US Dollar (DXY) Back to Flat on the Day After German Inflation and US ISM Data

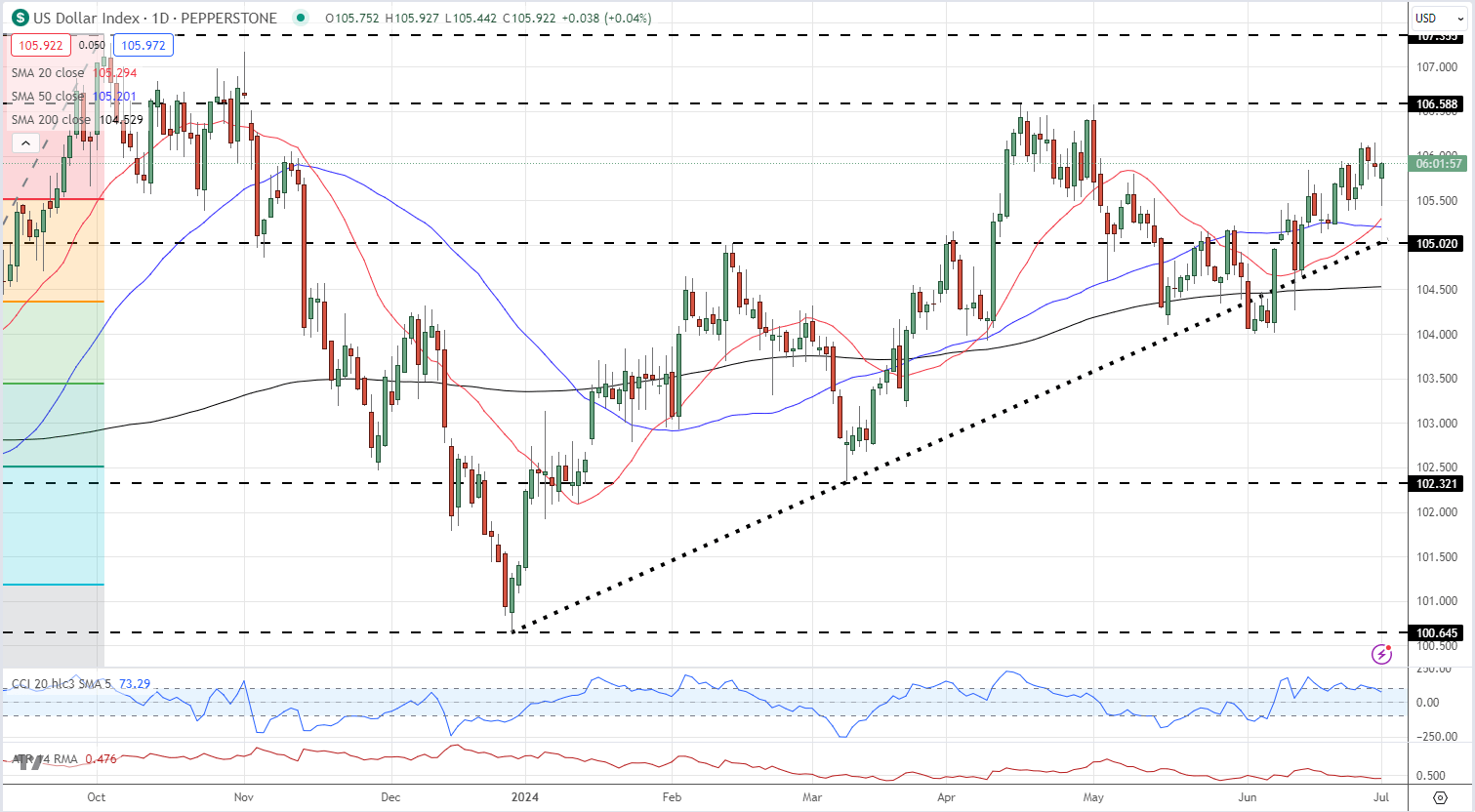

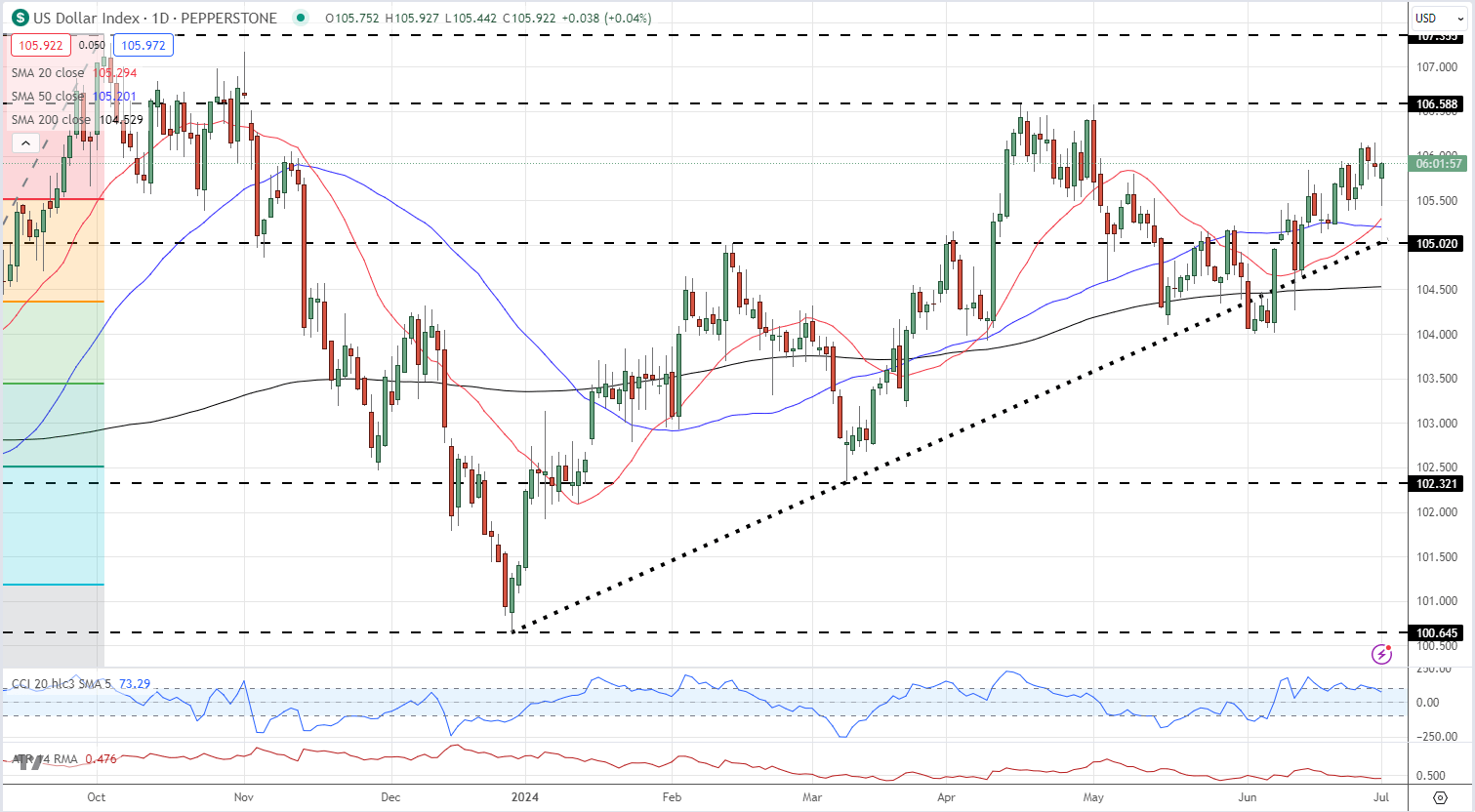

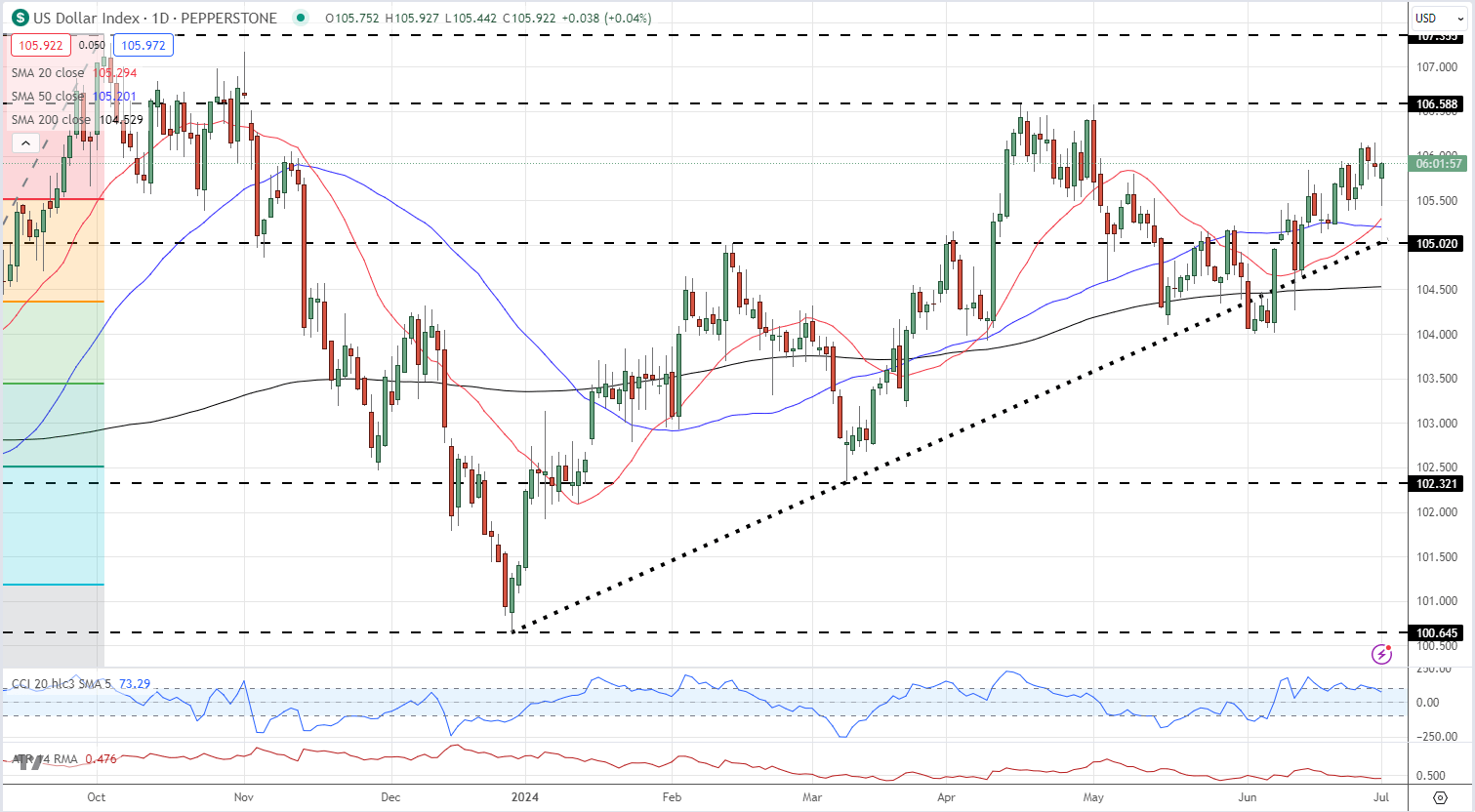

- US dollar index driven by Euro moves.

- ISM report shows ongoing weakness in the US manufacturing sector.

For all high impact data and event releases, see the real-time Dreamboot Wealth Institute

Economic activity in the US manufacturing sector contracted in June for the third straight month, and the 19th time in the last 20 months, according to the latest ISM manufacturing report.

According to Timothy Fiore, chair of the Institute for Supply Management Manufacturing Business Survey Committee, “Demand remains subdued, as companies demonstrate an unwillingness to invest in capital and inventory due to current monetary policy and other conditions. Production execution was down compared to the previous month, likely causing revenue declines, putting pressure on profitability. Suppliers continue to have capacity, with lead times improving and shortages not as severe.”

Attention now turns to the monthly US Jobs Report on Friday (July 5th). US financial markets are closed on Thursday to celebrate July 4th, so the NFP data may not get the same amount of attention it usually commands as traders may look to extend their Independence Day holiday.

The US Dollar Index picked up a very small bid after the data but the greenback’s price action today is being driven by the Euro after the first round of the French elections on Sunday. The Euro accounts for nearly 58% of the US dollar index. The Euro opened the week higher after the results of the first round of voting suggested that the French right-wing party RN would not get an overall majority in the second round of voting. The Euro then gave back some early gains as the latest German inflation release showed price pressures easing by slightly more than expected.

The DXY remains pointing higher and looks set to re-test the recent double high around 106.15.

US Dollar Index Daily Chart