- PBoC left its gold reserves untouched for the second consecutive month.

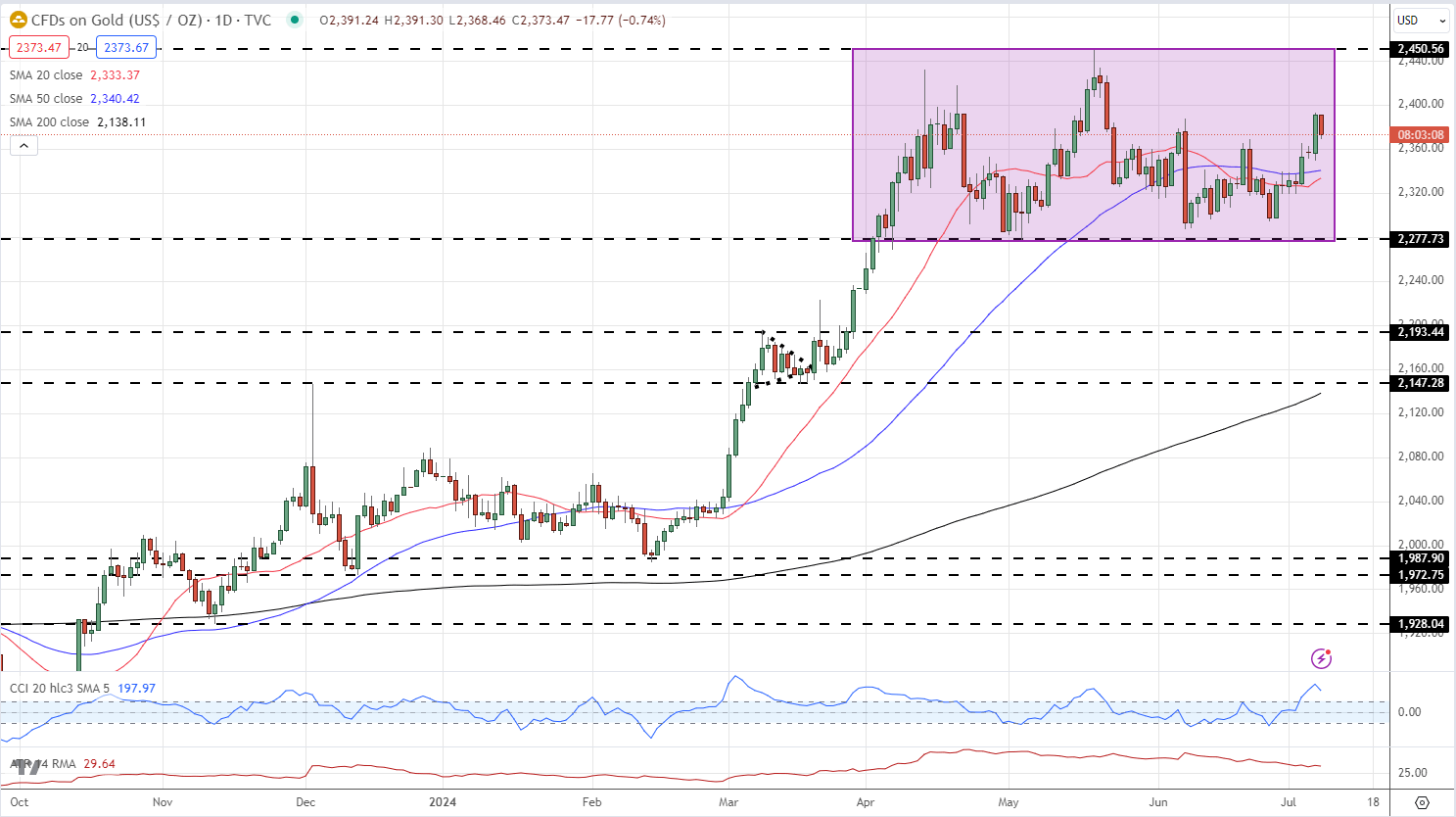

- Gold’s multi-month range remains in play.

Gold prices are under slight pressure as China's central bank – the People’s Bank of China (PBoC) - holds off on purchases for the second straight month. This absence of a significant buyer – the PBoC have been a constant buyer of gold over the last 18 months - leaves the precious metal susceptible to profit-taking after last week’s NFP -inspired rally. The precious metal traded at a six-week high last Friday at just under $2,400/oz. but has drifted lower today after the weekend news.

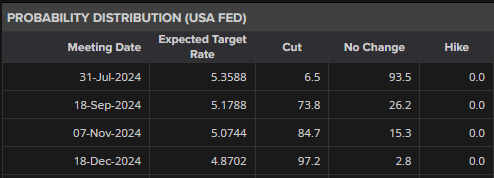

US interest rate cut expectations nudged higher at the end of last week after the latest US Jobs Report suggested a hiring slowdown. While the headline NFP number was slightly higher than expected, the prior month’s revisions, and the increase in the jobless rate to 4.1%, more than outweighed the headline beat. There is now a 74% probability of a 25bp cut at the September 18th FOMC meeting with a further quarter-point cut priced in by the end of the year.

Gold remains rangebound and is currently sitting in the middle of a multi-month range. The 20- and 50-day simple moving averages remain supportive, while a clean break above $2,287/oz. would leave range resistance at $2,450/oz. under threat. A break below the two moving averages would leave $2,320/oz. as the next level of interest.

Gold Daily Price Chart

Retail trader data shows 51.73% of traders are net-long with the ratio of traders long to short at 1.07 to 1.The number of traders net-long is 7.45% higher than yesterday and 14.76% lower than last week, while the number of traders net-short is 2.83% higher than yesterday and 17.61% higher than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall. Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed Gold trading bias.