Japanese Yen (USD/JPY) Analysis

- USD/JPY registers massive decline, stoking intervention speculation

- Rate differential explains why FX intervention is largely expected to be ineffective

- Major risk events ahead: US QRA, FOMC , manufacturing PMI and NFP

- Get your hands on the Japanese Yen Q2 outlook today for exclusive insights into key market catalysts that should be on every trader's radar:

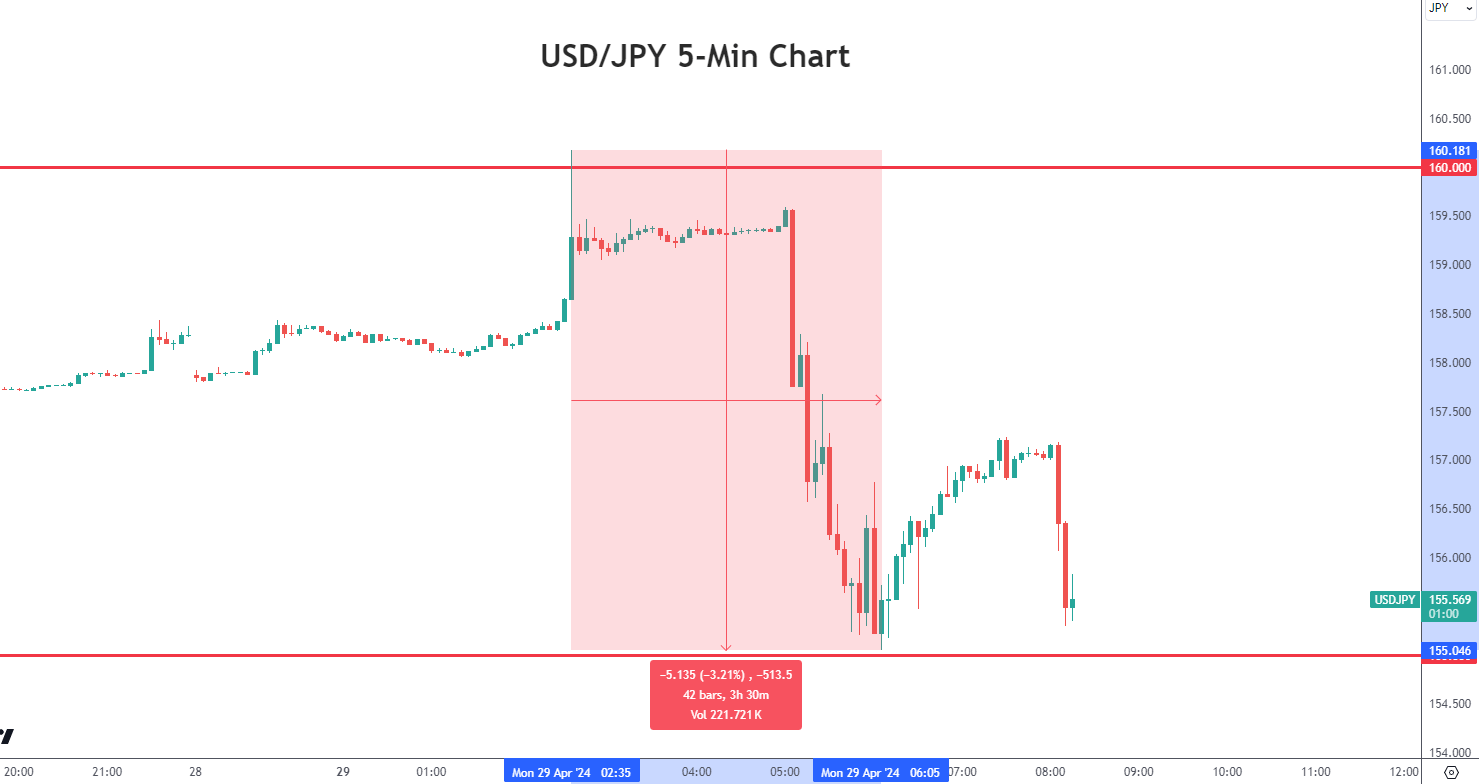

USD/JPY Registers Massive Decline, Stoking Intervention Speculation

USD /JPY tagged the 160 mark and immediately dropped towards the 155 level as speculation around possible FX intervention did the rounds on Monday morning. The early surge in the pair came off the back of Friday’s disappointing Bank of Japan (BoJ) meeting where Governor Ueda mentioned that the weak yen has no significant impact on inflation .

Japan is currently on holiday for Showa Day, one of the holidays observed during Golden Week. Further holidays will be observed this Friday and Monday next week. The bank holidays naturally present a lower liquidity environment which can help advance a sharp, large move in USD/JPY.

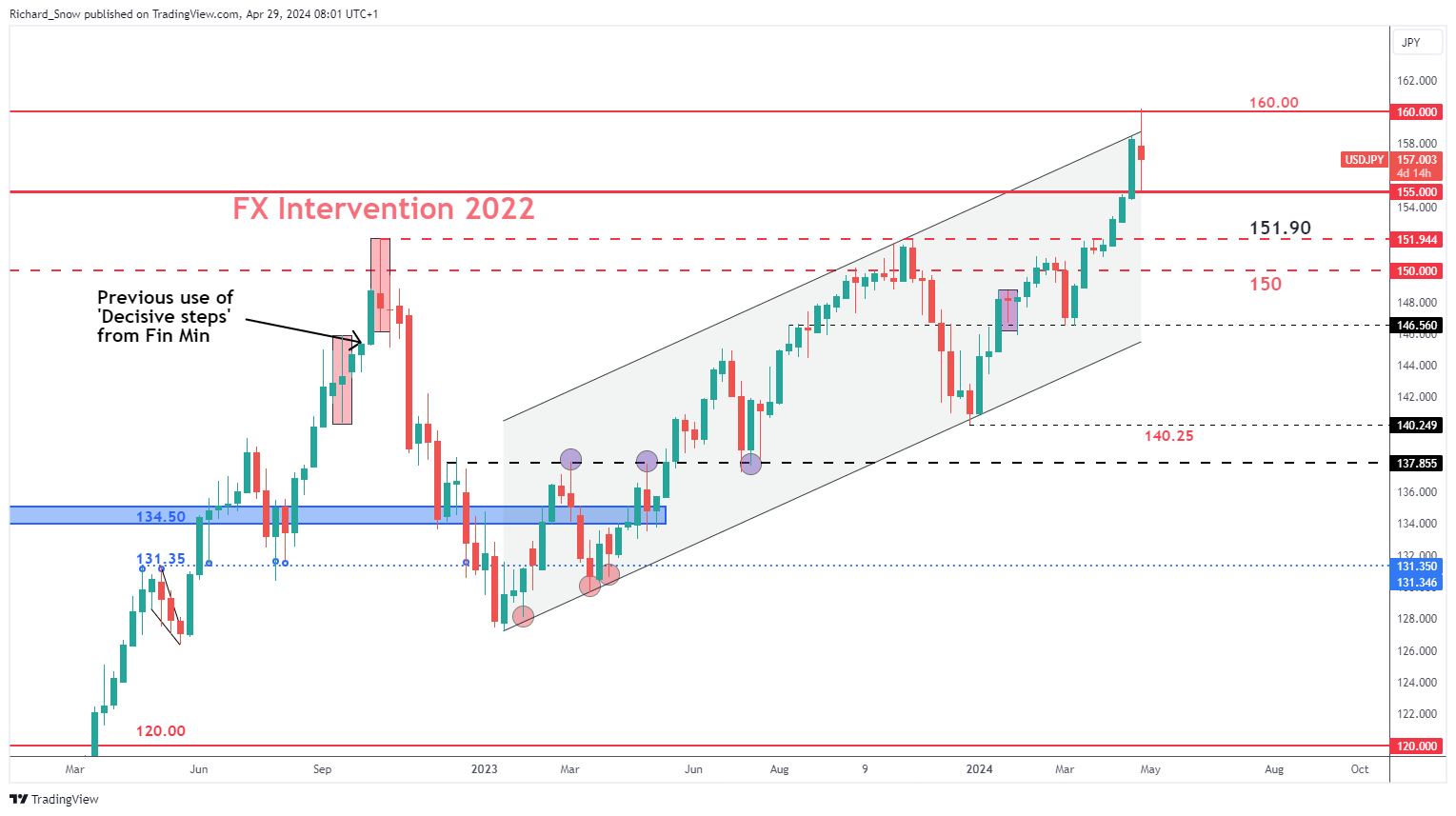

Bigger Picture: Why FX Intervention is Likely to be Ineffective

FX intervention could provide a short-lived boost for the yen because ultimately, yields and rates matter in the longer run. USD/JPY rose is consistent fashion in the first quarter of 2024 as low volatility conditions favour the ‘ carry trade ’. The interest rate differential between the US and Japan is over 5%, meaning traders and investors were more than happy to collect the positive carry at a time when hotter US inflation buoyed the greenback.

If what we have observed today is, in fact, an effort from Japanese officials to strengthen the yen, then it is likely the market views any sizeable decline in USD/JPY as an opportunity to go long at more attractive entry levels as the US-Japan rate differential is unlikely to narrow any time soon.

The issue was made worse by comments from the BoJ Governor Ueda that the yen’s weakness does not have a significant effect on inflation. Therefore, it appears the Bank is not looking to hike simply to defend the local currency. Furthermore, Ueda mentioned he does not have a predetermined timeline for the next hike, which has been perceived as dovish.

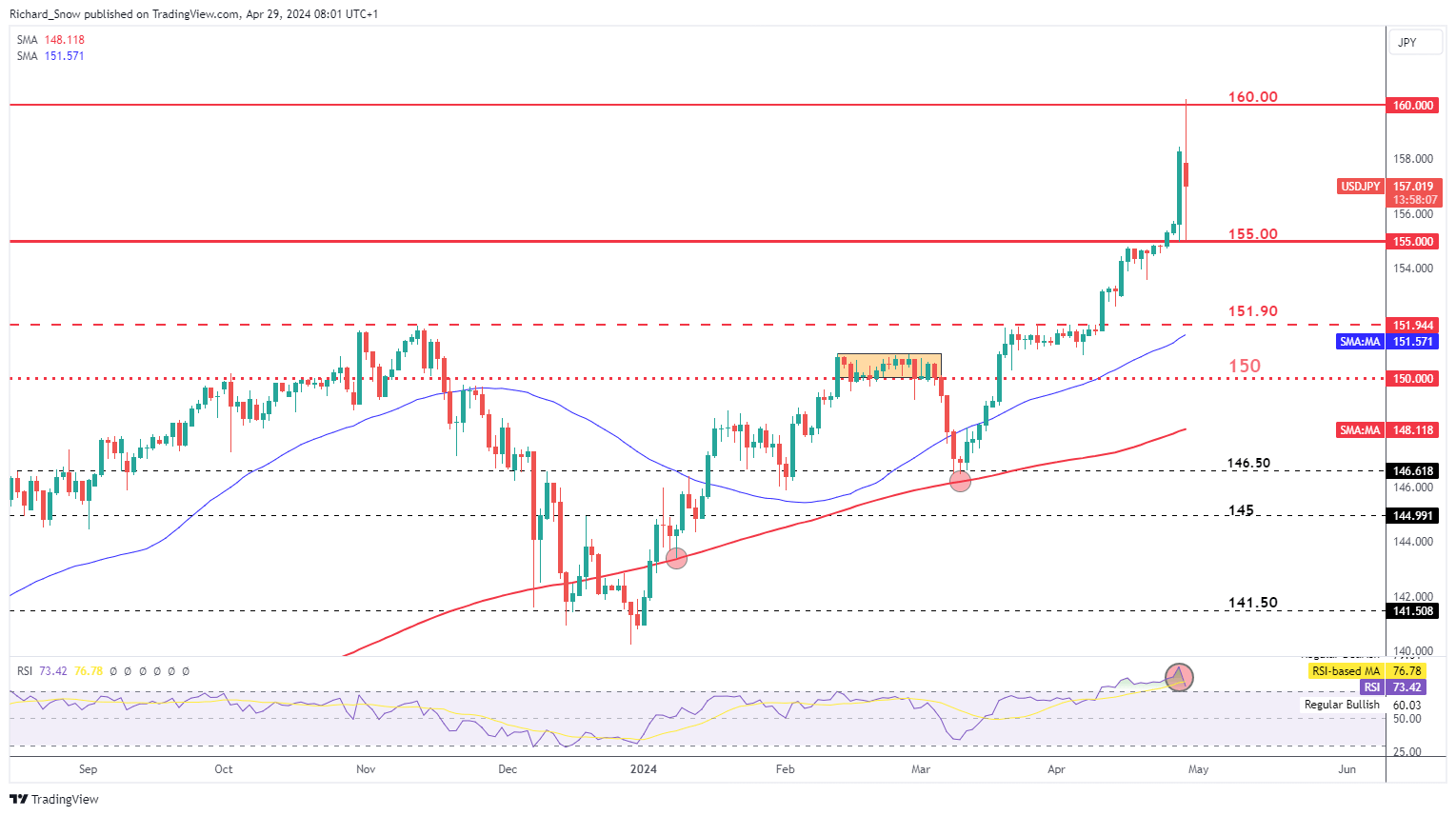

USD/JPY Daily Chart

Learn the ins and outs of trading USD/JPY - a pair crucial to international trade and a well-known facilitator of the carry trade

The weekly chart helps portray the longer-term bull trend and reveals the confluence area of resistance around the 160 mark. The pair approached channel resistance and the important 160 mark before reversing sharply lower. 155 remains a key level, if prices can close below it on the daily candle today.

USD/JPY Weekly Chart

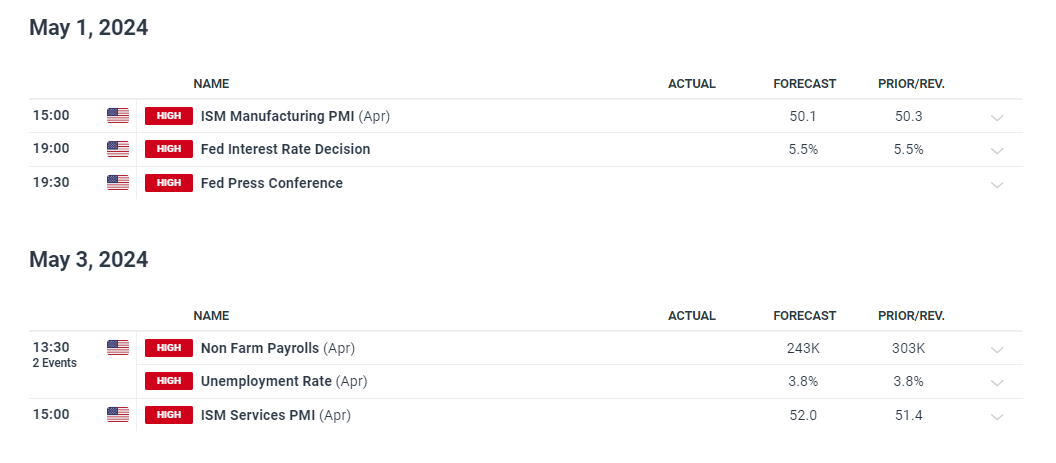

Major Risk Events Ahead: US Treasury QRA, FOMC and NFP

Perhaps the biggest risk to the recent lower move in USD/JPY is the FOMC meeting on Wednesday. However, there are several high importance US events/data that can impact USD/JPY.

On Monday, the US Treasury will detail how it plans to fund the government, detailing a mix of shorter and longer-term issuances (mix of T-bills, notes and bonds). Then on Wednesday, markets will be on the lookout for a greater acknowledgement of re-accelerating inflation from the Fed but the committee could also downplay recent inflation surprises as disinflation is broadly observed.

US ISM manufacturing PMI data is likely to attract more attention than usual after the S&P Global survey now sees the sector as having dipped into a contraction.

Friday ends the week off with non-farm payrolls, where it is expected that the US economy would have added another 243k jobs for the month of April. Therefore, the prospect of growth concerns, combined with hot inflation and a strong labour market provides the Fed with a lot to think about as high interest rates risk weighing on economic growth but is also necessary to calm resurgent price pressures.