British Pound Faces Challenges in Q3

The British Pound is under pressure going into the third quarter of the year as interest rate cuts finally heave into view, while the UK general election is set to cause a bout of volatility, and likely Sterling weakness, with the incumbent Conservative Party expected to poll its worst set of results in decades. Current polls suggest that Labour will win the July 4th election by a landslide, and with their spending plan still unclear, investors may shun Sterling, and Sterling-denominated assets, until the economic picture is clearer.

UK Inflation: Target Reached, but Difficulties Remain

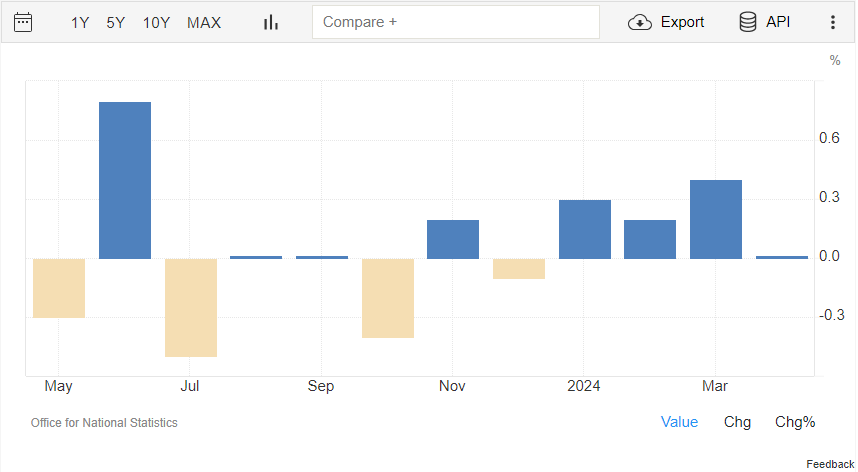

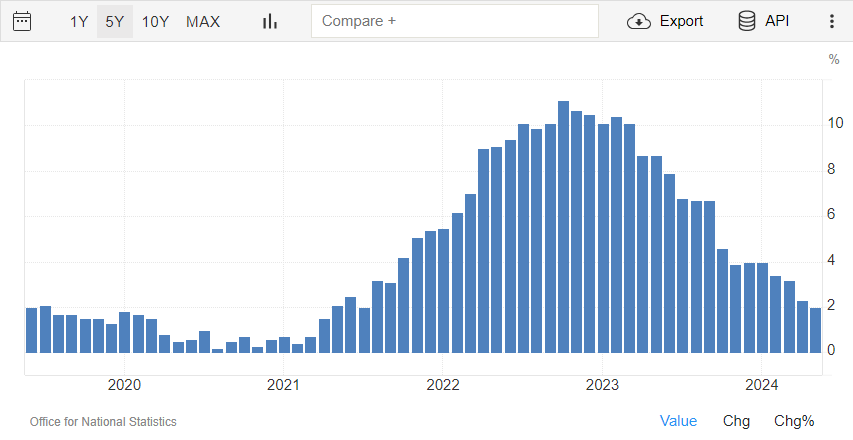

The United Kingdom reached a significant economic milestone in May as inflation data revealed a return to the Bank of England's (BoE) target rate. For the first time in nearly three years, the UK's headline inflation rate dropped to 2%, aligning with the BoE's long-standing target. This development marks a notable turning point in the country's fight against elevated price pressures.

Core inflation - ex food and energy - also fell from 3.9% to 3.5%, while services inflation fell from 5.9% to 5.7%, a move in the right direction but still worryingly high for the BoE.

The Bank of England has been vocal over the last few months that inflation would hit target around the start of H2. However, the BoE also warned recently that CPI inflation is expected to rise slightly in the second half of the year, ’as declines in energy prices last year fall out of the annual comparison’. With the BoE remaining data dependant, the UK central bank may want to see further evidence of inflation, especially Core and services inflation, falling further before it initiates a round of interest rate cuts.

UK Interest Rate Outlook: Projected Path and Market Expectations

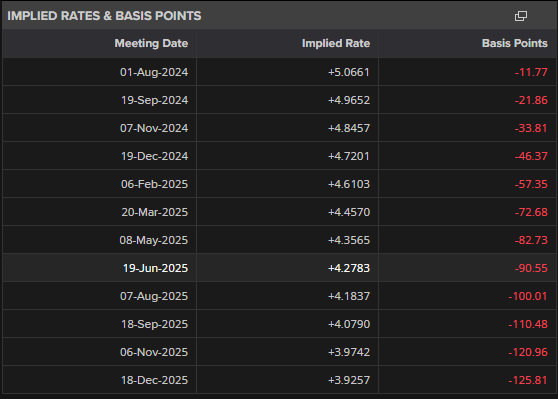

The trajectory for UK interest rates continues to trend downward, with the timing of the initial 25 basis point reduction emerging as a key factor influencing Sterling's performance in the coming quarter. Current market assessments provide valuable insights into potential rate adjustments and can affect the value of Sterling against arrange of currencies.

- Financial markets currently price in a 49% probability of a rate cut at this session. This balanced outlook suggests significant uncertainty surrounding the Bank of England's immediate intentions.

- Should rates remain unchanged in August, market indicators point to a near-certainty of a downward adjustment at the September meeting:

- The market anticipates a high likelihood of a second-rate reduction before year-end with the probability of an additional cut at 90%.

- Looking further ahead, market expectations suggest a continued easing cycle with a forecast Bank Rate of 4% at the end of 2025.

UK growth stalled in April after rising in each of the prior three months, again highlighting the tricky balance that the UK central bank has when looking at easing monetary policy. The UK economy expanded by just 0.1% in 2023, its weakest annual growth since 2009, and while growth in the first three months of 2024 beat market expectations, April’s figure is disappointing. UK growth expectations have been upgraded since the beginning of the year with various bodies projecting growth of between 0.6% and 1.0% in 2024, although these may be affected by the upcoming UK general election.