In the realm of economics, politics, and financial markets, this year is shaping up to be an extraordinary one. We find ourselves amid not just one but two significant global conflicts, while President Xi of China reaffirms his commitment to annex Taiwan, and Kim Jong Un of North Korea issues unsettling threats against the United States. Moreover, the political landscape is far from tranquil, with the most probable Republican candidate facing challenges to his presence on state ballots, all in the name of safeguarding democracy.

These wars and political upheavals, events that often send shockwaves through financial markets, are taking place against a backdrop where some on Wall Street perceive them as demonstrations of America’s resilience and prowess on the global stage. This confluence of geopolitical tension and market dynamics presents a unique set of challenges and opportunities, making this year’s economic and political landscape one for the history books.

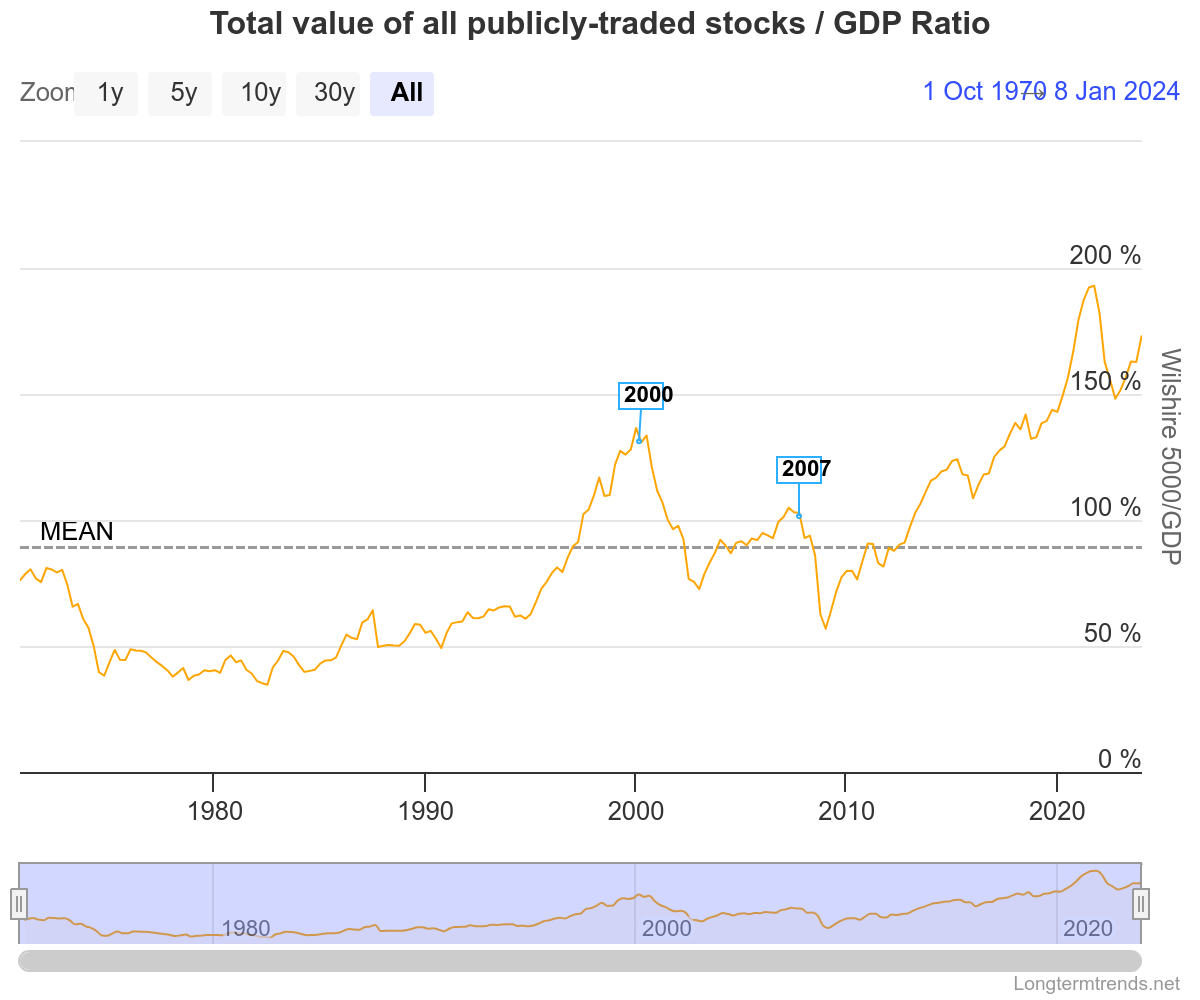

Amidst this complex tapestry of geopolitical challenges, we find ourselves in a financial landscape that’s unlike any we’ve seen before. To put it in perspective, before the tumultuous year of 2020, we were already grappling with the most expensive stock market in history. The price-to-sales ratio currently stands at a staggering 2.62, and the total market capitalization of equities has soared to a remarkable 175% of GDP. You can see on the following chart that anything over 150% is fundamentally considered as overvalued.

These figures are not only near record highs but also far exceed the historical averages we were accustomed to before the pandemic.

Now, let’s delve into the equity risk premium, a critical gauge of market dynamics. At present, it hovers around zero, a stark signal that the earnings yield of stocks is actually lower than the yield one can secure by simply holding a risk-free T-bill. In simpler terms, investors are essentially not being compensated at all for taking on the added risk associated with owning stocks over T-bills.

These metrics underscore the precarious state of our financial markets, where valuations are at historic peaks, and the traditional trade-off between risk and return seems to be ignored. In such an environment, the path forward becomes more intricate and uncertain, with investors facing the daunting task of navigating uncharted waters in search of yield and stability.

However, my concern lies completely in the U.S. Treasury market which is a total mess. Simply look at the following chart since the pandemic. From peak to bottom the losses were 46%. While this would be difficult in any market, I contend that Treasuries have always been the gold standard for savers. Banks who invested in Treasuries in leveraged portfolios faced insolvency.

Today the U.S. government faces a problem that every stockbroker has encountered at least once in their careers, when you promote a bad investment to a customer it is hard to regain their trust. Since U.S. Treasuries lost 46% of their value, what reasoning is there to invest in them moving forward?

For those who might not be familiar with the tumultuous events of March 2020, the US Treasury market, historically considered the investor’s sanctuary of safety and liquidity, underwent a seismic transformation. Suddenly, what were once perceived as ultra-safe and ultra-liquid assets, known to rally when markets faced turbulence, turned inexplicably illiquid. Concurrently, they started selling off in unison with the broader market turmoil and the government bringing out the printing press to paper over the perceived problem.

This abrupt shift in the Treasury market’s dynamics left many scratching their heads and seeking to understand the root causes. The liquidity problems that surfaced during this period were multifaceted, stemming from a confluence of factors. One of the primary catalysts was the sheer magnitude of market stress, triggered by the reality where negative yielding investments were now facing massive capital principal losses. As uncertainty and fear swept through financial markets, investors rushed to liquidate assets, causing a surge in trading volumes and overwhelming market infrastructure.

Furthermore, the suddenness of the market turmoil caught many off guard, leading to heightened demand for the safety of cash and cash equivalents, in only shorter-term treasury instruments. This rush for the exits exacerbated the liquidity crunch, as dealers and market participants struggled to keep pace with the deluge of sell orders.

In hindsight, the events of March 2020 underscore the fragility of even the most liquid markets during periods of extreme stress. It serves as a sobering reminder that in times of crisis, the very assets once considered safe havens can become caught up in a maelstrom of volatility and illiquidity, reshaping investor perceptions and market dynamics.

To correct those faulty dynamics, investors need to see a meaningful real rate of return offered by U.S Treasuries.

But herein is the greater risk, and in my opinion is the path to creating better understanding of what is driving the markets moving forward.

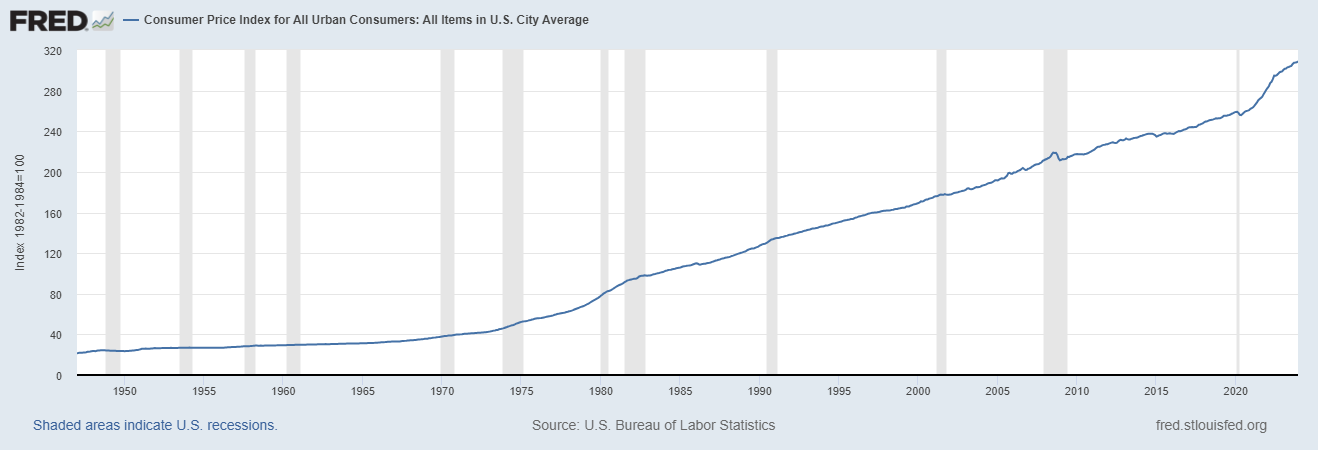

The latest data from the Bureau of Labor Statistics reveals that the Consumer Price Index, a crucial gauge of average price fluctuations for everyday goods and services, experienced a 0.3% increase in December compared to the previous month, in line with the consensus expectations .

This data sheds light on the ongoing dynamics in our economy, offering valuable insights into the cost of living for consumers and the broader inflationary trends that continue to shape our financial landscape.

Does the following long-term chart of the Consumer Price Index look like it is slowing down or reversing to you?

The rubber meets the road by comparing the CPI to the yield on Ten Year Notes. The current yield on 10-year Treasuries is 4.038%. Since the CPI came in at an annualized figure of 3.6% the difference between these values represents the current real rate of return which is .0438%. This value which changes every day, is what investors who are willing to loan the government money for the next 10 years will net. Quite frankly, after a 46% loss in capital over the last 45 months, I conclude that this reality spells trouble for the Treasury market moving forward.

The sobering reality which no one wants to discuss is that no one will loan their funds out to the US Treasury for that paltry return. The conclusion that investors have made is that the risks far outweigh the potential returns. And this poses the crux of the problem moving forward. How does the government finance its operations and deficits moving forward when investors over the last 45 months have lost confidence in the U.S Treasury market? The magnitude of the problem is amplified when we grow to understand that the entire $34 trillion of U.S. Debt will need to be refinanced in the next 1 to 5 years.

Investors exhibit reluctance to invest in the U.S. Treasury market when yields are low or equal to the rate of inflation due to several significant factors. Here are the primary reasons:

1. **Loss of Purchasing Power**: The foremost concern for investors in this scenario is the potential erosion of their purchasing power. When yields fail to outpace inflation, investors are effectively losing real value over time. This is particularly worrisome for those seeking to preserve and grow their wealth.

2. **Opportunity Cost**: Low Treasury yields mean that investors may be missing potentially higher returns in other investment avenues, such as equities or corporate bonds. The opportunity cost of tying up funds in low-yield Treasuries can be substantial when more attractive alternatives exist.

3. **Income Generation**: Investors, especially retirees, rely on income generated from their investments to cover living expenses. When Treasury yields are low, it becomes challenging to generate sufficient income from these investments, potentially impacting their financial security.

4. **Risk Aversion**: Some investors may perceive low-yield Treasuries as offering insufficient compensation for the perceived risks they associate with government debt. They may prefer to allocate capital to assets they believe offer a better risk-reward profile.

5. **Duration Risk**: When interest rates are low, Treasury bonds become more susceptible to interest rate risk. Investors worry that if rates rise, the value of their existing bonds will fall, leading to capital losses.

6. **Inflation Expectations**: Investors are forward-looking and base their decisions on expectations. If they anticipate higher inflation in the future, they may be hesitant to invest in low-yield Treasuries as these may not keep pace with rising prices.

7. **Alternative Investments**: The availability of alternative investments, including international bonds, dividend-paying stocks, and real assets like real estate or commodities, can divert capital away from the Treasury market when yields are unattractive.

8. **Monetary Policy**: Central bank actions and monetary policy play a significant role. If investors perceive that central banks are keeping rates artificially low, they may be concerned about the long-term implications and choose to explore other investment options.

9. **Market Sentiment**: Market sentiment and perception can influence investor behavior. If there’s a prevailing belief that low yields are indicative of economic challenges or uncertainty, it may deter investors from Treasury securities.

In summary, investors’ reluctance to invest in the U.S. Treasury market when yields are low or barely above inflation primarily stems from their concern about the loss of purchasing power. They seek investments that not only protect their capital but also provide a reasonable return on their investments, considering the real impact of inflation over time. Here is a chart from the Federal Reserve of St. Louis which shows that since the beginning of the pandemic there has been a 19.6% loss of purchasing power.

US Treasury securities, a colossal financial cornerstone with over $34 trillion in circulation, represent the world’s preeminent government bond market. The yields on these securities perform the crucial role of serving as global interest rate benchmarks, effectively dictating the baseline for borrowing costs across a spectrum of financial instruments, from foreign governments seeking dollar-denominated loans to corporations issuing debt. This makes the Treasury market the nucleus of international debt markets and, consequently, a linchpin of the global economy.

Given the perception of US public debt as a “risk-free” asset, it functions as the focal point for pricing other, riskier debt instruments. For instance, when corporations issue bonds, their pricing typically incorporates a premium above US Treasuries. To illustrate, a BBB-rated US corporation currently might need to offer a yield 1.8 percentage points above the 10-year US Treasury yield, currently at 4%, resulting in a corporate bond yield of 5.8%. The same principle extends to foreign governments issuing debt.

In essence, the entire world’s debt ecosystem hinges on Treasury securities. A mere one-percentage-point uptick in Treasury yields echoes throughout the realm of US dollar borrowers, causing their own borrowing costs to rise proportionally. With the global debt load exceeding $300 trillion, such an interest rate increase would translate into a staggering $3 trillion additional expenditure for borrowers, a sum eclipsing the GDP of all but the world’s top seven economies.

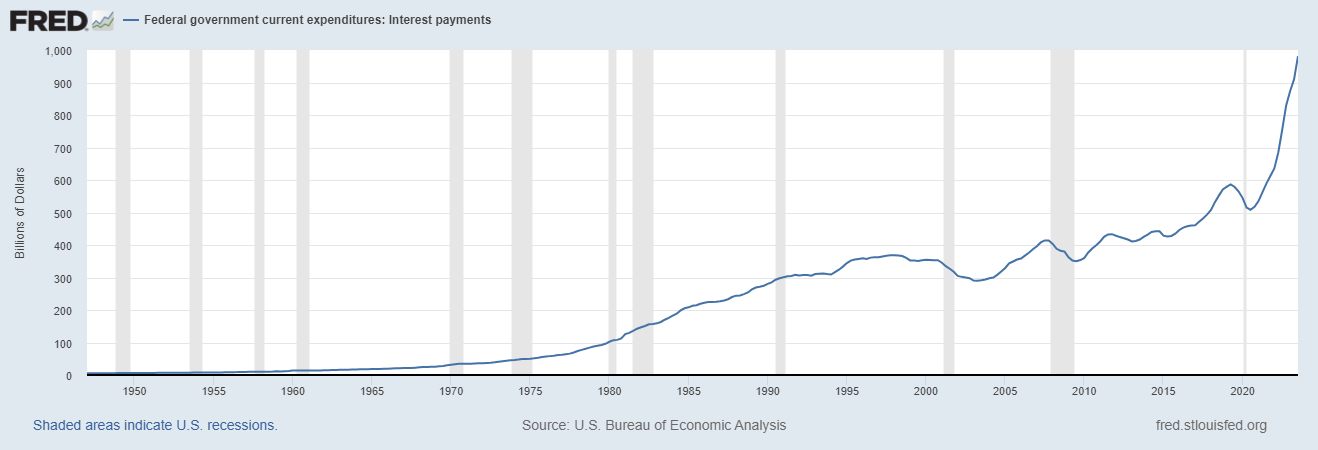

The genesis of Treasury securities lies in the inexorable need for the US government to procure funds. Given the perennial disparity between government expenditures and tax revenue, bridging the fiscal chasm necessitates the issuance of debt. Beyond mitigating deficits, the US government must also grapple with the refinancing of existing debt, an endeavor of substantial magnitude. In a remarkable twist, a remarkable 85% of Treasury debt issued in 2023 matures within a year or less, precipitating a perpetual cycle of refinancing requirements. For instance, 4-week Treasury bills demand refinancing on a monthly cadence, totaling thirteen times annually. This intricate financial dance underscores the intricate interplay between government finances and the broader global economy.

The government has to refinance $7 trillion this year.

Recent Treasury auction results have been horrific.

Investors are unwilling to go out longer than 3 years in buying Treasuries.

Yet in spite of this problem, we are told by our political leaders and monetary authorities that our economy and markets are strong and resilient.

In the realm of monetary policy, should the Federal Reserve abstain from its interventionist tendencies and permit interest rates to gravitate towards their natural levels, the burden of interest rate payments on the federal debt would surge to proportions capable of instigating a financial crisis worse than 2008. Remarkably, despite the imminent scenario where the federal government is poised to allocate more resources to servicing its debt than to sustaining the Pentagon and the expansive military-industrial complex, the corridors of power in Washington, D.C. remain remarkably aloof to the necessity of fiscal restraint.

In a mere span from mid-September to the dawn of the new year, the federal debt burgeoned by a staggering trillion dollars, with projections indicating a further ascent of approximately another trillion dollars by the close of March. To place this in a historical perspective, one must contemplate that it took almost two centuries, spanning from the ratification of the Constitution in 1787 to the year 1981, for the federal debt to ascend to the landmark figure of one trillion dollars. Today we are surpassing trillion deficits in less than three months. Such fiscal profligacy not only bespeaks a profound disregard for prudent financial management but also underscores the looming precipice upon which the nation teeters in the wake of this unchecked debt expansion.

When it comes to this whole Treasury borrowing mess, we need to toss those fancy numbers out the window and focus on some harsh realities.

Primarily, let’s get one thing straight: the U.S. government isn’t going to cut spending willingly. It just won’t happen. So, pay attention, if we ever hit a point where we can’t keep issuing Treasury bonds, you better believe our dollar’s going to tank. At that point, the government will be left with three grim choices:

- Increase Taxes

- Continue Inflating the debt away.

- Default

Historically what governments always do is gradually inflate the debt away until you have lost all purchasing power.

Look, we’re already stuck with a whopping $34 trillion in debt, and if we keep going down this path, $40 trillion is just a few empty political promises away.

Defaults on debt, whether in the realm of government or corporate finance, typically transpire as a gradual process rather than an abrupt event. The journey toward a default is often characterized by a series of warning signs and challenges that unfold over time. Understanding this gradual progression is vital for investors, policymakers, and financial analysts. While loss of purchasing power, often associated with inflation, is not considered a default in the traditional sense by economists, it also destroys trust in future transactions being viable.

In the corporate sector, defaults on debt can manifest in various ways. A common precursor is deteriorating financial performance, marked by declining revenue, shrinking profit margins, and an inability to cover interest expenses. For instance, a struggling retail chain might witness a gradual decline in sales, leading to insufficient cash flows to meet its debt obligations. As the financial strain intensifies, the company may resort to cost-cutting measures, such as layoffs or asset sales, which can further weaken its long-term viability.

Another red flag is a downgrade in credit ratings by agencies like Moody’s, Fitch, or Standard & Poor’s. These agencies continuously assess a company’s creditworthiness, and a downgrade signals heightened risk of default. For example, a highly leveraged energy company might see its credit rating lowered due to plummeting oil prices and mounting debt burdens. Such downgrades can increase borrowing costs and exacerbate financial challenges.

In government finance, defaults can unfold over a more extended period. Countries grappling with unsustainable debt levels may initially resort to deficit spending, gradually accumulating more debt. A lack of fiscal discipline and economic mismanagement can further contribute to the erosion of creditworthiness. The government may then encounter difficulty in rolling over maturing debt or securing new loans at favorable terms.

In summary, defaults on debt, whether in the corporate or government sector, evolve over time. They result from a combination of financial stresses, declining creditworthiness, and a difficulty to meet debt obligations. Recognizing the gradual nature of these developments is crucial for investors and policymakers to take timely measures and mitigate the risks associated with impending problems and issues.

Recently on X, formerly Twitter , a scene from the 1990 classic film “Home Alone” resurfaced and went viral, sparking a fascinating conversation about the changing landscape of consumer prices. In this iconic clip, the film’s star, Kevin McCallister played by Macaulay Culkin embarks on a shopping spree, procuring groceries, household essentials, and toys, all for a modest sum of $19.83. The clip went viral because the X community calculated the stark contrast to today’s prices, as a comparable shopping excursion would now set one back more than three times that amount! This simple cinematic moment serves as a poignant reminder of the persistent force of inflation, reshaping the purchasing power of our currency over the years and how loss of purchasing power is the norm in our society.

If we start with 1980 as a baseline:

- we can see DEBT has grown 37.41x in the last 43 years.

- The economy on the other hand has only grown 8.89x over the same time frame.

- In other words, debt has grown 3.21 x faster than the economy.

These are not impressive metrics by any stretch of the imagination.

The purpose of my reporting these facts and metrics is not to be an alarmist but rather to inform you that I recommend being aware of these sobering realities moving forward.

Can government keep inflation low? I’ll believe it when I see it. Trillions of new moneys will need to be created if the Treasury is unsuccessful at finding new buyers to fund current government obligations. And therein lies the crux of this problem.

When the FED reduces interest rates, they are eliminating the paltry real rate of return available to anyone who do invest in U.S. Treasuries, unless they can put the inflation genie back in the bottle. If they raise interest rates further, they make it increasingly difficult to service the exponential growth of interest on the current debt.

What does this mean to you as a trader?

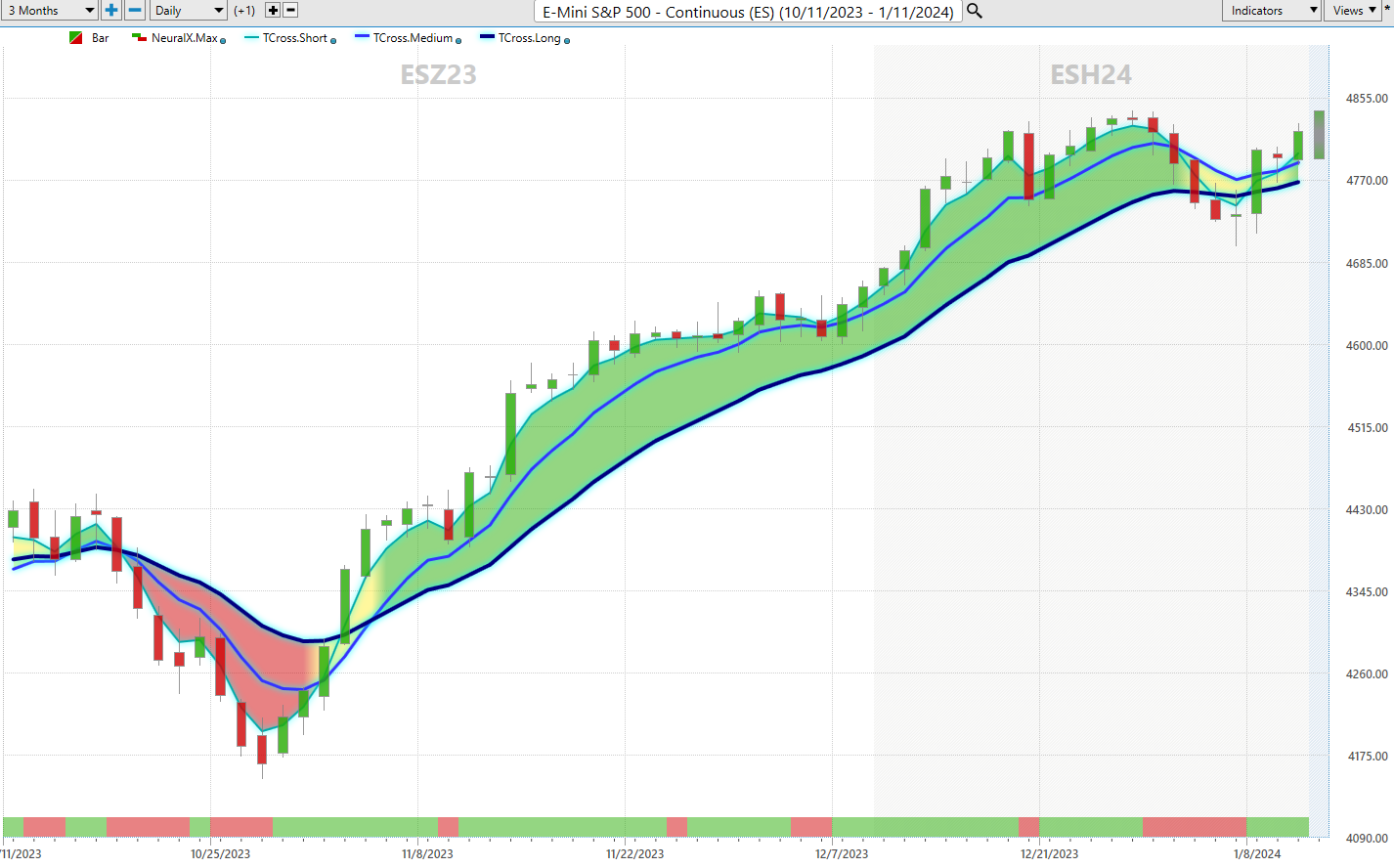

I’ve offered my opinion on why stocks have some extraordinarily strong fundamental headwinds ahead of them. I could be very wrong in my assessment. This is why I trade with artificial intelligence .

I am BEARISH government finances. I think debt will continue to explode moving forward. But in the recent past this scenario has been very bullish for stocks. More importantly, the trend as defined by artificial intelligence is currently bullish for the broader stock market indexes.

Which means that everything you have read is ahead of the curve timing-wise. I’m very aware of the bearish forecasts. Rest assured that when the ai forecast turns bearish, I will pounce on it.

Until then, I can embrace my opinions without going to the poorhouse. This is why artificial intelligence is so valuable in today’s fast paced world. Everybody is entitled to their own opinions. But markets are very unforgiving. Machine learning, artificial intelligence and neural networks prove to be invaluable in helping to keep me on the right side of the right trend at the right time.

Here is why this is so important today.

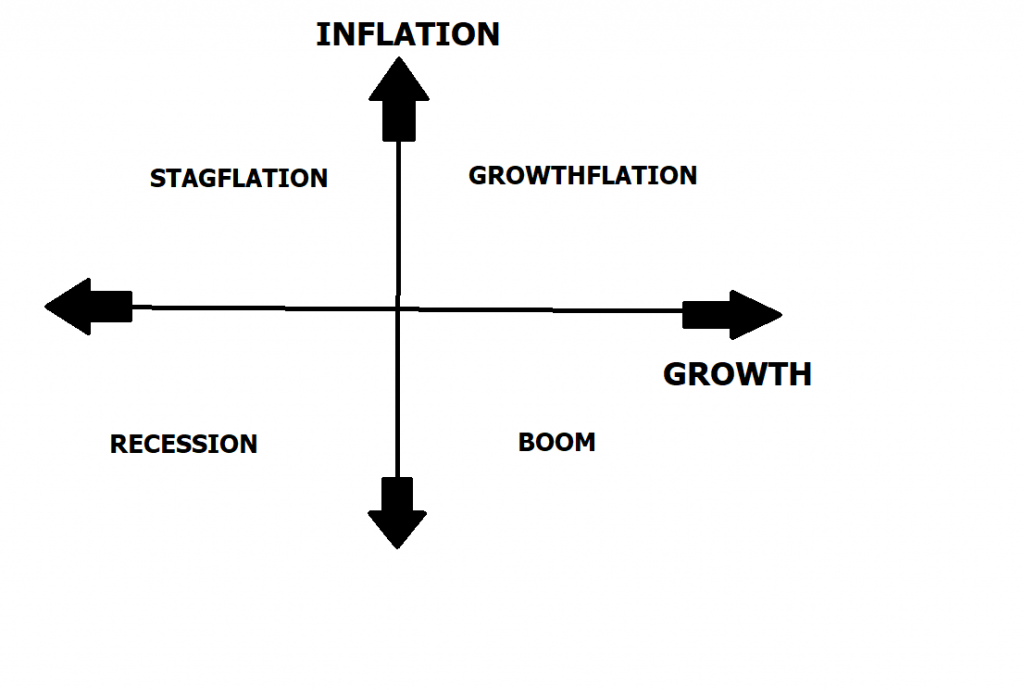

Traditional economic theory is best represented by the following graphic.

At present we are teetering somewhere between stagflation and recession.

Regardless of what the economy looks like, it is still necessary that you safeguard your portfolio. In today’s turbulent financial landscape, securing your investment portfolio demands a pragmatic, replicable system for identifying resilient trends, especially those that flourish during economic downturns.

So, what’s the optimal strategy for generating profits in the current financial markets?

The unanticipated answer lies in the realm of Artificial Intelligence (A.I.). In our contemporary investment landscape, where markets are more unpredictable than ever, A.I., Machine Learning, and Neural Networks have evolved from being optional to becoming indispensable tools for safeguarding your investments.

Allow me to assert unequivocally: I passionately believe that we’re headed for a decline in stock prices. Nevertheless, amidst this tempest, my guiding “NORTH STAR” will forever remain the trends illuminated by the potent force of artificial intelligence.

Will you know when to protect yourself from the financial storm that is on the horizon?

By harnessing the formidable analytical capabilities of A.I. and the predictive prowess of neural networks, you equip yourself with the precise arsenal needed to traverse the financial terrain with unwavering confidence. It’s about consistently aligning with the right trends at precisely the right juncture.

In a realm where only the fittest endure, hesitation is a luxury one cannot afford. To thrive, not just survive, in this high-stakes, zero-sum game, it’s imperative to embrace the power of innovative technology and intelligent trend analysis.

Artificial intelligence is so powerful because it learns what doesn’t work, remembers it, and then focuses on other paths to find a solution. This is the Feedback Loop that is responsible for building the fortunes of every successful trader I know.

Visit With US and check out the A.I. at our Next Free Live Training.

It’s not magic. It’s machine learning.

Make it count.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.