Euro (EUR/USD) Remains Under Pressure as German Economy Contracts in Q2

- The ECB may need to act to reboot the German economy.

- German inflation data out later today is now key.

For all high-importance data releases and events, see the

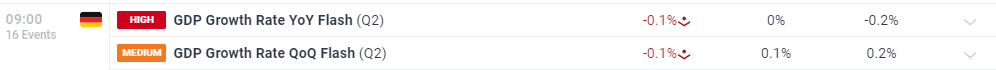

The German economy contracted in the second quarter of the year, missing expectations of a small expansion. Initial data from Destatis showed the economy contracting by one tenth of a percentage point in Q2, compared to expectations of 0.1% growth and 0.2% growth in Q1. As the Federal Statistical Office (Destatis) further reports, ‘investments in equipment and buildings, adjusted for price, seasonal and calendar effects, in particular decreased.’ Destatis will announce revisions to the GDP data on August 27th .

Later today, the latest look at German inflation will need to be closely monitored for any signs of weakening price pressures. Financial markets are currently showing a 66% probability of a rate cut on September 12 and any further weakening of German inflation will boost these odds. Preliminary German inflation data is released at 13:00 UK.

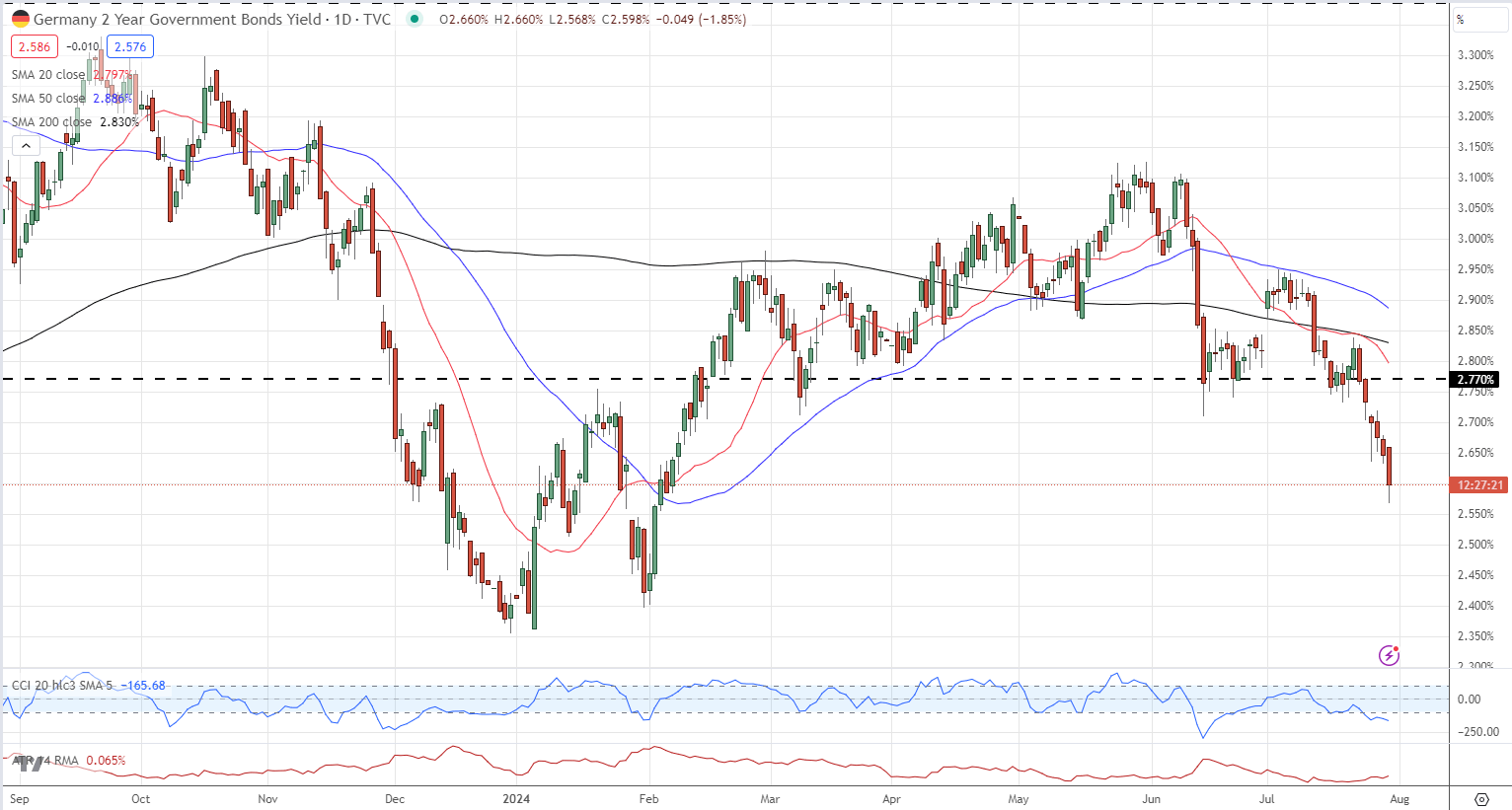

EUR/USD is trying to claw back some of Monday’s losses, but today’s German GDP release is putting renewed downward pressure on the pair. Short-dated German bond yields are back at lows last seen in early February, adding to the pressure on the Euro .

German 2-Year Daily Yield Chart

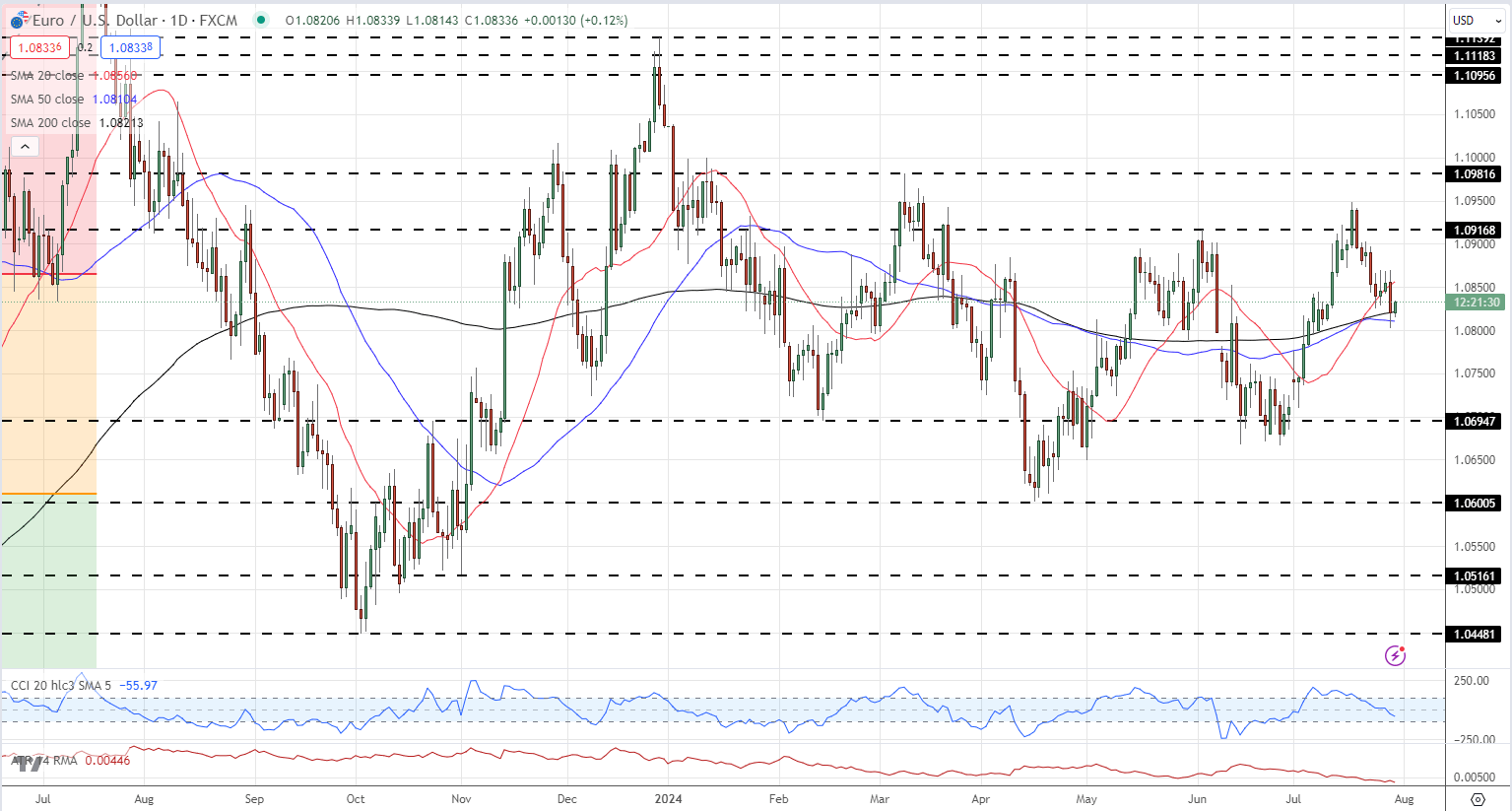

EUR/ USD currently trades around 1.0830, below the 20-day sma and just above both the 50- and 200-day smas. A break below the two smas and Monday’s 1.0803 low would leave the pair vulnerable to a move back to the 1.0750 area before 1.0700 comes into play. A move higher would see EUR/USD run into resistance around recent highs, and the 23.6% Fibonacci retracement around 1.0866.

EUR/USD Daily Price Chart

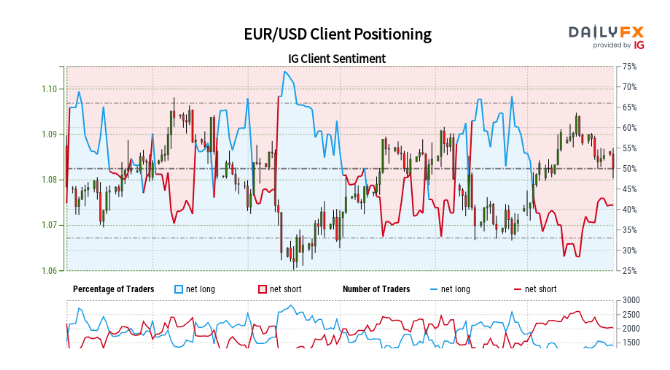

Retail trader data shows 47.20% of traders are net-long with the ratio of traders short to long at 1.12 to 1.The number of traders net-long is 14.81% higher than yesterday and 15.95% higher from last week, while the number of traders net-short is 9.23% lower than yesterday and 23.48% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse lower despite the fact traders remain net-short.