USD/JPY News and Analysis

- Janet Yellen meets with Asian finance officials as intervention speculation rises

- USD/JPY edges slightly lower after trilateral meeting

- Effectiveness of FX intervention efforts rise on multi-party alliance

- Get your hands on the Japanese yen Q2 outlook today for exclusive insights into key market catalysts that should be on every trader's radar:

Janet Yellen Meets with Asian Finance Officials as Intervention Speculation Rises

FX intervention remains a hot topic of discussion, particularly after the Japanese and South Korean finance ministers met with US Treasury Secretary, Janet Yellen. Japan and South Korea agreed to “consult closely” on FX markets after their respective currencies witnessed large declines as a result of the Fed having to delay its first interest rate, weighing on the respective Asian currencies.

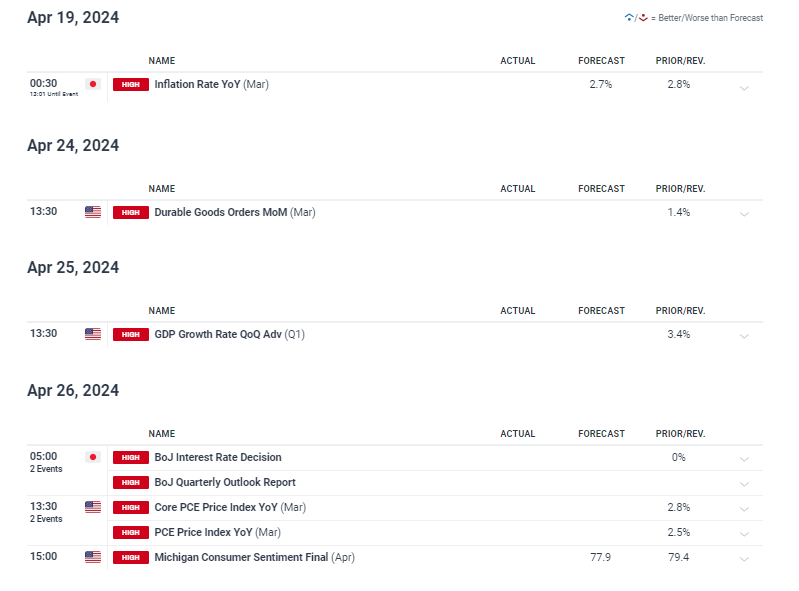

Under a G7 agreement, advanced economies agreed to allow their foreign exchange rate to be determined by the market unless excessive and disorderly moves are experienced. This is the latest development hinting that a move to defend the yen is getting closer and closer. Previously, on the 27th of March, the Japanese Finance Minister Shunichi Suzuki stated that authorities will take “decisive steps” against yen weakness. Those same words were preciously mentioned ahead of the first bout of intervention back in 2022 and sent a warning to the market. Nevertheless, the latest warnings have had little to no effect on the pair which has only marginally declined yesterday.

The pair trades dangerously close to the 155.00 line which is thought to be the tripwire likely to precede massive yen buying. The issue with intervention efforts is it can be costly and its effectiveness is still up for debate. A strong US economy has delayed the Fed’s plans to cut interest rates, meaning unless the Bank of Japan raise interest rates in a rapid fashion (highly unlikely), the massive interest rate differential between the two is only going to revitalise the carry trade. A co-ordinated effort however, implies a broader, longer lasting effort to strengthen the yen.

USD /JPY Weekly Chart

USD/JPY Edges Slightly Lower after Trilateral Meeting

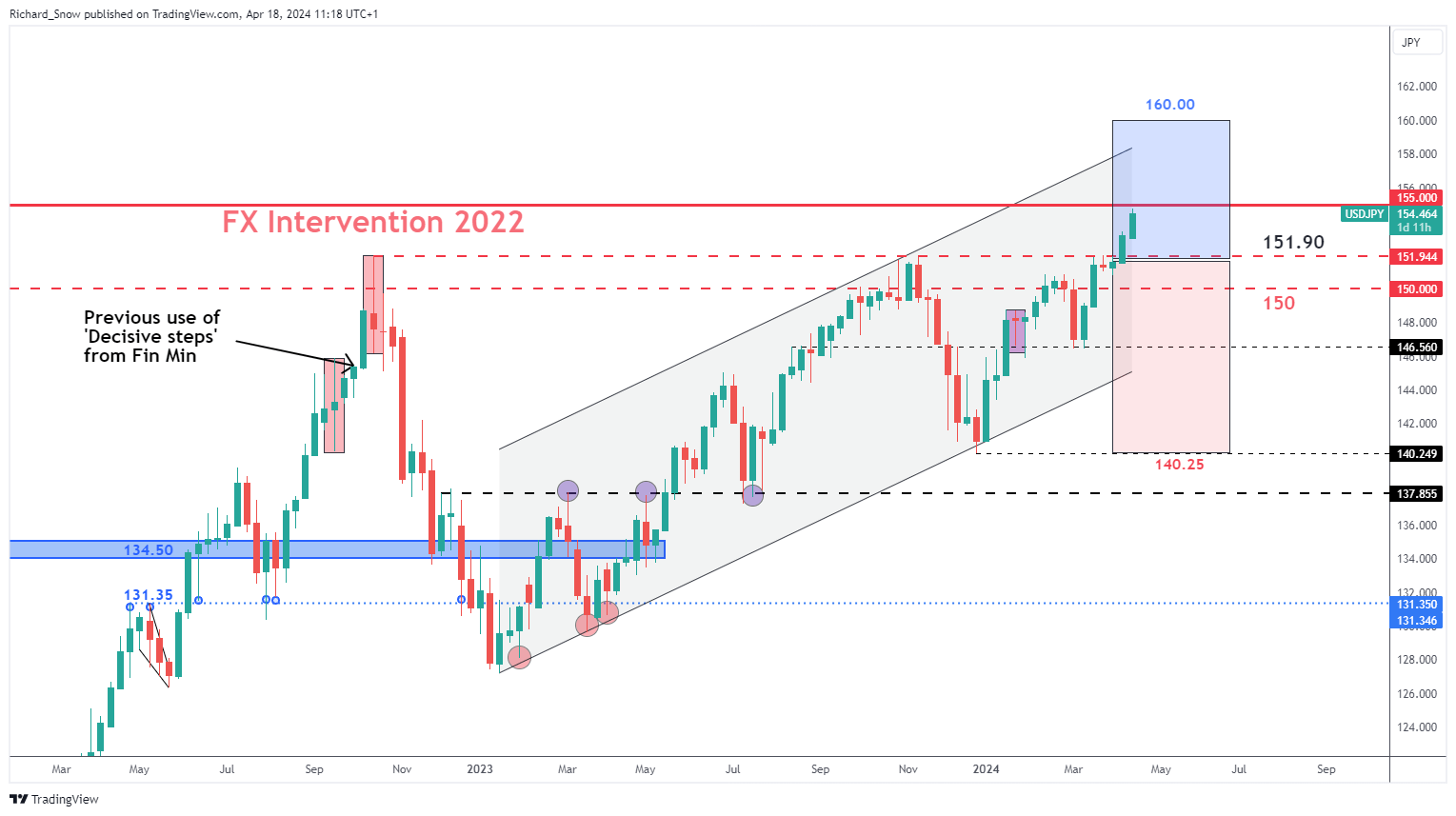

USD/JPY continues in overbought territory but has shown restraint ahead of the 155.00 level. This level is very likely to be tested if US growth and PCE inflation data next week continues to show resilience.

In the absence of further jawboning from Japan officials, it would appear the market isn’t heeding prior warnings. 152.00 remains the level of interest in the event a pullback emerges or markets anticipate an imminent threat of FX intervention.

To the upside, 155.00 could be breached with the right catalyst (hit US PCE and growth), in the same way US CPI propelled the pair above the prior ceiling of 152.00

USD/JPY Daily Chart

Looking for actionable trading ideas? Download our top trading opportunities guide packed with insightful tips for the second quarter!

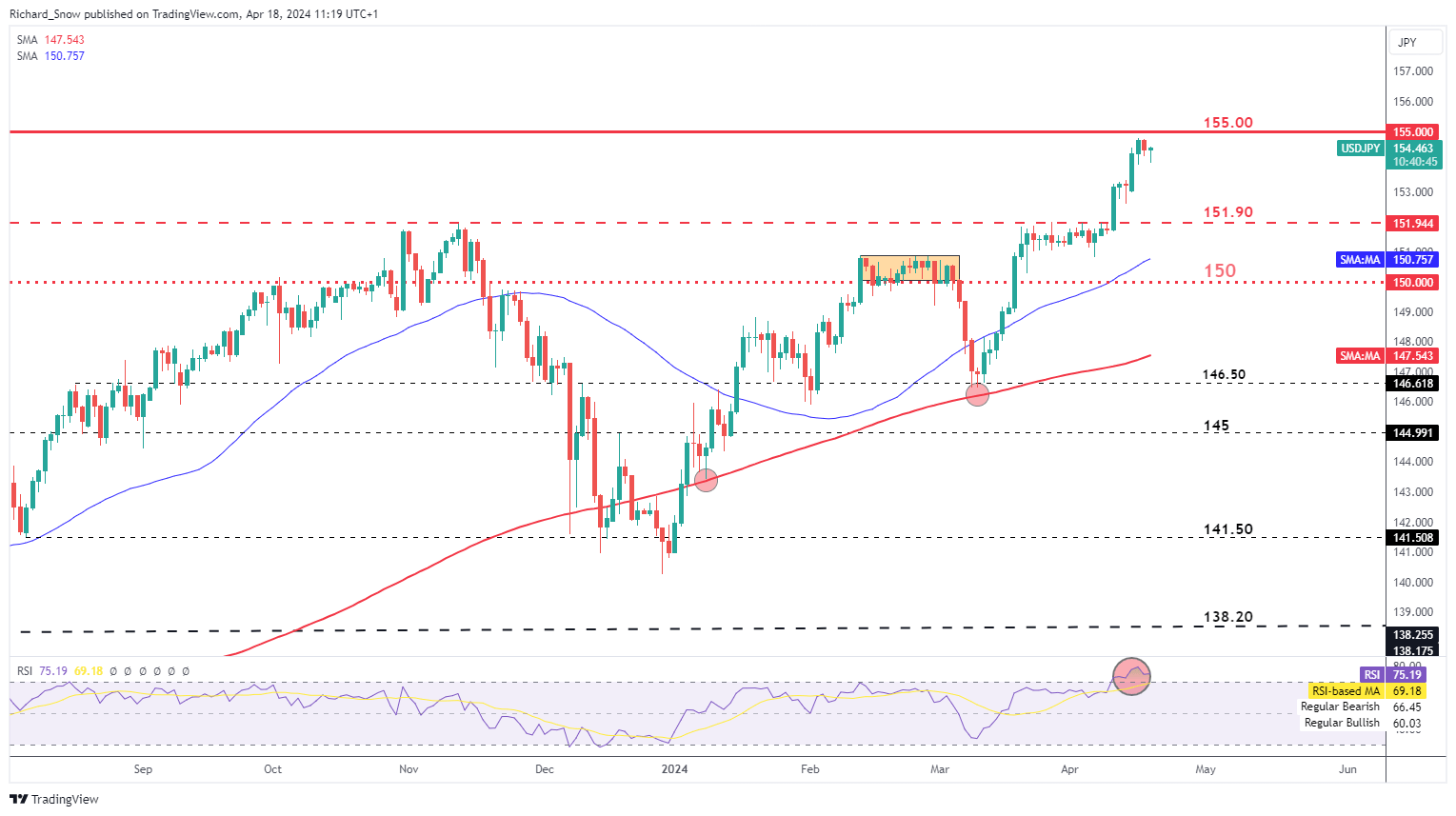

Risk Events on the Horizon

Tomorrow, Japanese inflation will factor into the BoJ’s thinking regarding its inflation outlook. Then next week, the potential for strong US growth in Q1 can further derail the yen ahead of the BoJ April decision which isn’t being eyed for another rate hike . US PCE is another threat to USD/JPY as hotter-than-expected US inflation has built up in 2024.