| This week’s stock analysis is Spotify – ($SPOT) |

Spotify is a revolutionary music streaming platform that was founded by Daniel Ek and Martin Lorentzon in 2006. Its mission is to give people access to all the music they love, allowing users to enjoy any song available with just a few taps of their finger. Spotify has more than 5,400 employees located all around the world, based in 83 different offices. They make their money mainly through subscription fees and ad revenue, which varies depending on which country the user lives in. As of 2018, they are publicly traded under the symbol $SPOT and listed on the New York Stock Exchange (NYSE).

It is not alone in its success – several other companies are vying for a place in the digital music market. Pandora and Apple Music are two of Spotify’s major competitors; both offer custom radio stations with ad-supported listening options. YouTube Music has made significant inroads as well, offering an extensive library of songs from both established artists and rising stars. Finally, Amazon Music provides members access to its vast database of music along with excellent voice integration for Amazon Alexa users. All these services have distinctive features that appeal to different types of users, making them some of Spotify’s main rivals.

Spotify still faces some big challenges related to its model. One of the biggest challenges for a company like Spotify is negotiating licensing agreements with record labels and music publishers for the rights to stream their content. These agreements can be complex and time-consuming, and the costs associated with them can be significant. Additionally, Spotify also faces challenges in terms of profitability, as despite its large user base, the company has yet to turn a profit.

The company faces high costs associated with content acquisition and licensing, as well as the need to invest in new technologies and features to stay competitive.

Lastly, Spotify also faces the challenge of copyright issues, as the company needs to make sure that the content provided to their users is legally obtained and that the rights holders are being compensated.

For one, it relies heavily on record labels. Its contracts require them to pay royalties when a customer listens to their music, making it difficult for Spotify to reduce costs. Another challenge is that due to its massive success, there are now numerous competitors in the market offering similar features at discounted prices. This means that Spotify regularly needs to adjust its pricing plan and innovate constantly in order to stay ahead of rivals. Finally, since most of the revenue comes from subscriptions rather than ads, ensuring user loyalty is key for them as any subscription cancellation would hit their profit hard. To make money, Spotify applies various tactics such as offering free trials of premium plans and deals with different companies in exchange for bonuses or exclusive content. Ultimately, Spotify’s business model requires carefully navigating its challenges if it wants to continue dominating the industry.

Spotify went public in April of 2018. It’s currently trading 41% lower than its opening price. When it went public it implemented a little-known method called the direct listing method. Direct listing is a method for a company to go public that allows existing shareholders to sell their shares directly to the public, bypassing the traditional initial public offering (IPO) process. It’s a way for companies to list their shares on a stock exchange without raising new capital.

In a traditional IPO, a company works with investment banks to set a price for its shares and then sells them to institutional investors, who then resell them to the public. In a direct listing, the company doesn’t raise new capital, instead it allows existing shareholders to sell their shares directly to the public, the stock exchange sets the price based on the demand from the buyers and sellers.

In this weekly stock study, we will look at and analyze the following indicators and metrics as are our guidelines which dictate our behavior on a particular stock.

- Wall Street Analysts’ Estimates

- 52-week high and low boundaries

- Best Case – Worst Case Analysis

- Vantagepoint A.I. Forecast (Predictive Blue Line)

- Neural Network Forecast

- Daily Range Forecast

- Intermarket Analysis

- Our trading suggestion

We don’t base our decisions on things like earnings or fundamental cash flow valuations. However, we do look at them to better understand the financial landscape that a company is operating under.

Wall Street Analysts’ Estimates

The first set of boundaries which we explore in our stock study is what do the professionals think who monitor the stock for a living. We can acquire this information by simply looking at the boundaries that the top Wall Street Analysts set for $SPOT. This initial set of boundaries provides us with an idea of what is expensive, fairly valued, and cheap.

The 27 analysts offering 12-month price forecasts for Spotify Technology SA have a median target of $119.76 , with a high estimate of 175.35 and a low estimate of 85.22. The median estimate represents a +20.64% increase from the last price of 99.27.

Simply being aware of these numbers informs us that Wall Street analysts consider $SPOT to be undervalued. Their downside risk is roughly 15% and the upside potential is as high as 75%. If their assessment is accurate, we are looking at a reward to risk ratio of roughly 5 to 1.

52-Week High and Low Boundaries

Where the rubber meets the road as far as analysis is concerned is looking at the charts and evaluating where the asset stands in relation to its 52-week highs. As counterintuitive as it may sound, great stocks tend to consistently make new 52-week highs.

One of the simplest ways to evaluate a stock is to look at some long term monthly and weekly charts to be able to zoom out and see the big picture of the trend. Some of the greatest traders in the world use the longer-term monthly charts to determine trend analysis.

For traders, the 52-week high and low metrics are of significant importance when making investment decisions. By comparing the current market price to past highs and lows, traders can better assess where the asset is in its annual range.

Over the past year we have seen $SPOT trade as high as $208.49 and as low as $69.28 It has an annual range of $139.21. This represents an annualized statistical volatility of 142% which is very high. A stock’s annualized statistical volatility is a measure of its past behavior, so it can help in predicting what the stock will do in the future. When a stock has a very high annualized statistical volatility, this indicates that large fluctuations have been observed and should be expected to persist into the future. Not all stocks with high volatility will turn out to be profitable investments, but it does indicate that the stock may potentially offer significant gains – or losses – along with increased risk and higher trading frequency. Being aware of a stock’s annualized statistical volatility ahead of time allows savvy investors to make more informed decisions about whether they want to invest in a given company.

We always pay attention to where we are in relation to the 52-week trading range. It is quite common to see the 52-week high provide very strong resistance to the market until it is breached. Often when the 52-week high is breached we will see the stock price explode higher very quickly over a very short period. The chart below shows how $SPOT has temporarily bottomed out and posted a very significant rally in a longer-term downtrend.

$SPOT is trading at the 22 nd percentile of its annual range.

When we drill down further we can see that it is down 41% from where it initially went public on the NYSE and it is trading in the 9 th percentile of its 5 year range.

Best Case – Worst Case Scenario $SPOT

Next, we want to look at the best case and worst-case scenarios. We do this to compare the magnitude of the rallies against the weakness of the declines. By simply connecting the intermittent highs and lows we can get a very real and practical perspective on the risk and volatility associated with trading $SPOT.

The graphic below shows the roller coaster ride.

Here is the best-case analysis.

Followed by the worst-case analysis.

We would expect this type of volatility to continue. This means that traders should anticipate wild swings in the market and pay attention to the a.i. forecast when we hit large drawdown levels from recent peaks.

Lastly, we compare $SPOT to the broader stock market indexes to get an idea of its performance on a weekly, monthly, quarterly, and annual basis.

This analysis clearly tells us that $SPOT is significantly more volatile than the broader market. More importantly, the BEARS have very much been in control on the trend in $SPOT over the past year.

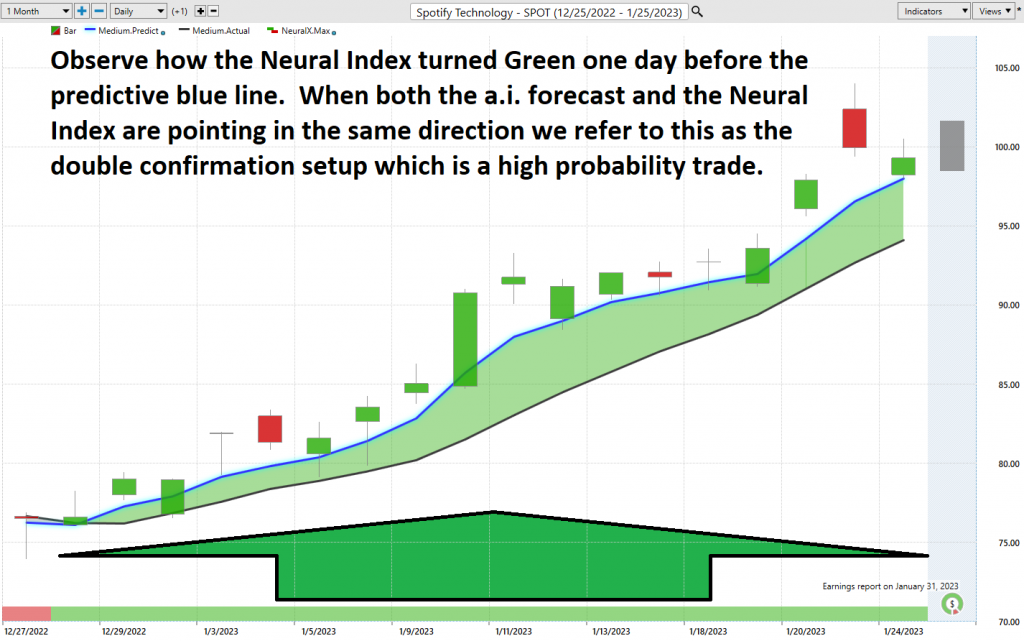

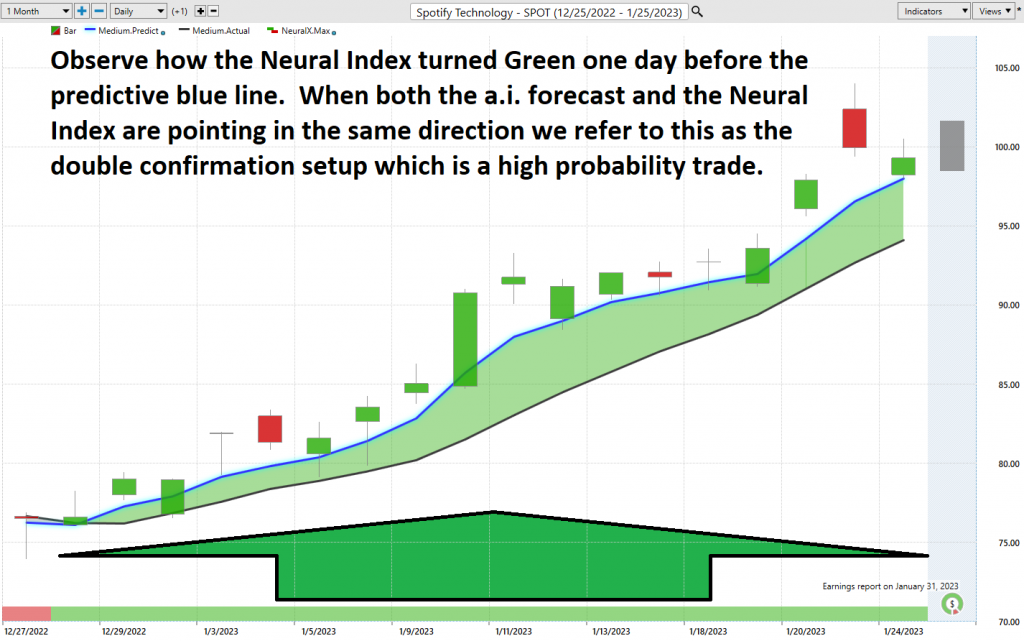

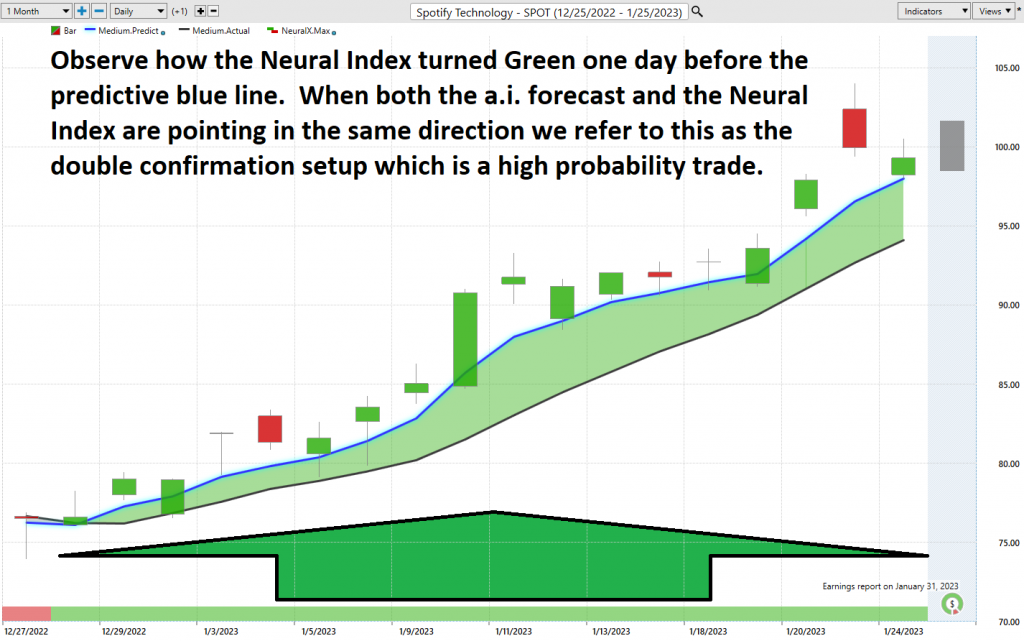

Vantagepoint A.I. Forecast Predictive Blue Line

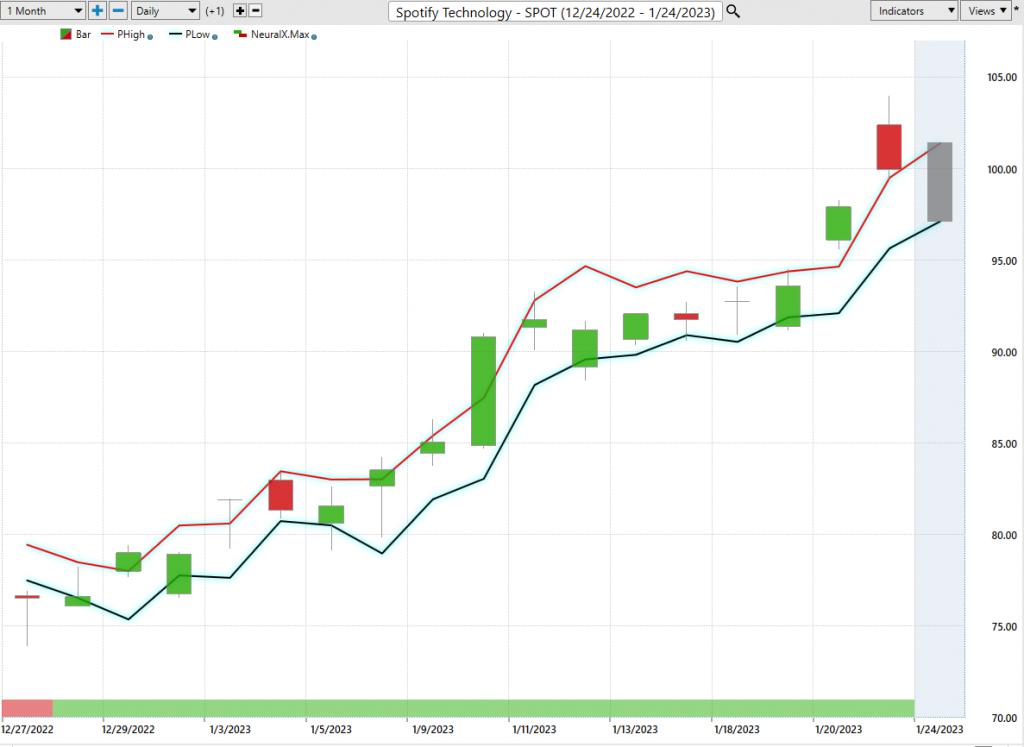

Using VantagePoint Software and artificial intelligence, traders are alerted to trend forecasts by monitoring the slope of the predictive blue line. The black line is a simple 10-day moving average of price which simply tells you what has occurred in the market. The predictive blue line also acts as a value zone where in uptrends traders try to purchase the asset at or below the blue line.

In studying the chart below, pay close attention to the relationship between the black line and predictive blue line. All that the black line tells you is what has occurred. It tells you where prices have been and what the average price over the last ten days is.

The predictive blue line, on the other hand utilizes that Vantagepoint patented Neural Network and Intermarket Analysis to arrive at its value. It looks at the strongest price drivers of an asset through artificial intelligence and statistical correlations to determine its value.

Whenever we see the predictive blue line move above the black line, we are presented with an UP-forecast entry opportunity. This is highlighted by UP arrows on the chart.

Whenever the predictive blue line moves below the black line, we are presented with a DOWN forecast. More importantly, there is no guesswork involved. Ideally traders are trying to buy at or below the predictive blue line.

Neural Network Indicator (Machine Learning)

At the bottom of the chart is the Neural Network Indicator which predicts future strength and/or weakness in the market. When the Neural Net Indicator is green it communicates strength. When the Neural Net is red it forecasts short-term weakness in the market.

We advocate that Power Traders cross reference the chart with the predictive blue line and neural network indicator to create optimal entry and exit points.

A Neural Net is a computational learning system that uses a network of functions to understand and translate massive amounts of data into a desired output, consistently monitoring itself and improving its performance. A neural network in trading is a type of artificial intelligence (AI) designed to identify trends, forecast outcomes, and make decisions. Neural networks are configured with an array of inputs that help the system decipher data points to create predictions. By training itself to recognize patterns in the data, traders have also been able to leverage neural networks as an automated decision support tool that can potentially improve their trading success.

Power Traders are always looking to apply both the neural network and A.I. to the markets to find statistically sound trading opportunities. We refer to this as a “double confirmation” setup and look for the predictive blue line to slope higher and to be confirmed by the Neural Net at the bottom of the chart.

We advise Power Traders to cross reference the predictive blue line with the Neural Net for the best entry opportunities. Observe how the slope of the predictive blue line has remained positive from the time earnings were announced.

You can see in the chart above how the Neural Index was consistently green which meant that rising prices were expected. These instances provide extremely high probability trading opportunities to exploit the trend.

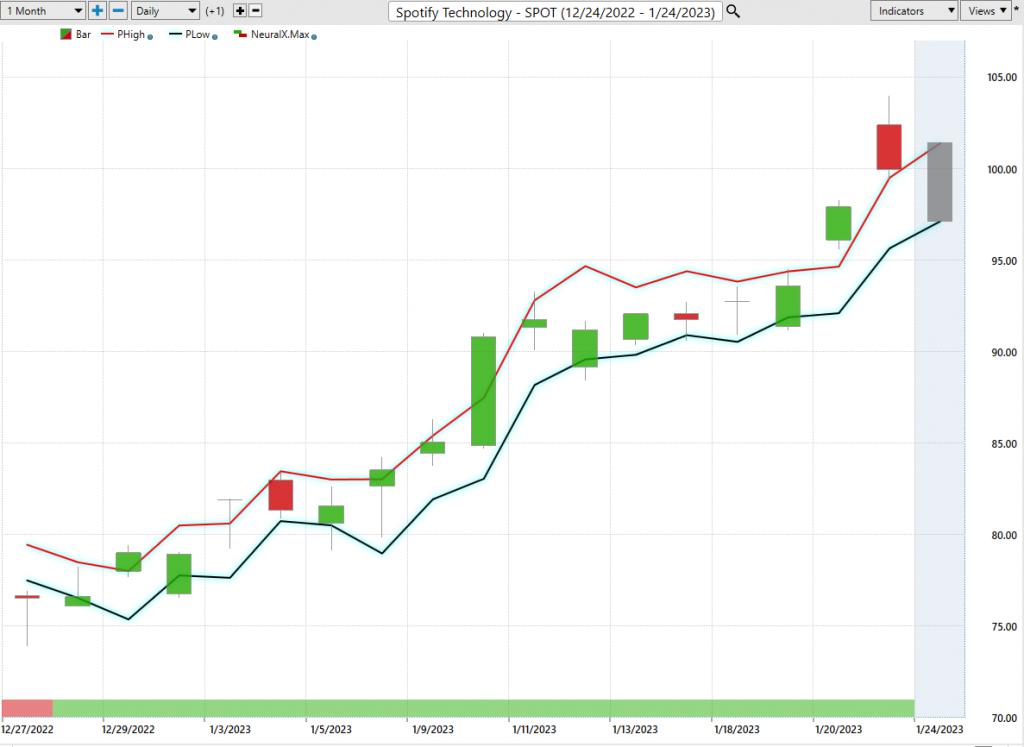

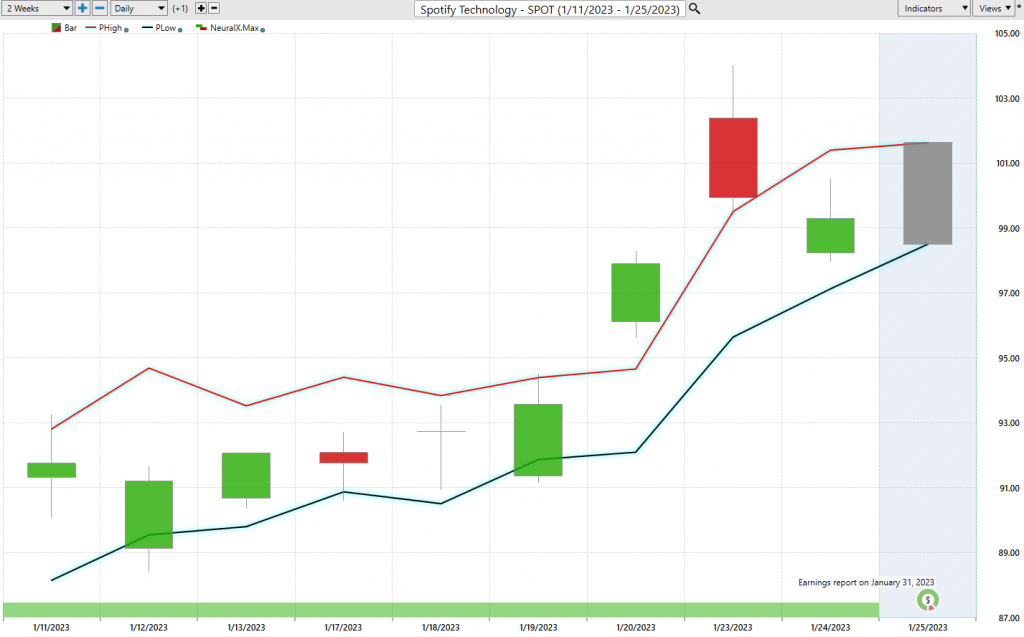

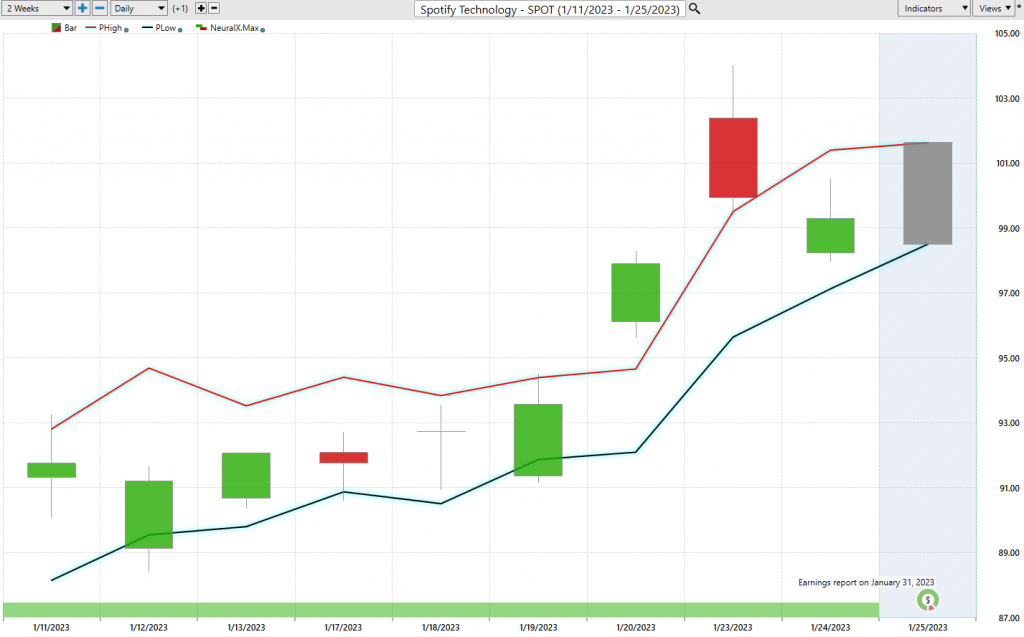

VantagePoint Software Daily Price Range Prediction

Every trader wants to know where to ideally buy and sell the underlying asset.

$SPOT is a very volatile stock as we have already discovered. This volatility can be a dream if you are on the right side of the trend at the right time. Or it can be a nightmare, if you are not.

Let’s look at the trading metrics for $SPOT over the past year:

One of the powerful features in the Vantagepoint A.I. Software which Power Traders use every day is the Daily Price Range prediction forecast.

This forecast is what permits Power Traders to truly fine tune their entries and exits into the market.

What is the most important feature that traders are concerned about? Traders need to know where to enter and exit a market. VantagePoint provides this answer with exacting precision. Every day the Daily Range forecast is updated to provide insight to anticipated price action.

By cross-referencing the double confirmation setup with the daily range forecast Power Traders are alerted to swingh trading opportunities with exacting precision.

Intermarket Analysis

What makes the Vantagepoint Software extraordinary is its capacity to perform Intermarket analysis and to find those assets which are most statistically interconnected and are the key drivers of price.

Studying the charts can always provide objective realities in terms of locating support and resistance levels which become truly clear on a chart. But we live in a global marketplace. Everything is interconnected. The billion-dollar question for traders is always what are the key drivers of price for the underlying asset that I am trading?

These intangibles are invisible to the naked eye yet show extremely high statistical correlations. Intermarket analysis is an analytical technique that studies correlations between different types of financial markets and assets. By analyzing the connections between stocks, commodities, money markets, bonds, currencies—essentially anything tradable in public markets—investors can gain insight into potential trends. Intermarket analysis uses both fundamental data like news reports and technical data such as price movements to establish relationships that can be used for making trading decisions.

Small changes in Interest rates, Crude Oil Prices, and the Volatility of the dollar amongst thousands of other variables affect the decisions companies must make to survive in these very challenging times. Trying to determine what these factors are is one of the huge problems facing investors and traders.

There is excellent value to be had in studying and understanding the key drivers of $SPOT’s price action.

By doing so you can often see which ETFs are most likely to acquire $SPOT as well as uncovering other industries which affect $SPOT price movement.

Our Suggestion

The trend is UP.

Momentum is UP. The stock is undervalued according to Wall Street Analysts.

The entire problem with $SPOT is that they have yet to earn an annual profit. Yet the company generated $9.6 billion in revue in 2022. Analysts believe that earnings will grow at 75.44% per year.

152 million people had a subscription for the music service at some point last year, making it the go-to platform for digital entertainment. With more and more musicians and listeners turning to streaming every day, one can expect this company’s annual revenue to continue to climb in coming years. On the one hand the company reminds traders and investors of Amazon in the early days. It took Amazon over 20 years to turn a profit.

For these reasons we look at $SPOT as a HIT and Run candidate. We think there is a bit more upside but will trade in small quantities for short periods of time.

Our experience has been that when a temporary bottom is placed the next few months can see very sharp rallies in the asset. $SPOT was very oversold and even now after the impressive rally over the last month it is still trading in the 9 th percentile of its 10-year range. Volatility is massive in $SPOT. Be careful.

Our advice: Follow the a.i. trend analysis and practice good money management on all your trades .

We will re-evaluate this analysis based upon:

- Wall Street Analysts’ Estimates

- 52-week high and low boundaries

- Vantagepoint A.I. Forecast (Predictive Blue Line)

- Neural Network Forecast

- Daily Range Forecast

- Intermarket Analysis

Let’s Be Careful Out There!

Remember, It’s Not Magic.

It’s Machine Learning.

Disclaimer: THERE IS A HIGH DEGREE OF RISK INVOLVED IN TRADING. IT IS NOT PRUDENT OR ADVISABLE TO MAKE TRADING DECISIONS THAT ARE BEYOND YOUR FINANCIAL MEANS OR INVOLVE TRADING CAPITAL THAT YOU ARE NOT WILLING AND CAPABLE OF LOSING.

VANTAGEPOINT’S MARKETING CAMPAIGNS, OF ANY KIND, DO NOT CONSTITUTE TRADING ADVICE OR AN ENDORSEMENT OR RECOMMENDATION BY VANTAGEPOINT AI OR ANY ASSOCIATED AFFILIATES OF ANY TRADING METHODS, PROGRAMS, SYSTEMS OR ROUTINES. VANTAGEPOINT’S PERSONNEL ARE NOT LICENSED BROKERS OR ADVISORS AND DO NOT OFFER TRADING ADVICE.