Euro Latest – EUR/USD and EUR/GBP Technical Outlooks

- EUR/ USD pares Wednesday’s gains after a hawkish FOMC meeting.

- EUR/ GBP volatility may rise as political risk increases.

The Euro is giving back some of Wednesday’s US CPI -inspired gains after the US dollar got a bid later in the session after the Fed trimmed US interest rate expectations. The latest dot plot shows Fed officials now forecasting just one 25 basis point rate cut in 2024, down from three cuts seen in March.

FOMC Roundup: Fed Reconsiders Rate Cuts as Inflation Forecast Drifts Higher

With the US inflation data and the FOMC now in the rearview mirror, EUR/USD should no longer be dominated by the greenback. Looking at the CCI indicator, EUR/USD was heavily oversold going into Wednesday’s events, leaving the pair vulnerable to a sharp move higher. After pairing gains on the FOMC announcement, EUR/USD now sits around 1.0800 below the recent uptrend support line. Initial support is seen around 1.0787 – the 200-day sma – before Tuesday’s 1.0720 and the mid-February swing low at 1.0695 come into focus. Trend resistance around 1.0850 guards the recent multi-week high at 1.0916.

EUR/USD Daily Price Chart

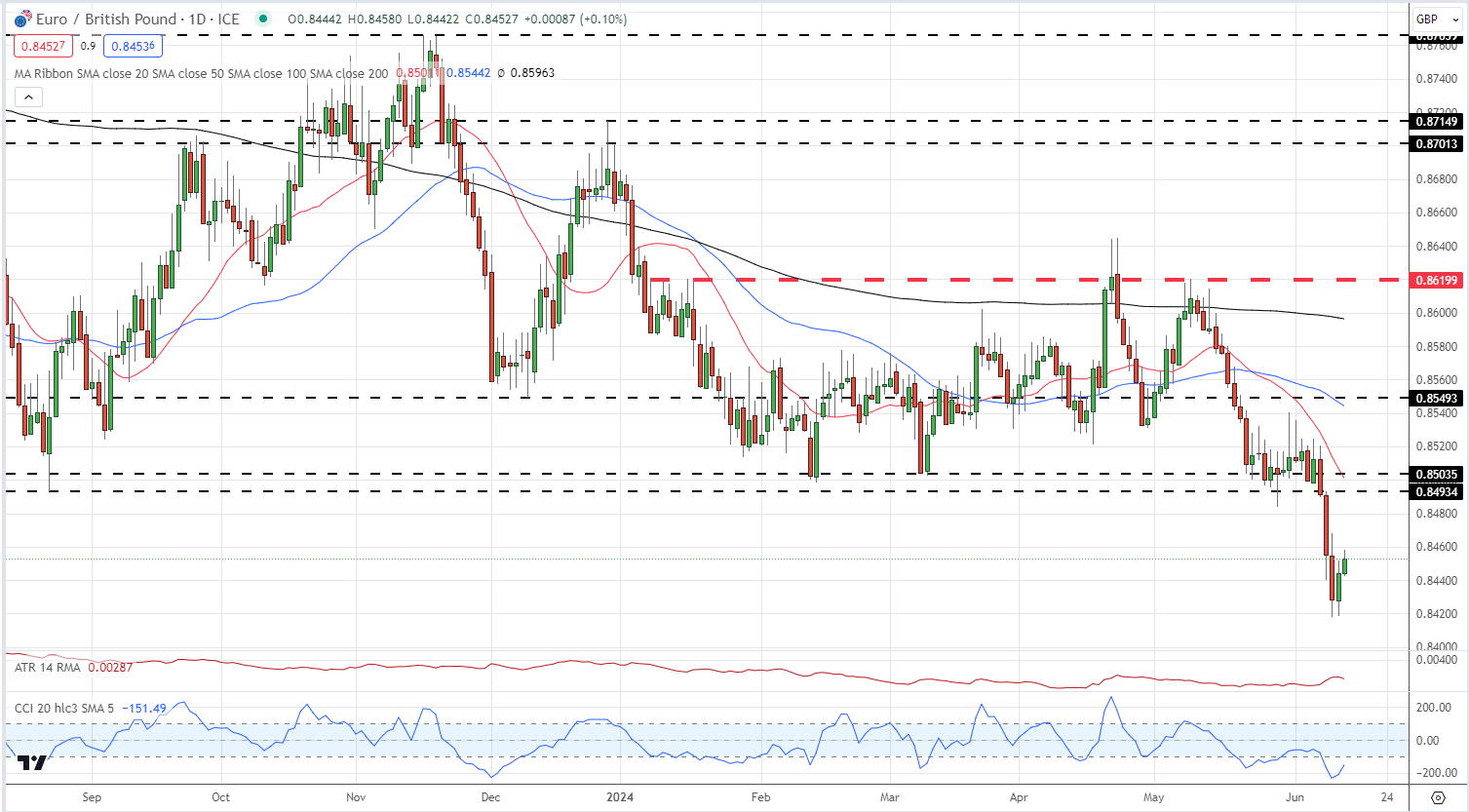

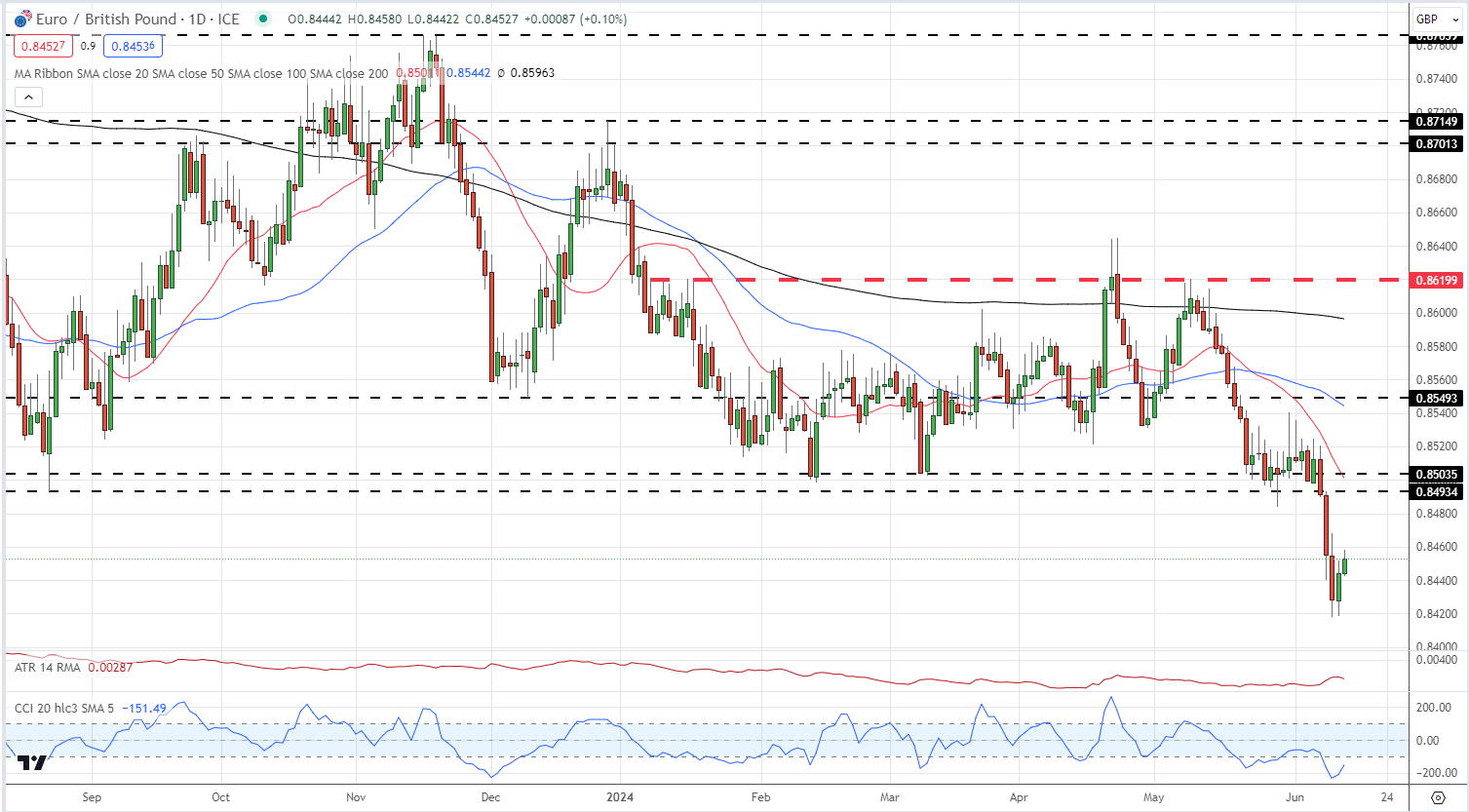

EUR/GBP is expected to become increasingly volatile over the next month as elections in the UK and France come firmly into focus. EUR/GBP has weakened notably since early May as the ECB shifted towards loosening monetary policy, while rate cuts in the UK have been pushed back. The result of the upcoming elections, and the ongoing fallout from the recent European Parliamentary elections, will now drive the pair. EUR/GBP remains heavily oversold, but yesterday’s move higher lacks conviction. The double low just below 0.8420 remains vulnerable, while a prior zone of support on either side of 0.8500 is now seen as resistance. The pair remain below all three simple moving averages and will struggle to break higher.

EUR/GBP Daily Chart

All charts using TradingView

Retail Trader Sentiment Analysis: EUR/GBP Increasingly Bearish Contrarian Bias

According to the latest IG retail trader data 80.79% of traders are net-long with the ratio of traders long to short at 4.21 to 1.The number of traders net-long is 1.21% lower than yesterday and 7.92% higher than last week, while the number of traders net-short is 8.11% lower than yesterday and 15.53% lower than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/ GBP prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/GBP-bearish contrarian trading bias.

| Change in | Longs | Shorts | OI |

| Daily | -6% | -5% | -6% |

| Weekly | 4% | -14% | -1% |