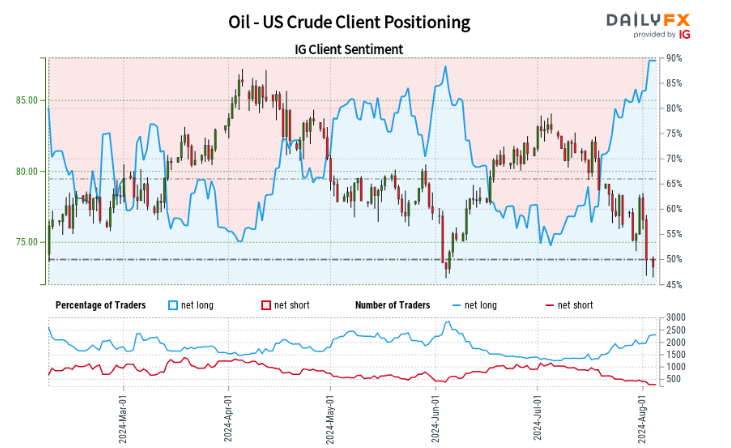

US Crude Oil Market Analysis:

Oil prices have dropped sharply as fears of a global economic slowdown takes hold. If restrictive monetary policy weighs too heavily on economic activity , countries will demand less oil as industries are less likely to be expanding. In addition, consumers tend to tighten their belts, deciding to drive less and go on fewer holidays which can further affect the amount of fuel demanded in the economy.

Current data indicates that , with a long-to-short ratio of 6.94 to 1. Compared to yesterday, there is a 4.94% decrease in long positions, but a 15.01% increase from last week. Short positions have increased by 9.72% since yesterday but decreased by 26.85% from last week.

Given the high percentage of long positions, our contrarian approach suggests a potential downward trend in US Crude Oil prices. However, the mixed changes in positioning over different time frames present a .

Richard Snow

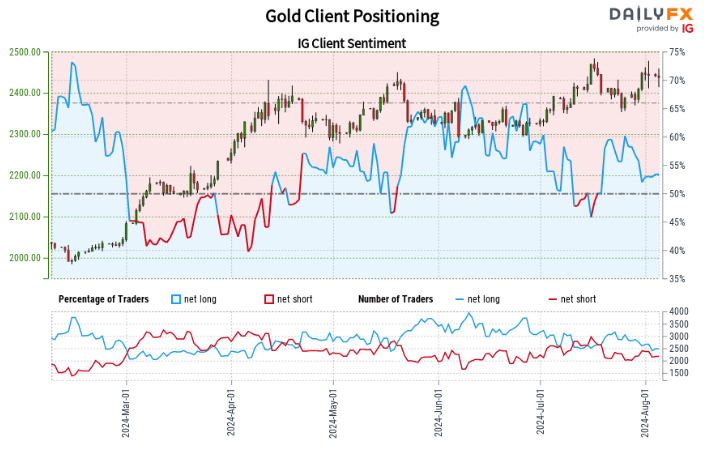

Gold Market Analysis:

Retail trader data shows , with a long-to-short ratio of 1.12 to 1. Long positions have decreased by 2.93% since yesterday and 17.23% from last week. Short positions show a slight 0.64% decrease from yesterday but a 4.01% increase from last week.

While the majority long position typically indicates a potential price decrease in our contrarian view, the recent reduction in long positions and increase in short positions suggest a .

Richard Snow

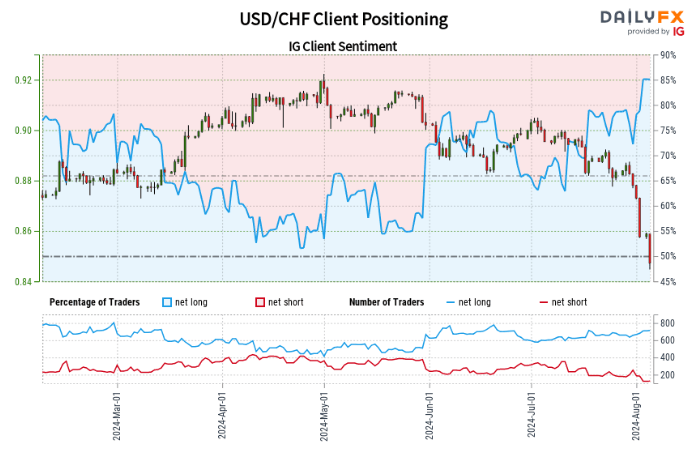

USD/CHF Market Analysis:

The Swiss franc is one of the better-known safe havens and has appreciated markedly over the last few trading sessions.

Current data reveals , with a long-to-short ratio of 5.43 to 1. Long positions have decreased by 3.25% since yesterday but increased by 4.27% from last week. Short positions show a 0.80% increase from yesterday but a significant 38.54% decrease from last week.

The high percentage of long positions suggests a potential downward trend in USD/CHF prices, according to our contrarian approach. However, the mixed changes in positioning over different time frames .

Richard Snow