The Bank of Canada (BoC) voted to cut interest rates at its June meeting from 5% to 4.75%, relying on its improved confidence that inflation is heading lower. The BoC highlighted the declining three-month measure of core inflation as one of the indications that CPI is heading lower but Governor Tiff Macklem also issued caution that the further progress is likely to be uneven and risks remain. The main risks to the inflation outlook include rising wage growth , the potential for escalating global tensions and the threat of house prices rising faster than anticipated.

Dreamboot Wealth Institute

Learn how to prepare for major news events and consider this easy-to-implement approach to tope tier economic data:

15 minutes after the rate adjustment, US ISM services PMI data came in stronger than anticipated – a bit of a shock to the system given the streak of softer US data of late. This helped prop up the dollar and shows up more notably in the USD/CAD pair.

Markets increased the likelihood of a surprise rate hike this week so while the outcome came somewhat as a surprise, outcome had gained traction in recent days. Last week Wednesday markets priced in 16 basis points (bps), but ahead of the announcement it had risen to 20 bps.

Unemployment has picked up; and while GDP growth improved in Q1 compared to Q4, it still disappointed when viewed alongside estimates. Low growth and inflation combined with rising unemployment provides a mix that the committee believed justified a rate cut today.

Source: Refinitiv, prepared by Richard Snow

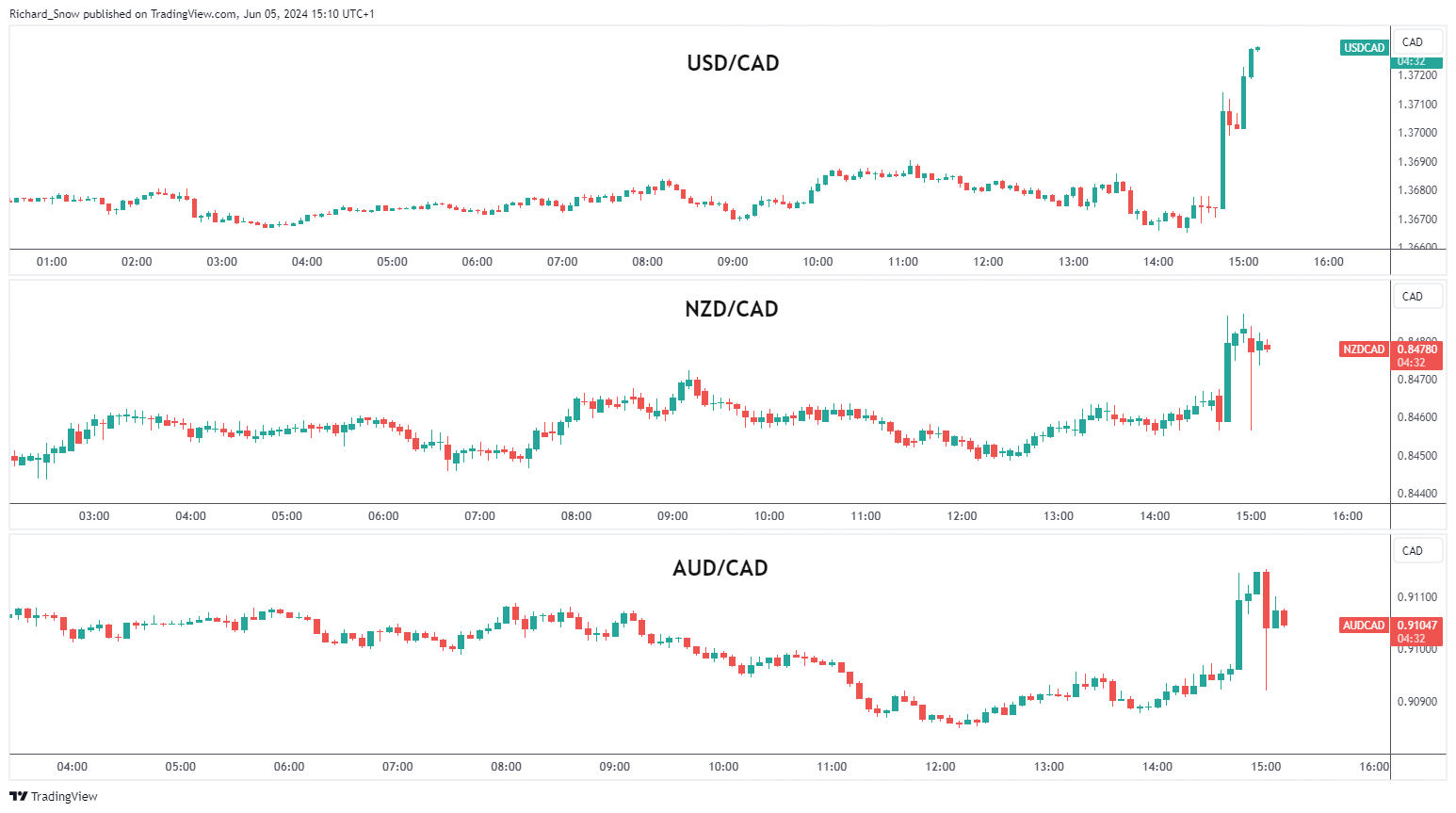

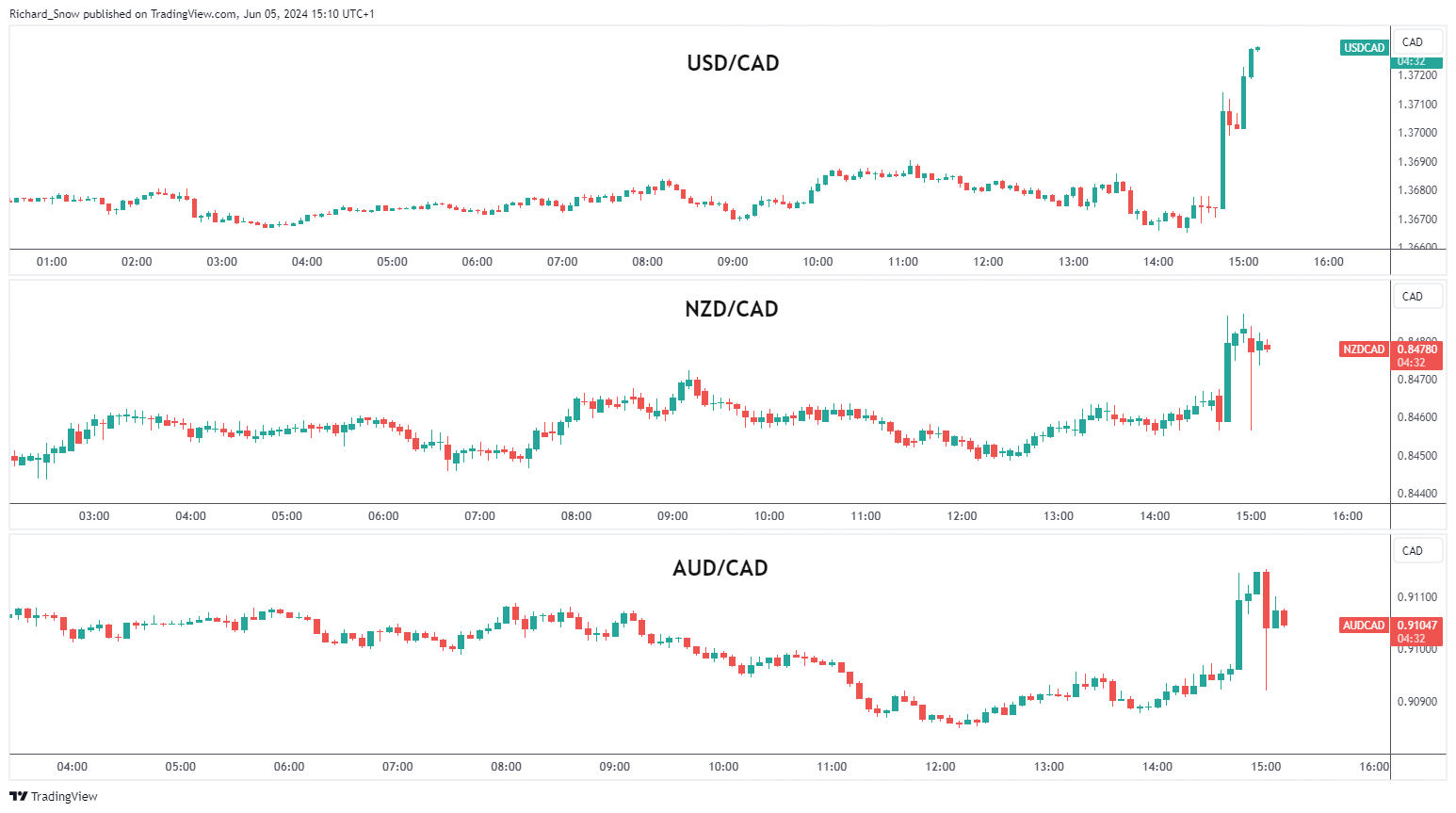

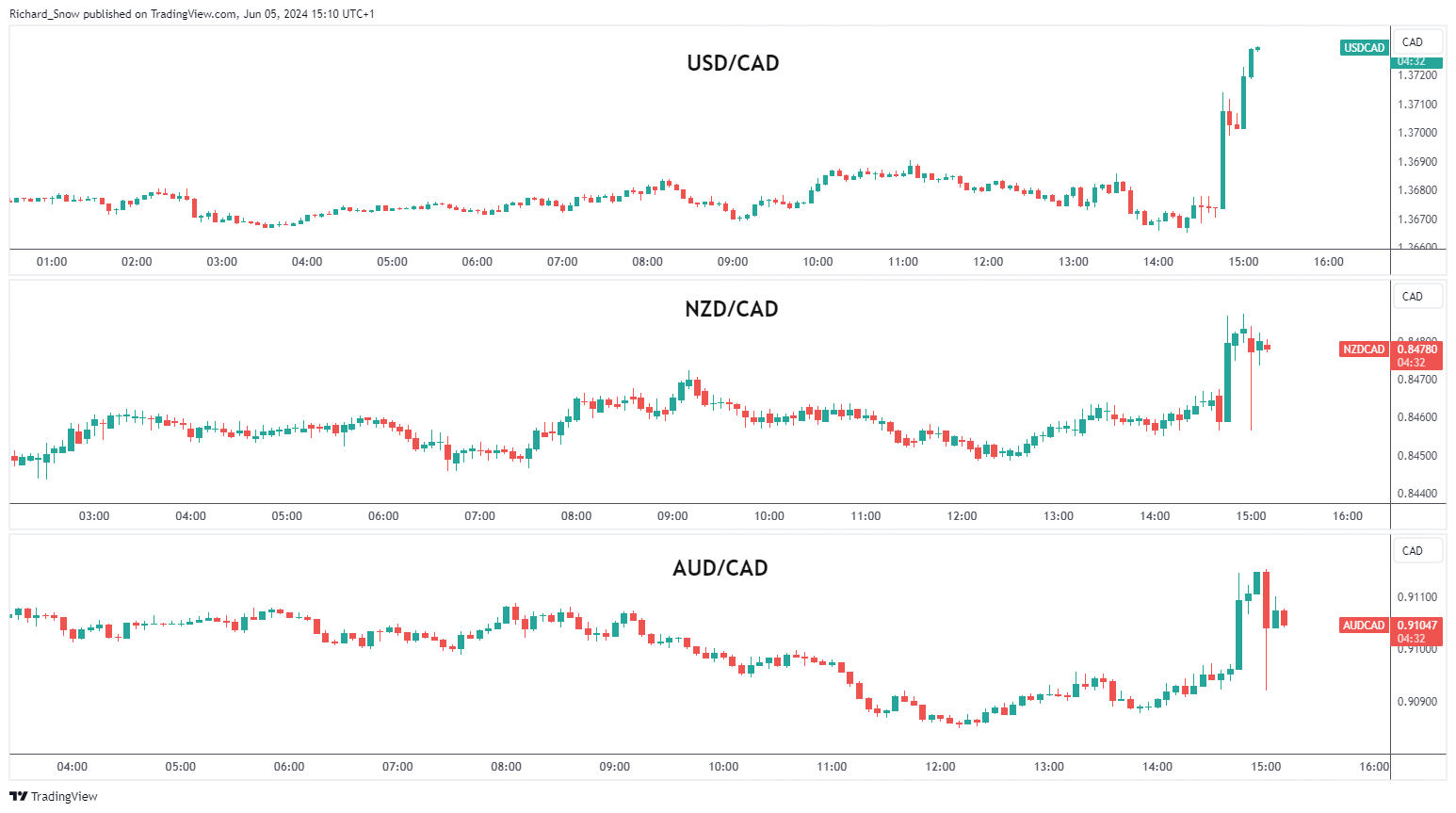

Canadian Dollar (CAD) Price Reaction

Following the interest rate cut from the Bank of Canada, the Canadian dollar understandably dropped across most G7 currencies, most notably witnessed in the USD /CAD pair which rose after the data. Further gains trickled in after US services PMI defied forecasts and the recent spate of weaker-than-expected data by surprising to the upside – lifting the greenback.

AUD /CAD (downside) offered up an interesting prospect in the event the meeting produced a hawkish outcome as this week has seen a tentative approach to risk assets. Looking at the dovish outcome, NZD/CAD comes into focus as the Reserve Bank of New Zealand recently stressed that they are not in a position to cut rates any time soon.

Multi-Pair Reaction (FX)

Source: TradingView, prepared by Richard Snow

If you're puzzled by trading losses, why not take a step in the right direction? Download our guide, "Traits of Successful Traders," and gain valuable insights to steer clear of common pitfalls