US Dollar, EUR/USD, and GBP/USD Analysis

- Thursday’s US CPI report is the next driver of US dollar price action.

- EUR/USD and GBP/USD latest sentiment analysis

US Fed Chair Jerome Powell gave little away today at his latest biannual testimony to Congress, reiterating his recent FOMC commentary. In his opening statement, Chair Powell said that the ‘The Federal Reserve remains squarely focused on our dual mandate to promote maximum employment and stable prices for the benefit of the American people. Over the past two years, the economy has made considerable progress toward the Federal Reserve's 2 percent inflation goal, and labor market conditions have cooled while remaining strong. Reflecting these developments, the risks to achieving our employment and inflation goals are coming into better balance.’

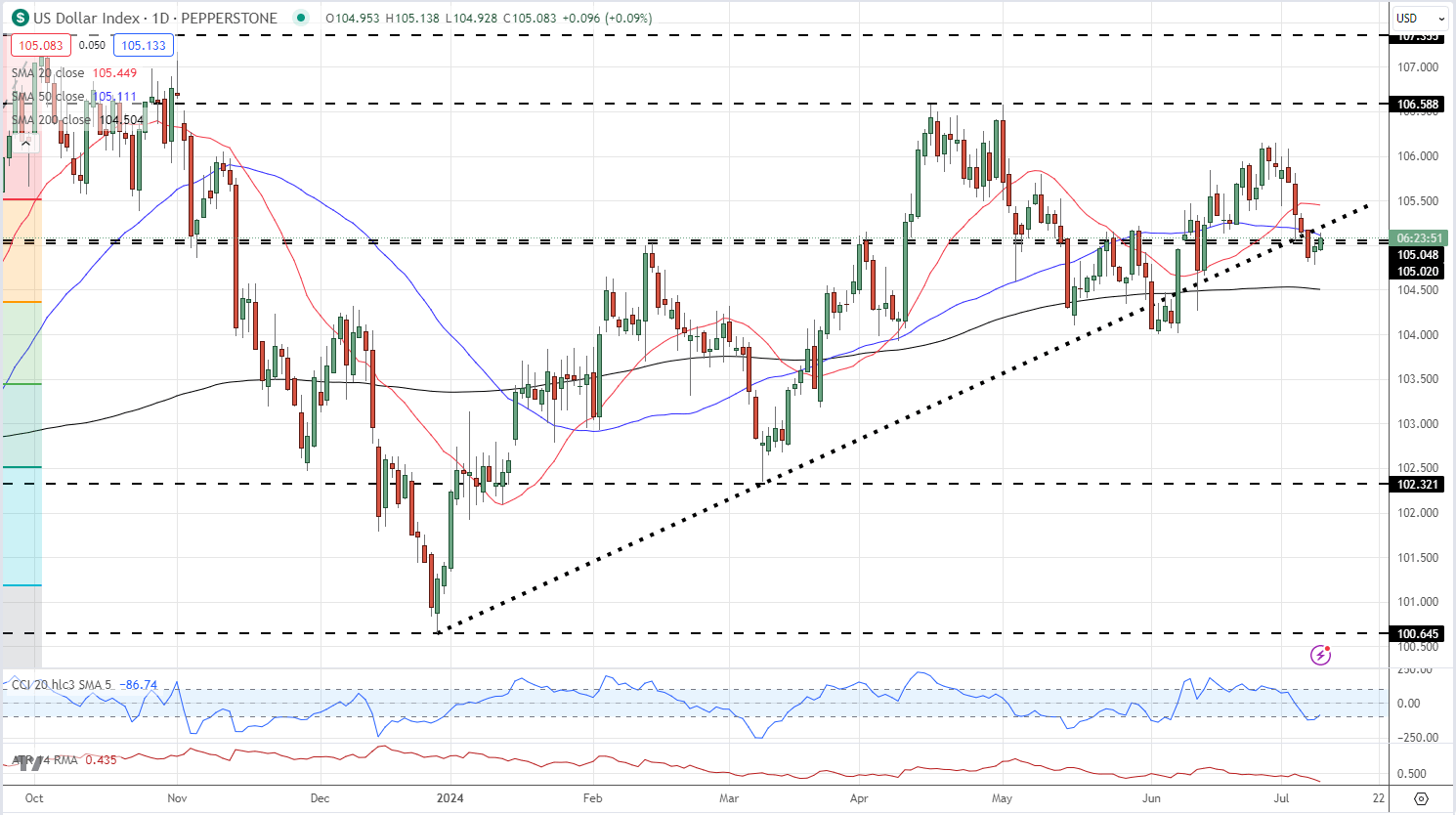

The US dollar index (DXY) nudged marginally higher after falling for four of the past five sessions, but the move was limited and left the DXY below the recent trend support. Thursday’s US CPI report (13:30UK) is now expected to be the next driver of US volatility. Core inflation y/y is expected to remain unchanged at 3.4%, while headline inflation y/y is forecast at 3.1%, down from 3.3% in May.

US Dollar Index Daily Chart

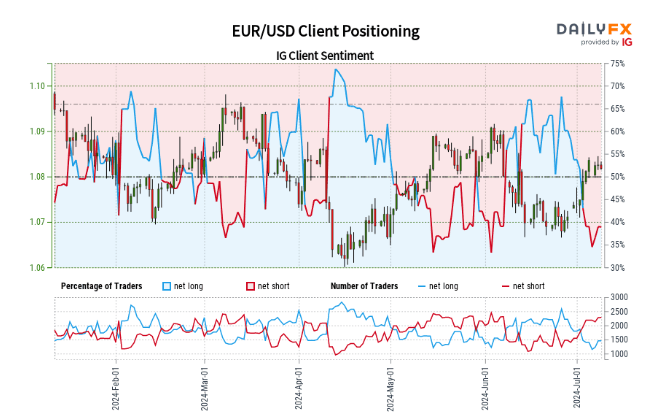

EUR/USD Sentiment Analysis

Retail trader sentiment for EUR / USD is mixed. While 39.48% of traders are net-long, recent shifts in positioning suggest conflicting signals. The contrarian view indicates potential upward price movement, but changes in net-short positions present a nuanced outlook. Our current trading bias for EUR/USD remains mixed.

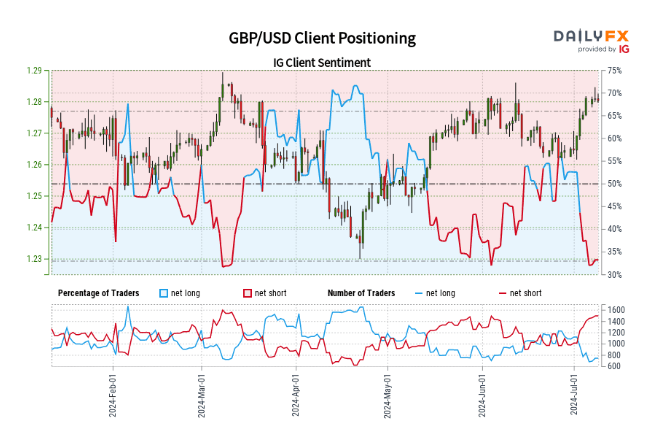

GBP/USD Sentiment Analysis

GBP /USD sentiment is currently mixed. With 33.70% of traders net-long, the contrarian view suggests potential price increases. However, recent changes in positioning present conflicting signals. Net-long positions have increased slightly daily but decreased significantly weekly, while net-short positions have grown both daily and weekly. This combination results in a mixed GBP/USD trading bias.