US Dollar Index Slumps as Inflation Data Comes in Lower Than Expected

- US inflation fell unexpectedly in May

- US dollar slumps post-release.

The latest US inflation report showed price pressures easing by more than forecast, with all headline numbers coming in below expectations and last month’s numbers. The move lower in core CPI y/y, from 3.6% to 3.4%, surprised the market and sent the USD lower and risk markets higher.

US Bureau of Labor Statistics – US CPI Report (May)

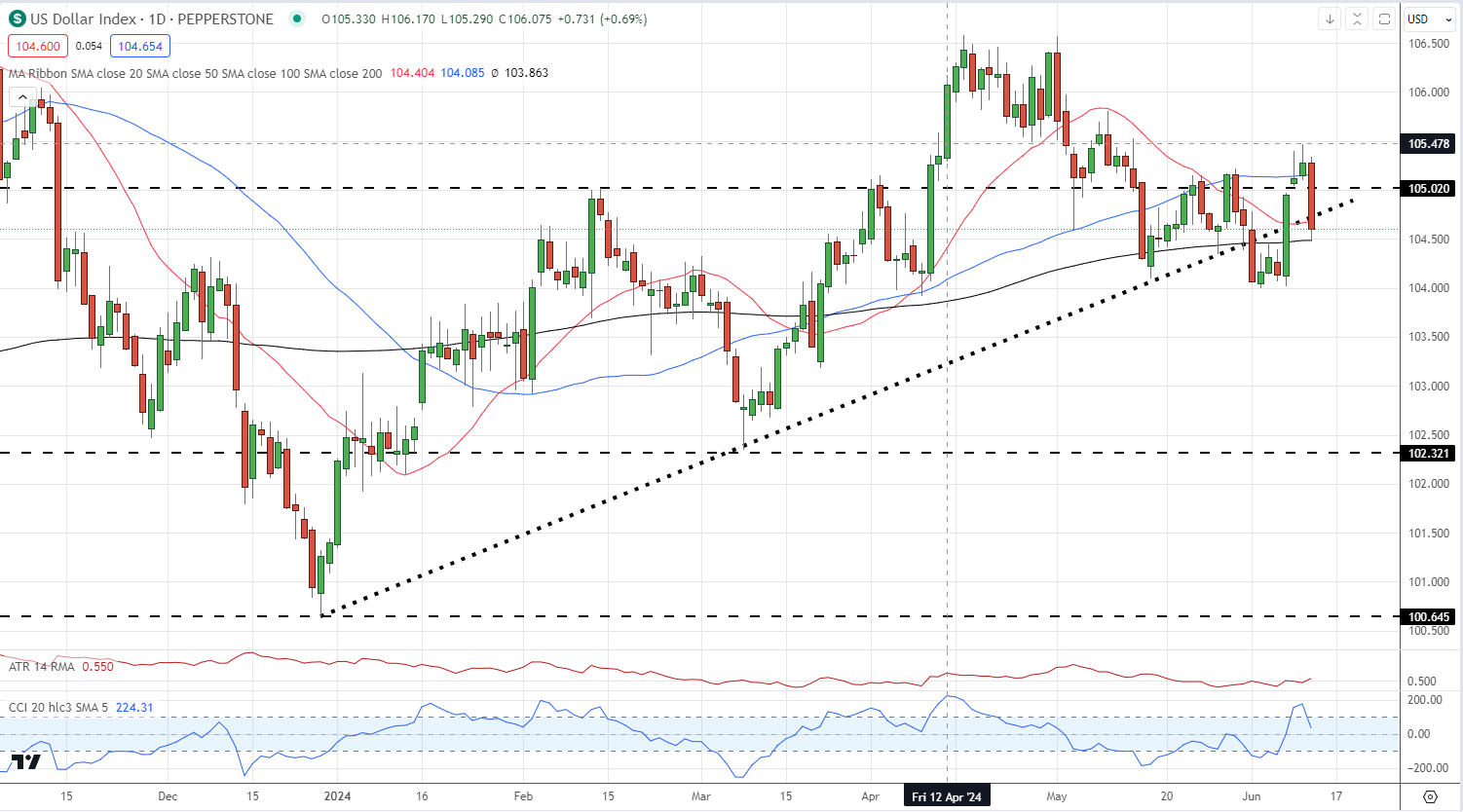

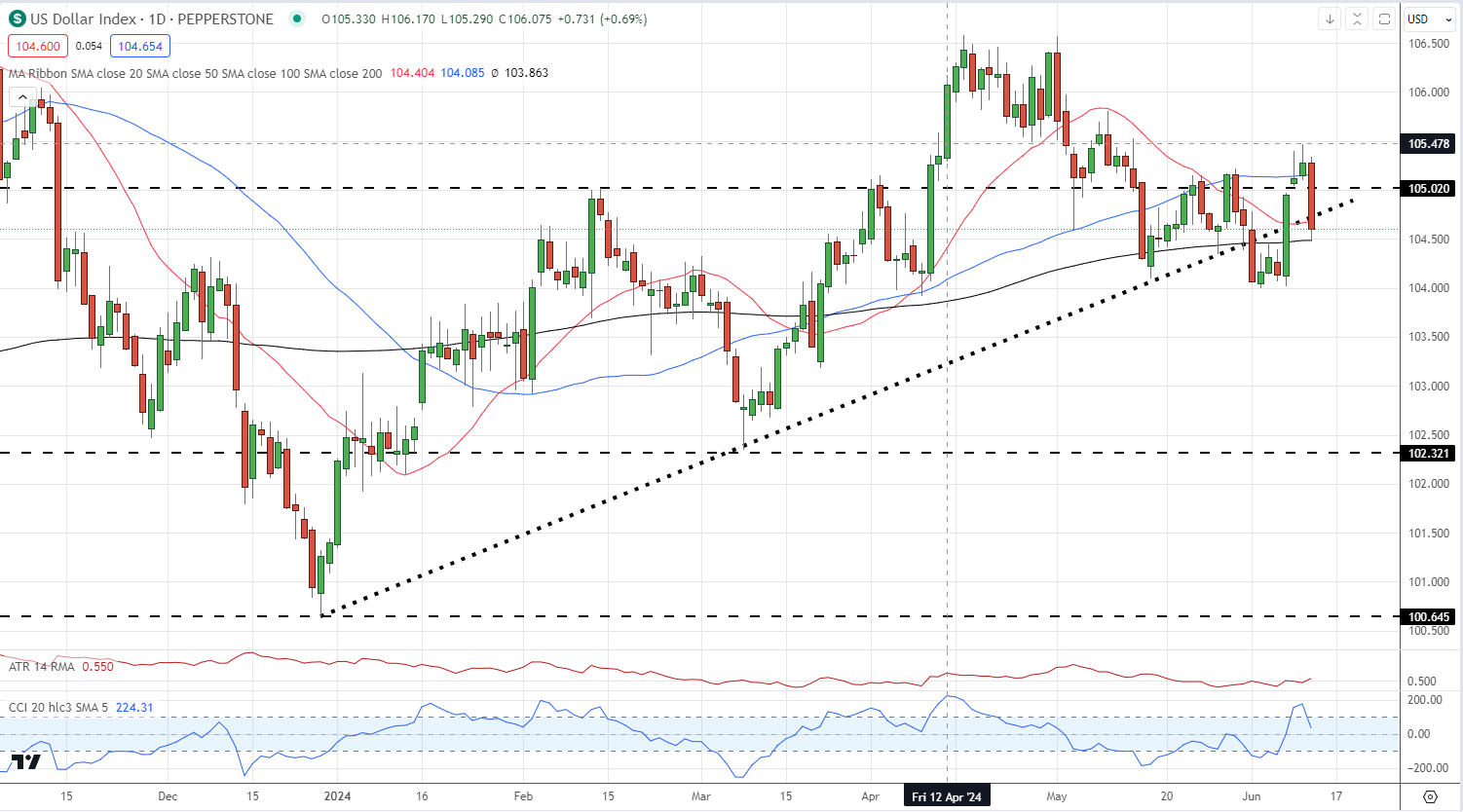

The US dollar index fell by around 3/4s of a point after the release, before finding support off the 200-day simple moving average.

US Dollar Index Daily Chart

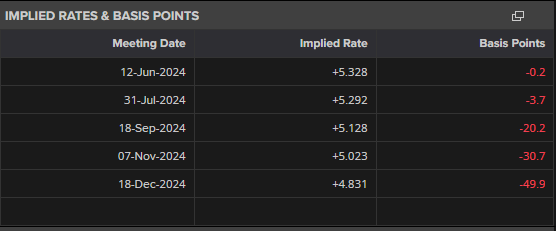

Later today (19:00 UK), the Fed will announce its latest monetary policy decision and its quarterly Summary of Economic Projections. While the US central bank is expected to leave all policy dials untouched, today’s inflation report may alter their thoughts on where interest rates are headed in the months ahead. The new dot plot will be worth watching closely. Before the CPI release, the market was forecasting a total of 39 basis points of easing this year, this has now been upgraded to a fraction under 50 basis points. The September meeting is now back in play for the first-rate cut.

US Dollar Eyes CPI Data and FOMC Policy Release, Dot Plot Key Indicator