China slowdown weighs on Alibaba

Alibaba reports earnings on 15 August. It is expected to see earnings per share rise to $2.12 from $1.41 in the previous quarter, while revenue is forecast to rise to $34.71 billion, from $30.92 billion in the final quarter of FY 2024.

China's economic growth has been sluggish, with GDP rising just 4.7% in the quarter ending in June, down from 5.3% in the previous quarter. This slowdown is due to a downturn in the real estate market and a slow recovery from COVID -19 lockdowns that ended over a year ago. Moreover, consumer spending and domestic consumption remain weak, with retail sales falling to an 18-month low due to deflation .

Alibaba's core Taobao and Tmall online marketplaces saw revenue growth of just 4% year-on-year in Q4 FY'24, as the company faces mounting competition from new e-commerce players like PDD, the owner of Pinduoduo and Temu. Chinese consumers are becoming more value-conscious due to the weak economy, benefiting these discount e-commerce platforms.

Alibaba's cloud computing business has also seen growth cool off considerably, with revenue rising by only 3% in the most recent quarter. The slowdown is attributed to easing demand for computing power related to remote work, remote education, and video streaming following the COVID-19 lockdowns.

Despite the headwinds, Alibaba's valuation appears compelling at under 10x forward earnings, compared to Amazon's 42x. The company has also been doubling down on share repurchases and plans to increase merchant fees. However, the uncertain macroeconomic environment and mounting competition pose risks to Alibaba's future performance.

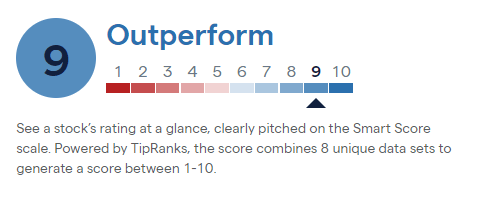

Despite the low valuation, Alibaba has an ‘outperform’ rating on the IG platform, utilising data from TipRanks:

Meanwhile, of the 16 analysts covering the stock, 13 have ‘buy’ ratings, with three ‘holds’:

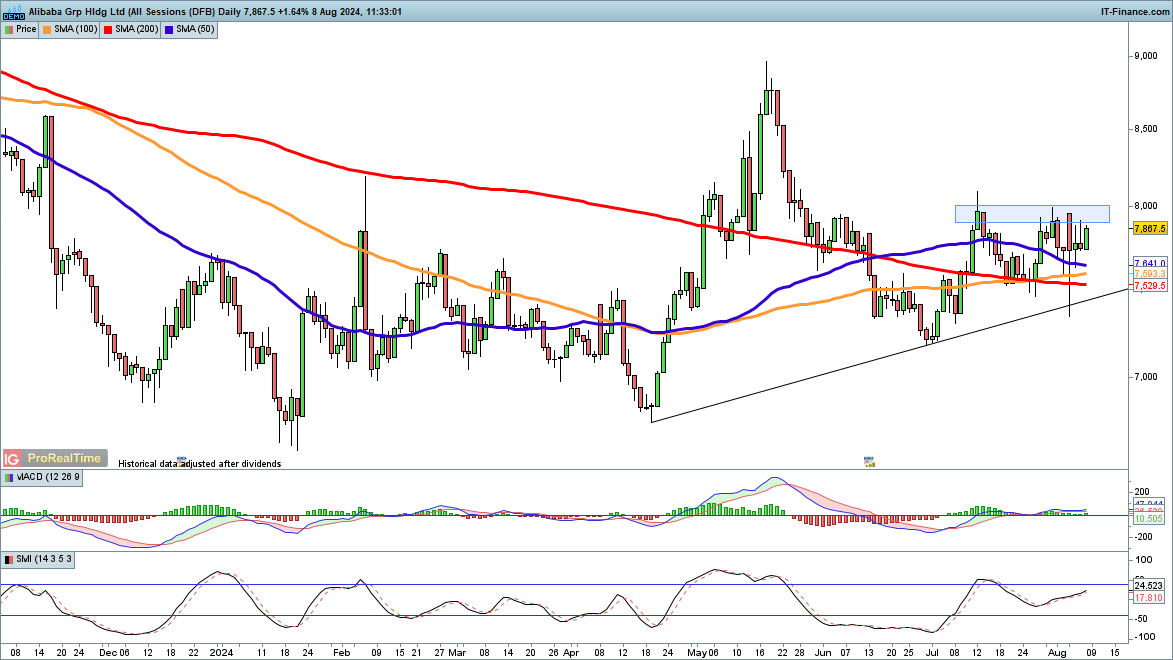

Alibaba stock price under pressure

Alibaba's stock has suffered a sharp decline of 65% from levels of $235 in early January 2021 to around $80 now, while the S&P 500 has increased by about 45% over the same period. The company has underperformed the broader market in each of the last three years.

Despite this, there are signs of bullishness in the short term. The price has risen from its April lows, forming higher lows in late June and at the end of July. Notably, it rapidly shrugged off weakness at the beginning of August.

The price remains above trendline support from the April lows and has also managed to hold above the 200-day simple moving average (SMA). Recent gains have stalled at the $80 level, so a close above this would trigger a bullish breakout.