Gold Price Analysis and Charts

Download our complimentary Q2 Gold Technical and Fundamental Forecasts below:

Most Read: Understanding Inflation and its Global Impact

Market’s have opened the session on a mildly positive note, ahead of a week packed full of high-profile data and equity releases, along with the latest Federal Reserve policy decision. Data releases this week include US ISM readings and the latest US Jobs Report, while in the equity space, a host of notable US companies open their books, including Amazon, Apple, AMD, Moderna, and Pfizer.

Markets Week Ahead: FOMC, Apple, Amazon, USD/JPY, Gold and USD Outlooks

The Middle East is experiencing a period of relative stability and peace at the moment, leaving gold traders looking for other drivers. Central bank demand for gold remains strong, especially from China, while investors looking to move away from the US dollar continue to diversify into gold. Sentiment this week will be driven by the latest US Fed policy decision on Wednesday – no change in rates expected – while on Friday the latest US Jobs Report will give the market the usual pre-weekend volatility jolt.

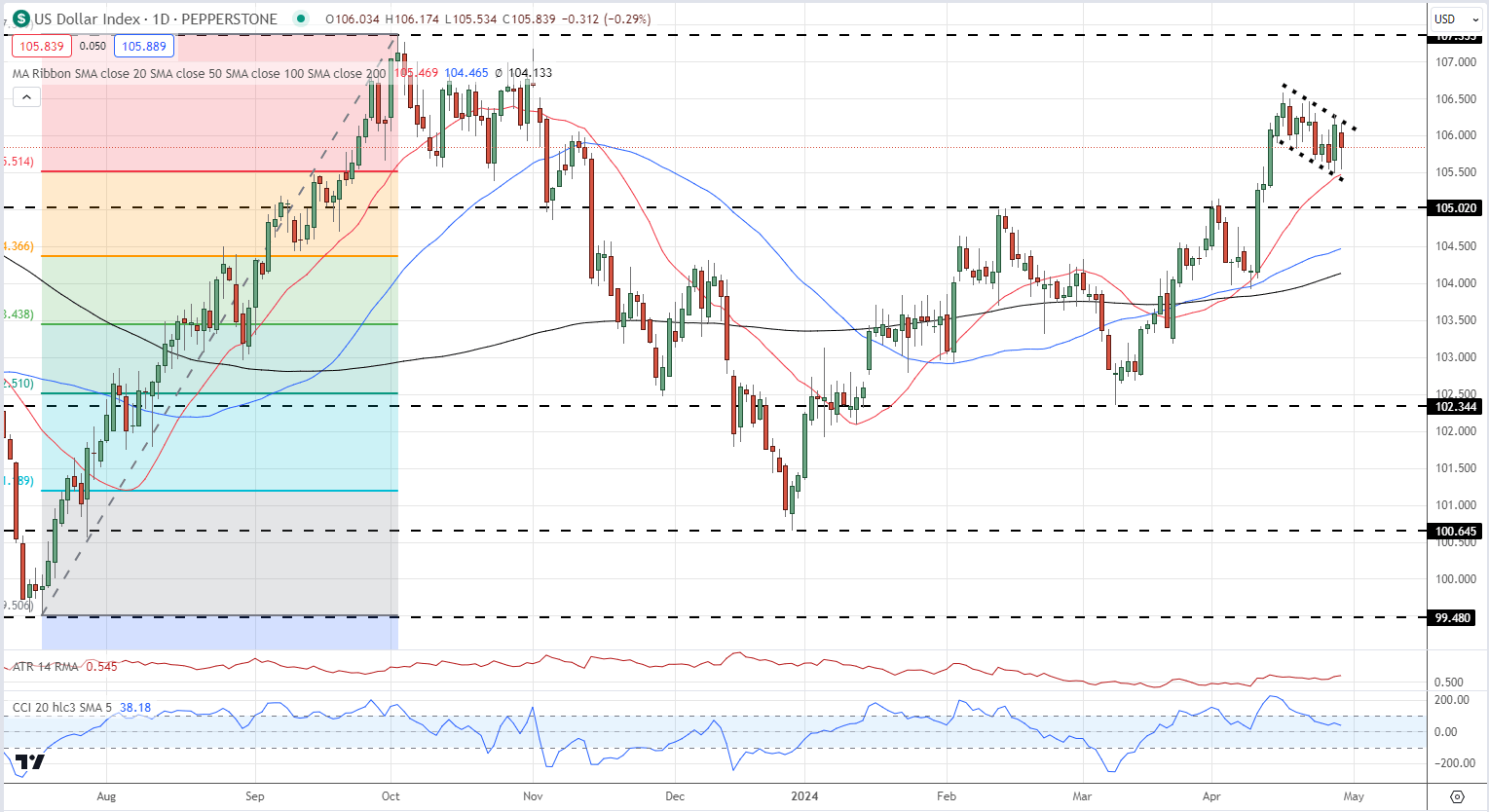

The US dollar is lack luster in early trade but continues to build a bullish flag formation, suggesting the greenback is set to go higher. This week’s US data and events will frame the next move, but if the US dollar keeps within the Bull flag formation, then a break higher would see the recent high at 107.36 come under pressure.

US Dollar Index Daily Chart

Learn Forex: Trading the Bull Flag Pattern

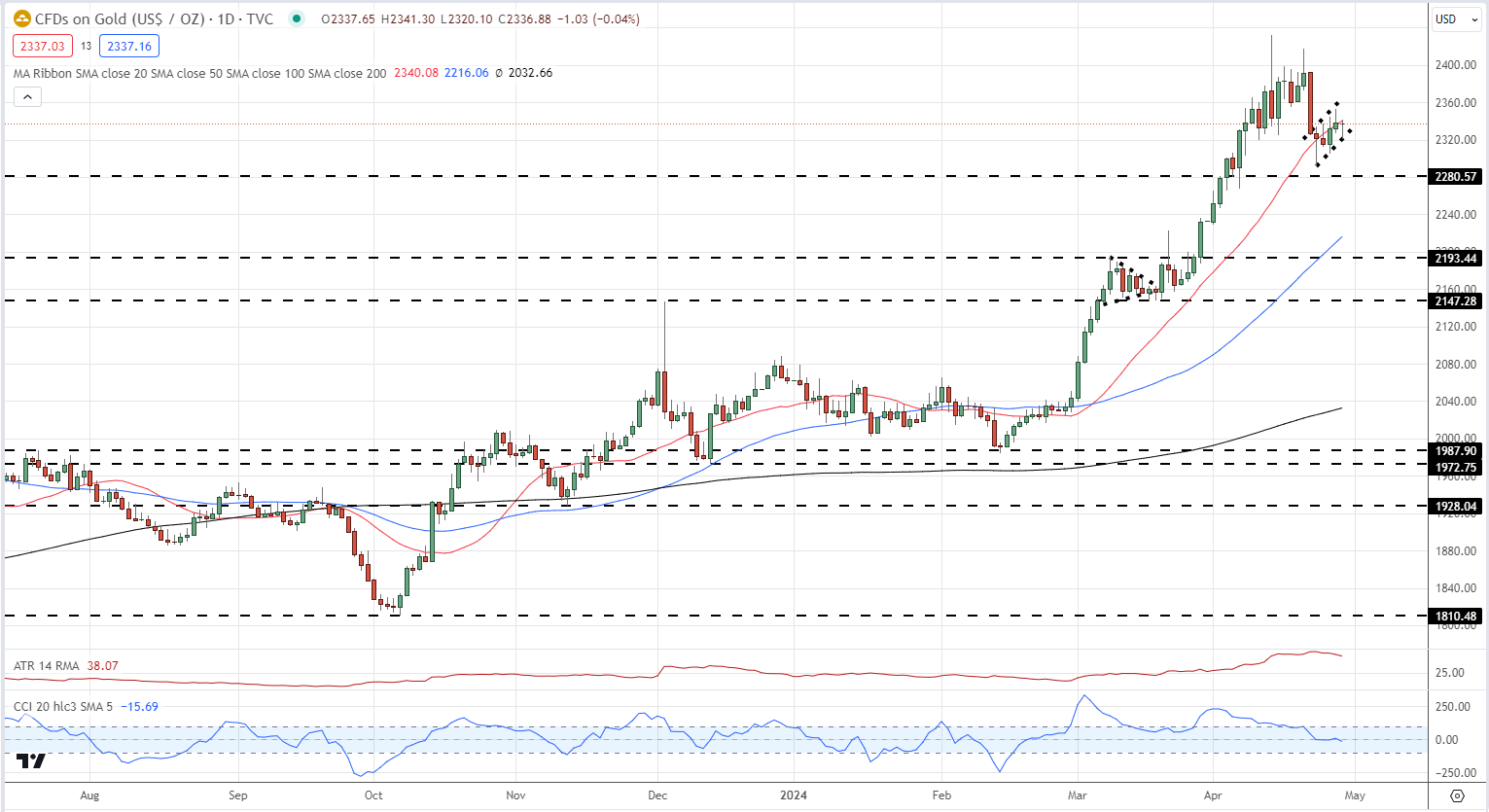

While the US dollar looks technically bullish, gold is starting to look bearish, at least on a short-term basis. A technical bear flag has appeared on the daily chart over the last week and a confirmation of this setup would see gold break below $2,280/oz. The short-dated 20-day simple moving average is being tracked and a break and open below this indicator should see gold move lower. A cluster of recent highs just under $2,400/oz. should act as resistance in the case of any move higher.

Gold Daily Price Chart

How to Trade a Bearish Flag Pattern

Charts via TradingView

IG Retail Trader data shows 53.40% of traders are net-long with the ratio of traders long to short at 1.15 to 1.The number of traders net-long is 2.13% lower than yesterday and 3.38% higher than last week, while the number of traders net-short is 2.69% higher than yesterday and 6.01% lower than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall.

See the Full Report Below:

| Change in | Longs | Shorts | OI |

| Daily | 7% | -1% | 4% |

| Weekly | 36% | -26% | 3% |