US Dollar, Gold Analysis and Charts

- US manufacturing sector back in the doldrums.

- US dollar index eyes a two-month low.

For all economic data releases and events see the Dreamboot Wealth Institute

According to the Institute for Supply Management (ISM), the US manufacturing sector contracted for the second consecutive month in May, as the Manufacturing PMIregistered 48.7%, down 0.5% compared to April’s reading of 49.2%. “After breaking a 16-month streak of contraction by expanding in March, the manufacturing sector has contracted the last two months at a faster rate in May. Two out of five subindexes that directly factor into the Manufacturing PMIare in expansion territory, up from one in April. The New Orders Index moved deeper into contraction after one month of expansion in March.’

Full ISM Report

For all economic data releases and events see the Dreamboot Wealth Institute

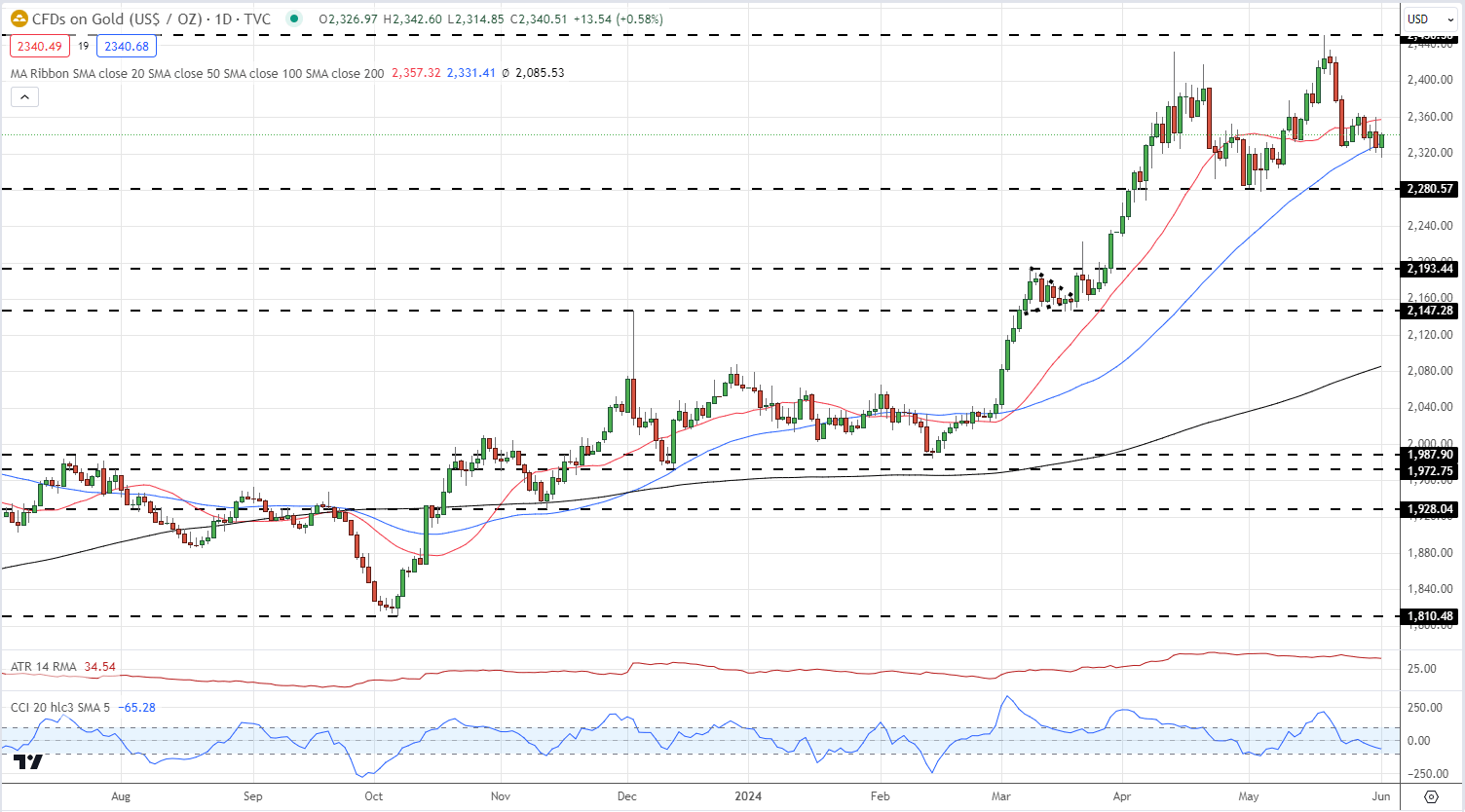

The US dollar turned lower after the ISM release with the US dollar breaking through 38.2% Fibonacci retracement support at 104.37 and through the 200-day simple moving average. The greenback is now looking at the May 16th multi-week low at 104.10.

US Dollar Index Daily Chart

Chart by TradingView

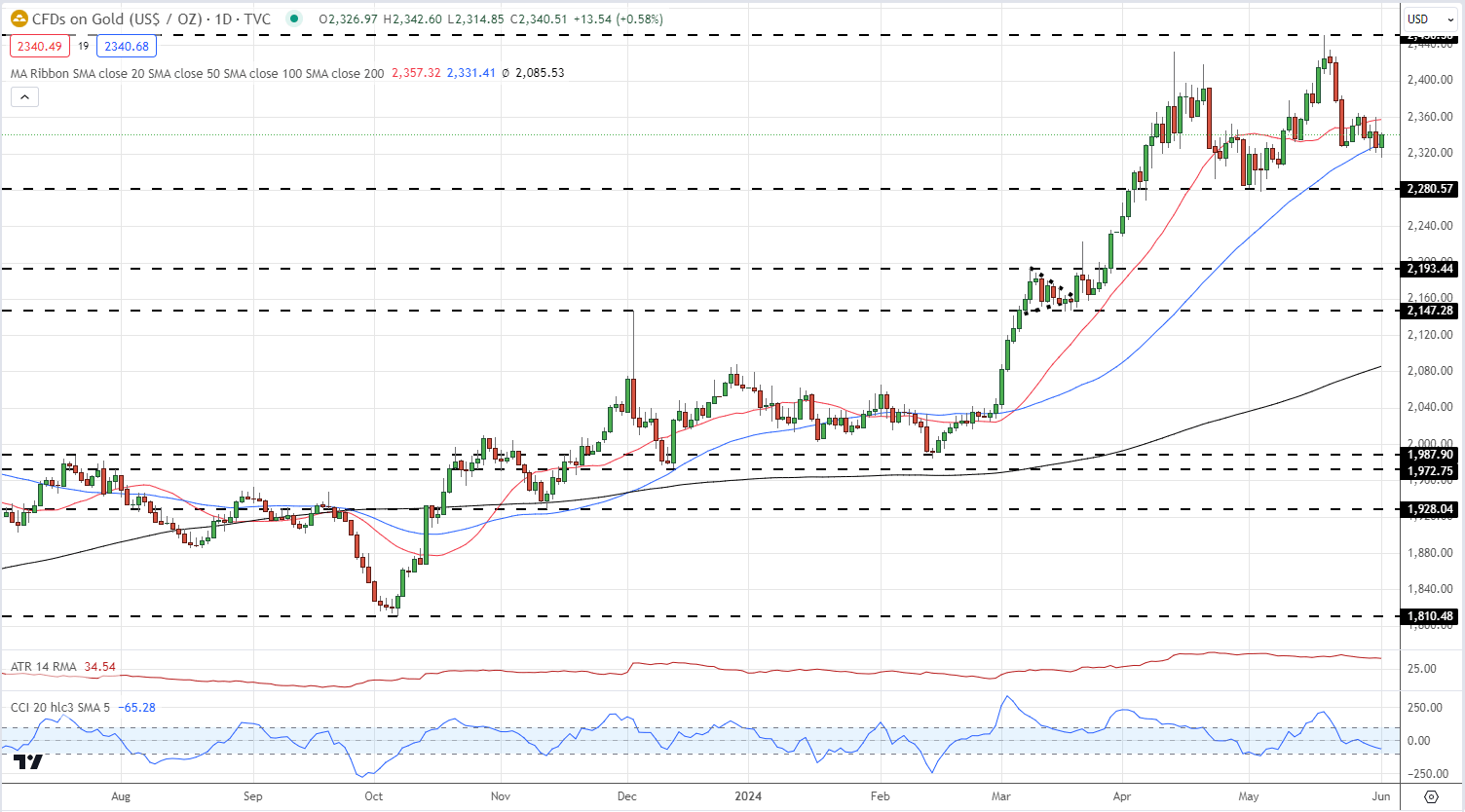

Gold moved a touch higher after the release, trading back above $2,340/oz. The precious metal has been under pressure in the last two weeks and today’s data may help to stem any further falls. Support remains at $2,280/oz.

Gold Daily Price Chart

Retail trader data shows 60.04% of traders are net-long with the ratio of traders long to short at 1.50 to 1.The number of traders net-long is 0.32% higher than yesterday and 6.82% lower from last week, while the number of traders net-short is 15.37% higher than yesterday and 10.74% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current Gold price trend may soon reverse higher despite the fact traders remain net-long.

| Change in | Longs | Shorts | OI |

| Daily | 8% | -17% | -2% |

| Weekly | 1% | -14% | -4% |