US Crude Oil , Gold , DAX 40 Sentiment

US Crude Oil

US Crude Oil sentiment analysis reveals a predominantly bullish retail trader positioning, with 56.14% net-long. The long-to-short ratio stands at 1.28:1. Technical indicators suggest a potential bearish reversal, as increased long positions often precede price declines. Recent changes show a slight decrease in net-long positions day-over-day but an increase week-over-week. This mixed signal strengthens the bearish bias from a contrarian viewpoint.

You can download our complimentary Q3 Oil Forecast below;

Gold

Gold sentiment analysis reveals a slight bullish bias in retail trader positioning, with 54.39% net-long. The long-to-short ratio stands at 1.19:1. Technical indicators suggest a potential bullish reversal, despite the overall net-long positioning. Recent changes show a significant decrease in net-long positions both day-over-day (-4.97%) and week-over-week (-18.36%), while net-short positions have increased substantially (7.48% daily, 27.08% weekly). This rapid shift in positioning strengthens the case for a possible upward price movement, contrary to the typical contrarian view.

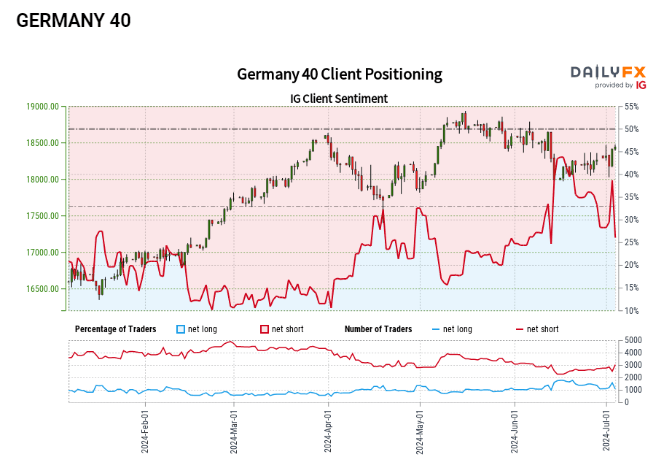

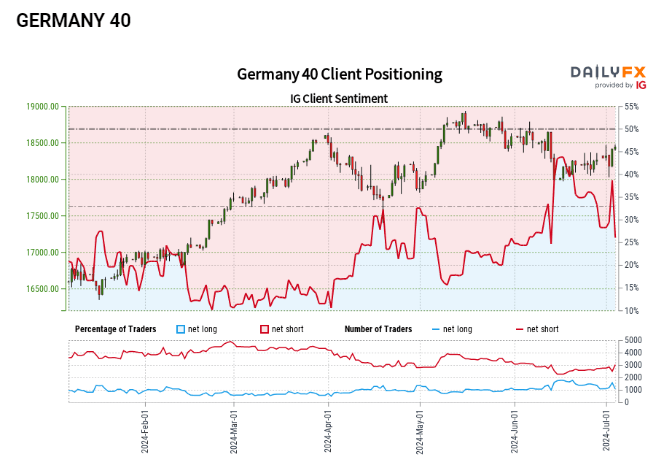

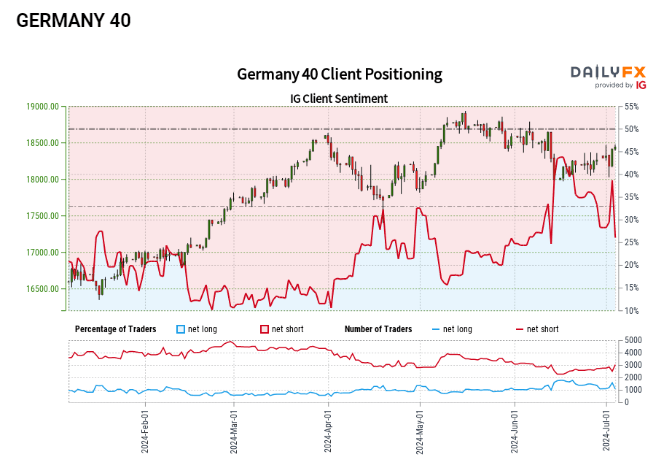

DAX 40

Retail trader data for Germany 40 shows a significant imbalance, with 29% of traders holding long positions and 71% holding short positions. This creates a short-to-long ratio of 2.45 to 1. Historically, such extreme positioning often precedes price movements in the opposite direction, suggesting a potential upside for Germany 40. The recent trend of increasing short positions and decreasing long positions further strengthens this contrarian bullish outlook.

| Change in | Longs | Shorts | OI |

| Daily | 4% | 6% | 6% |

| Weekly | -18% | 17% | 5% |