Crude Oil Technical Forecast: West Texas Intermediate and Brent

Prices continue to hover around the downtrend line from June 2022 and, although the market has recently pushed back above that point, it doesn’t yet look too comfortable there. If prices can remain around current levels into month end, bulls may be emboldened to try the current medium-term range top at $82.90, ahead of psychological resistance at $83.

Retracement support at $80.14 is close to the current market as this quarter bows out, with a slide back to the $76 region possible if it breaks. While there have been brief forays both above and below the current broad range since November 2022, the market seems unlikely to depart from it for long in the near-term without some major change to the fundamental picture, and traders should probably bear this in mind when the market nears either bound.

WTI Crude Oil Weekly Chart

Source: TradingView, Prepared by David Cottle

After acquiring a thorough understanding of the oil market's technical backdrop in Q3, why not see what the fundamental landscape suggests by downloading the full oil forecast for the third quarter?

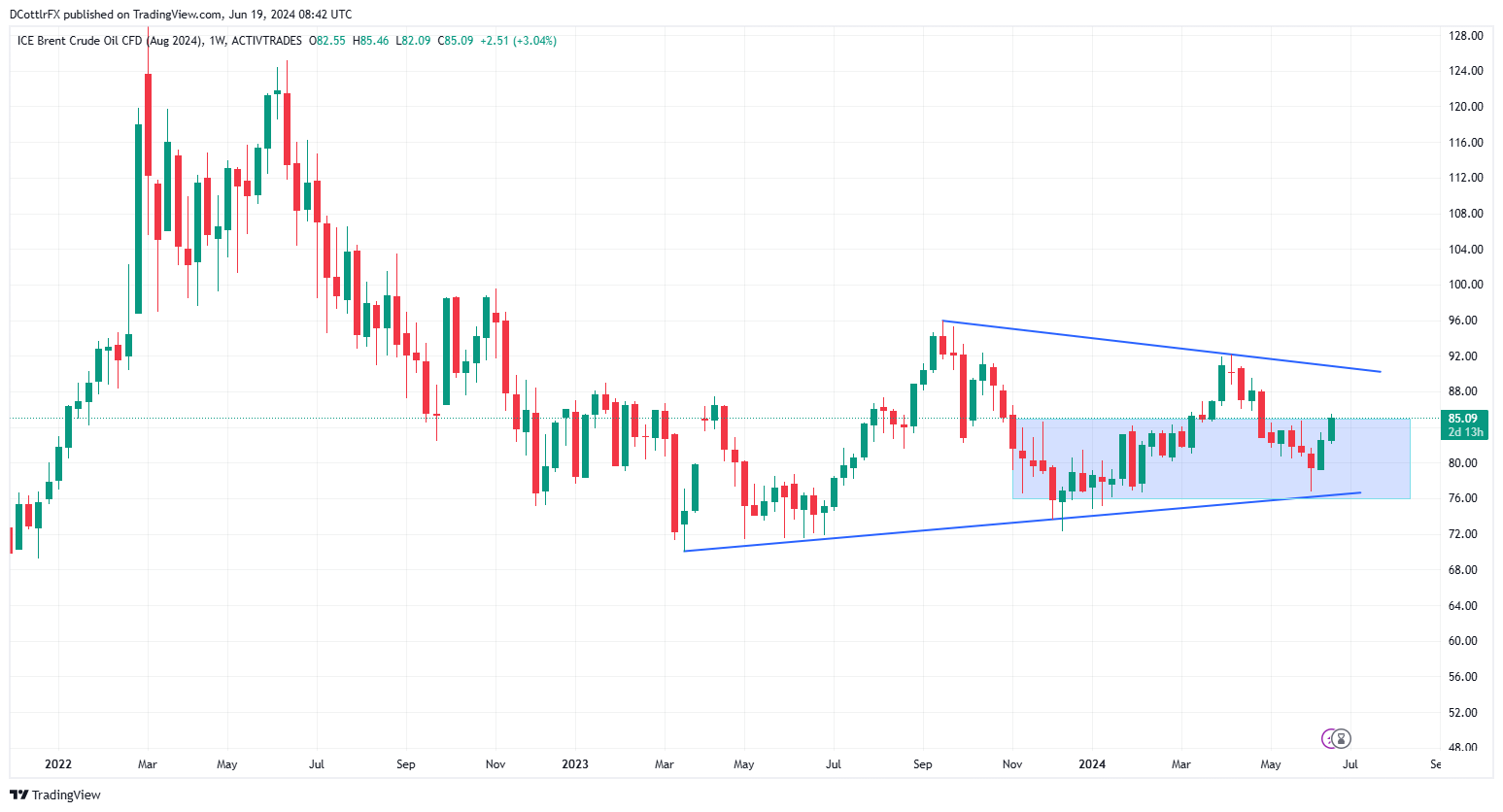

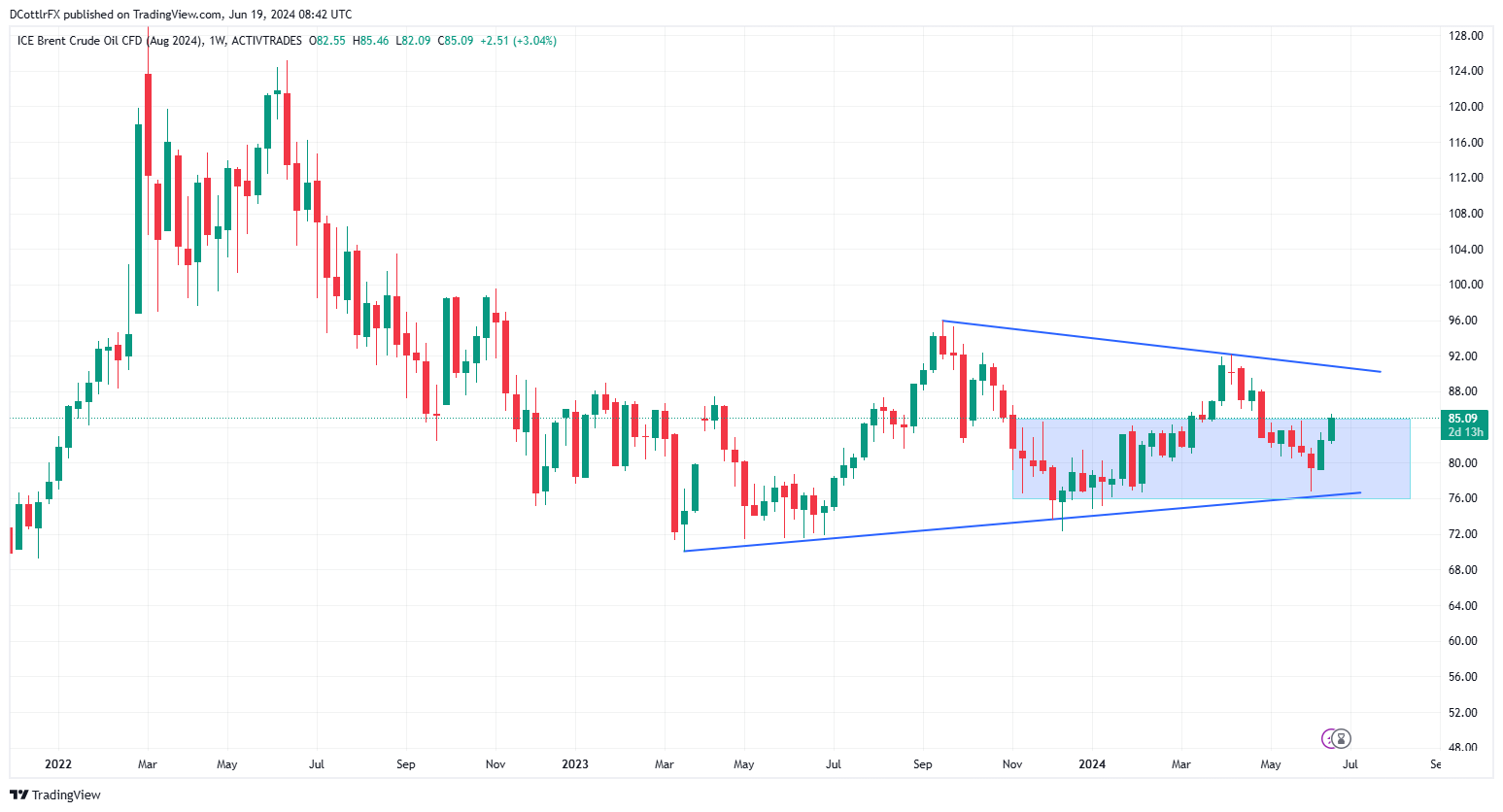

Brent is obviously more of an international benchmark than the US-focused WTI marker and its weekly chart does look a little different, possibly because this chart is more directly exposed to the energy ramifications of the conflict in Ukraine .

Still, the story this year has been of declining volatility, with the market caught between narrowing downtrend and uptrend lines, confined to narrower ranges than those seen previously.

As with WTI, prices seem to be ending the second quarter with some momentum and, if this is maintained into the next three months, a trial of this year’s peaks above $90 could be seen again. However, absent similar breakouts for other benchmarks, investors are likely to be wary at the highs.

Support in the $75 region looks solid but watch that ascending trendline.

Brent Crude Weekly Chart

Source: TradingView, Prepared by David Cottle