| This week’s stock analysis is TG Therapeutics – ($TGTX) |

TG Therapeutics ($TGTX) is a biopharmaceutical company founded in 2013 by Michael S. Weiss and Lou Reese with headquarters located in New York, NY. TG Therapeutics is focused on developing valuable treatments for cancer and autoimmune diseases through its innovative therapies. They specialize in antibody-drug conjugates and oral small molecule drugs, aiming to make sure that the patient experience isn’t impacted with side effects so that their quality of life remains as normal as possible. Currently, TG Therapeutics has around 125 employees, who are enthusiastic about advancing drug therapies and partnering up to create treatments for those in need.TG Therapeutics believes everyone deserves access to better and safer healthcare options, which is why they develop technologies that could revolutionize the field of medicine. $TGTX trades on the NASDAQ, has a market cap of 1.72 billion with an average volume traded of 4.2 million shares daily.

Shares of $TGTX exploded higher over the past few months as the company received initial approval from the Food and Drug Administration for it multiple sclerosis drug Briumvi (Ublituximab-xiy). Briumvi is a monoclonal antibody that binds to CD20 molecules on specific types of cells to reduce their ability to cause tissue damage. Many people with MS are hopeful that this new drug will help mitigate their symptoms. While some researchers are skeptical about its efficiency, ublituximab-xiiy could represent an important step forward in treating MS if it does become approved by the FDA.

Explosive biotech stocks have long been a source of wealth for early investors, as these stocks can yield huge returns. One example of a stock that has led to tremendous returns is Novavax, Inc. The company was an experimental drug developer and diagnostic supplier in 2012 when it was trading around single digit prices per share. Fast forward to 2021 and the stock skyrocketed over 2100% to over $300 per share due to their success in developing the COVID-19 vaccine. Another example is NantKWest, Inc., who developed cell-based immunotherapies and Viral Therapy platforms between 2003 and 2013 when the stock surged from 80 cents a share to over $10. Finally, Regeneron Pharmaceuticals are also known for their groundbreaking genetics research which led to incredible gains in regenerative medicine treatments. Back in 2006, their stock was valued at around $13 per share, but has since increased to over 600% due to a growing customer base who recognizes its potential in the health care industry. Early investors into these kinds of biotech stocks have seen tremendous returns and it is likely that this trend will continue as discoveries continue to be made in the exciting world of Biotech innovation.

Multiple sclerosis is an unpredictable, often disabling disease of the central nervous system. It is caused when the body’s own immune system mistakenly attacks the myelin sheath that wraps around and protects nerve fibers in the brain, spine, and optic nerves. Symptoms may include changes in sensation as well as motor control, speech difficulties, vision problems, fatigue and more. Though there is currently no known cure for multiple sclerosis, treatments such as therapy and medication can help individuals manage their symptoms and improve their quality of life. While it affects everyone differently, multiple sclerosis can be a debilitating disease that requires special medical attention to help those who suffer to experience a better lifestyle. This can cause a variety of symptoms ranging from temporary vision loss and extreme fatigue to more serious complications such as paralysis or difficulty breathing. Unfortunately, the exact cause of MS is still unknown; however, researchers suspect it has to do with a combination of genetic predispositions, environmental triggers, and lifestyle factors.

At the present time, there is no one-size-fits-all treatment for MS, since the disease can manifest differently depending on the individual. Instead, doctors typically employ a mix of treatments to reduce the impact of MS symptoms and prolong the periods of remission between symptoms. These treatments include physical therapy to maintain muscle strength, medications such as immunosuppressants and antispasmodics to help control inflammation and spasms, occupational therapy to maximize mobility and reduce fatigue, cognitive behavior therapy for psychological challenges posed by MS, and medications that can slow or halt the progression of MS episodes. While there is currently no cure for MS, these treatments can often significantly slow its progress, giving those with MS more time to enjoy life in remission.

It is estimated that around 2.3 million people worldwide suffer from multiple sclerosis (MS), a chronic and potentially disabling disease of the central nervous system. Each year, approximately 200,000 individuals are newly diagnosed with MS, but the actual number of new cases is likely higher due to underdiagnosing or misdiagnosing the condition. MS can affect anyone at any age but typically first appears between the ages of 20 and 40 years old. Research continues to explore both genetic and environmental factors that may contribute to who develops MS and why its prevalence varies geographically.

Looking at the companies’ financial situation their earnings are forecasted to grow by 56.7% per year. The stock has been diluted over the past year. Stock dilution is when a company issues more shares of its stock, thus increasing the outstanding share count. This reduces the ownership stake of each current shareholder as well as the earnings per share. Dilution typically occurs when companies issue additional shares to raise capital for expansion, financing activities or capital expenditures, when employees are granted stock options to purchase shares at set prices, and through mergers and acquisitions involving the issuance of new company stock. Regardless of how it is caused, stock dilution can be detrimental for investors.

Analysts are not overly concerned about the stock dilution that has occurred as they see it as a sign that the company is using resources internally to fund its own future growth. However, cash reserves are less than one year of operational revenue.

In this weekly stock study, we will look at and analyze the following indicators and metrics which are our guidelines to dictate our behavior regarding any stock analysis.

- Wall Street Analysts’ Estimates

- 52-week high and low boundaries

- Vantagepoint A.I. Predictive Blue Line

- The Best Case – Worst Case Scenarios

- Neural Network Forecast

- Daily Range Forecast

- Intermarket Analysis

- Our trading suggestion

We don’t base decisions on things like earnings or fundamental cash flow valuations. However, we do look at them to better understand the financial landscape that a company is operating under.

Wall Street Analysts’ Estimates

The 9 analysts offering 12-month price forecasts for TG Therapeutics Inc have a median target of $23.00, with a high estimate of $40.00 and a low estimate of $6.00 . The median estimate represents a +98.88% increase from the last price of $11.57.

We love to see this heavily divergent opinion as it tells us that volatility is baked into the mix.

52-Week High and Low Boundaries

Over the past year we have seen $TGTX trade as low as $3.48 and as high as $20.69. This tells us that the annual trading range is $16.01

We would also like to divide the annual trading range of $16.01 by the current price of $11.57 to get a broad-based estimate of trading volatility.

Here are the annual 52-week metrics of $TGTX so that you can see the powerful price journey it has taken over the last year.

The 52-week low price boundary is a significant level that professional traders pay close attention to for a few reasons. First, it helps them to define what is “fair value” for a given security. Second, it can be useful in defining what is “cheap” – i.e. when a security is trading significantly below its analyst estimates, it may be an attractive buying opportunity. Finally, professional traders will often look for bottoming price action near the 52-week low boundary – this can be a helpful indication that the security is about to begin a new uptrend. As such, the 52-week low boundary is a key level that professional traders use in their analysis.

Usually, when a stock makes a 52-week low it is a very negative indication. When the negative momentum continues and the stocks makes a lower 52-week low it also is a negative bellweather. However, when the low price level is tested numerous times and holds, it is important to pay attention as you will often see tremendous price rallies based simply upon the bottoming price action. This is what has occurred in $TGTX as it has rallied 95% in the last 37 trading sessions.

Power Traders will compare the Wall Street Analysts estimates with these broad volatility estimates to get a broad sense of price action in $TGTX.

The price action can be explosive in a company like $TGTX specifically because of how beaten up it has become over the long term. All you nered to do is look at the 10 year chart and you can see how the bear market in the broader market also dragged down $TGTX very heavily.

I am not implying that it will climb back to its 10 year high level anytime soon.. But in this particular instance the 52-week low is also a 10 year low and the stock was considered to be extremely oversold.

Best Case – Worst Case Scenario $TGTX

We also want to compare the best rallies to the worst declines to understand the assets real time volatility and then compare the performance of the asset we are considering with the returns of the major market indexes.

Great trading is always about being very aware of the potential volatility of an asset. As traders we look for MOTION. But motion is a two-edged sword and by initially looking at rallies and declines we can quickly determine whether an asset is holding on to gains or not. Keep in mind that $TGTX has an annualized volatility of 149%! Observe how the annual statistical volatility metric tends to confine rallies and declines.

Here is the BEST-CASE analysis.

Followed by the WORST-CASE Analysis:

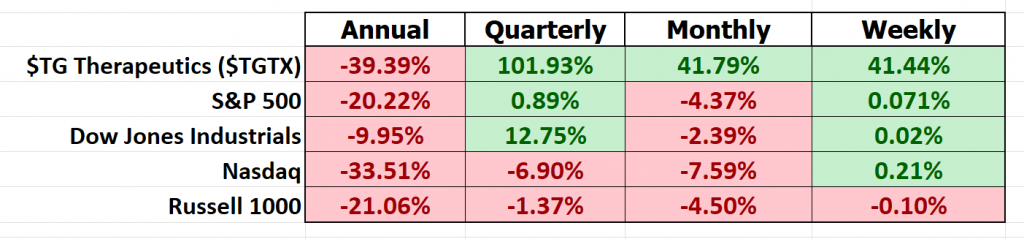

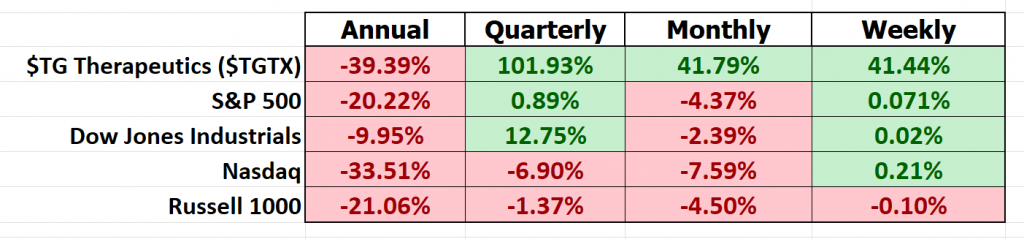

Next, we compare the performance of $TGTX to the broader major stock market indexes.

So, in $TGTX we recognize that this is a highly volatile asset which can move 60% higher or lower in a matter of weeks.

We can also see that in $TGTX we have a stock which even in spite of its recent FDA approval is still down 39% year over year. This communicates to us that $TGTX is a very short-term trading vehicle. Traders and investors are fishing for undervalued assets within the broader bear market trend.

More importantly, the drawdowns have been quite large as well. The largest drawdowns were 61.8% and 67% peak to trough. This tells us that in $TGTX we are dealing with what we refer to as a HIT and RUN trading opportunity.

Vantagepoint A.I. Forecast Predictive Blue Line

Let’s do some basic trend forecasting analysis based upon looking at the VantagePoint predictive blue line over the last year. On the following chart you will see the power of the VantagePoint Predictive blue line which determines the medium term trend price forecast.

The guidelines we abide by are as follows:

- The slope of the predictive blue line determines the trend and general direction of $TGTX

- When the blue line turns above the black line an UP opportunity occurs

- When the blue line turns below the black line a DOWN opportunity occurs

- Ideally, the VALUE ZONE is determined to try and buy the asset at or below the predictive blue line

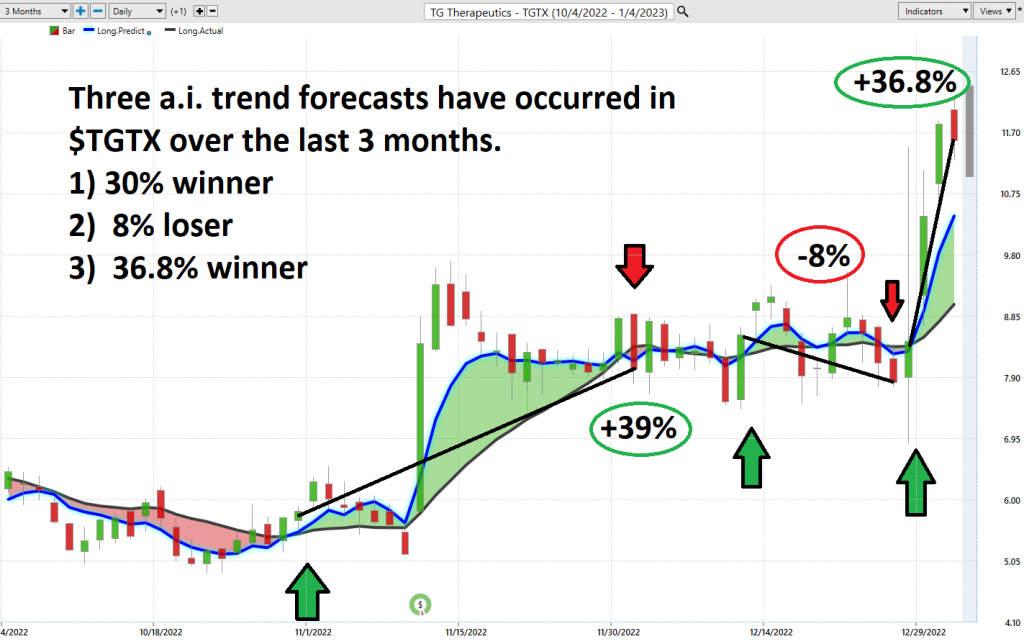

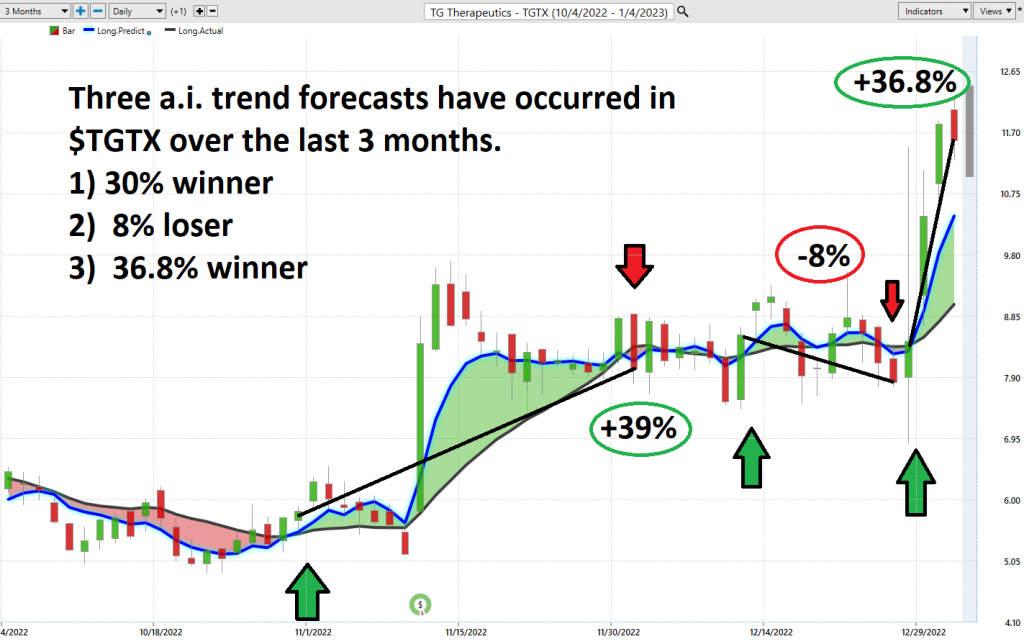

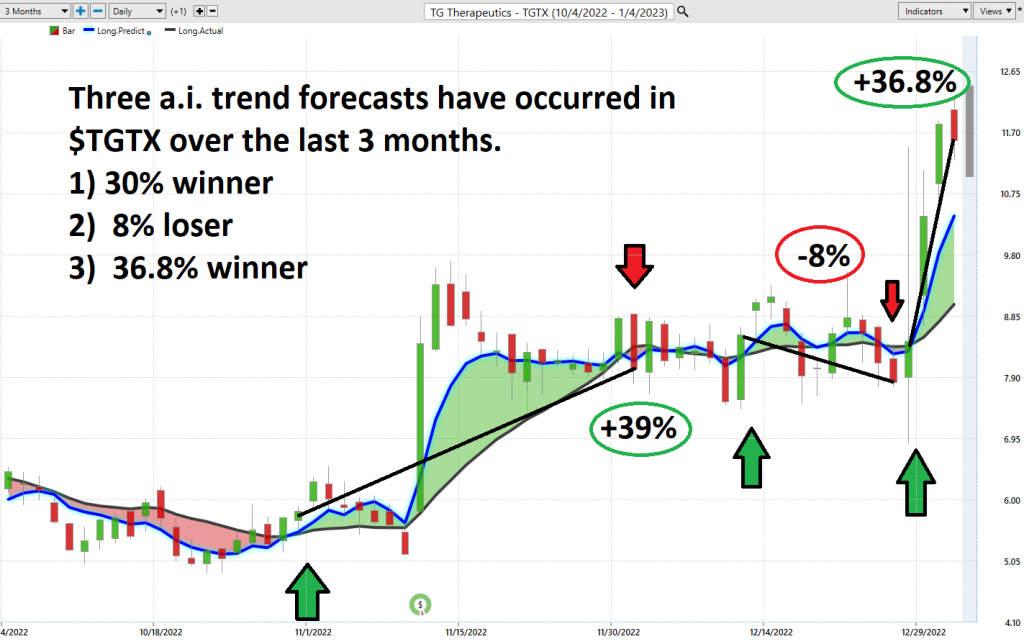

Over the last 3 months there have been 3 trading opportunities. 2 have been winners. 1 has been a loser.

This is the power and effectiveness of the Vantagepoint A.I. forecast in assisting traders to stay on the right side of the trend at the right time.

The predictive blue line is the initial indicator which Power Traders use to monitor and navigate the trend.

Next traders cross-reference this signal with the historical pattern recognition available with machine learning and the Neural Index.

Neural Network Indicator (Machine Learning)

At the bottom of the chart is the Neural Network Indicator which predicts future short-term strength and/or weakness in the market. When the Neural Net Indicator is green it communicates strength. When the Neural Net is red it forecasts short-term weakness in the market.

A neural network is a computing system that is modeled after the brain. neural networks are composed of input nodes, output nodes, and hidden nodes. Input nodes receive information from the outside world, while output nodes send information to the outside world. Hidden nodes are neither input nor output nodes; rather, they process information internally. neural networks learn by adjusting the weights of the connections between the nodes. The stronger the connection between two nodes, the more influential that connection is. Neural networks can be used for a variety of tasks, including pattern recognition and data classification.

Neural networks in trading have the potential to revolutionize the way financial market’s function. This is because they can analyze vast amounts of data quickly and make probabilistic decisions with much greater accuracy than human traders alone. Through using large datasets, complicated algorithms, and custom-built analysis tools, neural networks are emerging as a powerful tool for understanding and anticipating market movements. Indeed, increasingly financial institutions are harnessing this technology to assess possible moves in currencies, stocks, and other assets. As this technology progresses further, it could open more efficient ways to evaluate risk factors involved with the trading of financial instruments.

At its essence, a Neural Net is a computational learning system that uses a network of functions to understand and translate massive amounts of data into a desired output, consistently monitoring itself and improving its performance. Neural networks are a type of artificial intelligence that is modeled after the brain. Trading neural networks are used to identify patterns in big data sets, which can then be used to make predictions about future market movements. Traders use neural networks because they are able to perform complex statistical and probability analysis on historical data, as well as multi-variable analysis on current market conditions. This allows them to generate trading signals with a high degree of accuracy. Neural networks have proven to be a valuable tool for traders who are looking to gain an edge in the markets.

Whenever Power Traders are looking for statistically valid trading setups, they look for a DOUBLE confirmation signal. This signal occurs whenever the blue predictive line and the Neural Net at the bottom of the chart suggest the same future expected outcome.

We advocate that Power Traders cross-reference the chart with the predictive blue line and neural network indicator to create optimal entry and exit points.

Traders look for confirmation on the Neural Net to position themselves for LONG or SHORT opportunities in the market. In other words, when the A.I. forecast is green, and The Neural Net is green, that presents a buying opportunity.

The inverse is also true, when the A.I. forecast is red and the Neural Net is red, that is a selling opportunity. The arrows on the chart below highlight the trading zones where Power Traders would’ve been using double confirmation to find a buying opportunity in cross-referencing the A.I. forecast with the Neural Net.

Power Traders are always looking to apply both the Neural Network and A.I. to the markets to find statistically sound trading opportunities.

VantagePoint Software Daily Price Range Prediction

One of the powerful features in the VantagePoint Software which Power Traders use daily is the Price Range prediction forecast.

This forecast is what permits Power Traders to truly fine tune their entries and exits into the market.

Every day traders are faced with the anxiety and frustration of wondering where they should be looking for opportunities to buy and sell the market. VantagePoint’s A.I. makes this decision super easy with the Daily Price Range Forecast. This is where the rubber meets the road.

Stock prices are affected by an array of factors, both internal and external to the company. Some of the main forces influencing stock value include financial performance, such as profits, revenue growth, and debt levels; news events related to the company or its industry; overall market sentiment and macroeconomic conditions such as GDP and inflation rates; supply and demand of particular stocks; general investor confidence or fear; insider buying or selling; government policies such as taxation changes, monetary policy actions by central banks, trade disputes and interest rates; technological updates affecting the business model. Traders also watch technical indicators like volatility, relative strength index (RSI), to estimate short-term performance among other technical data. Collectively, these factors make up the complex puzzle that is price movement in stock markets.

These multifaceted factors can affect the daily price range of stocks, from global political events to the weather. As a result, forecasting the daily price range is a complex task that requires careful analysis. There are a number of methods that can be used to forecast daily price ranges, including technical analysis, fundamental analysis, and news-based analysis. Technical analysis involves studying past price movements to identify patterns that may provide clues about future price behavior. Fundamental analysis focuses on economic indicators such as company earnings and interest rates. News-based analysis involves tracking breaking news stories that could have an impact on the stock market. Vantagepoint A.I. uses a proprietary algorithm that combines the power of a.i., neural networks and machine learning to provide a daily price range forecast. By using a combination of these methods, it is possible to develop a more accurate forecast of the daily stock market price range.

Historically speaking this is what last year’s average trading ranges on the daily, weekly, and monthly time frames look like.

You can quickly understand that with this level of volatility that risk and opportunity are two different sides of the same coin. What Power Traders do is recognize that the software is incorporating this level of volatility into its algorithm to find entry and exit levels with high probabilities of occurring.

Here is the price chart of $TGTX during the most recent uptrend. The software very clearly delineates the daily forecast by providing an exact lower and upper boundary and specifies the short-term trend.

This chart helps traders decide where stop placement should occur. Observing how to place protective sell stops below the dark line on the chart was a powerful way to minimize risk on this trade.

See how the upper and lower bands of the price range forecast for a clear channel of trading activity as well. Swing traders are always looking for opportunities to buy towards the bottom of the predicted channel and selling opportunities above the top band.

Intermarket Analysis

Power lies in the way we respond to the truth we understand.

One of the supremely important questions in trading is what is driving the price? Headlines often create interesting narratives. But these “stories” only capture the imagination. Traders want and need to understand the cause and effect of price movement.

The only way to get an answer to this important question is through Intermarket analysis which looks at statistical price correlations of assets.

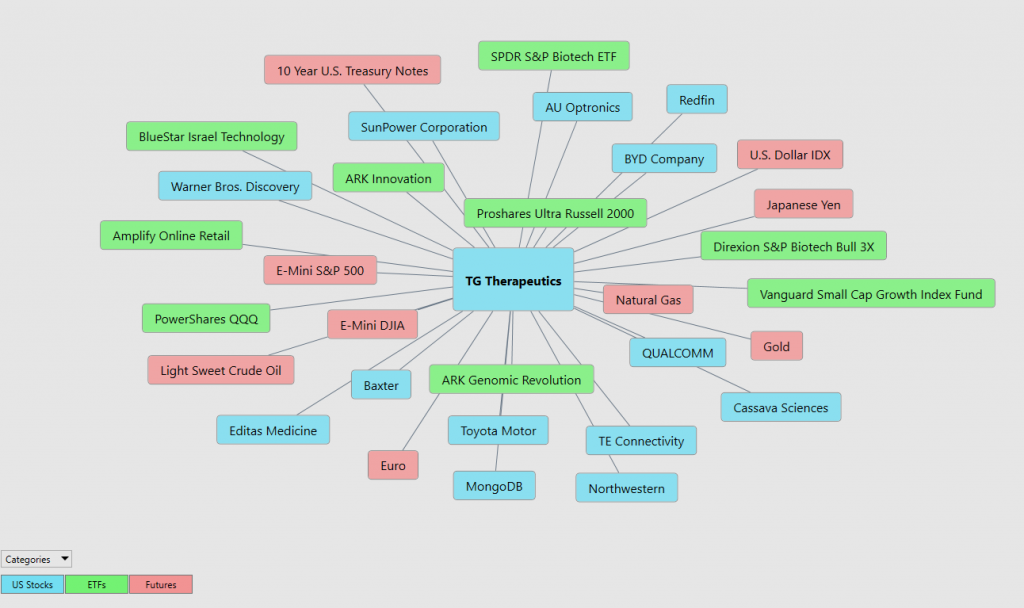

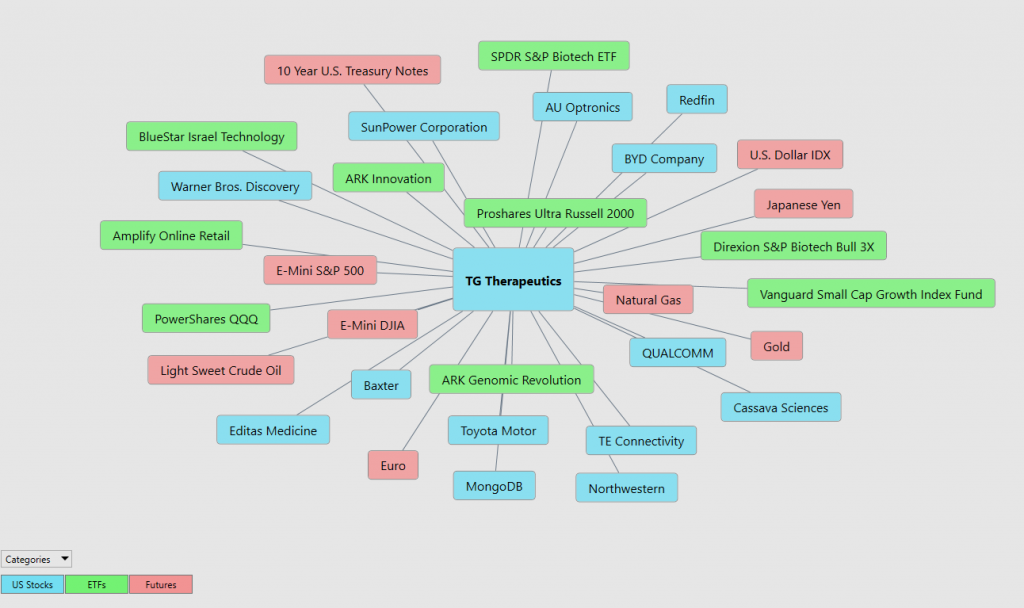

The following graphic shows you the top 31 drivers of $TGTX’s price action.

Intermarket analysis, when applied to the biotech sector, can be a powerful tool in improving the decision-making process of traders. By looking at price and volume trends of different related markets such as foreign markets, commodities markets, and different healthcare or pharmaceutical indexes, traders can identify correlations that would otherwise go unnoticed. This in turn helps them better assess risk factors associated with trading within the biotech sector. In addition to correlation trend spotting, intermarket analysis also allows traders to compare market sectors for potential opportunities and stay up to date with current macroeconomic events. With this information accessible from one platform, traders are well equipped to make informed decisions about their investments in the biotech sector.

Biotech stocks can be very risky investments due to the inherently volatile nature of the industry. Many biotech stocks are based on speculative, untested products that may never make it to market; as such, their value can skyrocket or plummet depending on various factors. The uncertainty of drug, medical device and biotechnology research makes it difficult to predict when, if ever, new products will become widely available and what the effect on stock prices would be if one were a success. Additionally, increasing regulatory scrutiny can put a damper on potential profits and render even established biotech companies vulnerable to wild fluctuations in stock prices. Despite these risks, savvy investors who know how to read company financials often snap up biotech stocks for their potentially high rewards.

Intermarket analysis is the study of relationships between different financial markets. It looks at how these markets affect each other, and how they can be used to predict future market movements. By understanding these relationships, traders can make informed decisions about where to allocate their capital. Intermarket analysis can be used to trade a variety of asset classes, including stocks, bonds, commodities, and currencies. There are a number of Intermarket indicators that can be used to identify opportunities, such as price correlations and momentum indicators. By taking the time to understand Intermarket dynamics, traders can give themselves a significant edge in the market.

So, a study of the relationship(s) will prove to be beneficial to a trader.

We live in a global marketplace.

Everything is interconnected.

Interest rates, Crude Oil Prices, and the volatility of the Dollar amongst thousands of other variables affect the decisions companies must make to flourish and prosper in these challenging times. Trying to determine what these factors are is one of the huge problems facing investors and traders.

Intermarket analysis is a helpful tool for investors looking to make informed decisions about the stock and commodities markets, and there are a few people who are considered to be pioneers of this valuable technical analysis method. Jack Schwager, John Murphy and Vantagepoint A.I. founder Lou Mendelsohn, are three of the most influential individuals in intermarket analysis – Jack Schwager through his book ‘The Definitive Guide to Intermarket Analysis’ which offers insights on how to use this market strategy effectively and John Murphy through his popular focus on the forecasting power of trends and long-term cycles. These pioneers have helped give investors an advantage when it comes to surveying both the global economy and financial markets.

You always have a choice. You can tune in to the talking heads in the media who spin talking points which promote fear. Or you can rely on facts to base your decision making on.

Our Suggestion

We like the price action in $TGTX. Our expectation is that volatility will increase, and the stock will challenge its 52-week highs shortly. However, this is an extremely volatile asset, so it is essential that you practice exceptional money management when trading an asset like $TGTX.

But we think that if the a.i. is signaling an uptrend in $TGTX that we should use these pullbacks to scale in small tradeable positions.

The Weekly, monthly, and yearly trends are UP. Since $TGTX is a very volatile asset it can easily pull back towards the $4.08 area and still maintain its upward trajectory.

Two graphics are essential for your trading success.

PUT $TGTX on your radar and allow the a.i. to guide your trading decisions. To be clear, this looks simply like it could be a hit and run trading opportunity.

Practice solid money management in all your trades. TG Therapeutics has not formally confirmed its next earnings publication date, but the company’s estimated earnings date is Tuesday, March 7th, 2023, based off prior year’s report dates.

We will re-evaluate based upon:

- New Wall Street Analysts’ Estimates

- New 52-week high and low boundaries

- Vantagepoint A.I. Forecast (Predictive Blue Line)

- Neural Network Forecast

- Daily Range Forecast

Let’s Be Careful Out There!

It’s Not Magic.

It’s Machine Learning.

Disclaimer: THERE IS A HIGH DEGREE OF RISK INVOLVED IN TRADING. IT IS NOT PRUDENT OR ADVISABLE TO MAKE TRADING DECISIONS THAT ARE BEYOND YOUR FINANCIAL MEANS OR INVOLVE TRADING CAPITAL THAT YOU ARE NOT WILLING AND CAPABLE OF LOSING.

VANTAGEPOINT’S MARKETING CAMPAIGNS, OF ANY KIND, DO NOT CONSTITUTE TRADING ADVICE OR AN ENDORSEMENT OR RECOMMENDATION BY VANTAGEPOINT AI OR ANY ASSOCIATED AFFILIATES OF ANY TRADING METHODS, PROGRAMS, SYSTEMS OR ROUTINES. VANTAGEPOINT’S PERSONNEL ARE NOT LICENSED BROKERS OR ADVISORS AND DO NOT OFFER TRADING ADVICE.