Japanese Yen (USD/JPY) Analysis

- Dovish Powell leads Treasury yields , JGBs lower – weighing on the yen

- USD/JPY lifts gradually after the yen surrendered recent gains

Dovish Powell Leads Treasury Yields, JGBs Lower - Weighing on the Yen

Jerome Powell continued to hint at improving conditions, laying the groundwork for the Fed’s first rate cut since the hiking cycle began in 2022. The Fed chairman repeated that the Fed will not wait until inflation is at the all important 2% market before lowering rates as monetary policy operates with a variable lag.

Powell added that the committee is looking for more of the same when it comes to economic data as parts of the labour market show signs of easing, growth has moderated and inflation continues to edge lower.

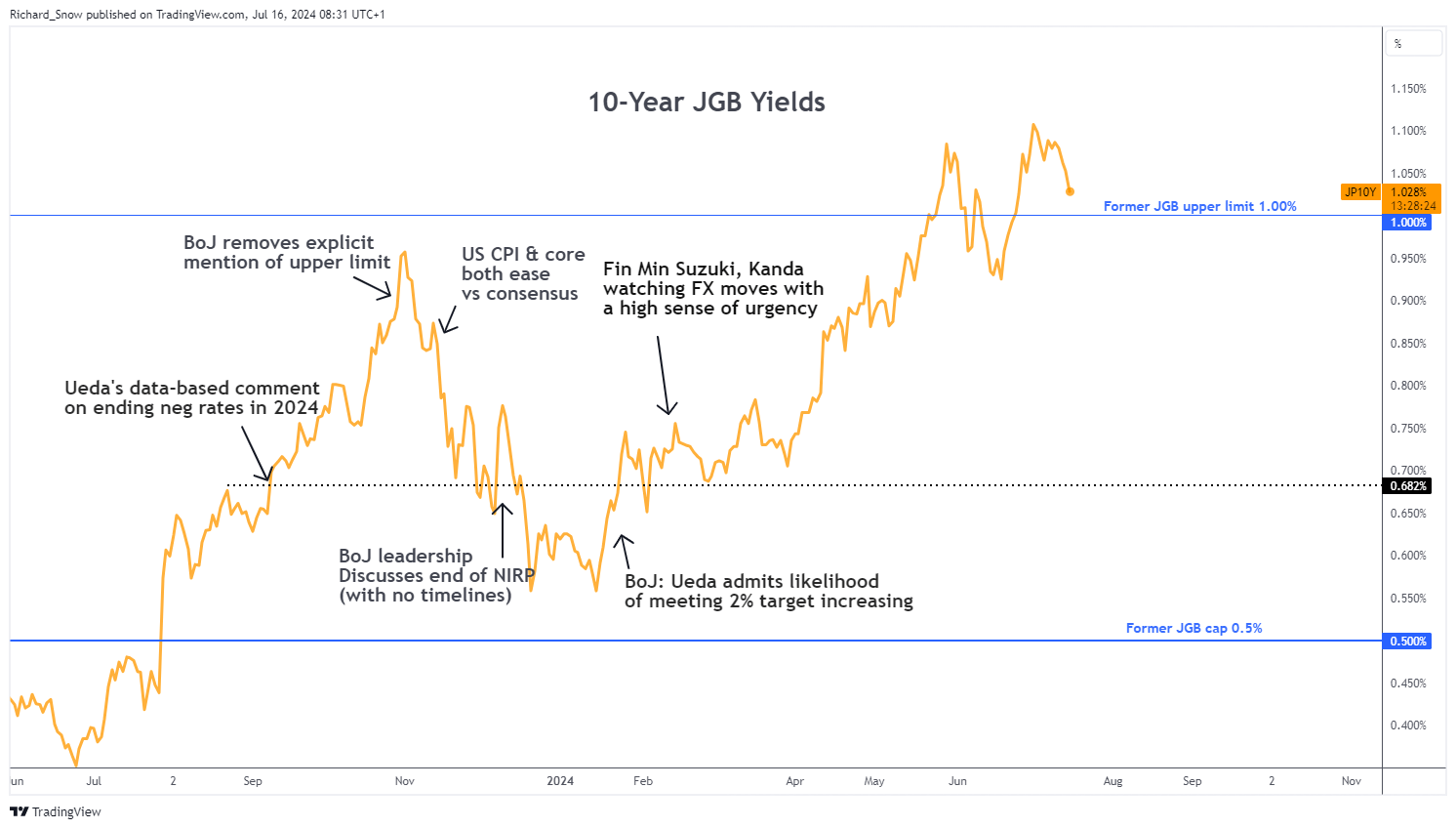

Nevertheless, the US dollar refused to weaken despite the recent sharp selloff in response to last week’s lower US inflation figures. US yields, however, lead the rest of the pack lower this morning with Japanese government bond yields following suit. The 10-year yield now trades near a three week low and approaches the former cap of 1%. Later this month the Bank of Japan (BoJ) will meet to potentially hike rates and have promised to reveal more details to their bond tapering plans.

Richard Snow

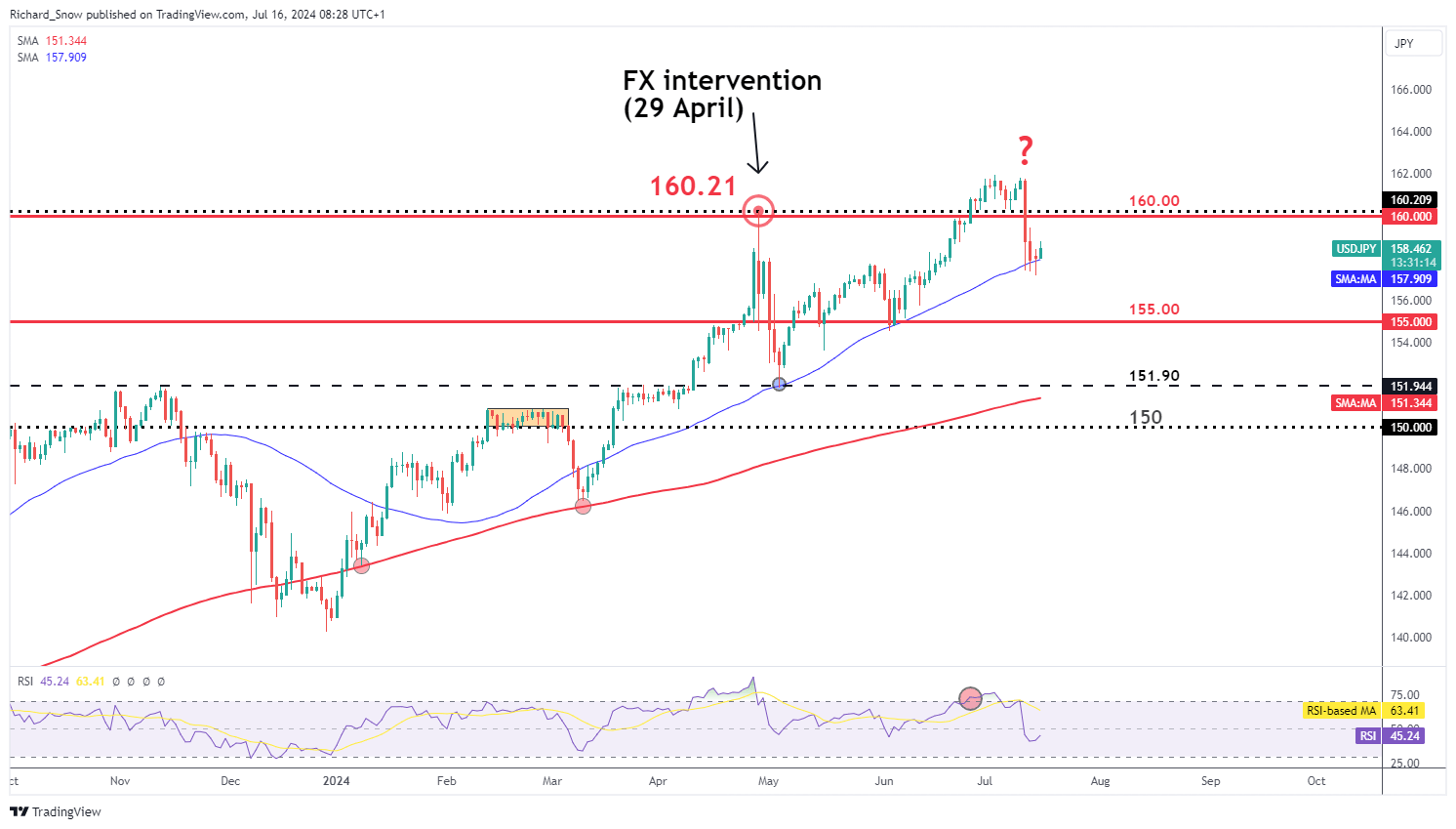

USD /JPY has been the subject of much debate after official BoJ data suggests 3.57 trillion yen may have been deployed to strengthen the yen. Officials declined to comment on whether it was a targeted FX intervention exercise and continued to stress that recent yen weakness is undesirable.

The pair appears to have found momentary support at the blue 50-day simple moving average, where a bullish continuation highlights the 160.00 mark once again. If further signs of a Fed cut materialize, the pair could consolidate and favour sideways trading but this appears as a less likely outcome given the interest rate differential continues to disadvantage the yen. In any case, 155.00 remains the next level of support.

Richard Snow