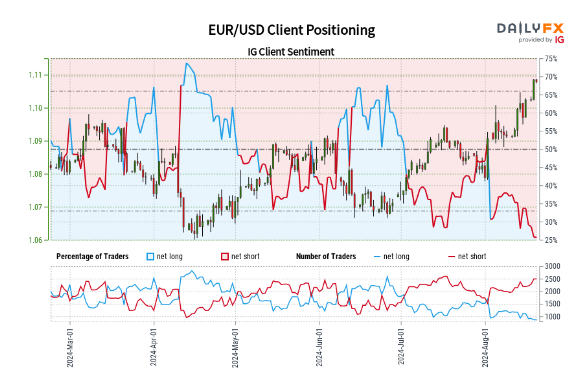

Current sentiment:

- 25.61% of traders are net-long

- The ratio of short to long traders is 2.90 to 1

Changes in trader positions:

- Net-long traders: 8.49% decrease since yesterday, 27.19% decrease from last week

- Net-short traders: 9.83% increase since yesterday, 17.79% increase from last week

Analysis approach:

- The analysis takes a contrarian view to crowd sentiment

- The fact that traders are net-short suggests EUR/USD prices may continue to rise

Conclusion:

- Traders are more net-short compared to yesterday and last week

- The combination of current sentiment and recent changes indicates a stronger EUR/USD-bullish contrarian trading bias

This analysis suggests that despite most traders taking short positions on EUR/USD, the contrarian approach indicates that the EUR/USD price might increase. The increasing number of short positions over the past day and week strengthens this bullish outlook for EUR/USD.

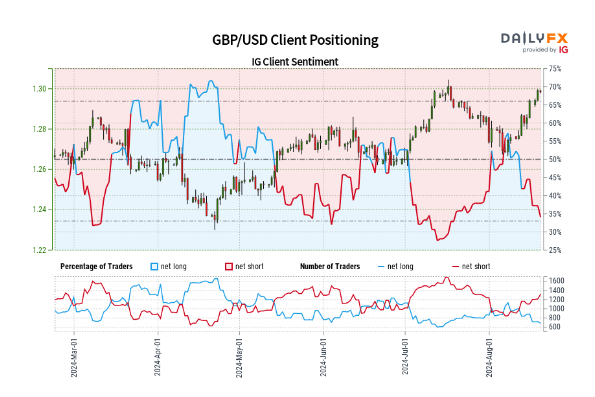

Current sentiment:

- 34.22% of traders are net-long

- The ratio of short to long traders is 1.92 to 1

Changes in trader positions:

- Net-long traders: 6.33% decrease since yesterday, 32.24% decrease from last week

- Net-short traders: 8.18% increase since yesterday, 35.65% increase from last week

Analysis approach:

- The analysis takes a contrarian view to crowd sentiment

- The fact that traders are net-short suggests GBP/USD prices may continue to rise

Conclusion:

- Traders are more net-short compared to yesterday and last week

- The combination of current sentiment and recent changes indicates a stronger GBP/USD-bullish contrarian trading bias

This analysis suggests that despite most traders taking short positions on GBP/USD, the contrarian approach indicates that the GBP/USD price might increase. The increasing number of short positions and decreasing number of long positions over the past day and week strengthens this bullish outlook for GBP/USD.