Gold (XAU/USD) & Silver (XAG/USD) - Latest Retail Sentiment Analysis

- Trader Sentiment Shift Hints at Potential Gold Price Reversal

- Trader Data Reveals Mixed Sentiment in Silver Market

You can Download Updated Retail Sentiment Data Below:

| Change in | Longs | Shorts | OI |

| Daily | 2% | 9% | 5% |

| Weekly | -4% | 18% | 5% |

Gold (XAU/USD) Latest:

According to the latest IG retail trader data, 57.27% of traders are currently net-long on gold, with the ratio of traders long to short standing at 1.34 to 1. However, there has been a notable decrease in the number of net-long traders compared to the previous day and last week. Specifically, the data shows a 4.01% decline in net-long traders from yesterday and a more substantial 14.89% drop from last week's figures. Conversely, the number of traders holding net-short positions has increased, rising 11.17% higher than yesterday and a significant 16.72% higher than the previous week.

While a contrarian view of crowd sentiment typically suggests that the net-long positioning of traders could indicate further downward pressure on gold prices , the recent shifts in sentiment point to a potential reversal in the current price trend. Despite the overall net-long positioning of traders, the decreasing number of net-long traders and the increasing number of net-short traders warn that the current downward trend in gold prices may soon reverse higher, even as traders remain predominantly net-long.

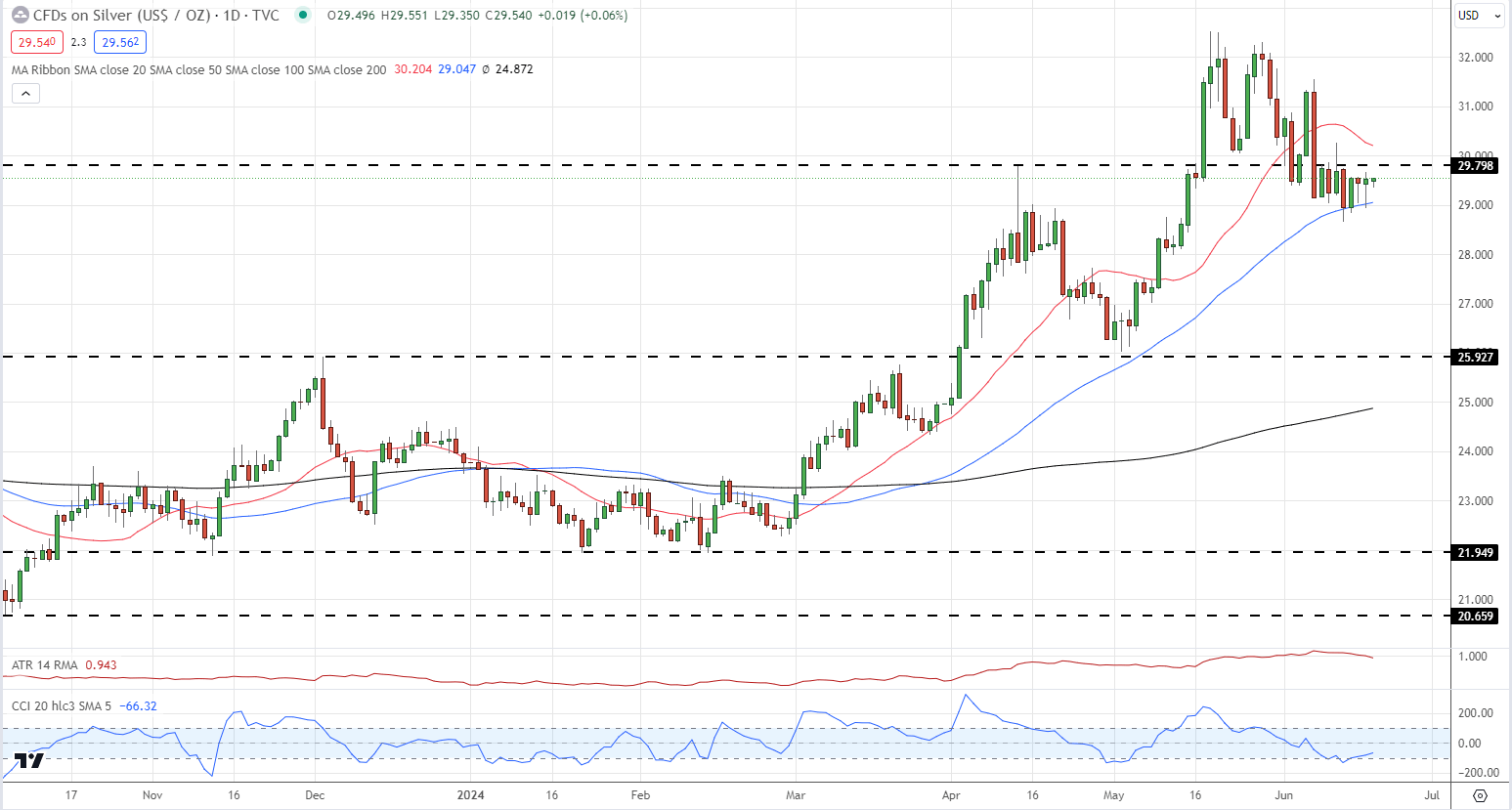

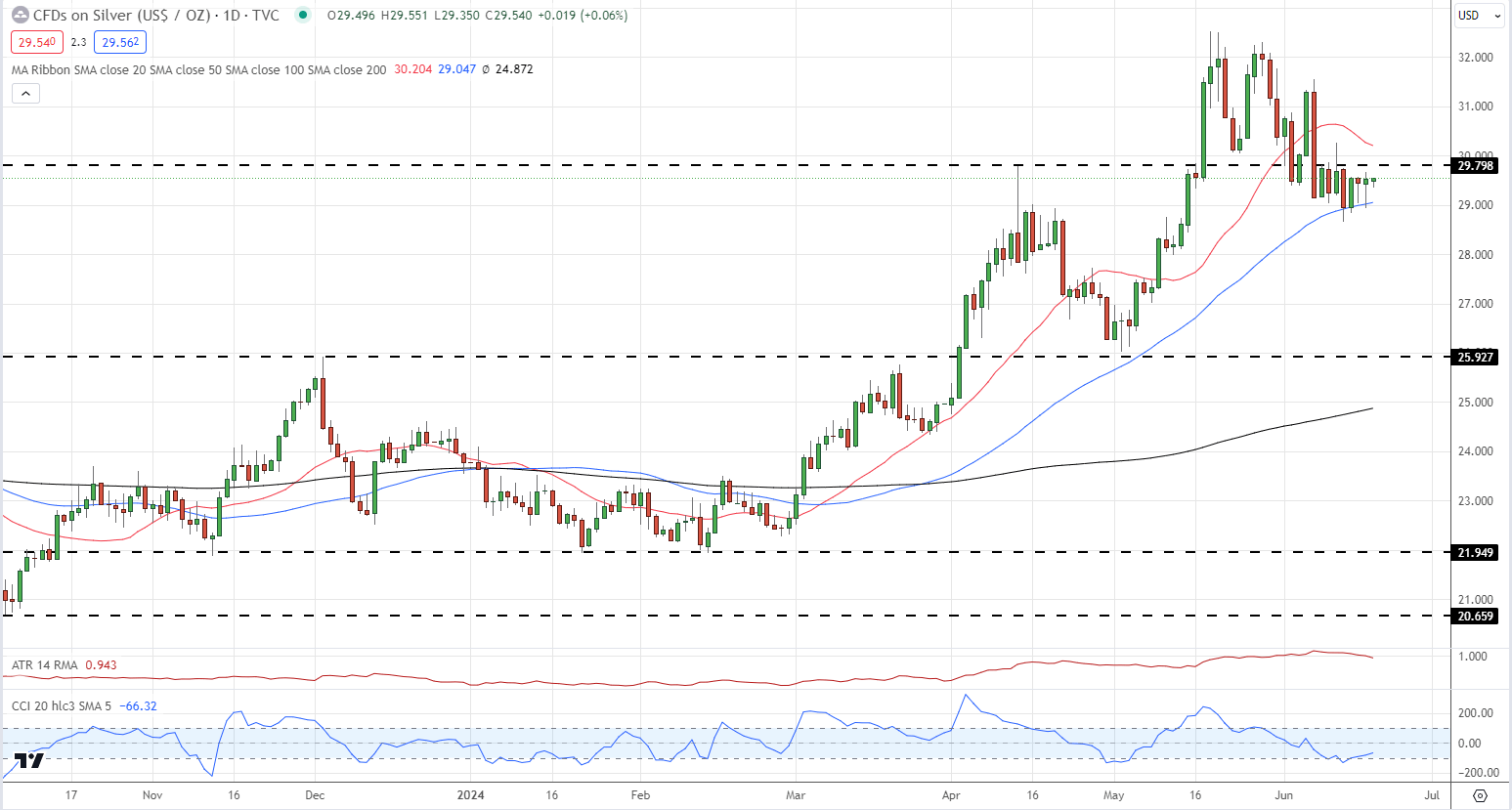

Gold Daily Price Chart

Silver (XAG/USD) Latest:

The latest retail trader data indicates that 77.94% of traders are net-long on silver, with the ratio of traders long to short standing at a significant 3.53 to 1. However, there has been a slight decline in the number of net-long traders, with a 1.29% drop compared to yesterday and a more substantial 4.69% decrease from last week. Conversely, the number of traders holding net-short positions has increased by 7.08% compared to the previous day, although it is 7.35% lower than the figures from last week.

While a contrarian view of crowd sentiment traditionally suggests that the predominant net-long positioning of traders could indicate further downward pressure on silver prices, the recent changes in sentiment present a mixed picture.

The decrease in net-long traders and the increase in net-short traders compared to yesterday could signal potential bearish market conditions. However, the overall net-long positioning is higher than last week, suggesting a potential bullish sentiment. This combination of current net-long sentiment and recent changes in trader positioning gives a mixed bias for silver trading, making it challenging to gauge the potential direction of price movements in the near term.

Silver Daily Price Chart

Charts via TradingView