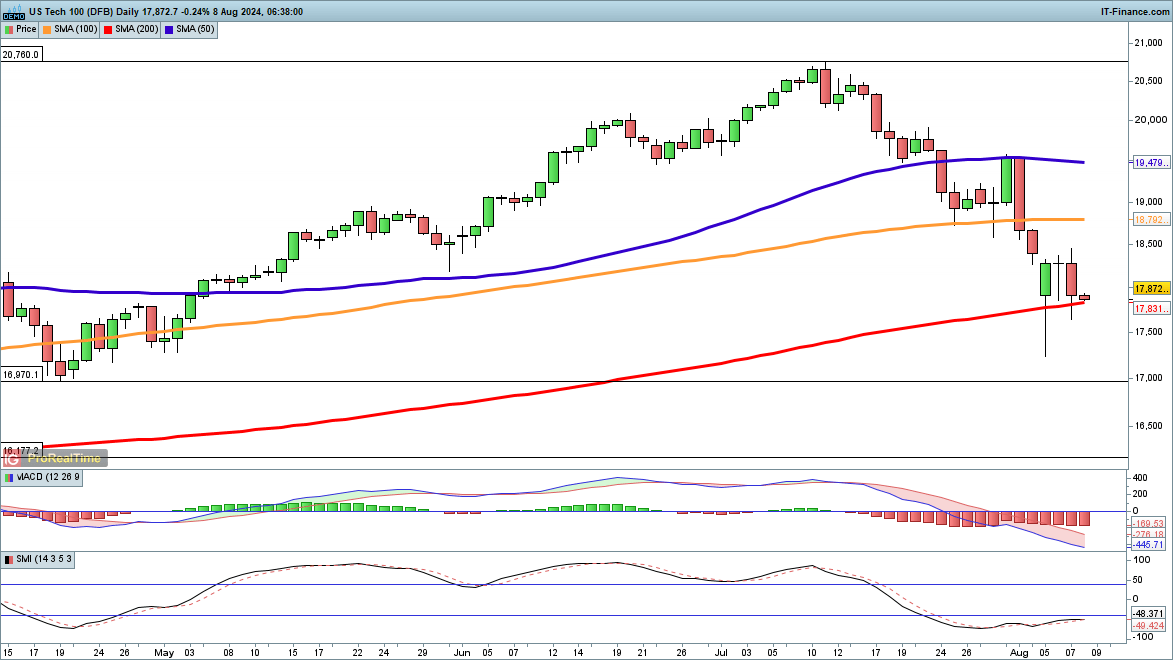

Nasdaq 100 fights to hold 200-day MA

After rebounding on Tuesday the index fell back on Wednesday to the 200-day simple moving average (SMA), currently 17,831, and closed above this level.

Early trading on Thursday has put further pressure on the price, though it is still above the 200-day SMA for the time being. A close below the 200-day would suggest a new push towards the lows of the week. A close back above 18,300 would help to indicate that a low has formed.

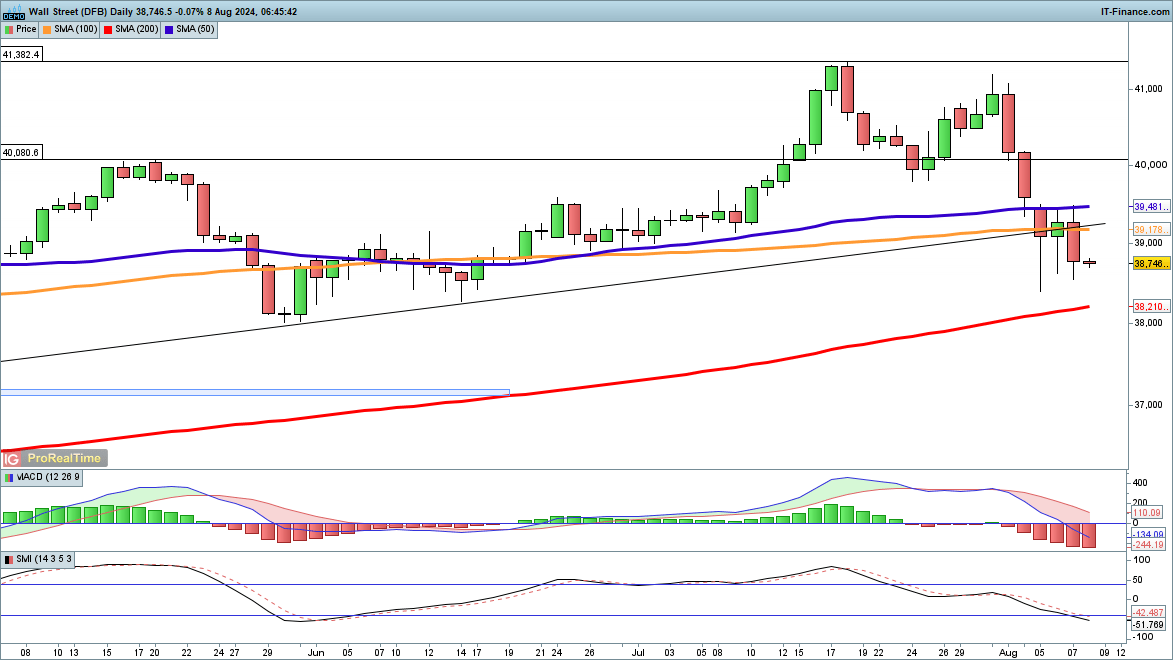

Dow on the back foot after reversal

Wednesday saw renewed losses for the index, though it has held above Monday’s lows for now. A bounce on Tuesday failed to continue into a second day, leaving the price at risk of further declines. The Monday low and then the 200-day SMA (currently 38,210) come into view in the event of more losses.

A close back above 39,200 might suggest that a low has formed.

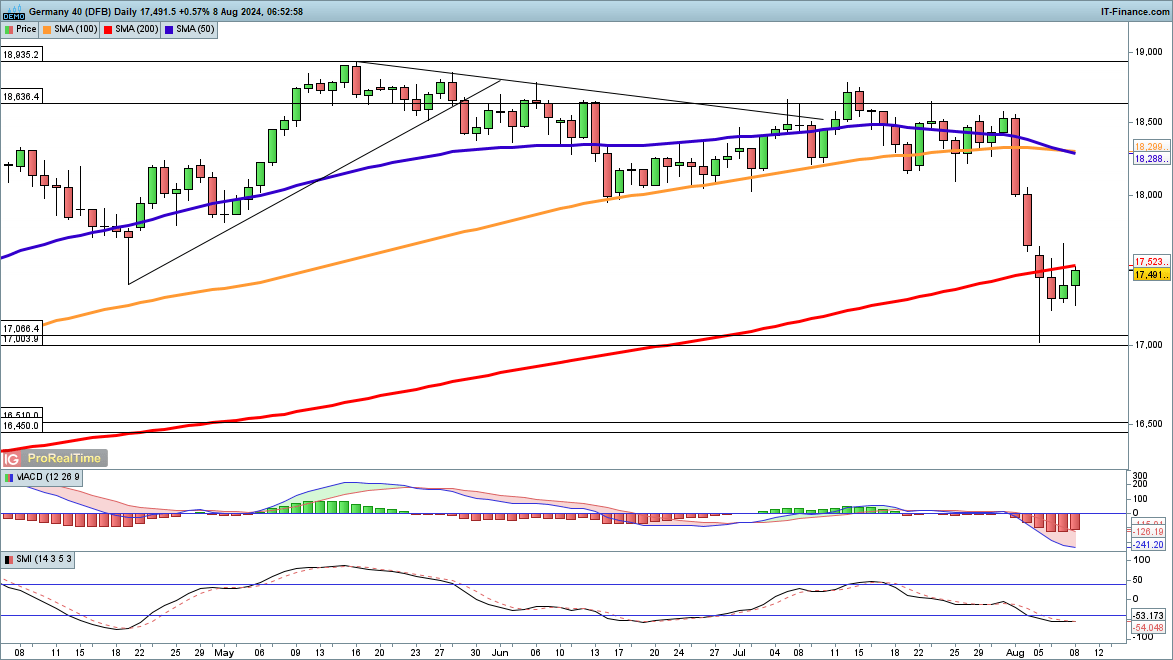

Dax rebounds

Thursday has begun with gains for the index, which may now test its 200-day SMA from below, after reversing course yesterday and closing below this indicator.

A close back above the 200-day SMA might help suggest a low has formed and would put the price back on an upward course. A failure to hold above the 200-day SMA would suggest a fresh turn lower that would test 17,250 and lower.