British Pound (GBP/USD) Analysis and Charts

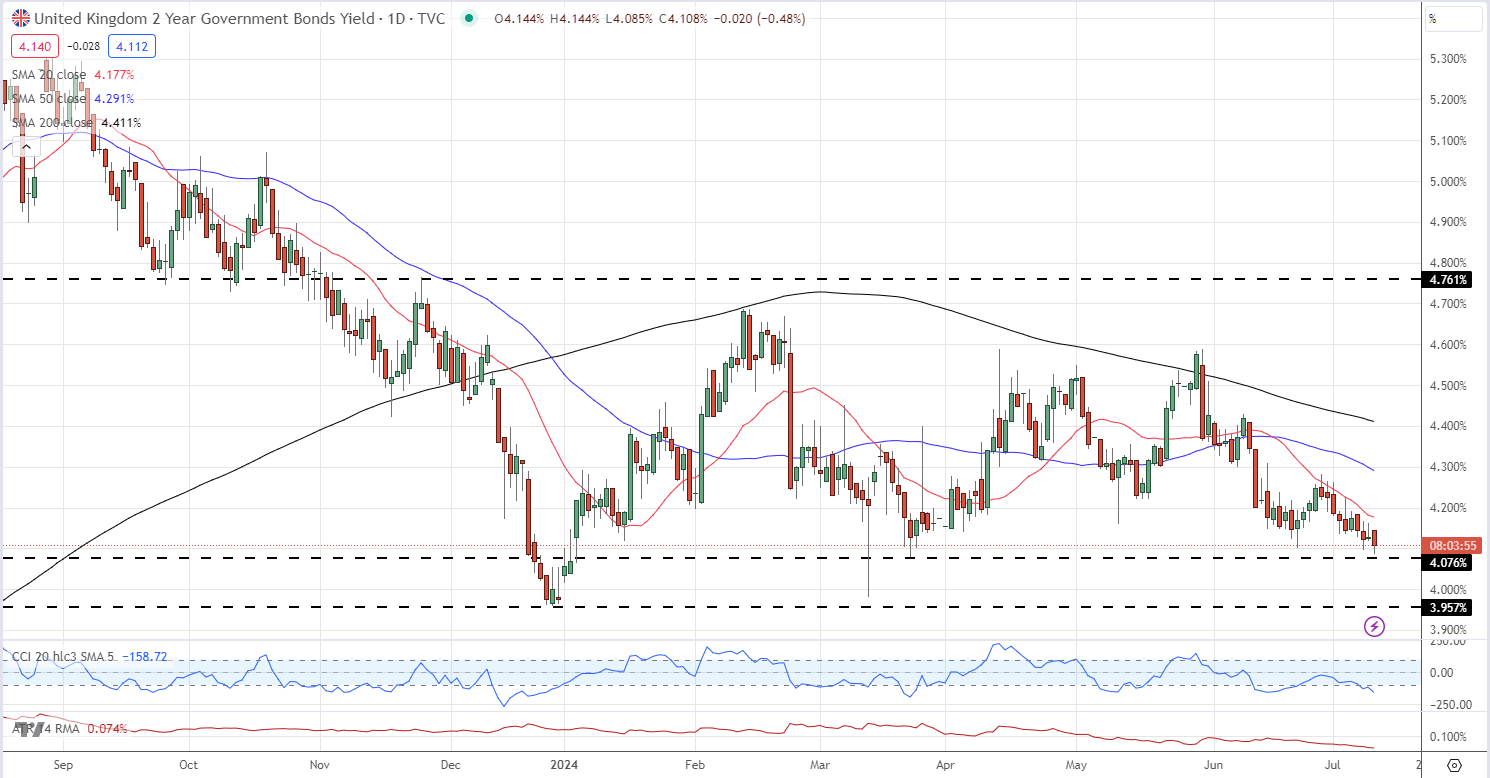

- UK 2-year Gilt yields set to break below 4%.

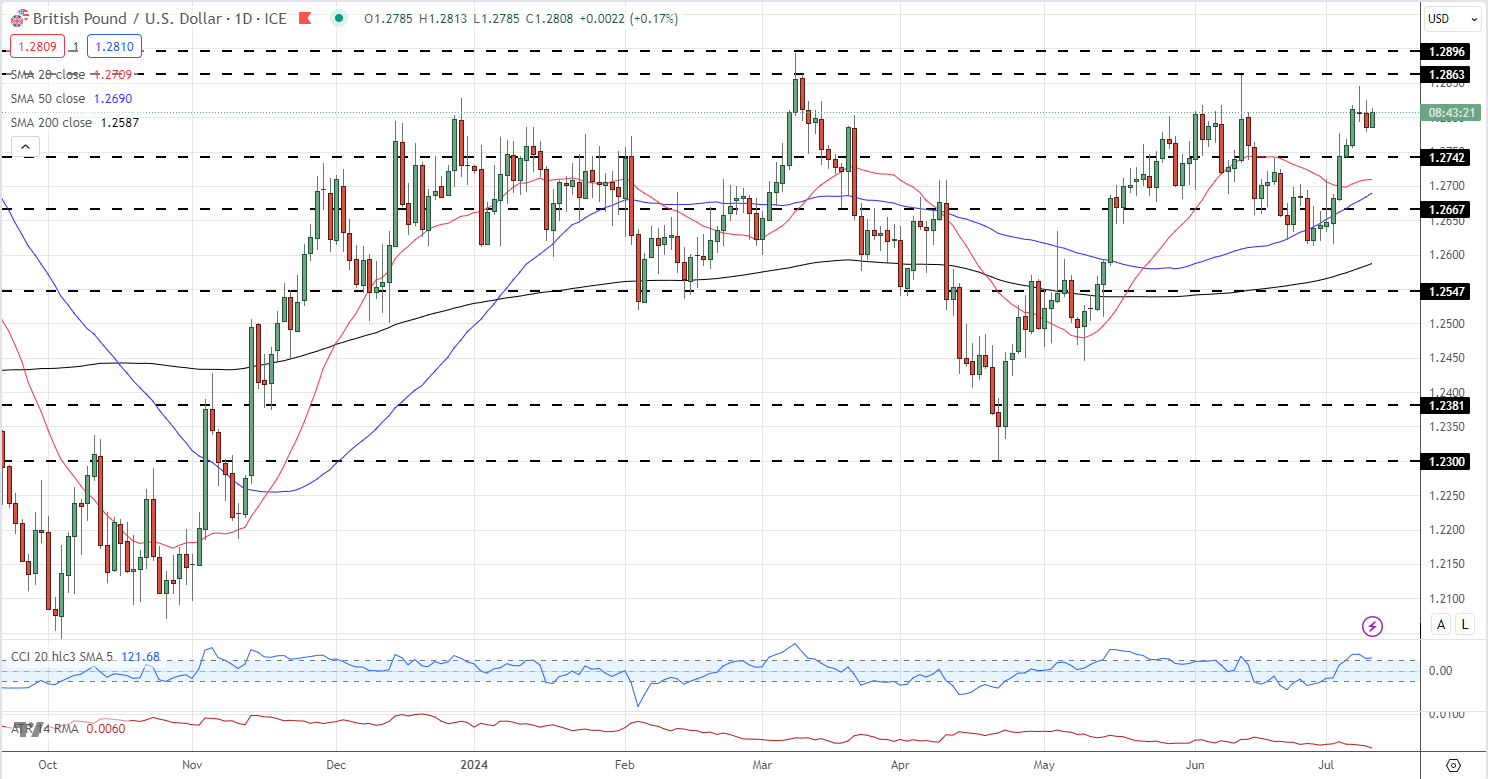

- GBP/USD eyes Thursday’s US CPI release.

UK government borrowing costs are declining as investors anticipate lower interest rates. The 2-year gilt yield is approaching levels not seen in over three months, reflecting market expectations of two 25 basis point rate cuts this year. Investors are projecting the first reduction at the Bank of England's September meeting. Additionally, the current political stability is contributing to downward pressure on gilt yields, despite long-term concerns about potentially increased borrowing under the new Labour government.

A break and open below the March 22nd low at just under 4.08% should open the way for the 2-year gilt yield to test 4.0% and then 3.96%.

US 2-Year Gilt Yield

GBP/ USD remains around the 1.2800-1.2850 area ahead of Thursday’s US CPI release. Cable tested, and quickly rejected the early June 1.2863 level on Monday and now needs a catalyst if it is to break higher. All three simple moving averages remain positive. Initial support is seen around 1.2750.

GBP/USD Daily Chart

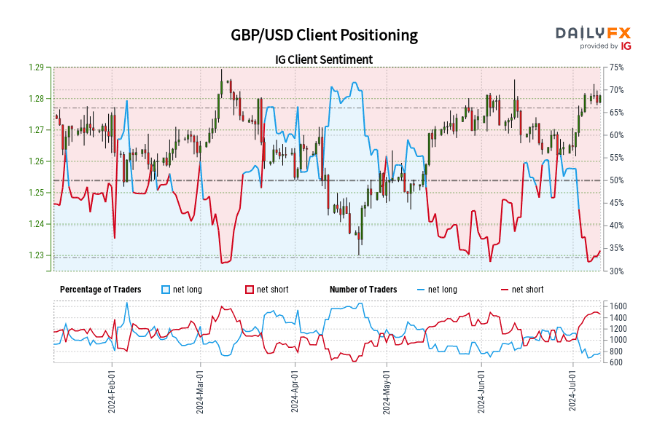

Retail trader data shows 34.93% of traders are net-long with the ratio of traders short to long at 1.86 to 1.The number of traders net-long is 2.01% higher than yesterday and 19.14% lower from last week, while the number of traders net-short is 3.39% lower than yesterday and 15.61% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise. Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed GBP/USD trading bias.