It is tricky to project asset prices over a three-month horizon at the best of times, never mind during a pivotal election in one of Europe’s largest economies and during a time when the Fed is likely to prepare for its first rate cut later this year. Nevertheless, this forecast endeavours to provide the most pertinent factors to consider for the euro in Q3 with an indication of significant FX levels to keep in mind throughout.

French Snap Election: A Cause for Concern for Bond Market Investors

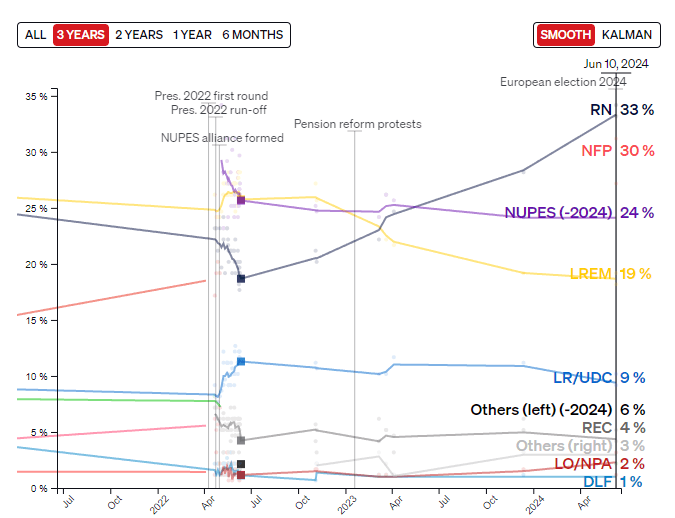

After a heavy defeat in the European elections, French President Emmanuel Macron announced a snap parliamentary election catching everyone off guard. Macron and his party have suffered a loss of support most notably since the pension reform protests and hasn’t quite managed to recover as the right-wing opposition, the National Rally (RN), and a consortium of left leaning parties appeared to fill the void.

Investors do not like uncertainty and a potential victory for RN could lead to standoffs when it comes to passing legislation as conflicts between the president and a RN majority in parliament could frustrate processes.

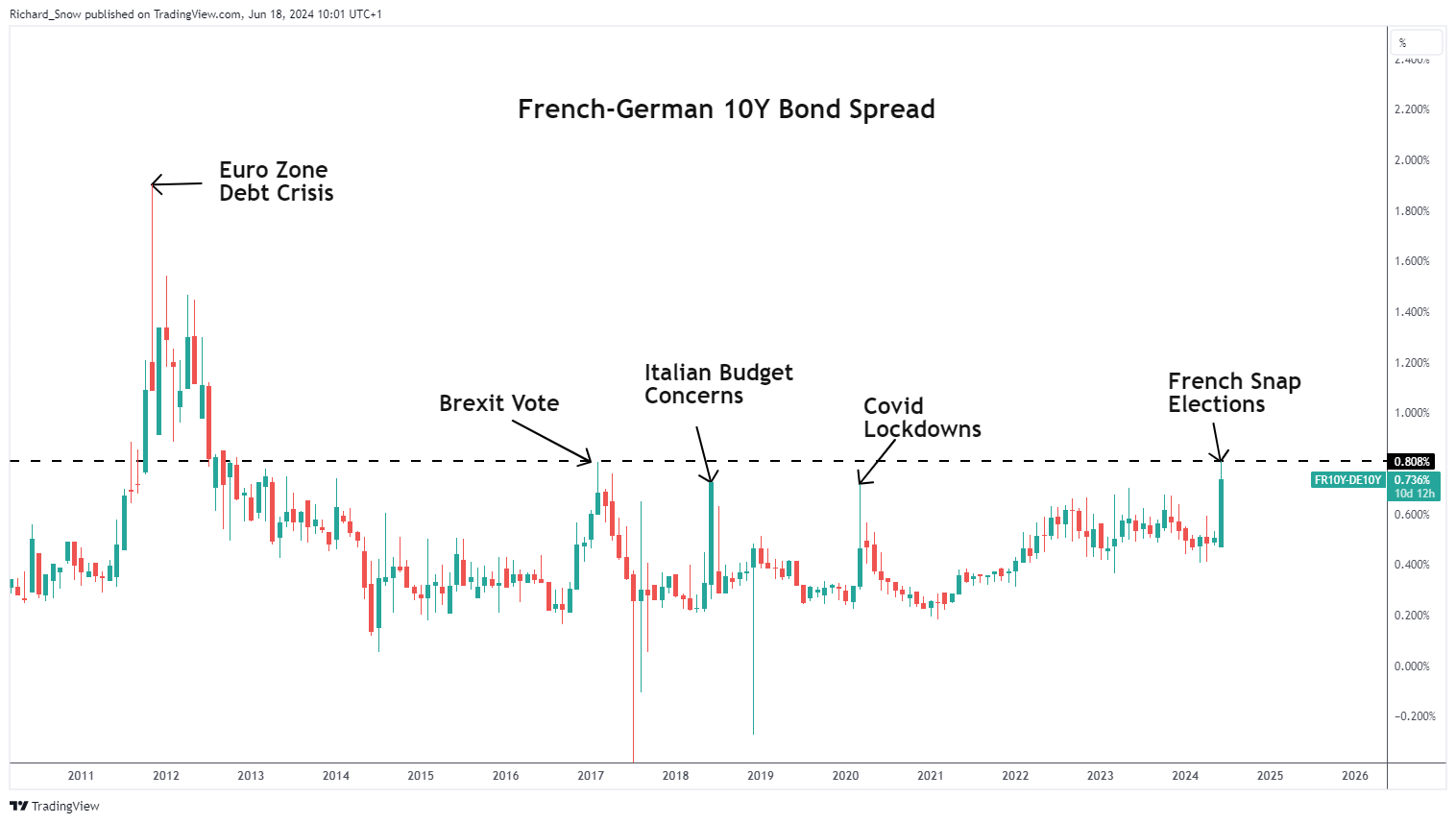

OAT-Bund spreads have widened to familiar levels, underscoring the impact of a potential political headache. RN have been known to be critical of the European Commission and could push against policies passed down from Brussels, especially the issue of deficit spending – something that concerns the bond market given France already breaches EU guidelines of 60% debt to GDP ratio with its near 110% figure. If first round elections on June 30th reveal anything close to the winning margin at the European election, then the French risk premium is likely to rise further and history warns us that the euro tends to sell-off when debt-laden countries face higher borrowing costs. Contagion risk among periphery nations will be chief among investor concerns if the political landscape is headed for change.

Fed Policy to Outweigh ECB Rate Impact

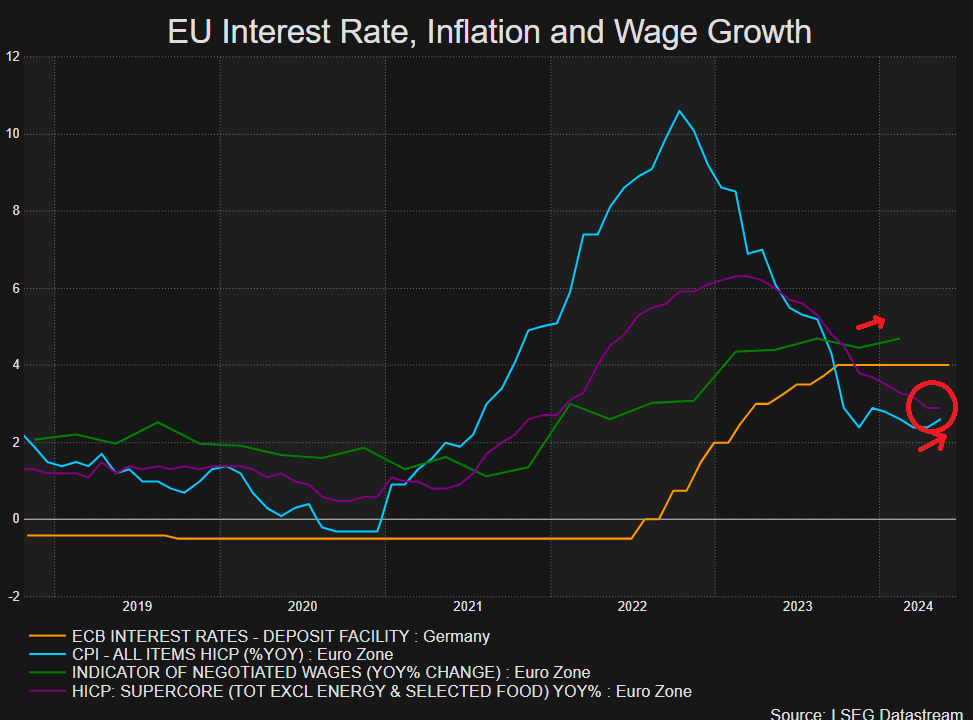

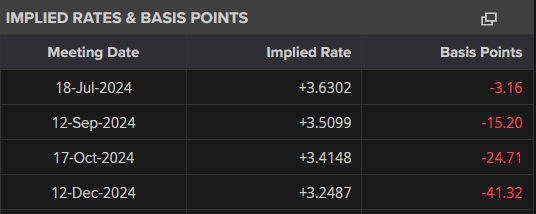

While the ECB has already started to lower interest rates, anticipation around the Fed’s first cut is likely to be a major driver of EUR/USD price action in Q3. Market implied probabilities suggest the European Central Bank (ECB) is likely to pause for the next two meetings and reengage rate cuts in October and potentially again in December to cut a total of three times in 2024. This lack of urgency, at a time when US data is pointing to a rate cut later this year, could keep the euro supported in the absence of political instability in France.

For the US April and May CPI data revealed disinflation is back on track after months of stubborn price pressures dented Fed officials’ confidence of a return to the 2% target. Economic growth is moderating but the labour market remains robust. Should services CPI and super core inflation reveal meaningful declines, short-term US yields are likely to see a sizeable drop, setting the scene for Fed officials to lower rates sooner than November and potentially cut twice in 2024 despite June’s updated dot plot which revealed only one cut in 2024. The Fed refrains from policy adjustments during US Presidential elections which means, if conditions permit, the Fed may eye September more seriously and in doing so the dollar could lose further ground to the euro.

The latest ECB forecasts suggest that inflation is only likely to return to 2% after 2025 and the governing council anticipates an uptick in inflation in the short-term – potentially providing a tailwind for the euro in Q1.

EU Inflation Ticks up in May – a Blip or Something to Watch out for?

In addition, EU inflation in May jumped higher – to the annoyance of some ECB members after the rate setting council had essentially already committed to a cut in June. For now, it’s just one print but if June follows with a hot print of its own rate cut expectations may get trimmed back, adding further to a potential euro reprieve.