Gold (XAU/USD) & Silver (XAG/USD) - Retail Sentiment Analysis

- Gold : Bearish Signals Emerge from Retail Trader Positioning.

- Silver : Retail Sentiment Indicates Potential Bearish Trend.

You can Download Retail Sentiment Data on a Range of Asset Classes Below:

| Change in | Longs | Shorts | OI |

| Daily | -12% | 9% | -4% |

| Weekly | 1% | -4% | -1% |

Gold (XAU/USD) Latest:

Recent IG retail trader data reveals a significant bullish sentiment towards gold, with 63.96% of traders holding net-long positions. The long-to-short ratio is 1.77 to 1, indicating a clear preference for long positions. However, this overwhelming bullish sentiment may paradoxically signal potential downward pressure on gold prices .

Compared to yesterday, net-long traders have increased by 2.36%, while net-short positions have decreased slightly by 0.47%. The weekly trend is even more pronounced, with net-long positions up 11.72% and net-short positions down 18.12%.

Given our contrarian approach to market sentiment, this data suggests gold prices may continue to decline. The combination of current positioning and recent shifts strengthens our bearish outlook on gold.

Gold Daily Price Chart

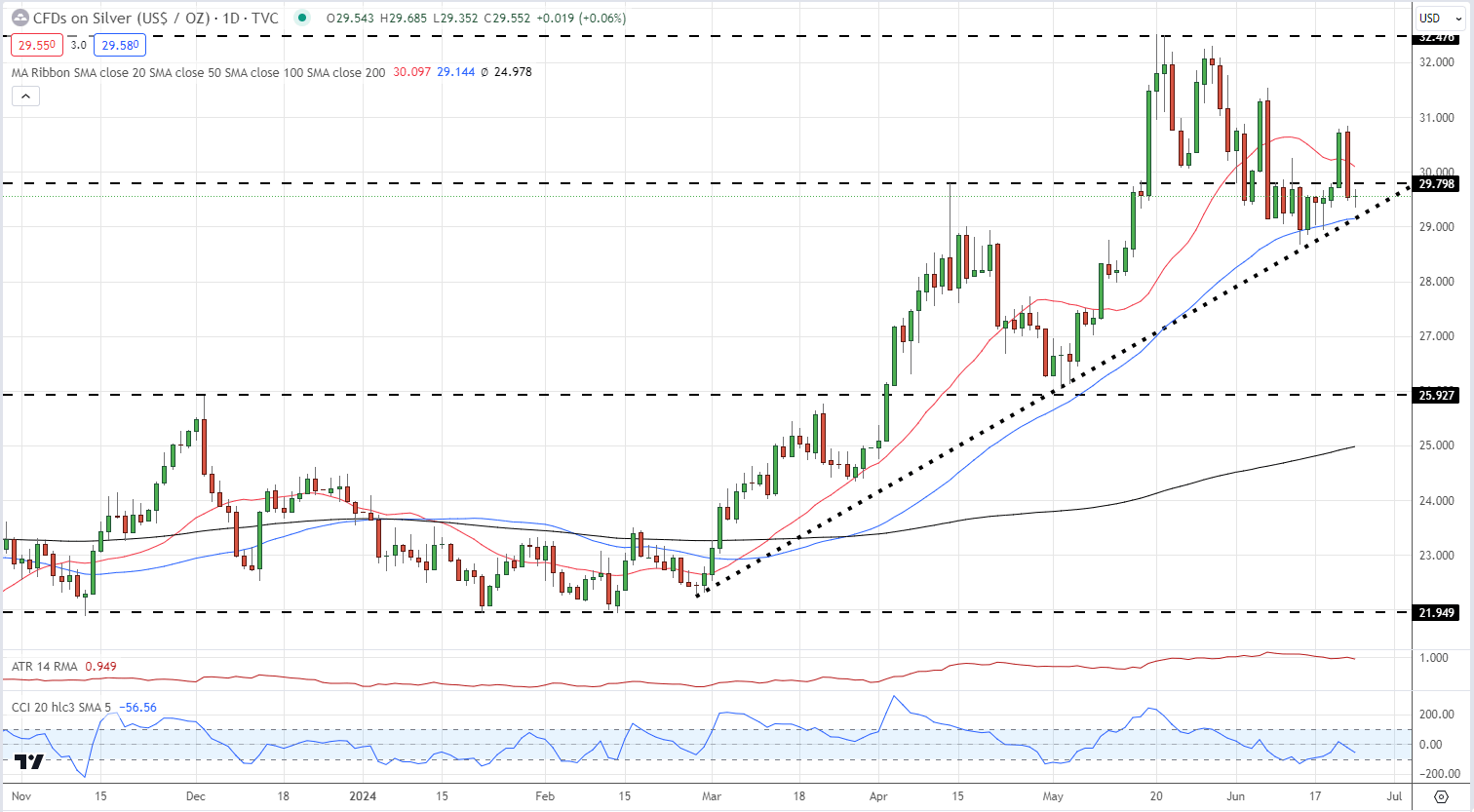

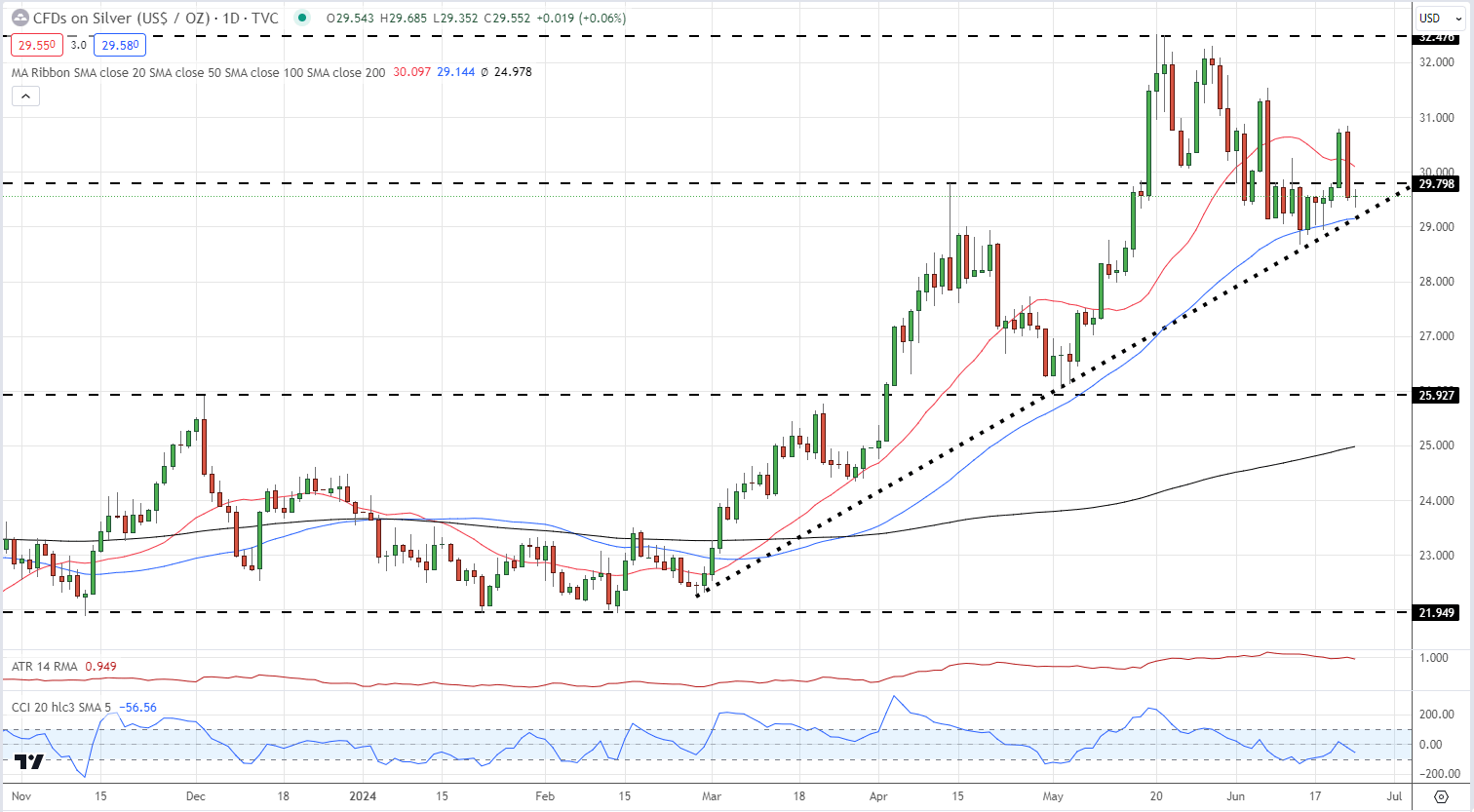

Silver (XAG/USD) Latest:

IG retail trader data reveals an overwhelming bullish sentiment towards silver, with 84.00% of traders holding net-long positions. The long-to-short ratio stands at a remarkable 5.25 to 1, indicating a significant imbalance in market positioning.

Compared to yesterday, net-long traders have increased by 1.46%, while net-short positions have decreased by 3.06%. The weekly trend is even more pronounced, with net-long positions up 3.61% and net-short positions down 25.24%.

Adopting a contrarian view to crowd sentiment, this extreme bullish positioning suggests silver prices may face downward pressure. Combining current sentiment and recent shifts strengthens our bearish outlook on silver.

Silver Daily Price Chart

Charts via TradingView