RBA, AUD/USD, GBP/AUD Analysis

- RBA Governor reiterates versatile approach amid two-sided risks

- AUD/USD fights back after RBA Governor Bullock highlights inflation worries

- GBP/AUD declines after massive spike higher – rate cut bets revised lower

RBA Governor Reiterates Versatile Approach Amid Two-Sided Risks

RBA Governor Michele Bullock attended a question and answers session in Armidale where she maintained the focus on inflation as the number one priority despite rising economic concerns, lifting the Aussie in the process.

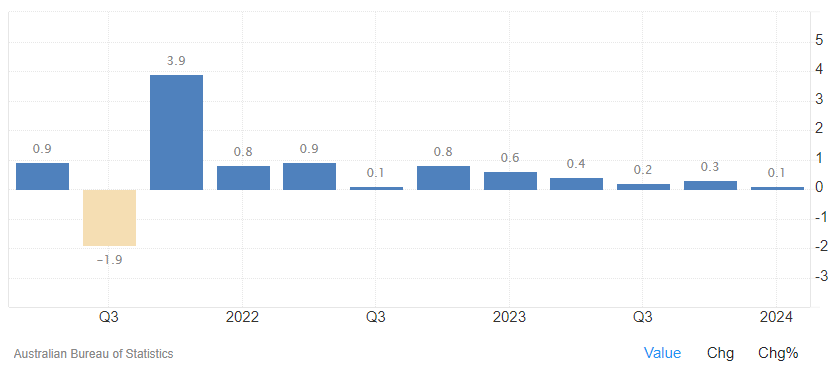

On Tuesday, the RBA released its updated quarterly forecasts where it lifted its GDP , unemployment, and core inflation outlooks. This is despite recent indications suggesting to the RBA that Q2 GDP is likely to be subdued. Elevated interest rates have had a negative impact on the Australian economy, contributing to a notable decline in quarter-on-quarter growth since the start of 2023. In Q1 2024, the economy narrowly avoided a negative print by posting growth of 0.1% compared to Q4 of 2023.

Richard Snow

Bullock mentioned the RBA considered a rate hike on Tuesday, sending rate cut odds lower and strengthening the Aussie dollar. While the RBA assess the risks around inflation and the economy as ‘broadly balanced’, the overarching focus remains on getting inflation down to the 2%-3% target over the medium-term. According to RBA forecasts inflation (CPI) is expected to tag 3% in December before accelerating to 3.7% in December 2025.

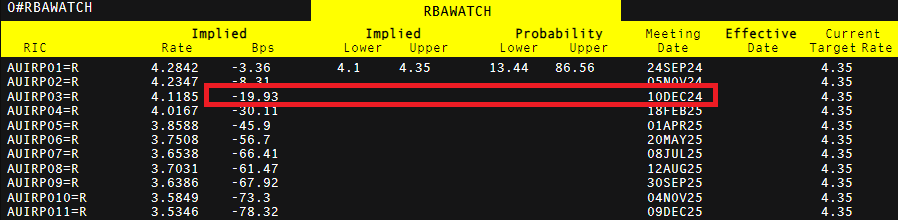

In the absence of consistently lower prices, the RBA is likely to continue discussing the potential for rate hikes despite the market still pricing in a 25-basis point (bps) cut before the end of the year.

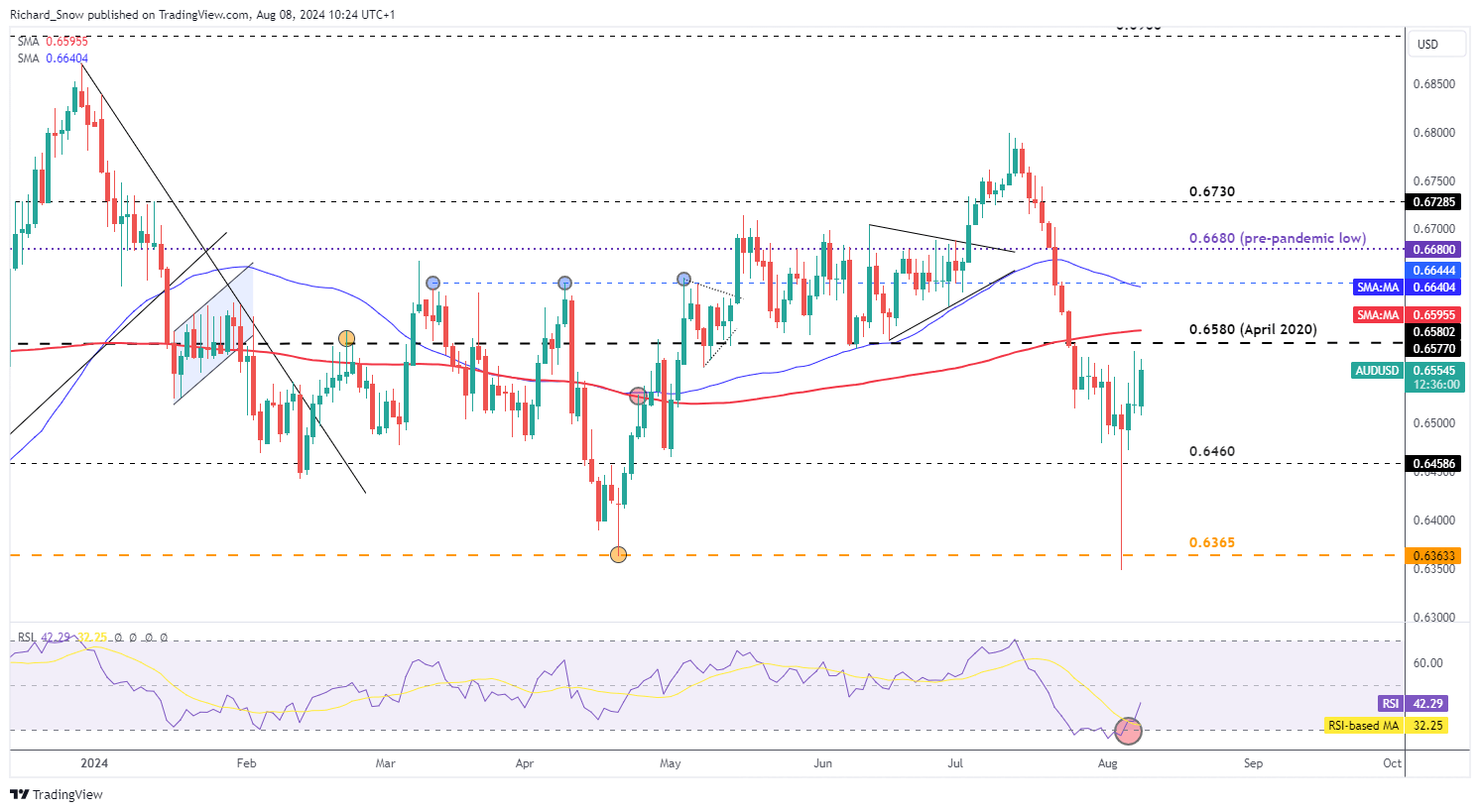

AUD/USD Correction Finds Resistance

AUD / USD has recovered a great deal since Monday’s global bout of volatility with Bullocks rate hike admission helping the Aussie recover lost ground. The degree to which the pair can recover appears to be limited by the nearest level of resistance at 0.6580 which has repelled attempts to trade higher.

An additional inhibitor appears via the 200-day simple moving average (SMA) which appears just above the 0.6580 level. The Aussie has the potential to consolidate from here with the next move likely dependent on whether US CPI can maintain a downward trajectory next week. Support appears at 0.6460.

Richard Snow

GBP/AUD declines after massive spike higher – rate cut bets revised lower

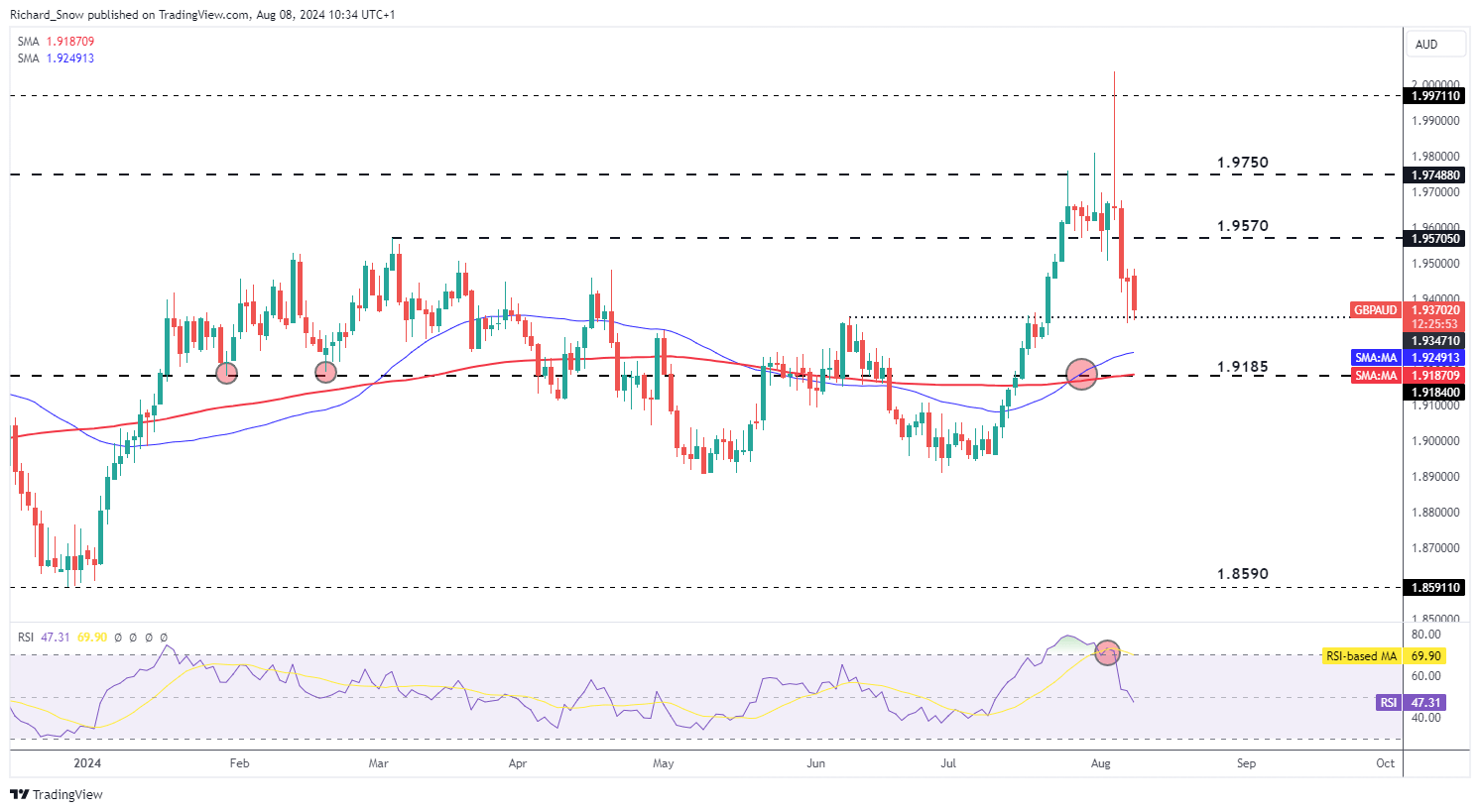

GBP /AUD has posted a massive recovery since the Monday spike high. The massive bout of volatility sent the pair above 2.000 before retreating ahead of the daily close. Sterling appears vulnerable after a rate cut last month surprised corners of the market – resulting in a bearish repricing.

The GBP/AUD decline currently tests the 1.9350 swing high seen in June this year with the 200 SMA suggesting the next level of support appears at the 1.9185 level. Resistance appears at 1.9570 – the March 2024 high.

Richard Snow

An interesting observation between the RBA and the general market is that the RBA does not foresee any rate cuts this year while the bond market priced in as many as two rate cuts (50 bps) during Monday’s panic, which has since eased to 19 bps.

Richard Snow

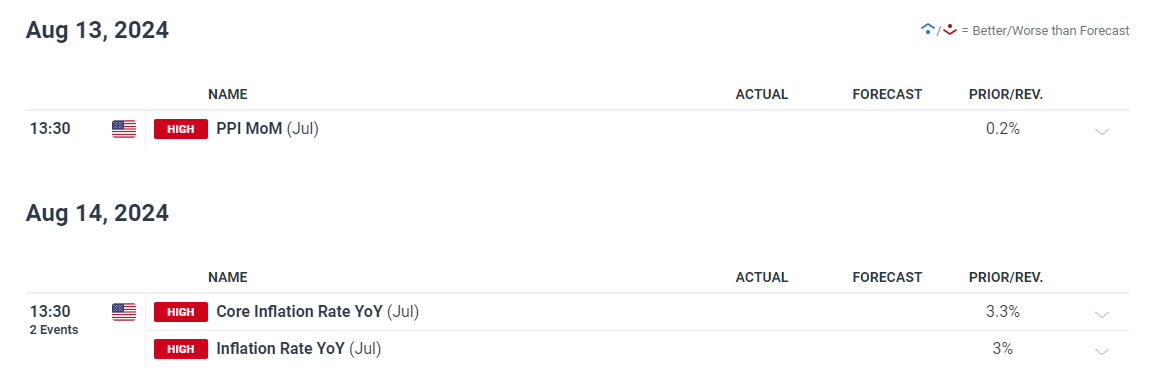

Event risk peters out somewhat over the next few days and into next week. The one major market mover appears via the July US CPI data with the current trend suggesting a continuation of the disinflation process.