Markets Week Ahead: ECB Rate Decision, US NFPs – USD, Gold, Euro, Nasdaq

- ECB to cut interest rates by 25 basis points on Thursday.

- US jobs week culminates with NFPs on Friday.

- Gold eyes early-May lows.

Navigating Volatile Markets: Strategies and Tools for Traders

A week full of potential volatility with the ECB policy meeting and the latest US Jobs Report the highlights for traders looking for volatility. While the ECB will cut rates by 25 basis points, will ECB President Christine Lagarde signal the timing of the next cut? Markets suggest that the second rate cut may be announced at the September 12th meeting but the October 17th is now seen as more likely. The ECB post-decision press conference will need to be parsed closely.

In the US, a raft of US jobs data – JOLTS, ADP, and initial jobless claims - will be released before Friday’s US Jobs Report. The market has pushed back US rate cuts over the past months as inflation remains uncomfortably high for the Federal Reserve. Any weakening in the US Jobs market may see the market start to re-price US interest rate cuts.

In addition to the above, the Bank of Canada announce their latest policy decision, Australian GDP is released, while US ISM Services data is always worth watching.

For all market-moving economic data and events, see the Dreamboot Wealth Institute

The US dollar looks under pressure and the US dollar index is withing 20 pips of printing a two-month low. From a technical viewpoint, the USD index is testing the 200-day simple moving average, and a confirmed break lower could see the greenback trade below 104.00.

US Dollar Index Daily Chart

Gold also looks vulnerable to a move lower. US Treasury yields rose during the week, driven by a raft of bills and bond sales, and a test of the $2,280/oz. looks likely. Friday’s US NFPs will direct the gold’s future performance.

Gold Daily Price Chart

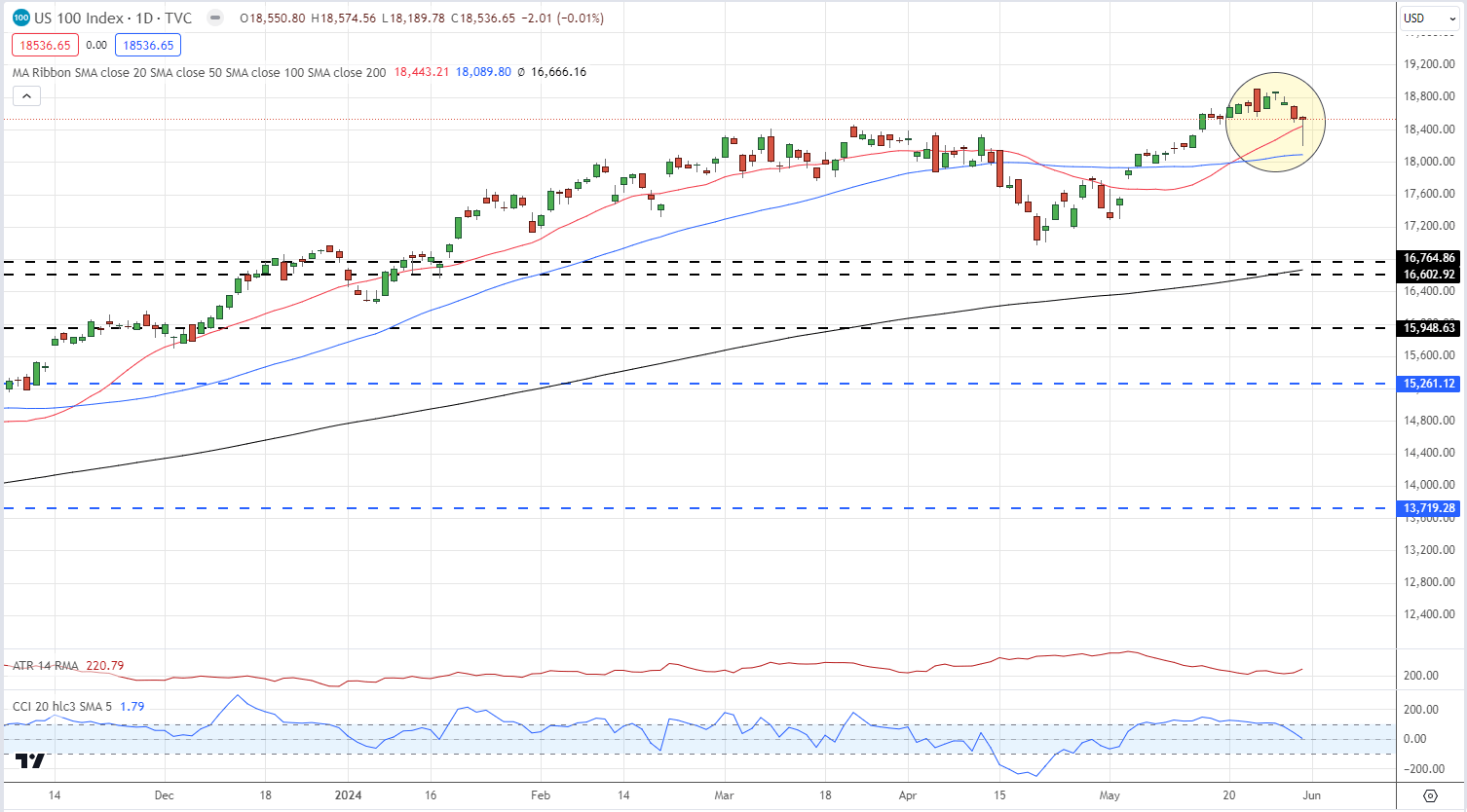

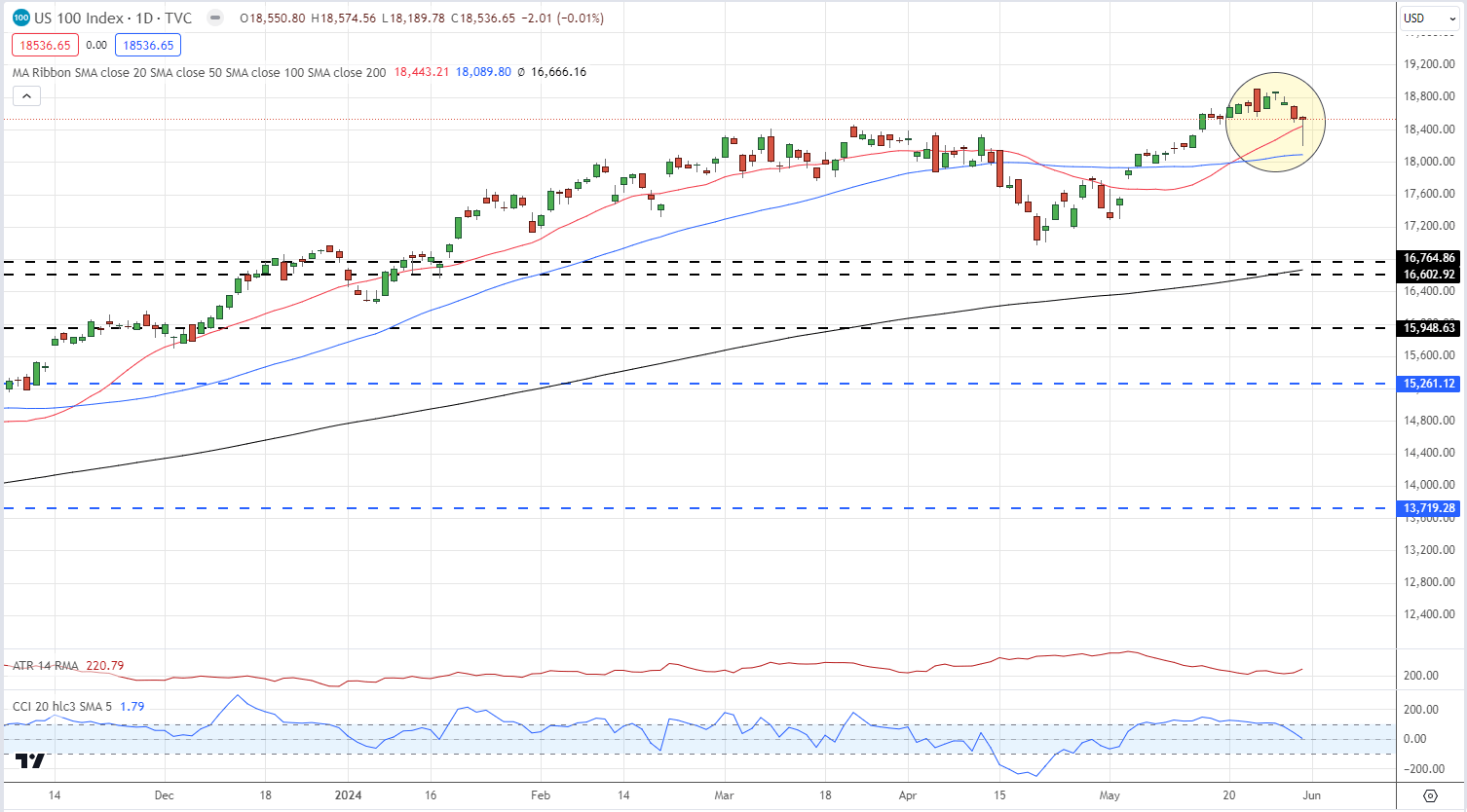

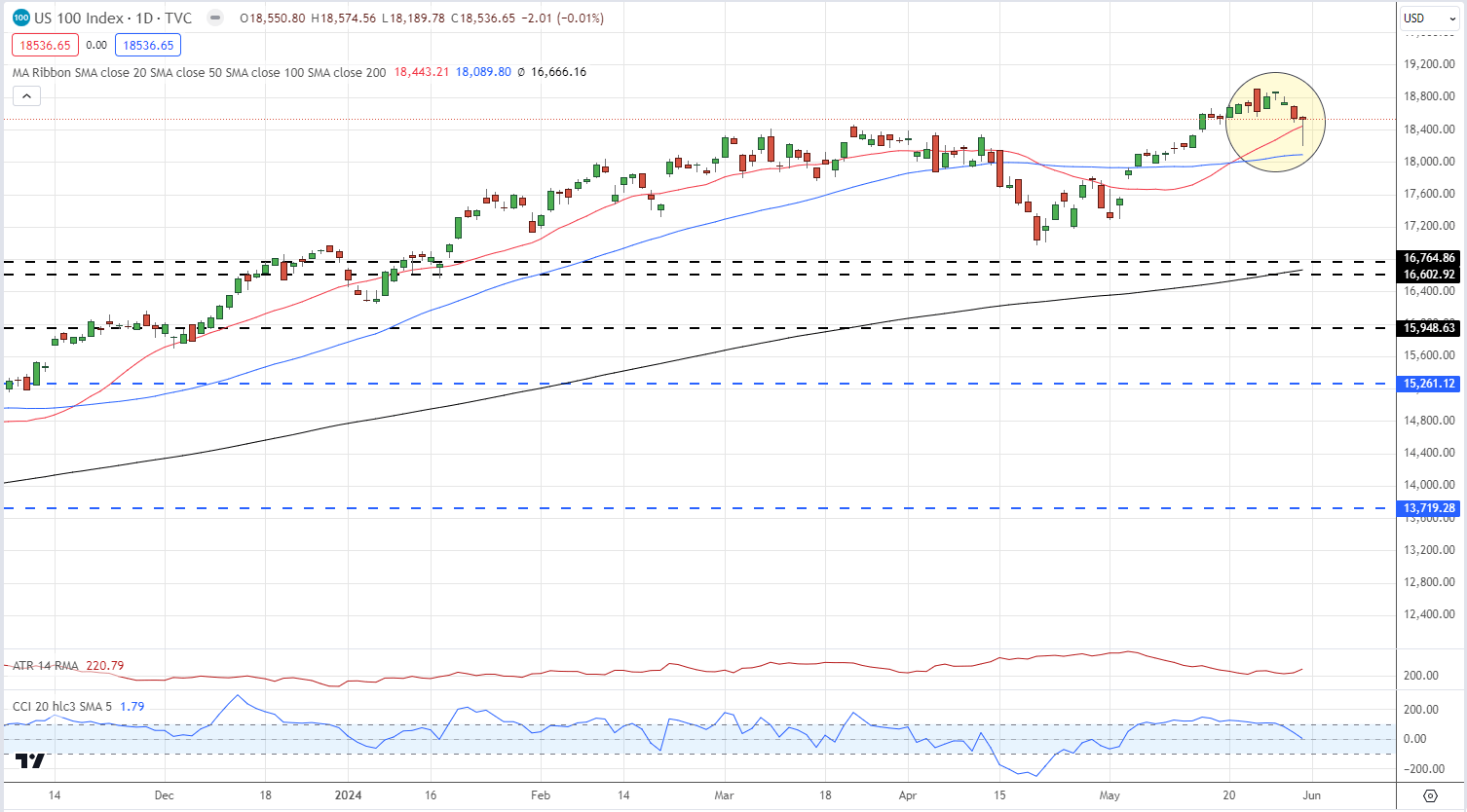

The Nasdaq 100 turned lower this week as cracks started appearing in Magnificent Seven members. With the index pulling back from a sharp early sell-off, Friday's price action will give bulls some hope of higher prices. Still, an index dominated by a handful of mega-cap companies remains vulnerable to a change in sentiment.

Nasdaq 100 Daily Chart

All Charts using TradingView