EUR/USD and USD/JPY – Latest Sentiment Analysis

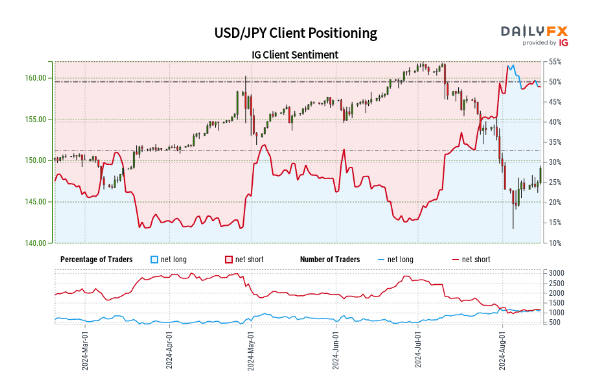

EUR/USD Sentiment Analysis

- 32.46% of traders are net-long

- The ratio of short to long traders is 2.08 to 1

- Net-long traders: Up 9.28% from yesterday, down 17.58% from last week

- Net-short traders: Down 10.10% from yesterday, up 15.36% from last week

:

- The analysis takes a contrarian view to crowd sentiment

- The net-short position suggests EUR/USD prices may continue to rise

- Positioning is less net-short than yesterday but more net-short than last week

- This combination results in a mixed EUR / USD trading bias

The analysis suggests that while there's been some recent shift towards long positions, the overall sentiment remains predominantly short. This contrarian approach implies that the EUR/USD might continue to strengthen, despite the majority of traders betting against it. However, the mixed signals from different timeframes (daily vs weekly changes) lead to an overall mixed trading bias.

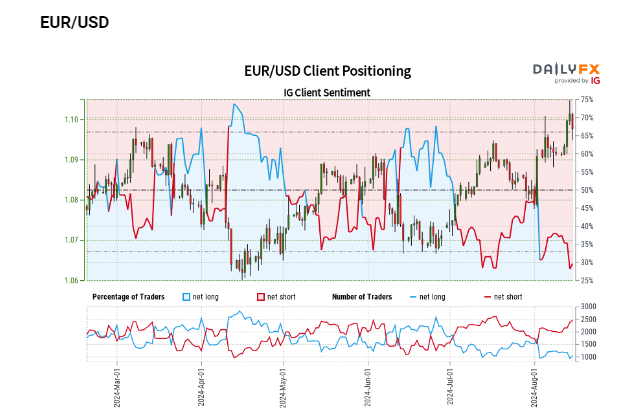

USD/JPY Sentiment Analysis

- 42.64% of traders are net-long

- The ratio of short to long traders is 1.35 to 1

- Net-long traders: Down 14.49% from yesterday, down 11.96% from last week

- Net-short traders: Up 10.17% from yesterday, up 10.94% from last week

- The analysis takes a contrarian view to crowd sentiment

- The net-short position suggests USD/JPY prices may continue to rise

- Traders are further net-short compared to both yesterday and last week

This data shows a significant shift towards short positions in USD/ JPY over both daily and weekly timeframes. The percentage of net-long traders has decreased, while net-short traders have increased. Using the contrarian approach, this growing bearish sentiment among retail traders is interpreted as a bullish signal for USD/JPY. The analysis suggests that despite more traders betting against the currency pair, its price may actually continue to rise.

The consistent movement towards short positions across both timeframes (daily and weekly) provides a clearer signal compared to the previous EUR/USD data, which showed mixed trends.