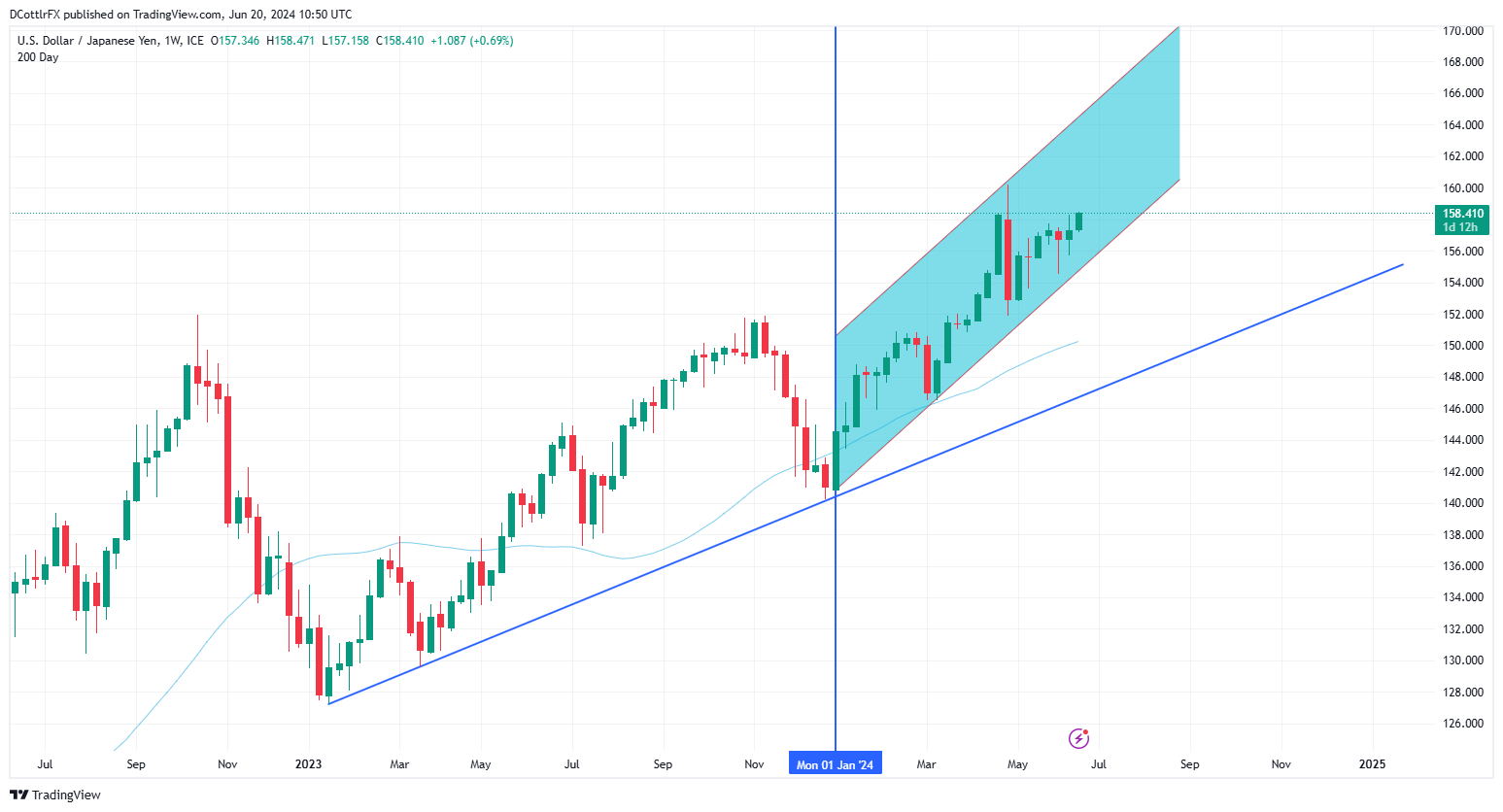

USD/JPY Forecast

The bullishness of USD/JPY can be seen in the multiple uptrends now in place. The dominant upward channel from early January is perhaps the most obvious but, even were that to give way completely to the downside, which looks unlikely, the Dollar would still find considerable support in the uptrend from early 2023 which hasn’t been challenged at all since the first month of this year.

Clearly the market is getting a little warier as it returns to the 158-160 levels at which the authorities in Tokyo stepped in to buy the Yen back in May. Volatility has fallen and weekly ranges have narrowed as that point approaches again.

That range is likely to be the first major battlefield of the coming three months, with its fate dictating the near-term direction.

USD /JPY Weekly Chart

Source: TradingView, Prepared by David Cottle

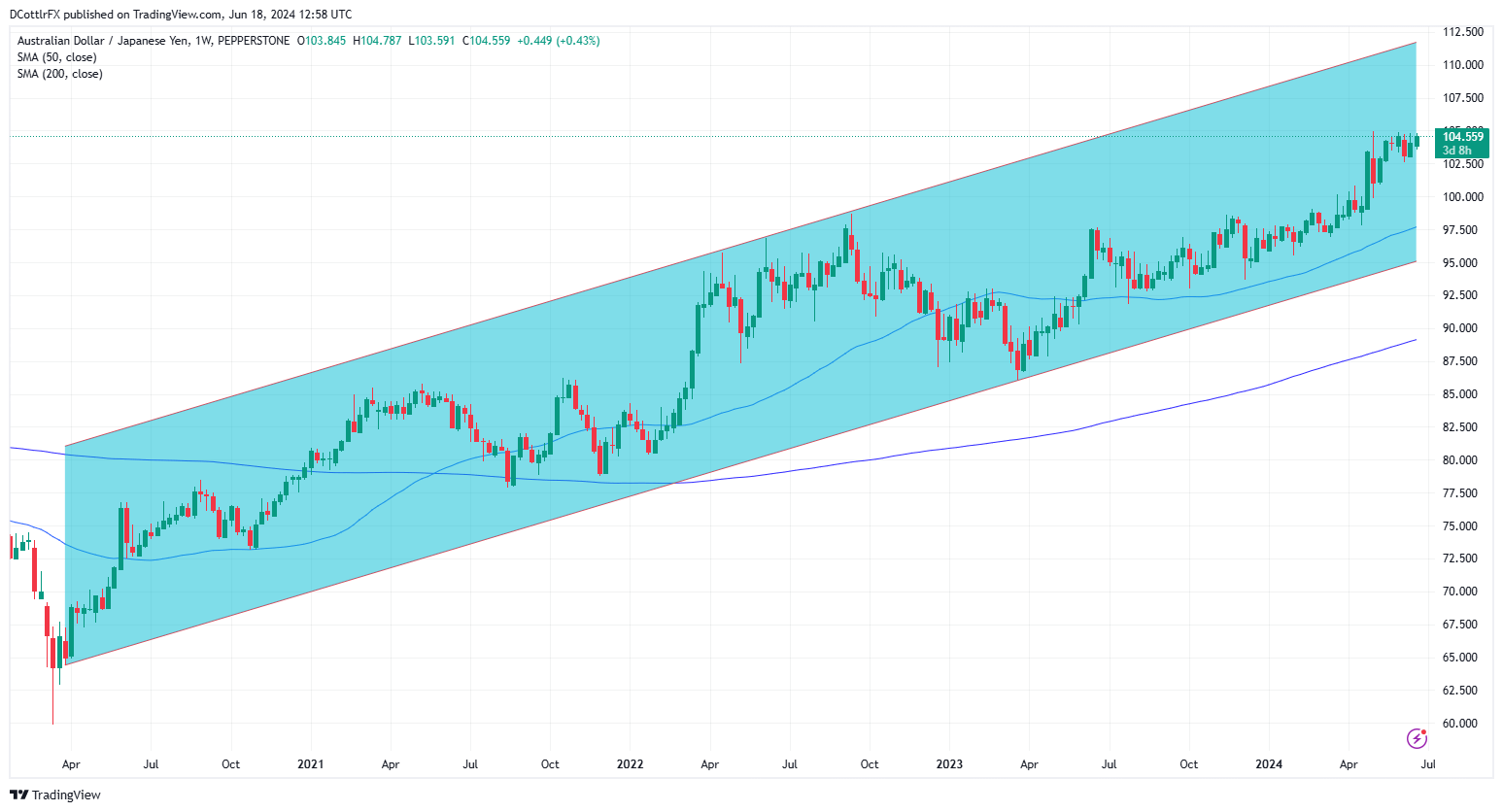

AUD/JPY Forecast

AUD/JPY is back at the highs last briefly attempted in April 2013. While the Australian Dollar is still inside the dominant uptrend channel from 2020’s lows, there are signs that psychological resistance at 105.00 is proving a major hurdle on the road higher. The market is also a very long way above both its 50- and 200-day moving averages.

The cross will probably closely follow USD/JPY, but the coming three months could bring some consolidation below current peak. The Australian Dollar is closely correlated with overall risk appetite, of course, while the Yen tends to prove attractive only when investors are feeling risk averse. That dynamic will remain key for AUD/JPY this quarter.

AUD/JPY Weekly Chart

Source: TradingView, Prepared by David Cottle

After acquiring a thorough understanding of the technical aspects surrounding the Japanese Yen in Q3, why not see what the fundamental landscape suggests by downloading the full Japanese Yen forecast for the third quarter?