US Dollar Index (DXY) Listless After Core PCE Meet Forecasts

- Core PCE y/y and m/m met market forecasts.

- US dollar quiet post-data, US non-farm payrolls (July 5th) the next driver.

For all high-impact data and event releases, see the real-time Dreamboot Wealth Institute

US Dollar Slips After US Durable Goods, Jobs Data – US Q1 GDP Meets Forecasts

The US dollar barely moved after the release of the highly-anticipated US Core PCE data as all readings met market forecasts. Core PCE y/y fell to 2.6% from 2.8% in April, while the m/m reading feel to 0.1% from a prior reading of 0.3%. Month-end and quarter-end rebalancing flows may shift currencies going into the weekend.

Attention now turns to next week, where the monthly US Jobs Report (Friday July 5th) will hold sway. US markets are closed on Thursday to celebrate July 4th, so next week’s NFPs may not get the usual attention they command as traders extend their Independence Day holiday.

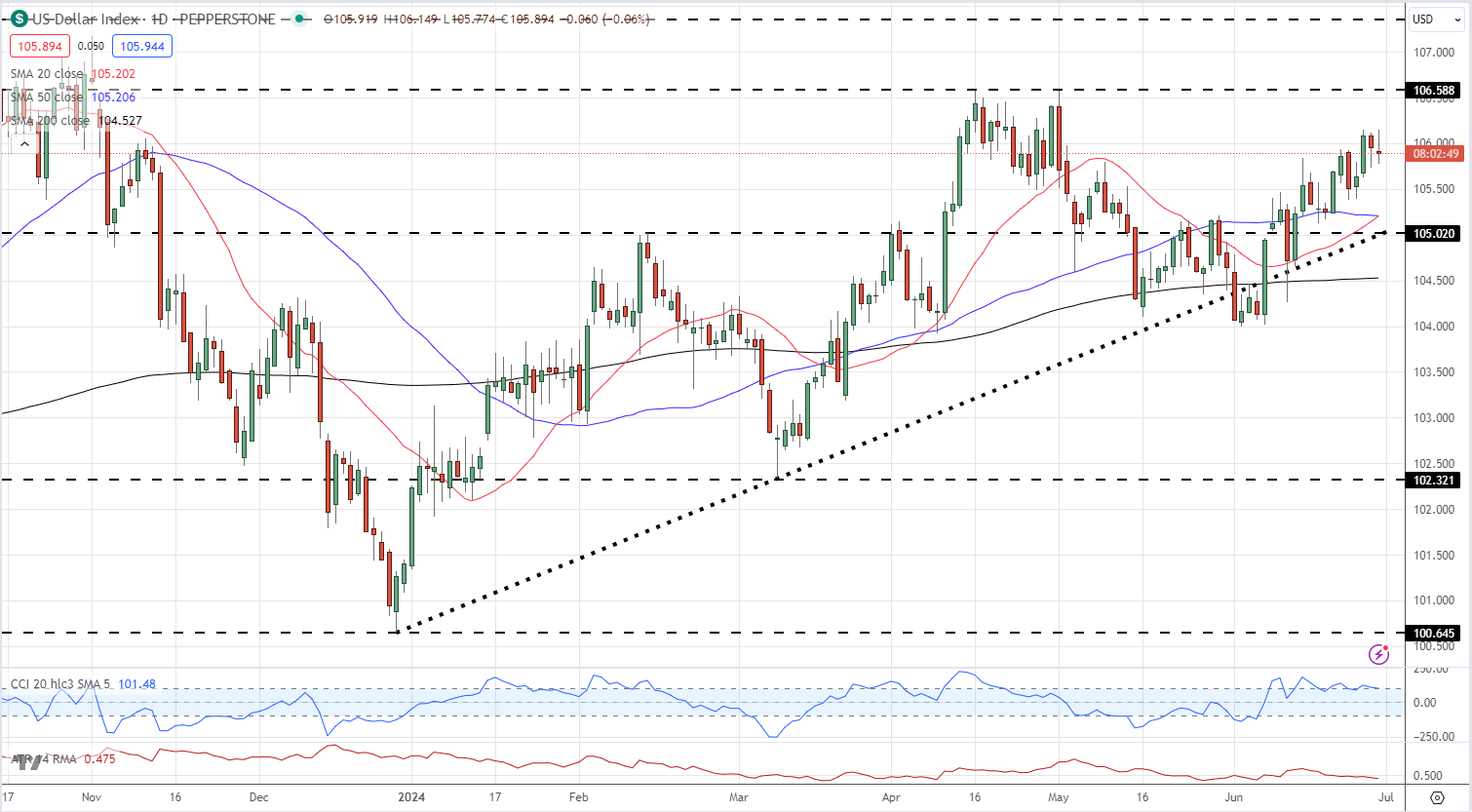

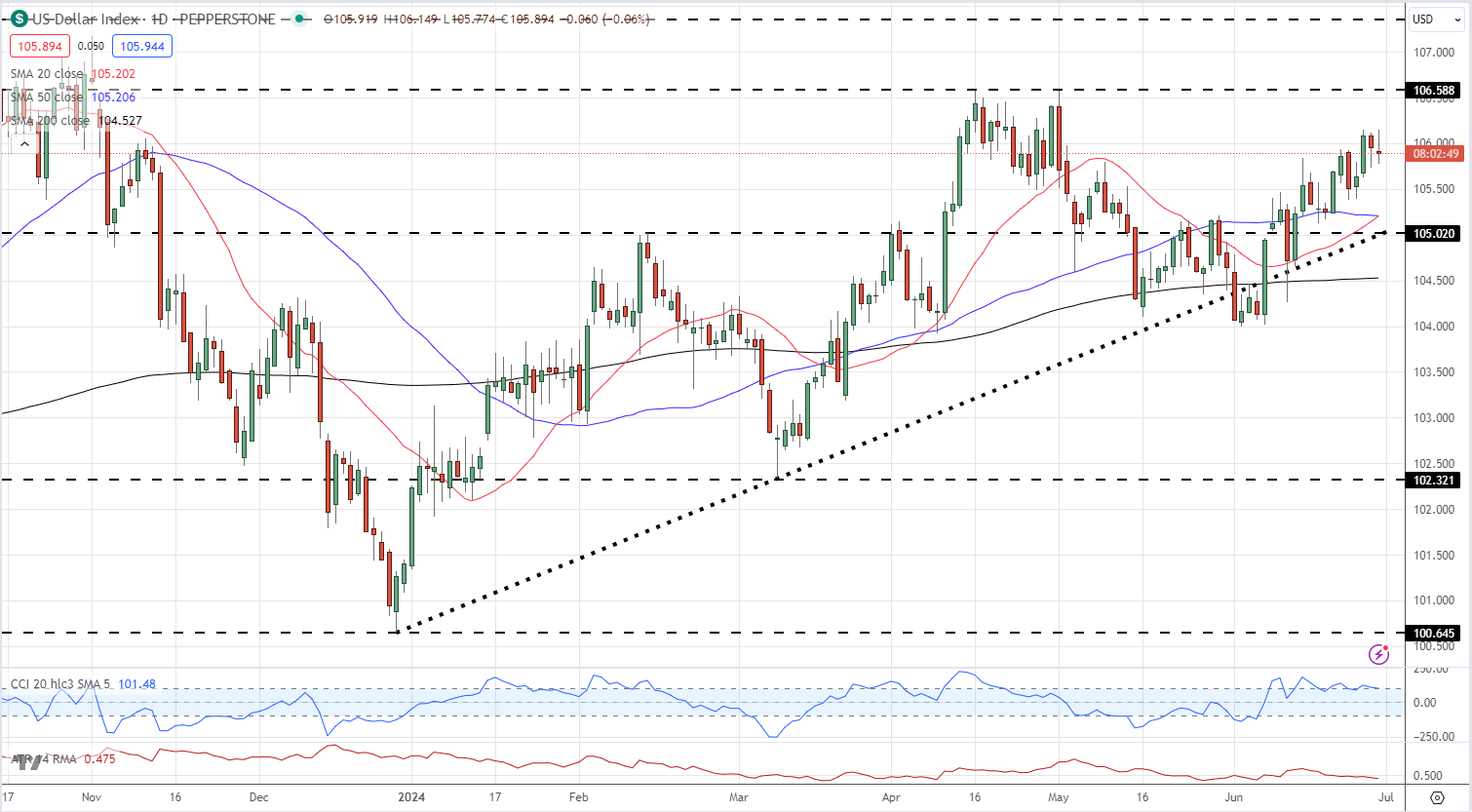

The US Dollar Index is flat on the day after attempting to print a new multi-week high earlier in the session. The daily chart shows the DXY continuing to post higher lows and higher highs since the end of last year, and if this sequence continues then the double high made in mid-April and early May will be tested in the short-term.

US Dollar Index Daily Chart

Chart using TradingView