British Pound (GBP/USD) Analysis and Charts

- GBP/USD is down but paring losses

- The market is looking first to Jerome Powell who is speaking later

- The Bank of England left rates alone last month but is expected to cut soon

The British Pound was weaker against the United States Dollar on Tuesday but overall continues the sideways trading which has dogged it since the Bank of England’s June policy meeting.

That resulted in no change to interest rates, but inflation seems to be relaxing quite markedly now and the market won’t be surprised to see borrowing costs fall in August. This prospect is naturally keeping a lid on any upside for Sterling across the board and not just against the Dollar.

However, this week’s focus is likely to be on the ‘ USD ’ side of GBP/USD, with Federal Reserve Chair Jerome Powell due to speak later in the day, and minutes from the last rate-setting meet due for release on Wednesday. These will set the scene for Friday’s blockbuster – the official non-farm payrolls report.

For its part the Dollar has seen a modest bounce as markets continue to fret the uncertainties attendant on a possible second Presidency for Donald Trump, with the prospect of increased tariffs should he return giving benchmark bond yields a boost and hurting risk appetite.

Still, the market remains reasonably confident that the Fed will start cutting its own interest rate in September, and, although it’s likely to proceed cautiously from there, the prospect also keeps Dollar bulls in check.

For now Sterling is on the back foot, although it has pared some of the losses seen earlier Tuesday in Asia. The UK’s General Election will take place on Thursday, but it seems to be having little effect on the currency, with victory for the opposition Labour Party in the price.

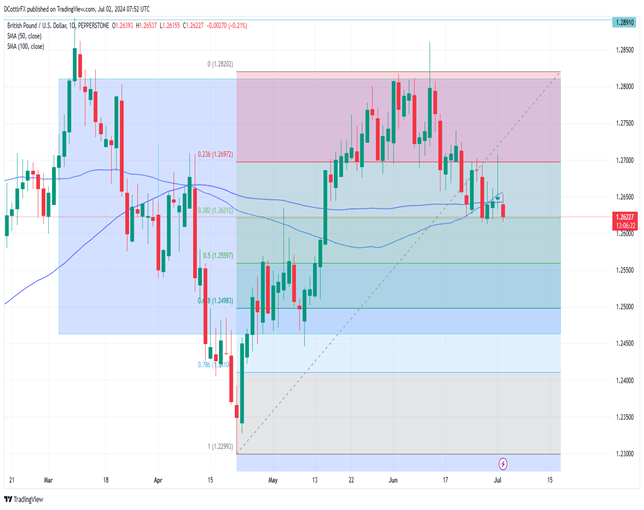

GBP/USD Technical Analysis

GBP/USD Daily Chart Compiled Using TradingView

While GBP/USD is clearly struggling with a downtrend in place since mid-June, trading ranges have clearly narrowed into a new month and retracement support at 1.26212 seems to be the limit of bearish ambition in the short-term. The pair is now trading around both its 50- and 100-day moving averages, with a solid rise above those levels likely to see more consolidation.

Still, Sterling bulls will have their work cut out to get back to the highs above 1.26972 which dominated trade between May and mid-June. A return to those levels would be positive for the Pound but doesn’t look likely. Below those levels the resumption of that downtrend will remain the most likely course for Sterling this week, even if falls are not deep.

While this week’s big US events are likely to see some trading opportunities on GBP/USD, they’re unlikely to produce enduring moves unless they alter current interest-rate views.