EUR/USD and EUR/GBP Latest Retail Sentiment Analysis

- EUR/USD – Big Jump in Weekly Longs.

- EUR/GBP Traders Remain Long but Shorts Increase.

EUR/USD – Mixed Outlook

According to the latest IG retail trader data, 54.49% of traders hold a net-long position, with the ratio of long to short traders at 1.20 to 1. The number of net-long traders has decreased by 0.84% compared to the previous day but has increased by 34.83% compared to last week. On the other hand, the number of net-short traders has increased by 7.36% from yesterday but has decreased by 4.00% from last week.

Our approach typically contrasts with crowd sentiment, and the fact that traders are net-long suggests that EUR / USD prices may continue to fall. However, the current positioning is less net-long than yesterday but more net-long compared to last week. This combination of current sentiment and recent changes presents a mixed trading bias for the EUR/USD pair.

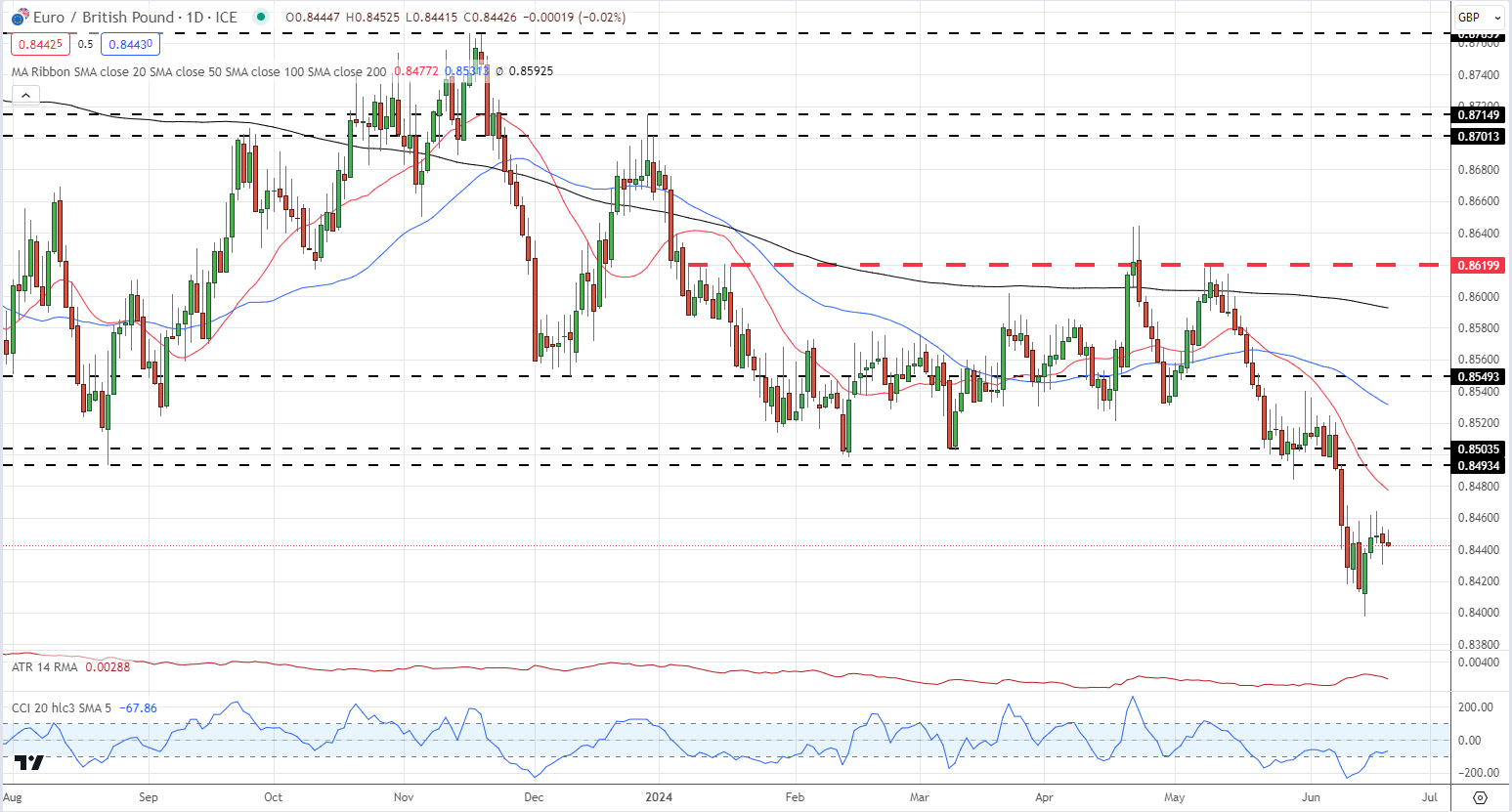

EUR/USD Daily Price Chart

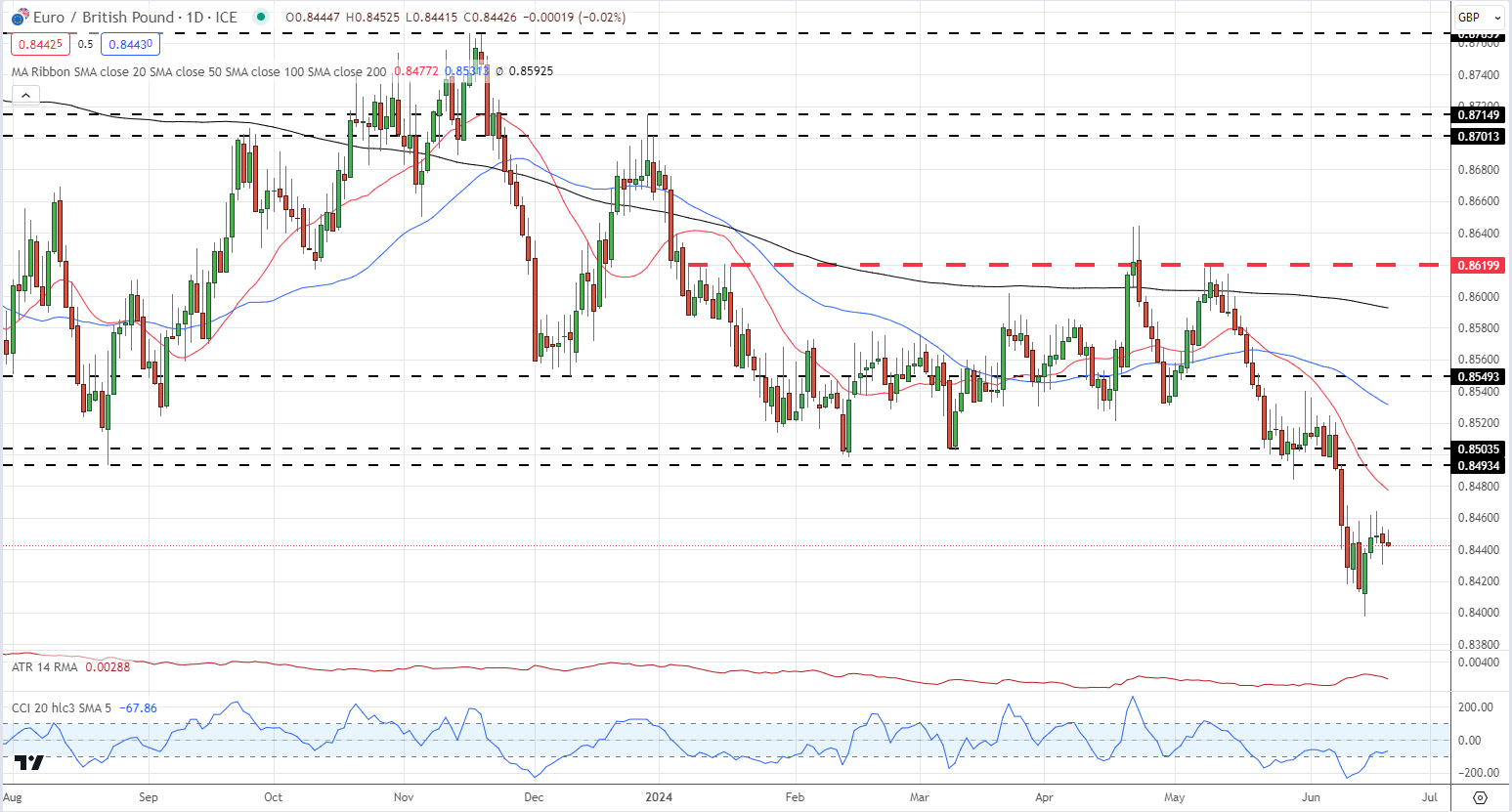

EUR/GBP – Traders Heavily Long

The latest IG retail trader data reveals that 73.13% of traders are maintaining a net-long position, with the ratio of long to short traders standing at 2.72 to 1. While the number of net-long traders has increased by 1.73% compared to the previous day, it has decreased by 6.71% from last week. In contrast, the number of net-short traders has decreased by 3.00% from yesterday but has increased by 48.09% from last week.

Our strategy typically involves taking a contrarian view to crowd sentiment, and the fact that traders are net-long suggests that EUR/ GBP prices may continue to decline. However, the positioning is more net-long than yesterday but less net-long compared to last week. This combination of current sentiment and recent changes presents a mixed trading bias for the EUR/GBP pair.

EUR/GBP Daily Chart

| Change in | Longs | Shorts | OI |

| Daily | -4% | -8% | -5% |

| Weekly | -10% | 29% | -2% |

All charts using TradingView