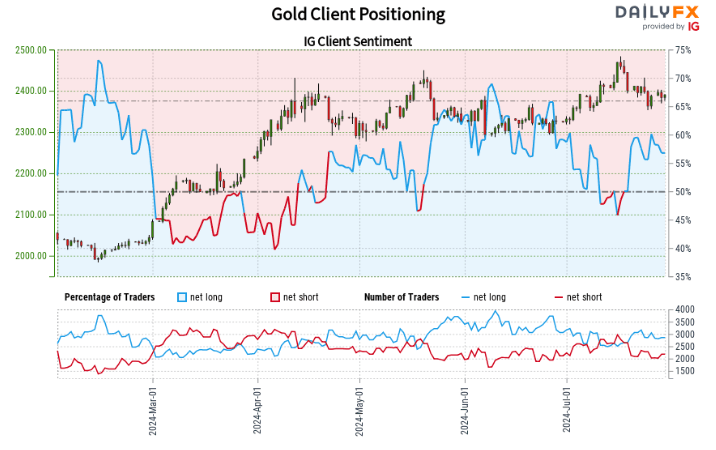

Analysis of retail trader positioning indicates , with a long-to-short ratio of 1.28 to 1. Net-long traders have decreased by 2.47% since yesterday and 3.96% from last week, while net-short traders have increased by 7.34% since yesterday but decreased by 4.98% from last week.

Adopting a contrarian approach to market sentiment suggests Gold prices may continue to decline, given the net-long position of traders. However, the positioning is less net-long than yesterday but more net-long than last week. This combination of current sentiment and recent shifts results in a mixed trading outlook for Gold .

Richard Snow

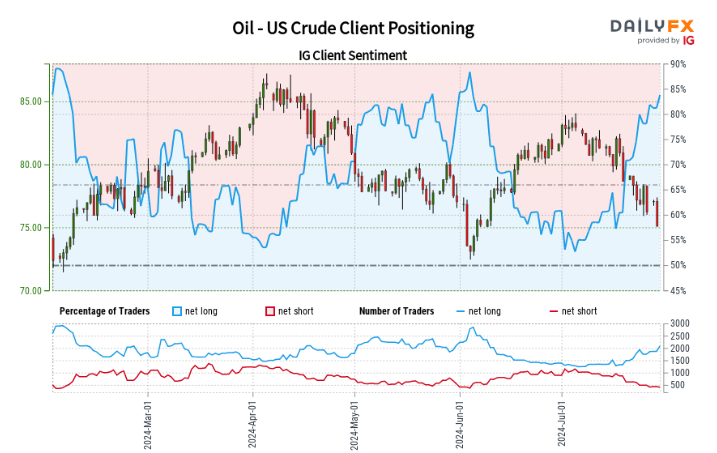

- US Crude: Retail trader data reveals , with a long-to-short ratio of 5.28 to 1. Net-long traders have increased by 11.02% since yesterday and 18.68% from last week, while net-short traders have decreased by 7.18% since yesterday and 34.26% from last week.

Our contrarian approach to market sentiment suggests Oil - US Crude prices may continue to decline, given the net-long position of traders. The further increase in net-long positions both since yesterday and last week reinforces a stronger bearish contrarian trading bias for Oil - US Crude

Richard Snow

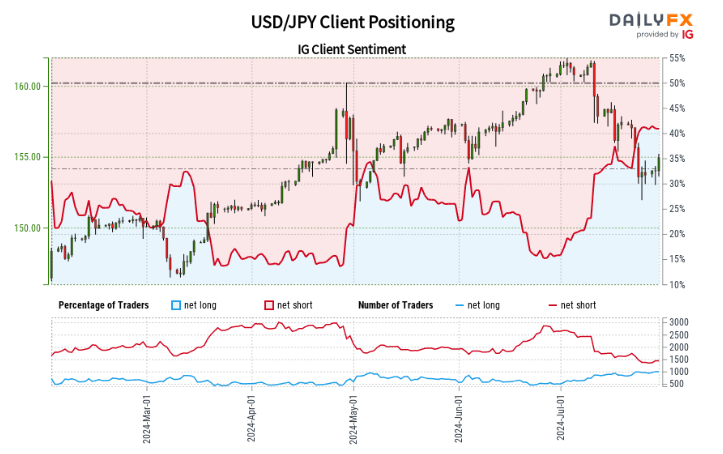

: Retail trader positioning shows , with a short-to-long ratio of 1.48 to 1. Net-long traders have increased by 1.25% since yesterday and 7.52% from last week, while net-short traders have increased by 0.77% since yesterday but decreased by 16.88% from last week.

Our contrarian approach to market sentiment suggests USD / JPY prices may continue to rise, given the net-short position of traders. However, traders are less net-short than yesterday and compared to last week. These recent shifts in sentiment indicate that the current USD/JPY price trend may soon reverse lower , despite traders remaining net-short.

Richard Snow