| This Week’s a.i. Stock Spotlight is MicroStrategy ($MSTR) |

MicroStrategy ($MSTR) has distinguished itself as a pioneering force in the cryptocurrency realm, particularly under the visionary leadership of Michael Saylor, who spearheaded the company’s strategic shift towards Bitcoin as a primary treasury reserve asset. This bold move, initiated to address concerns about long-term cash depreciation and the diminishing returns of traditional investments, positioned MicroStrategy among the first major corporations to embrace Bitcoin in such a capacity. The company funded its initial foray into Bitcoin through debt issuance, underscoring a fearless approach to capital management and investment in digital assets. As a result, MicroStrategy now boasts one of the largest Bitcoin portfolios of any publicly traded company, profoundly tying its market valuation and stock price movements to the volatile dynamics of the cryptocurrency market.

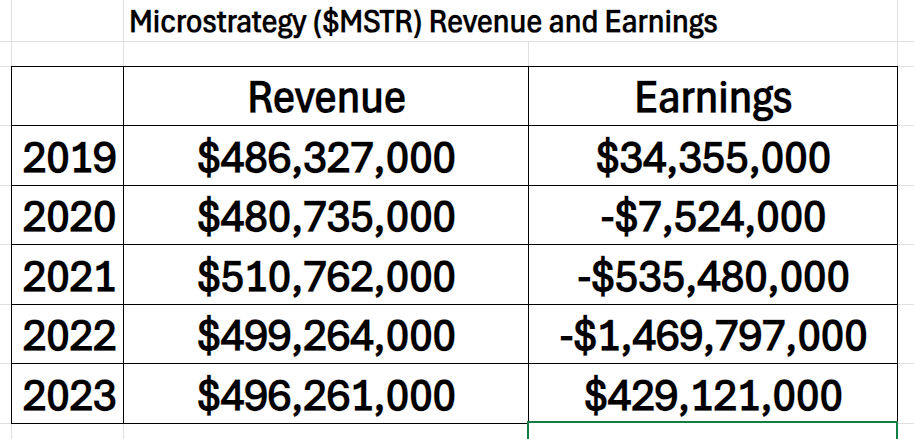

Despite its significant engagement with Bitcoin, MicroStrategy has not abandoned its roots in enterprise analytics. The company continues to innovate within its core software business, incorporating blockchain technologies into its product offerings. This effort to meld cutting-edge digital asset management with its traditional analytics services is evident at its annual user conference, which increasingly focuses on the convergence of cryptocurrency strategies and business analytics. Furthermore, the company was among the first in its industry to deliver mobile business intelligence (BI) solutions, reflecting its longstanding commitment to technological innovation and leadership. Through these actions, MicroStrategy has consistently advocated for wider institutional adoption of Bitcoin, influencing not only its corporate trajectory but also the broader financial and technological landscapes. Below is the revenue and earnings table for $MSTR over the last 5 years. When I uncovered these numbers, it forced me to dig deeper as I have never witnessed a balance sheet with such steady revenues but incredibly volatile earnings. Wall Street analysts who watch the company 24/7 are digging into the nooks and crannies to better comprehend these metrics.

The volatility on the earnings side of the ledger is what is raising eyebrows on Wall Street. Over the last 5 years revenue has been steady and increased 2%. But $MSTR has lost money in 3 of the last 5 years totaling over $1.5 billion. What is noteworthy is trying to understand the 2023 values. When have you ever seen a company that has generated earnings which are 86% of net revenue?

MicroStrategy’s foray into Bitcoin convertible bonds has been a significant move, drawing substantial attention both for its innovation and as a financing strategy. The company’s strategy with Bitcoin convertible bonds serves as a unique approach to raise capital while amplifying its position in the cryptocurrency market.

MicroStrategy initially introduced Bitcoin convertible bonds in 2020 and 2021 to fund its Bitcoin acquisition strategy. This approach provided the company with access to low-cost capital while enabling it to leverage Bitcoin’s appreciation potential. By issuing convertible debt, the company offered investors a blend of bond stability with an option to convert into equity, positioning itself as a hybrid of technology and cryptocurrency exposure. The appeal of these bonds was bolstered by favorable terms, as the market was especially bullish on Bitcoin and tech at the time.

These bonds provided MicroStrategy with a highly successful vehicle for raising billions in capital. As Bitcoin’s value soared, the company’s asset base grew substantially. The bonds’ popularity can be attributed to MicroStrategy’s dual focus on business intelligence and its embrace of Bitcoin as a treasury asset, offering investors exposure to both an enterprise software platform and a digital asset with growth potential. Furthermore, by timing these bond issuances strategically, MicroStrategy capitalized on periods of low interest rates, locking in favorable debt terms.

In recent earnings calls, MicroStrategy’s executive team has referenced the broader Bitcoin strategy rather than diving into specific performance metrics for the convertible bonds themselves. The focus has been on the overall Bitcoin holdings as a long-term asset, its impact on balance sheet strength, and the firm’s commitment to this investment approach.

However, CFO Andrew Kang has occasionally alluded to the company’s financing methods, mentioning the bond strategy within the broader context of their capital structure. The leadership has emphasized that they view the bond approach to support MicroStrategy’s Bitcoin position while maintaining operational flexibility in the business intelligence segment. The key issue that traders and investors face with $MSTR is wanting a better understanding of how does the company manage the volatility associated with its Bitcoin holdings?

Over the past four years, MicroStrategy’s convertible bonds have fluctuated in value, reflecting both its stock performance and Bitcoin’s volatility. Here’s a breakdown of key bond issuances and how they performed:

2021 Issuance: MicroStrategy issued $1.05 billion in convertible notes at a 0% coupon with a conversion premium of 50% over its stock price. Proceeds were used to buy Bitcoin, setting the tone for future issuances where Bitcoin acquisition played a central role. This bond gained value when Bitcoin rose and became a lucrative conversion option due to MicroStrategy’s stock appreciating alongside Bitcoin.

2024 Issuance : In early 2024, MicroStrategy issued $800 million in 0.625% convertible notes due in 2030, again using proceeds to purchase more Bitcoin. This bond, with a 42.5% conversion premium, added volatility to MicroStrategy’s debt portfolio, exposing it to Bitcoin’s market price swings. The bond terms allow conversions at higher stock prices, which have become attractive in Bitcoin’s bull phases but create risk during declines.

Recent 2024 Issuance : In September 2024, another $1.01 billion issuance was completed, also at a 0.625% coupon. These notes offered a 40% conversion premium and, like prior bonds, are convertible to cash or stock. This issuance was partly used to redeem existing secured notes and increase Bitcoin holdings, reinforcing the company’s heavy alignment with cryptocurrency markets. The notes showed potential for solid returns when MicroStrategy’s stock rose, especially as Bitcoin saw upward movement in late 2024.

The performance of these bonds largely mirrors Bitcoin’s price fluctuations, as investors weigh the conversion option’s potential against the backdrop of MicroStrategy’s aggressive Bitcoin acquisition strategy. This approach has made the bonds attractive during Bitcoin’s highs but riskier during market downturns due to their sensitivity to cryptocurrency prices.

MicroStrategy’s use of Bitcoin convertible bonds has been widely regarded as pioneering and very successful, giving it a unique position in the corporate market as one of the largest publicly traded Bitcoin holders.

As of September 2024, the company holds approximately 244,800 Bitcoins, representing about 1.2% of the total Bitcoin supply.

This approach not only allowed $MSTR to accumulate Bitcoin but also to position itself as a quasi-Bitcoin ETF, appealing to shareholders and investors who see potential in Bitcoin but prefer equity exposure over direct cryptocurrency holdings.

The success of the Bitcoin convertible bonds ultimately hinges on Bitcoin’s long-term price trajectory. Should Bitcoin maintain or exceed its past performance, MicroStrategy stands to gain significantly, amplifying shareholder returns without diluting equity as drastically as a traditional stock issuance might have done. However, this strategy remains riskier than traditional debt or stock speculating; a significant drop in Bitcoin’s value would strain MicroStrategy’s balance sheet due to the mark-to-market effects on its holdings and the fixed obligations from the bonds. Today, MicroStrategy ($MSTR) offers traders and investors a compelling vehicle where traditional debt financing is fundamentally reimagined through Bitcoin’s integration into corporate balance sheets. By issuing convertible bonds to acquire Bitcoin, MicroStrategy not only pioneers a novel use of debt but also demonstrates how a digital asset can amplify balance sheet strength and, potentially, long-term shareholder value. As more companies recognize the strategic advantage this model offers, it’s likely that we’ll see larger public firms adopting similar approaches, disrupting conventional financing norms. This strategy is as audacious as it is disruptive, pushing investors to reconsider fundamental questions about money itself—and how Bitcoin’s unique attributes may redefine that answer.

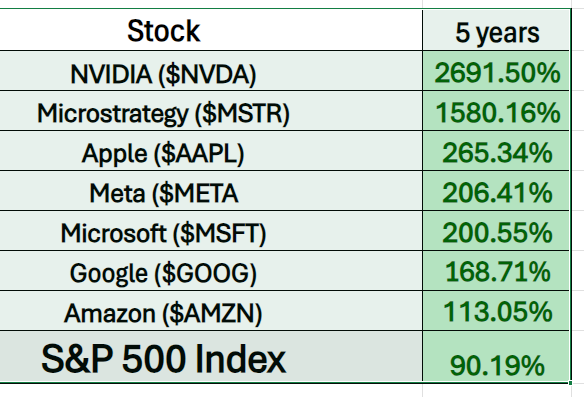

As this A.I. stock spotlight is published, Treasury departments within corporations are being challenged by activist Bitcoin investors to place a small portion of their reserves into Bitcoin to increase shareholder value similar to what $MSTR has done. Study the performance metrics below and you can appreciate why $MSTR has a huge following of loyal fans who endorse the company’s philosophy. These companies between them have hundreds of billions of cash in fiat. $MSTR has demonstrated that converting a portion of cash into Bitcoin quickly builds additional shareholder value.

In summary, MicroStrategy’s convertible bonds have been instrumental in financing its Bitcoin accumulation, achieving success by aligning corporate debt strategy with an asset highly correlated to the company’s broader vision. The leadership’s confidence in Bitcoin underscores this bold strategy, and while specific discussions on earnings calls have been limited, the bonds remain a cornerstone of MicroStrategy’s approach to maximizing its treasury assets. When Satoshi Nakamoto cracked the code on transferring value peer-to-peer, they didn’t just create a way to send, say, a million dollars from New York to Tokyo without relying on a bank. Inadvertently, they unlocked something even more revolutionary: the ability to move a million dollars through time, potentially forward by decades, without ever needing a trusted intermediary.

Think about it—if you can transfer something of value without a middleman, you’ve also gained the power to store it without one. And that’s where Bitcoin’s true ‘killer app’ lies. It isn’t just a way to send money — it’s a new form of a store of value, held securely in cyberspace, untethered from traditional financial systems. For those betting on Bitcoin, this digital resilience is the currency’s most compelling promise.

Today, MicroStrategy ($MSTR) offers traders and investors a compelling vehicle where traditional debt financing is fundamentally reimagined through Bitcoin’s integration into corporate balance sheets. By issuing convertible bonds to acquire Bitcoin, MicroStrategy not only pioneers a novel use of debt but also demonstrates how a digital asset can amplify balance sheet strength and, potentially, long-term shareholder value. As more companies recognize the strategic advantage this model offers, it’s likely that we’ll see larger public firms adopting similar approaches, disrupting conventional financing norms. This strategy is as audacious as it is disruptive, pushing investors to reconsider fundamental questions about money itself—and how Bitcoin’s unique attributes may redefine that answer.

In this stock study, we will look at an analysis of the following indicators and metrics which are our guidelines which dictate our behavior in deciding whether to buy, sell or stand aside on a particular stock.

- Wall Street Analysts Ratings and Forecasts

- 52 Week High and Low Boundaries

- Best-Case/Worst-Case Analysis

- Vantagepoint A.I. Predictive Blue Line

- Neural Network Forecast (Machine Learning)

- VantagePoint A.I. Daily Range Forecast

- Intermarket Analysis

- Our Suggestion

While we make all our decisions based upon the artificial intelligence forecasts, we do look at the fundamentals briefly, just to understand the financial landscape that $MSTR is operating in.

Wall Street Analysts Ratings and Forecasts

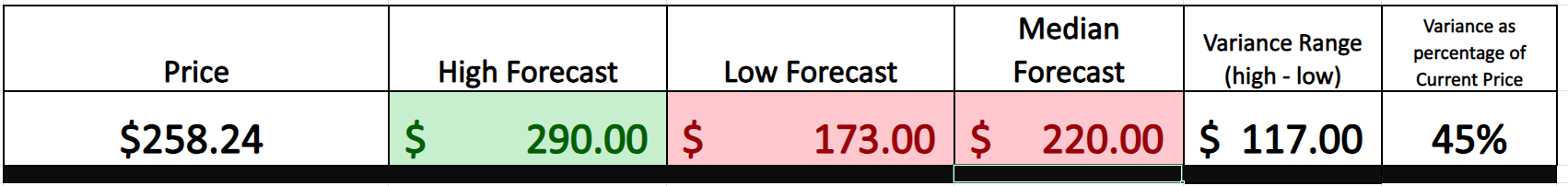

Based on 8 Wall Street analysts offering 12-month price targets for Microstrategy in the last 3 months. The average price target is $220.00 with a high forecast of $290.00 and a low forecast of $173.00

We advise traders to pay very close attention to the variance between the most bullish and most bearish forecasts as this tells us what the expected level of future volatility is. Currently this level is $117 or 45% of the current price. This level of volatility is considered to be high.

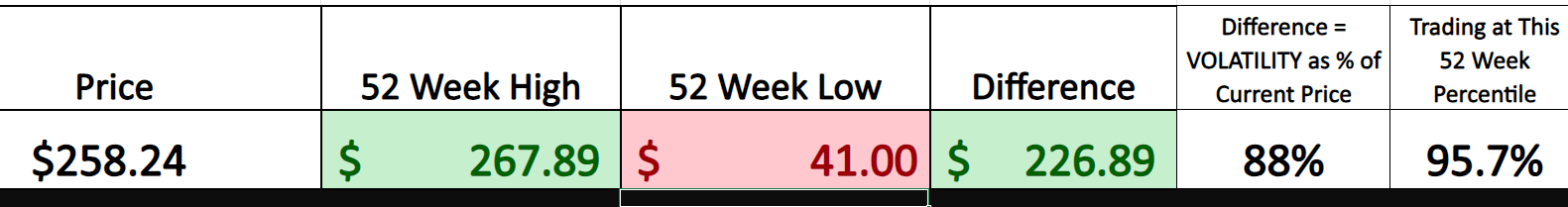

52-Week High and Low Boundaries

We always advise traders to monitor the 52-week boundaries on a stock because it provides a report card on the stock’s performance over the past year. The adage of strength begets strength, and weakness begets weakness is a philosophy we adhere to very closely as traders.

Over the last 52 weeks $MSTR has traded as high as $267.89 and as low as $41.00. This annual trading range is massive and tells us that the historic volatility of $MSTR over the past 52 weeks has been $226.89 or 88% of the most recent closing price. The range is huge, as demonstrated in the $MSTR 52-week chart below:

To get a better understanding of the longer-term trajectory of $MSTR we like to zoom out and look at the last 10 years’ worth of price action. Over the last 10years $MSTR has traded as high as $267.89 and as low as $9.00. What makes this range so striking is that the $9.00 low was posted as the pandemic in March 2020 was declared.

Best-Case/Worst-Case Analysis

In trading, too many participants leap into the markets without fully grasping the inherent risk and reward dynamics at play. To gain a clear, grounded understanding, a look at the most significant rallies and declines over the past year is indispensable. This simple yet effective analysis doesn’t just quantify volatility; it contextualizes it, allowing traders to visualize how price action unfolds when the market experiences its sharpest moves.

By studying these historic peaks and valleys, traders can anticipate how similar volatility might affect future trades. This isn’t about reacting to every tick; it’s about building a framework that incorporates both market optimism and pessimism — revealing the full spectrum of potential movements. Mapping out the highs and lows informs a deeper appreciation of the forces that drive prices and offers invaluable insight into navigating unpredictable shifts.

For a trader, this approach becomes the foundation of a comprehensive strategy, one that aligns tactical choices with a broader understanding of market behavior. In essence, analyzing past swings allows traders to not only prepare for market challenges but also seize opportunities with clarity and purpose, balancing potential gains with an acute awareness of risk.

First off, we look at the best-case scenario and study the magnitude of the uninterrupted rallies.

Next, we look at the worst-case scenario and measure the magnitude of the uninterrupted declines.

Within these two charts we can clearly understand the risks and potential rewards of trading $MSTR. While the bulls are clearly in control a trader must acknowledge and understand that $MSTR is extremely volatile and can drop 24% to 49% in a number of weeks.

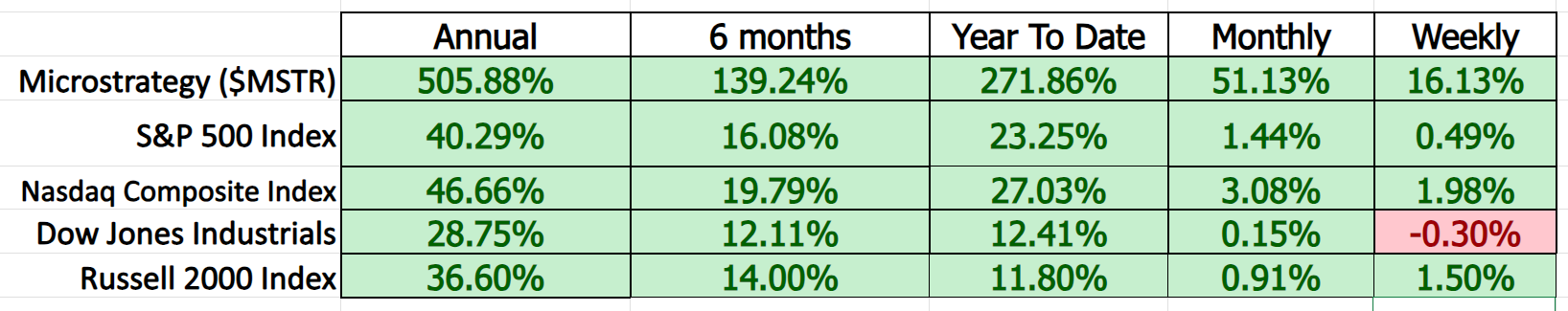

Our next step involves a comparative analysis of $MSTR against broader market indices across various time frames. This approach enables us to contextualize $MSTR’s performance within the broader market landscape, offering a clearer view of its relative strength or weakness against major indices. Through this lens, we can better assess how $MSTR stacks up across different market conditions and gain insight into its alignment—or divergence—from wider market trends.

The five-year beta for MicroStrategy ($MSTR) is approximately 3.12, indicating its price movement is over three times more volatile than the overall stock market. In simple terms, beta measures how much a stock’s price tends to move in comparison to the market.

Think of beta like a “volatility meter” for stocks. A beta of 1 means a stock moves roughly in line with the market; it goes up and down about the same amount. A beta of more than 1 means the stock is more “jumpy” than the market—it will likely rise or fall more than the market does. So, with MicroStrategy’s beta at 3.12, if the market were to go up or down by 1%, MSTR could theoretically go up or down by about 3.12%, making it a high-volatility stock suitable for investors who can handle big swings in price.

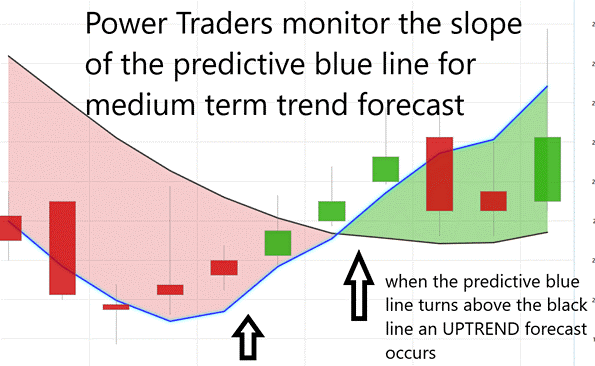

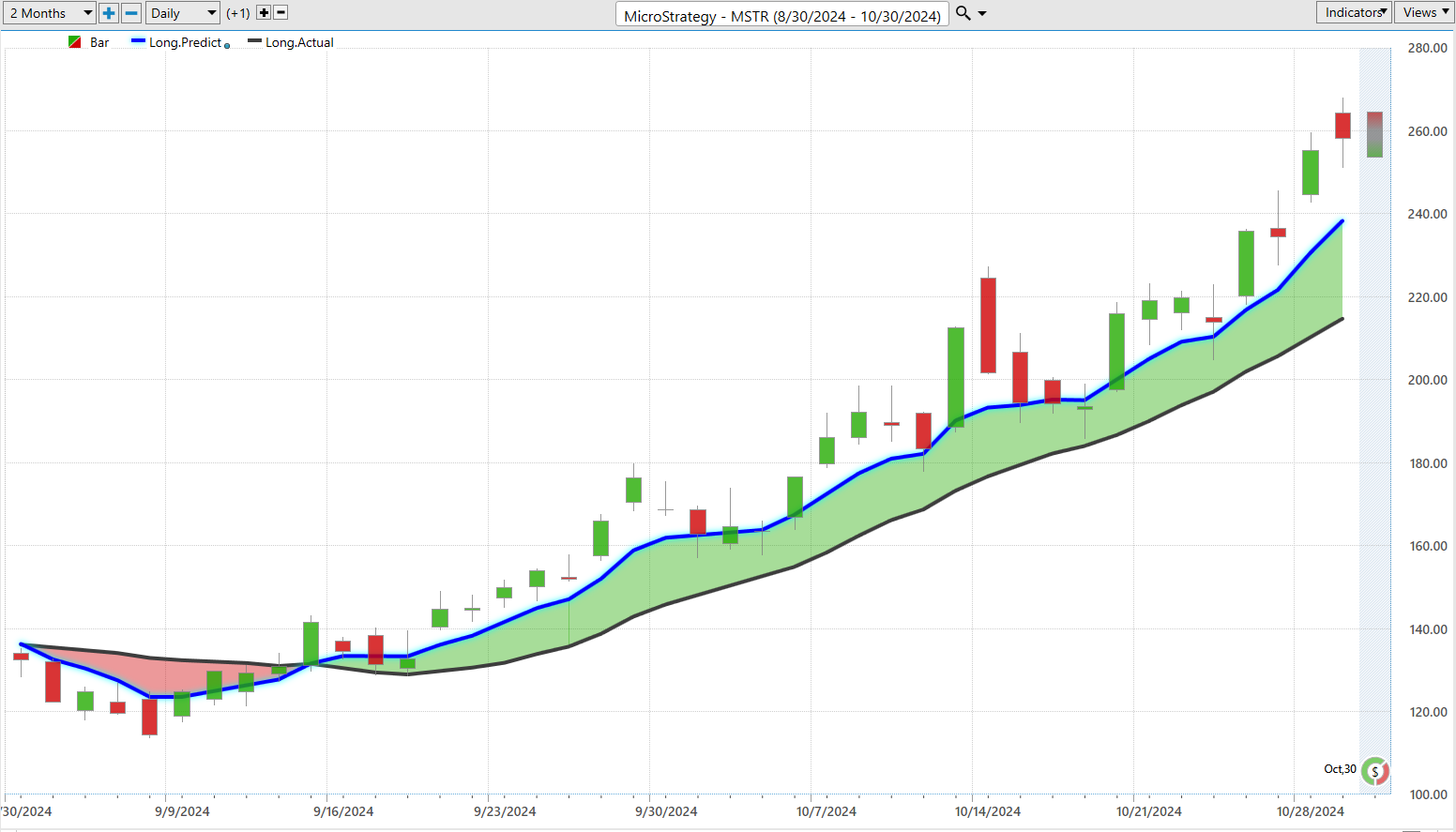

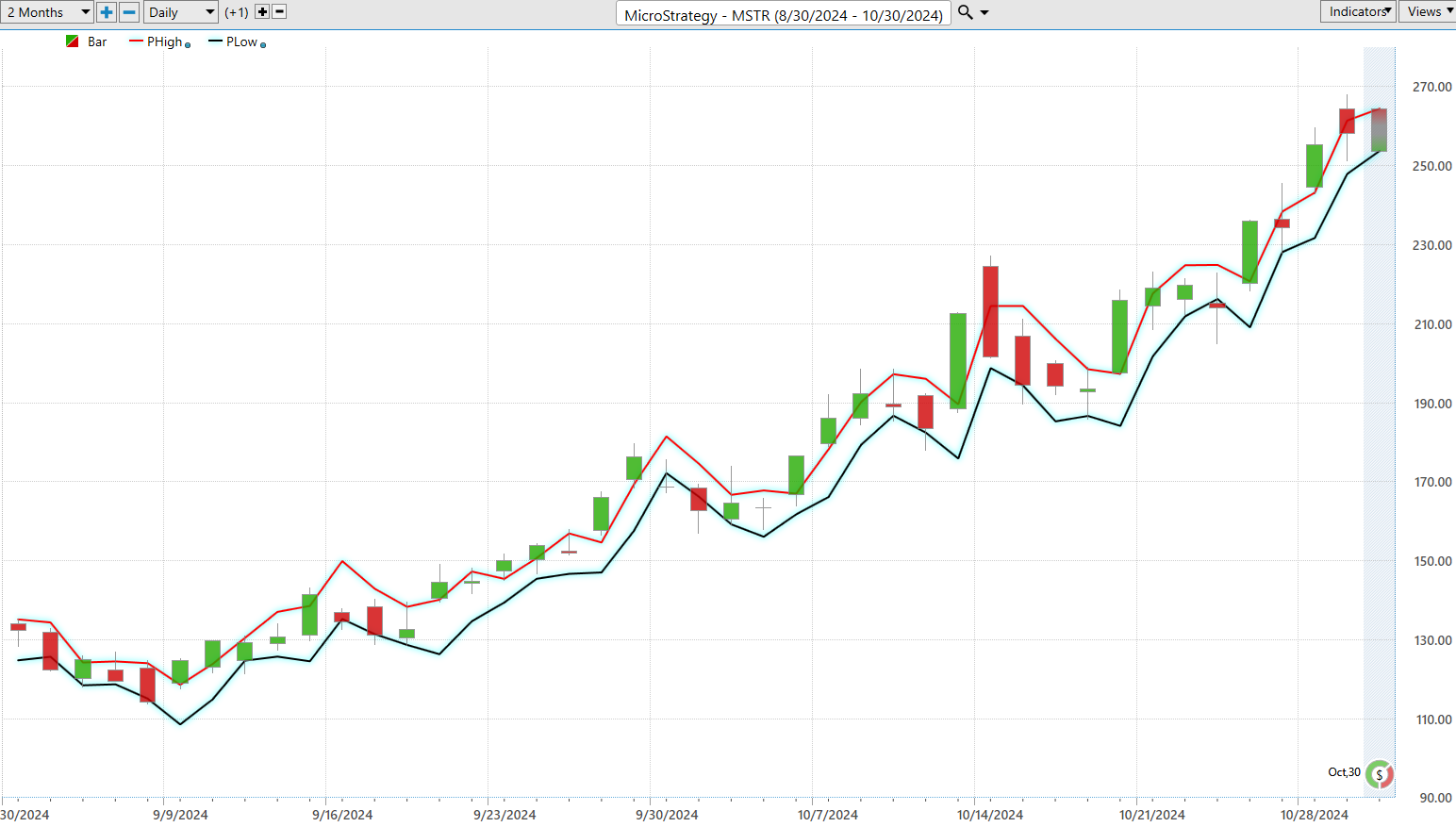

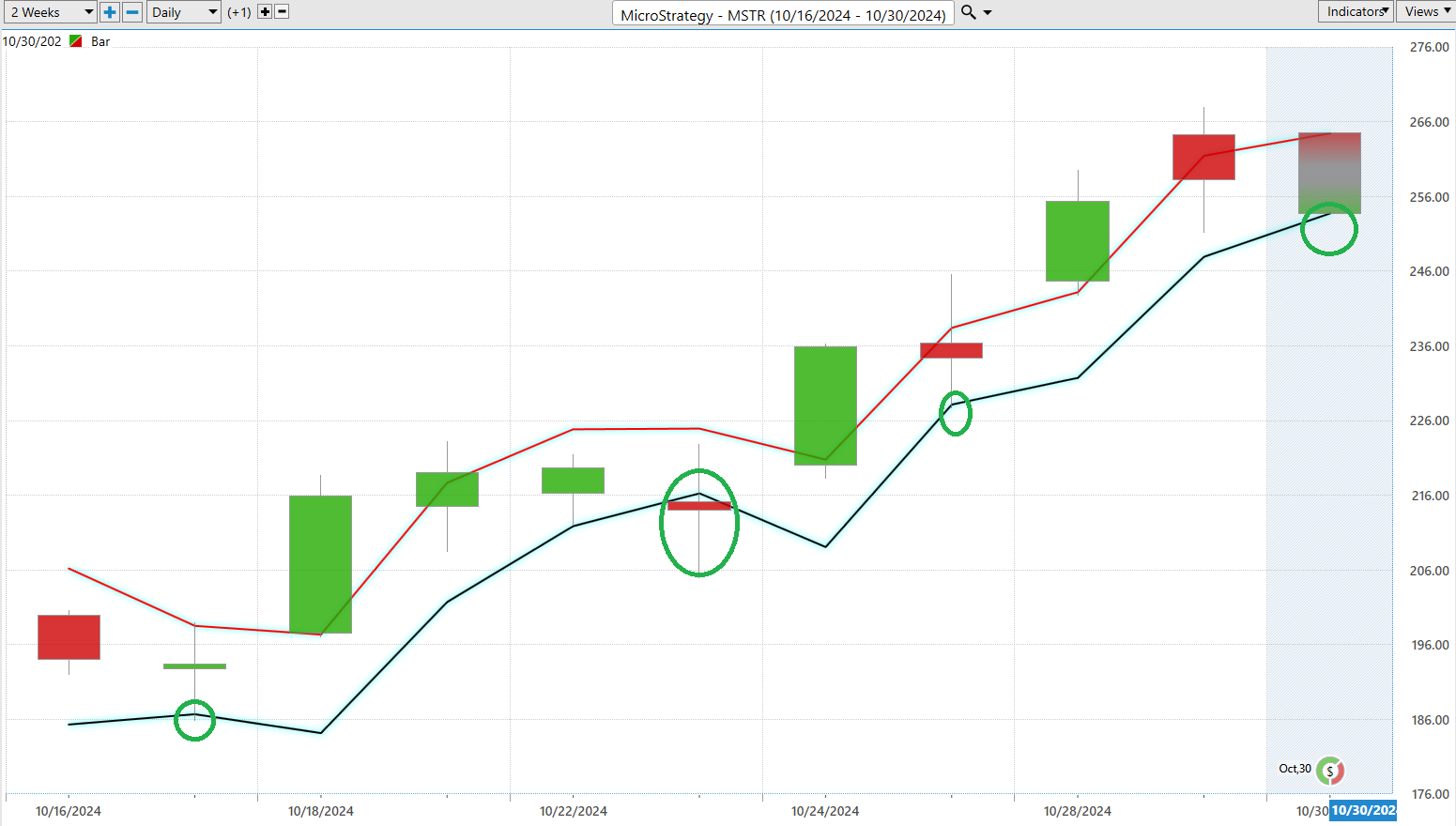

Vantagepoint A.I. Predictive Blue Line

Let’s dive into the advanced methodology behind VantagePoint Software’s A.I.-driven market predictions for $MSTR. At the heart of this strategy is the predictive blue line—a fusion of artificial intelligence and intermarket analysis. This line isn’t just data; it’s a strategic signal cutting through the noise, illuminating trends in $MSTR’s price movement with remarkable clarity.

Key to leveraging this tool is understanding the blue line’s slope and how it interacts with the stock’s actual price. A critical signal emerges when this blue line crosses above the black line, signaling a potential trend shift.

Here’s how to interpret it:

– The direction of the blue line acts as a compass for $MSTR’s trend trajectory, pinpointing likely market moves.

– The ‘Value Zone’ is a sweet spot where traders might consider buying as prices approach or dip below this predictive line. During a downtrend, a rise above the blue line could indicate an opportune moment to sell or trim positions.

– When the blue line tilts downward, it’s a red flag for potential declines, suggesting a time to consider hedging or reducing exposure.

By focusing on these slope adjustments, VantagePoint equips traders with a forward-looking edge, keeping them prepared for market fluctuations. This tool doesn’t just forecast direction; it provides traders with timely, actionable insights to optimize trade timing, boosting their potential for meaningful returns. With its sophisticated A.I., VantagePoint transforms raw data into strategic foresight, equipping market participants with a sharper edge in their trading decisions.

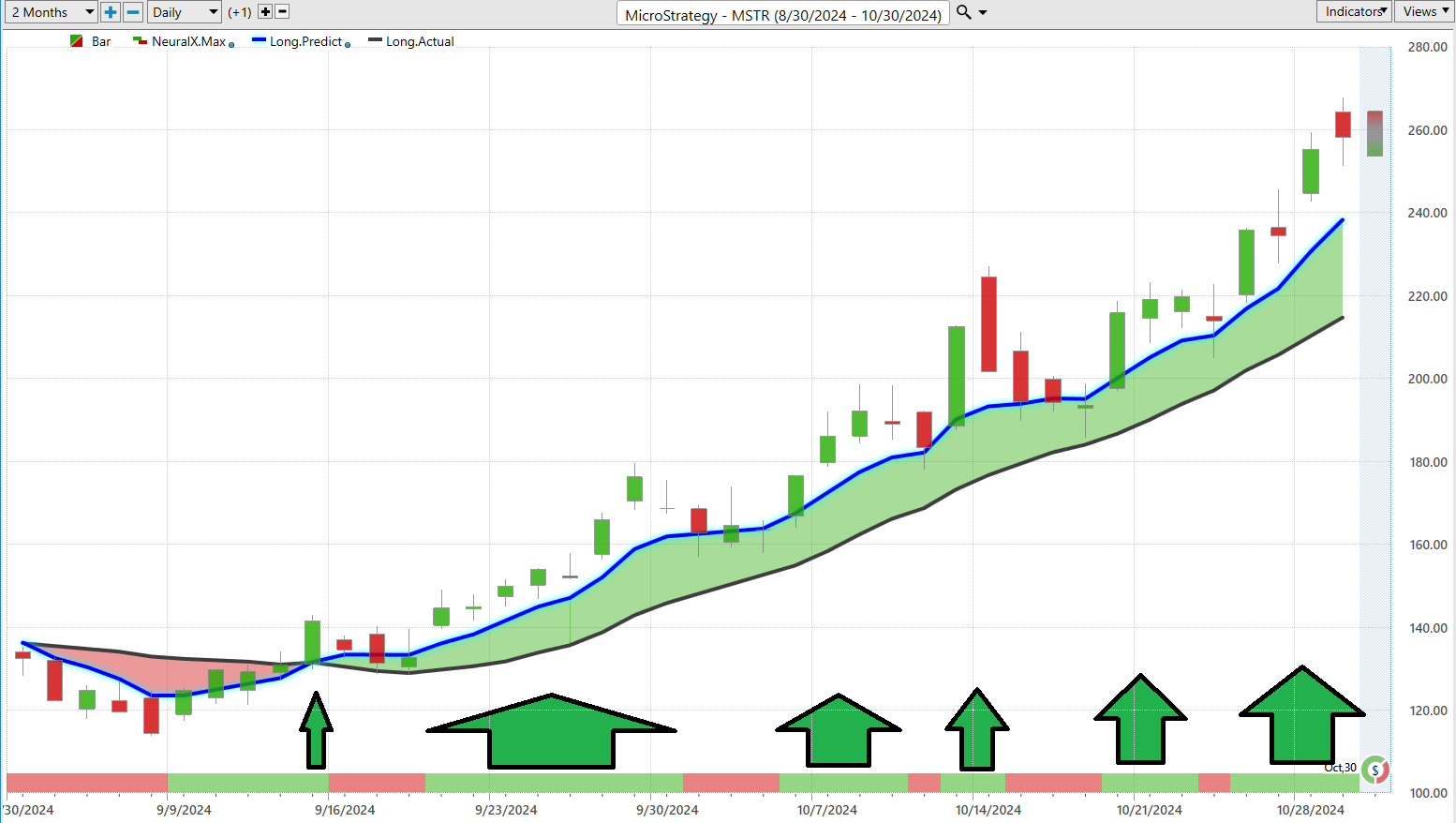

Neural Network Forecast (Machine Learning)

Picture a neural network as a powerful brainstorming team, where each member—called a node—works together in a vast interconnected web, much like the neurons in the human brain. These nodes process enormous amounts of information, from stock prices and trading volumes to broader market trends, and gradually learn from it, identifying patterns like a seasoned investigator piecing together clues.

Now, why does this matter to traders? Neural networks are the edge that today’s high stakes trading environment demands. These systems cut through market noise, detecting intricate patterns that might elude the human eye, and offer strategic guidance on optimal buy and sell points. This isn’t guesswork; it’s a method for making precise, data-driven decisions that can translate into substantial returns.

Neural networks are transforming the trading landscape, delivering unmatched speed, precision, and a learning capability that minimizes human error and boosts predictive accuracy. They provide traders with real-time insights into emerging market trends, acting as a continuously learning co-pilot to help navigate an unpredictable market.

Study the chart below. The arrows at the base of the chart are all of the instances when the neural index and the predictive blue line were both aligned and forecasting the same direction. Traditionally, these instances are high probability trading opportunities.

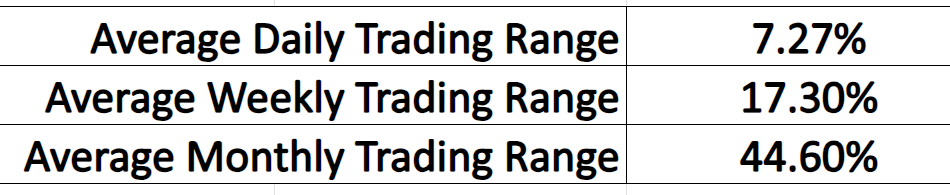

VantagePoint A.I. Daily Range Forecast

In the trading game, timing isn’t just nice to have—it’s everything. For those in the Power Trader’s circle, let’s talk about the VantagePoint A.I. Daily Range Forecast. This isn’t your average market tool; it’s the kind of tech that can be a game-changer, helping traders zero in on those prime moments to get in or out of a trade—moments that can make or break your play.

Now, volatility? That’s the market’s constant companion, always in the background. But in today’s landscape, raw data alone doesn’t cut it. To get a true edge, that data has to be transformed into actionable insight. That’s where A.I., machine learning, and neural networks come in — not just buzzwords for the boardroom but essential tools for cutting through market static and delivering laser-sharp forecasts.

The real challenge is applying these insights in real-time, dynamically, to nail those critical entry and exit points. VantagePoint’s A.I. software fits this need, turning mountains of market data into a clear, navigable path.

So let’s dive into what this means for $MSTR, with daily, weekly, and monthly average trading ranges over the past year, courtesy of the predictive power behind VantagePoint.

In trading, what truly matters is pinpointing those ideal entry and exit moments. The Daily Range Forecast isn’t just another chart; for the short-term swing trader, it’s practically a predictive compass, mapping out expected daily price moves with precision. In the fast-paced world of trading, accuracy is more than a luxury—it’s essential. VantagePoint A.I.’s Daily Range Forecast, powered by cutting-edge tech, deciphers each session’s intricacies, guiding you through the day’s volatility to those prime trading opportunities.

Study the chart below and observe how clearly the trend and expectations is delineated.

Here, staying ahead of the curve isn’t merely beneficial; it’s indispensable.

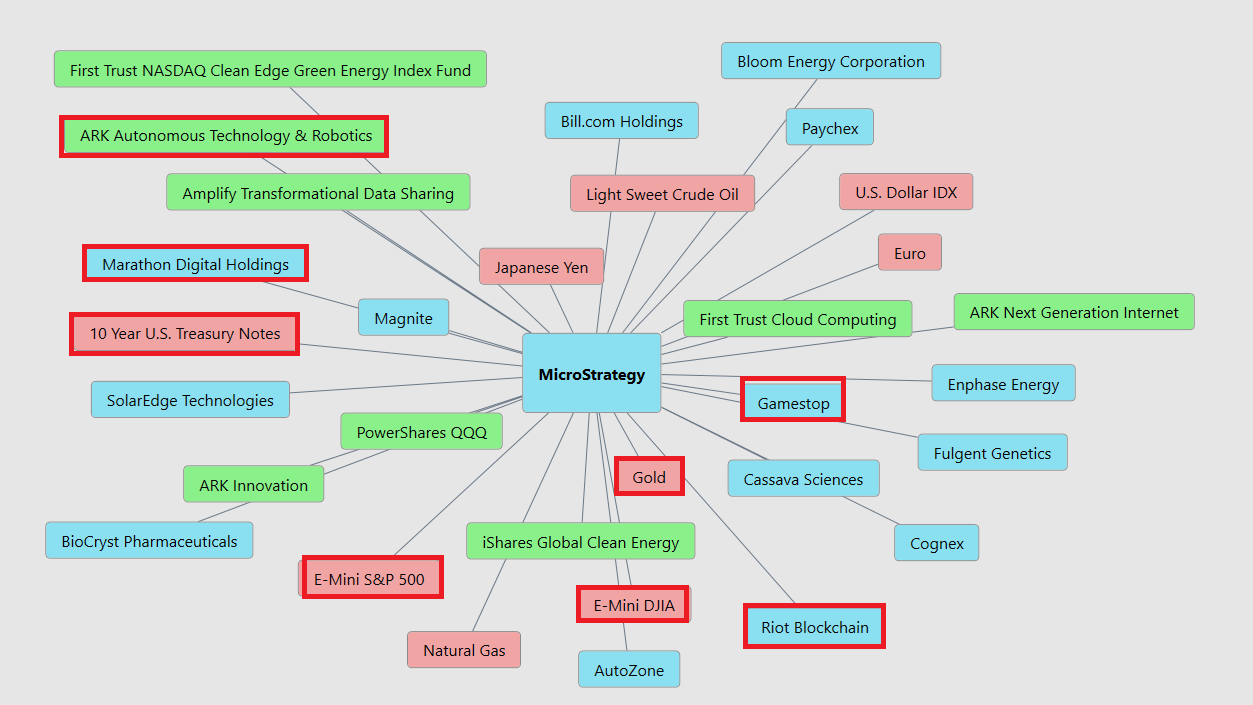

Intermarket Analysis

Imagine the financial markets as an intricate dance — a kaleidoscope of shifting elements where every move affects the next. This is intermarket analysis: the discipline of tracking how stocks, bonds, commodities, and currencies are interconnected. It’s not about isolating these assets but understanding the dynamic interplay between them. A rise in gold prices, for example, doesn’t just affect metals traders; it can signal broader shifts in stocks or currency fluctuations, giving savvy traders foresight into what’s coming.

In this world of analysis, John Murphy and Louis Mendelsohn are game changers. Murphy laid the groundwork by illustrating how these markets form a tightly woven web where shifts in one area can set off waves in another. Mendelsohn took it further by integrating artificial intelligence into intermarket analysis with VantagePoint, leveraging A.I. to digest massive datasets and predict market trends. Together, they’ve redefined how traders navigate these interconnected markets, making intermarket analysis more than a tool—it’s a lens that reveals the hidden patterns driving global finance.

Intermarket analysis plays a significant role in how MicroStrategy ($MSTR) approaches its convertible bond offerings, particularly as these bonds are heavily influenced by interest rate trends, currency fluctuations, and Bitcoin’s volatility. Since $MSTR’s bond offerings are partially used to acquire Bitcoin, shifts in bond yields or currency strength affect the attractiveness of its debt structure and the potential returns on its Bitcoin investments. Higher interest rates, for instance, can increase the cost of issuing debt, influencing $MSTR’s overall leverage strategy and impacting the return profile of its convertible bonds. By monitoring these intermarket connections, MicroStrategy can more strategically time its offerings to align with favorable market conditions, maximizing capital efficiency and minimizing financial risk.

Here are the 31 top drivers of price action for $MSTR:

Our Suggestion

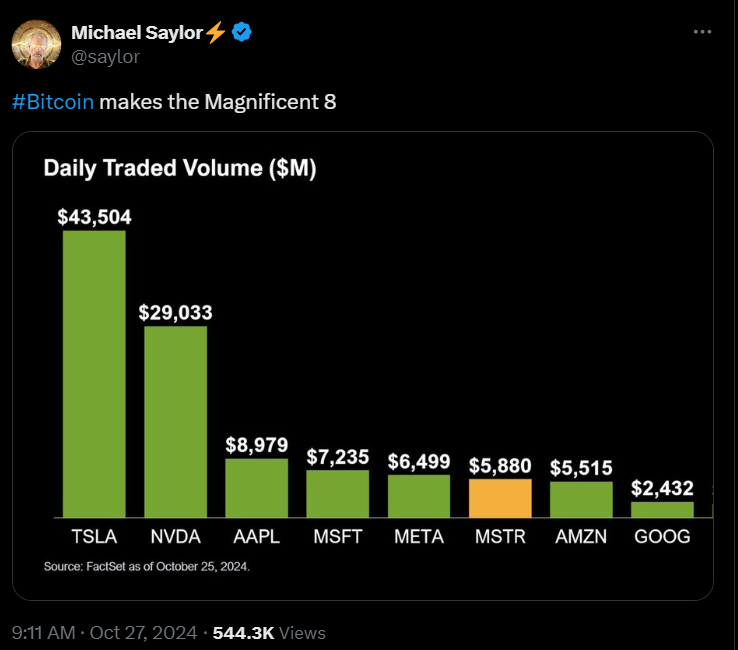

MicroStrategy ($MSTR) is set to report its Q3 2024 earnings this afternoon, October 30, 2024, and analysts are projecting an earnings-per-share (EPS) loss around -$0.14, with some range in opinion given the unpredictable impacts of Bitcoin’s volatility on the company’s financials. Additionally, revenue expectations sit around $121.5 million, with analysts closely watching how MicroStrategy’s Bitcoin holdings and software business influence results. The recent changes in accounting standards for digital assets could positively impact the balance sheet, marking up Bitcoin gains as earnings, which may introduce favorable surprises to Wall Street. Investors are also eyeing the broader market interest and potential for passive inflows if MicroStrategy is added to major indexes, as its market strategy has drawn interest from both institutional and retail investors alike.

MicroStrategy ($MSTR) has garnered significant interest in the market, and it’s clear why. Unlike Bitcoin ETFs, $MSTR carries no management fees, appealing to long-term investors seeking to minimize costs. What sets $MSTR apart even further is its unique approach to enhancing its Bitcoin per share by strategically issuing shares and bonds—a feat ETFs can’t replicate.

MSTR’s potential inclusion in major indexes like the QQQ and S&P 500 could soon bring passive inflows, a benefit inaccessible to Bitcoin ETFs. Additionally, MSTR provides leveraged Bitcoin exposure without the drawbacks of time decay or margin interest, making it a compelling alternative for those desiring amplified upside potential.

The company’s robust options market, coupled with potential FASB accounting changes, could significantly impact its valuation by allowing Bitcoin appreciation to boost earnings. Beyond Bitcoin, MSTR’s foundational software business supports its debt, creating a steady cash flow engine that Bitcoin ETFs lack.

Moreover, $MSTR’s strong market cap growth opens doors for future acquisitions, and its ability to buy back shares offers long-term flexibility to enhance BTC per share if conditions shift. The vibrant community of $MSTR investors echoes the passionate backing seen with companies like Tesla, creating a valuable alignment between mission and market support.

We advise that you add $MSTR to your watchlist and follow the ai daily range forecast for trading opportunities. Volatility should be high post earnings and provide numerous opportunities for traders to exploit the wide trading ranges.

Rely on the daily range forecast for short-term swing trading opportunities.

It’s not magic.

It’s machine learning.

Disclaimer: THERE IS A HIGH DEGREE OF RISK INVOLVED IN TRADING. IT IS NOT PRUDENT OR ADVISABLE TO MAKE TRADING DECISIONS THAT ARE BEYOND YOUR FINANCIAL MEANS OR INVOLVE TRADING CAPITAL THAT YOU ARE NOT WILLING AND CAPABLE OF LOSING.

VANTAGEPOINT’S MARKETING CAMPAIGNS, OF ANY KIND, DO NOT CONSTITUTE TRADING ADVICE OR AN ENDORSEMENT OR RECOMMENDATION BY VANTAGEPOINT AI OR ANY ASSOCIATED AFFILIATES OF ANY TRADING METHODS, PROGRAMS, SYSTEMS OR ROUTINES. VANTAGEPOINT’S PERSONNEL ARE NOT LICENSED BROKERS OR ADVISORS AND DO NOT OFFER TRADING ADVICE.