| This Week’s a.i. Stock Spotlight is Tapestry ($TPR) |

Let’s talk Tapestry, Inc. — a name synonymous with accessible luxury and powerhouse brands. If you’re carrying a Coach bag, rocking Kate Spade, or stepping out in Stuart Weitzman heels, you’re already acquainted with Tapestry (NYSE: TPR). This New York City-based fashion holding company is the mastermind behind these iconic names, and they’ve been shaping the industry since their origins as Coach in 1941. A rebrand to Tapestry in 2017 solidified their transformation into a multi-brand titan.

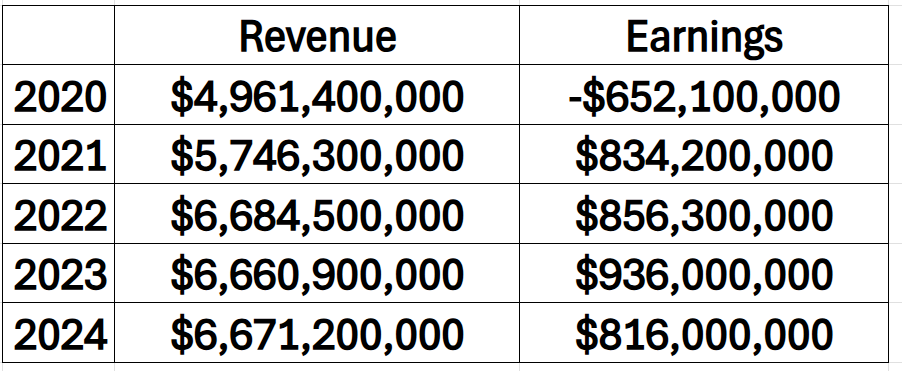

Here’s the breakdown: Tapestry pulls its revenue from three distinct profit centers. Coach dominates with handbags and ready-to-wear apparel. Kate Spade injects fun and flair with jewelry, handbags, and accessories. Meanwhile, Stuart Weitzman elevates your look with luxury footwear. Together, these brands generate billions, with handbags — particularly from Coach — being the star performers.

The revenue and earnings are posted below for your review.

Globally, Tapestry employs about 18,500 people, ensuring their products reach over 50 countries.

Now, the luxury market isn’t a solo runway. Competitors like Capri Holdings, LVMH, and Kering are major players in this space. Capri brings Michael Kors and Jimmy Choo to the table, while LVMH and Kering dominate with Gucci and Louis Vuitton. Tapestry stands firm as a leader in accessible luxury but faces ongoing pressure to innovate and capture younger demographics like Gen Z and millennials.

Tapestry’s opportunities lie in expanding their global footprint, particularly in Asia, and harnessing the power of AI to refine their e-commerce game. Tapestry doubled its e-commerce sales in just three years.

Sustainability is another key focus, with commitments to renewable energy and ethically sourced leather giving the company an edge in a climate-conscious market. They’re one of the first luxury firms to integrate generative AI for personalized shopping experiences.

Over the last decade, Tapestry has made bold moves, snapping up Kate Spade in 2017 and Stuart Weitzman in 2015. While a recent attempt to acquire Capri Holdings hit a regulatory roadblock, it hasn’t slowed them down. Their $2 billion share buyback program signals confidence in their financial health and a focus on rewarding shareholders.

Tapestry’s challenges are real — competition is fierce, and the global economy remains uncertain. But with a strong brand portfolio, a focus on digital transformation, and sustainability initiatives, the company is positioned to weather the storm and continue setting trends in the accessible luxury market.

Tapestry has experienced robust growth in international markets, with particularly strong performance in Europe and Asia. These regions represent significant opportunities for continued expansion, as increasing consumer interest in luxury goods drives demand in these key markets.

While Tapestry’s trajectory appears positive, several risks could impede its progress. The company operates in a highly competitive environment, with significant pressure from rivals like Capri Holdings, LVMH, and Kering. These competitors bring formidable brand portfolios and substantial resources, making it essential for Tapestry to continually innovate and differentiate itself to maintain market share.

Economic sensitivity also remains a concern. As a retailer in the luxury goods sector, Tapestry is particularly vulnerable to fluctuations in consumer spending. During economic downturns, discretionary spending on items such as handbags, footwear, and accessories often declines, potentially impacting revenue. Furthermore, Tapestry’s recent attempt to merge with Capri Holdings faced regulatory challenges, culminating in the termination of the $8.5 billion deal due to antitrust obstacles. This development raises questions about the feasibility of future growth through acquisitions and the regulatory scrutiny that may accompany such strategies.

Tapestry is well-positioned to navigate these challenges while capitalizing on its strengths in the accessible luxury market. Investors and stakeholders should watch closely as the company balances these dynamics to drive future success.

So, keep an eye on Tapestry as it stitches together the next chapter in the luxury fashion story.

In this weekly stock study, we will look at an analysis of the following indicators and metrics which are our guidelines which dictate our behavior in deciding whether to buy, sell or stand aside on a particular stock.

- Wall Street Analysts Ratings and Forecasts

- 52 Week High and Low Boundaries

- Best-Case/Worst-Case Analysis

- Vantagepoint A.I. Predictive Blue Line

- Neural Network Forecast (Machine Learning)

- VantagePoint A.I. Daily Range Forecast

- Intermarket Analysis

- VantagePoint A.I. Seasonal Analysis

- Our Suggestion

While we make all our decisions based upon the artificial intelligence forecasts, we do look at the fundamentals briefly, just to understand the financial landscape that $TPR is operating in.

Wall Street Analysts Forecasts

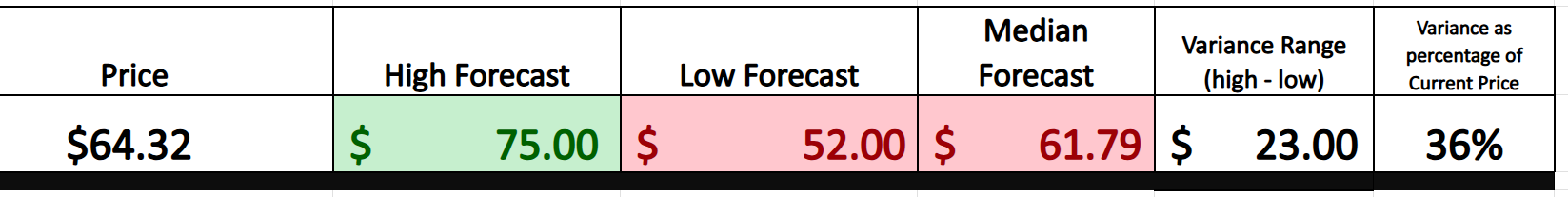

We always begin any trade by looking at what Wall Street’s finest minds are thinking. These individuals are paid to watch the stock 24/7 and pay close attention to all the fundamental information which can affect its performance.

In a round-up of recent Wall Street sentiment, 14 analysts have weighed in on Tapestry’s 12-month outlook, and the consensus carries a tone of tempered optimism. The average price target lands at $61.79, with projections ranging from a high of $75.00 to a low of $52.00. Interestingly, that average target suggests a modest decline of 3.9% from the current trading price of $64.32 — a sign that analysts are cautious about near-term upside, even as the company continues to solidify its position in the accessible luxury market. These numbers reflect a balancing act: confidence in Tapestry’s fundamentals against broader macroeconomic and competitive headwinds.

We always advise that traders pay very close attention to the variance between the most bullish and most bearish forecasts as this communicates clearly the level of volatility that these analysts are forecasting moving forward. Currently the variance is $23 or 36% of the current price. This level of volatility is moderately high but not extravagant. We welcome higher than normal volatility because that is how trading opportunities are created.

52 Week High and Low Boundaries

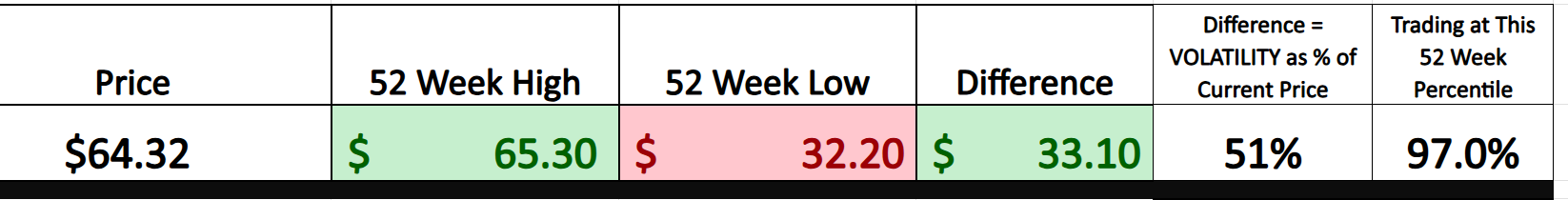

For new traders, tracking a stock’s 52-week high and low boundaries is an essential step in understanding its performance and behavior. These levels provide a clear snapshot of how the stock has moved over the past year, offering context about its volatility — the degree to which its price has fluctuated. This information is invaluable when deciding whether a stock aligns with your trading strategy and risk tolerance.

The 52-week high represents the highest price a stock has reached over the past year, while the 52-week low marks the lowest price. Together, these boundaries serve as benchmarks, offering insight into where the stock currently trades relative to its recent extremes. If a stock is trading near its high, it might suggest strong momentum and bullish sentiment. On the other hand, a stock closer to its low could signal challenges or potential undervaluation, depending on the circumstances.

These levels are also a starting point for understanding a stock’s volatility . By examining the difference between the high and low — known as the annual trading range — you can get a sense of how much the stock’s price has moved over the past year. A wider range indicates greater price fluctuations, suggesting higher risk and potential reward. A narrower range suggests more stability, which might appeal to risk-averse traders.

You can measure a stock’s historical volatility precisely by calculating its trading range and expressing it as a percentage of the current price. This simple calculation provides a benchmark to anticipate how volatile the stock might be in the future. Over the past year the annual trading range was $33.10, which represents 51% of the current price. This tells us that moving forward it would be perfectly normal to expect the price to trade 51% higher or lower than we are trading today.

By understanding the stock’s historical volatility, you can anticipate potential price movements and determine whether the stock fits your trading goals. Stocks with high volatility often offer larger rewards but come with greater risk. Knowing the trading range helps you assess whether the stock aligns with your risk tolerance.

A stock approaching its 52-week high may signal a potential breakout and attract bullish interest. Conversely, a stock nearing its 52-week low might be a buying opportunity for traders expecting a rebound or a warning signal for further decline.

The 52-week high and low are more than just numbers; they are critical tools for analyzing a stock’s performance and behavior. By tracking these levels and calculating volatility, traders gain a clearer understanding of the stock’s price history and potential future movements. This context allows traders to set realistic expectations, manage risk effectively, and make more informed decisions. For new traders, integrating this practice into your analysis will provide a solid foundation for navigating the dynamic world of trading.

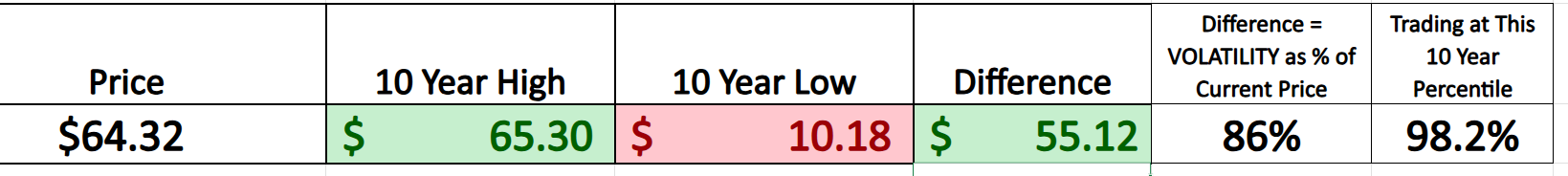

We also like to zoom out and look at the longer-term trajectory of the chart for more granular context.

Over the last 10 years $TPR has traded as high as $65.30 and as low as 10.18. One of our favorite trading setups is monitoring very closely stocks and assets that are making new 52 week highs and new all time hgihs. These stocks usually have tremendous momentum and offer massive opportunity for the seasoned trader. Their price action is living proof that they are overcoming all barriers to their success. Currently $TPR is making new 52 week highs and new 10 year highs and is worth putting on your watchlist radar specifically for this reason.

Best-Case/Worst-Case Analysis

What separates a professional trader from a newbie is a deep understanding of risk, reward, and volatility. The simplest way to grasp this critical concept is to pull up a long-term 52-week chart and measure the largest uninterrupted rallies against the largest uninterrupted declines. This straightforward exercise reveals why professionals are laser-focused on understanding the best-case possibilities versus the worst-case scenarios. They balance their risk accordingly, ensuring every trade is rooted in reality, not hope.

Too many traders dive into the markets blind to the realities of risk and reward. B y examining the biggest uninterrupted rallies and declines over the past year the risk and reward profile of any market will jump out at you immediately. These swings reveal the market’s true nature — its peaks of optimism and depths of pessimism. For traders, understanding these extremes isn’t just tactical; it’s essential. It’s about building a strategy that balances potential gains with the ever-present risk of loss, equipping them to navigate the markets with confidence, foresight, and discipline.

First, we look at the best-case scenario:

Followed by the worst-case scenario:

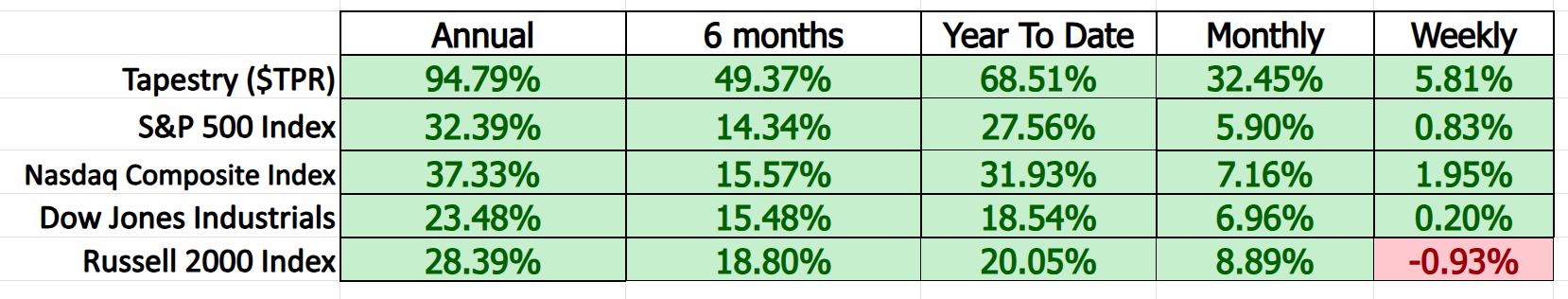

A quick look at these charts gives traders a clear snapshot of the risk-reward dynamics for $TPR, rooted in last year’s price action. But the story gets even more compelling when we zoom out and compare $TPR’s performance to broader market indexes across multiple timeframes. This expanded view highlights where $TPR stands amid the shifting tides of the market. The data speaks for itself — rallies have dwarfed declines, signaling that the bulls remain firmly in control.

Tapestry Inc. ($TPR) has a 5-year beta of 1.56, indicating that its stock price has been more volatile than the overall market. A beta of 1 is in line with the market, so if the market moves up or down by 1%, a stock with a beta of 1 would likely do the same.

With a beta of 1.56, $TPR typically moves 56% more than the market. For example, if the market goes up by 1%, $TPR might rise by 1.56%. On the flip side, if the market drops 1%, $TPR could fall by 1.56%. This higher beta means more potential for gains but also more risk, as the stock may experience larger swings in price.

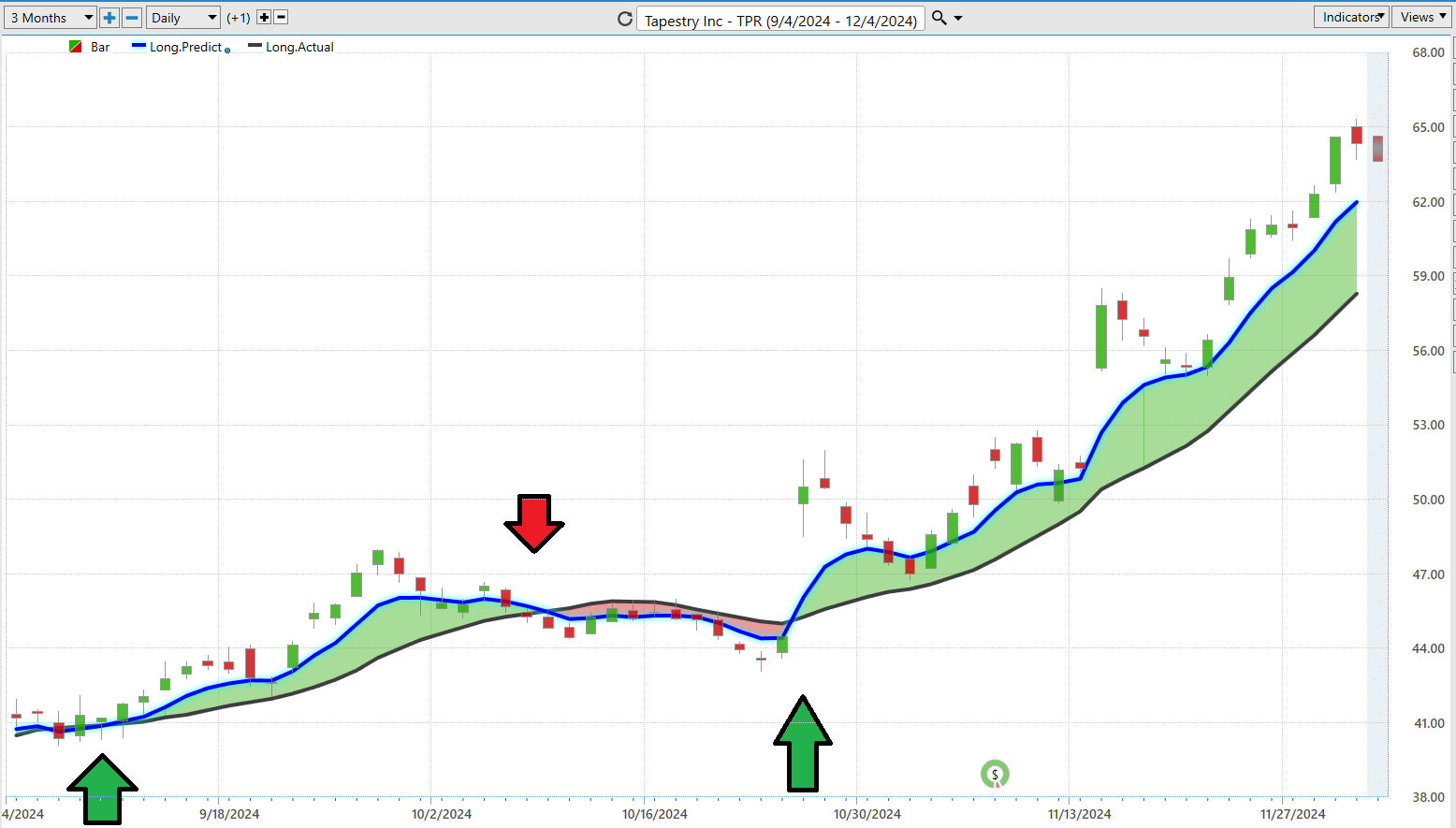

Vantagepoint A.I. Predictive Blue Line

Here is the powerful strategy behind A.I.-driven market predictions for $TPR with VantagePoint Software. At its core lies the predictive blue line — a revolutionary tool powered by cutting-edge artificial intelligence and intermarket analysis. Think of it as your financial North Star, guiding you through the often-chaotic waves of the markets.

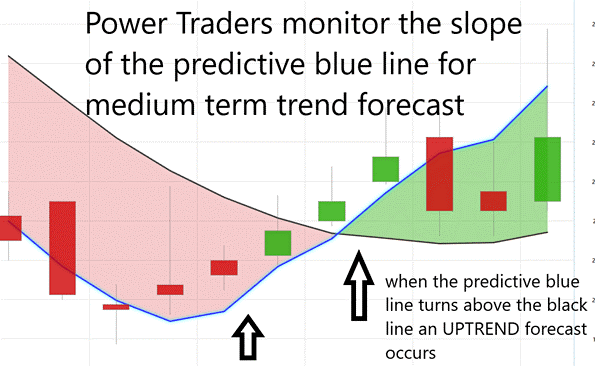

The secret? Pay close attention to the slope of the blue line and its relationship to price action. Here’s the formula for success:

- Trend Clarity : When the blue line crosses above the black line, it forecasts an upward trend.

- Value Zone : The sweet spot for buying is when prices dip to or below the blue line. In a downtrend, selling opportunities arise when prices exceed the line.

- Risk Awareness : A downward-sloping blue line warns of potential price declines, signaling traders to hedge or wait for better opportunities.

With VantagePoint’s advanced A.I. insights, traders stay ahead of the curve, leveraging the predictive blue line to make smarter, data-driven decisions in real-time.

In the fast-paced, high-stakes world of trading, every edge matters. That’s where VantagePoint Software steps in — a game-changer powered by cutting-edge artificial intelligence. At its core lies the predictive blue line, your financial compass. When it slopes upward, it signals bullish opportunities ripe for buying. When it turns downward, it warns of bearish trends, pointing to smart moments to sell or step aside.

This isn’t just a tool—it’s your secret weapon for navigating risk and reward with precision. By predicting trends and pinpointing the best moments to act, VantagePoint empowers traders to seize opportunities and stack the odds of success squarely in their favor.

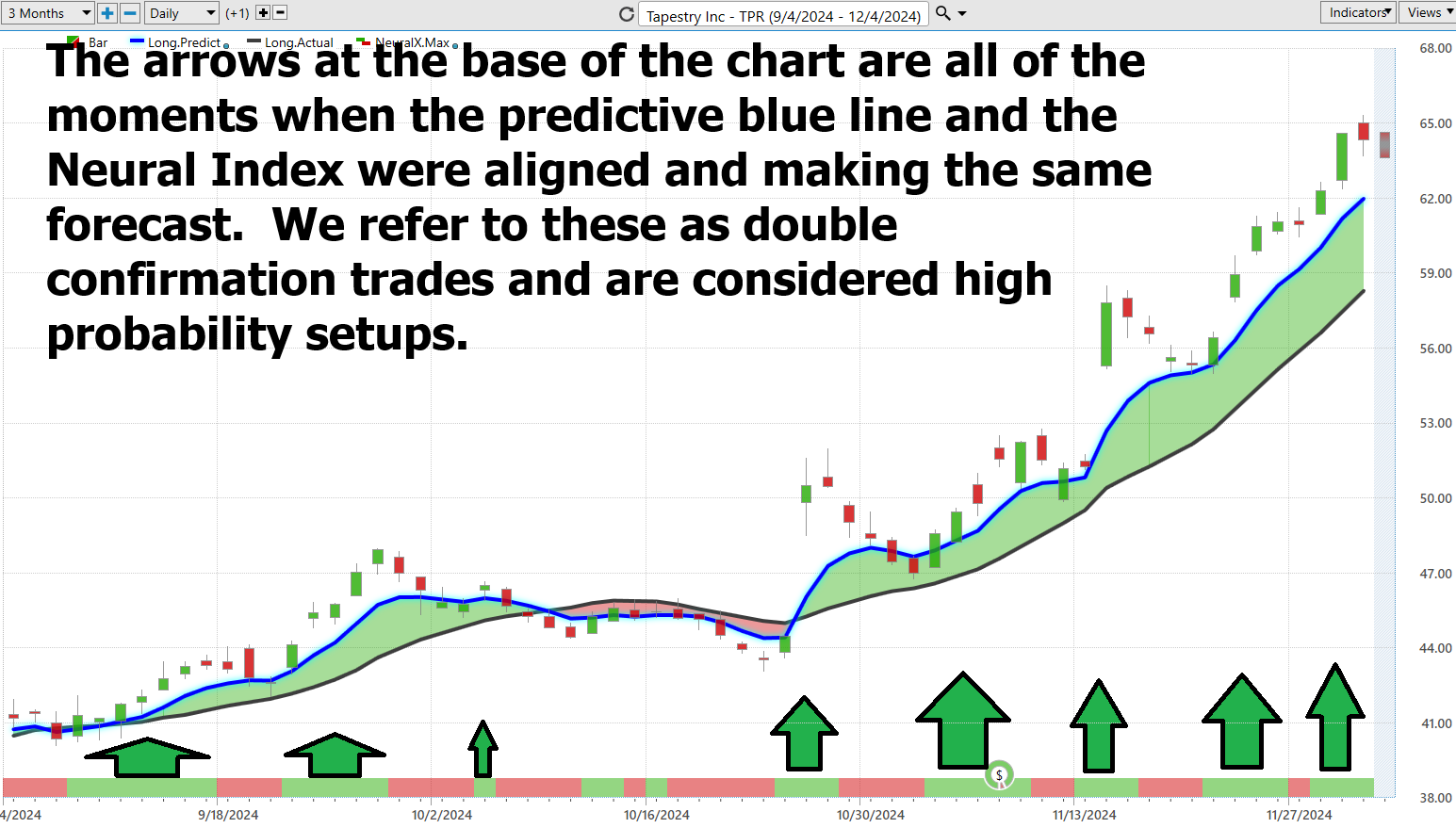

Neural Network Indicator (Machine Learning)

A Neural Network for traders is like having a trusted ninja trading advisor with superhuman intelligence working tirelessly behind the scenes. It’s a powerful system designed to analyze mountains of market data, spot hidden patterns, and deliver actionable insights with pinpoint accuracy. Think of it as cutting through the noise and guiding you toward smarter, more confident decisions.

At the heart of this technology is the Neural Index , a groundbreaking tool that delivers a short-term forecast for the next 48 to 72 hours. By analyzing intermarket relationships and leveraging the predictive power of artificial intelligence, the Neural Index highlights whether the market is likely to move up or down in the short term. It doesn’t just tell you what’s happening, it shows you what’s about to happen .

This gives traders a huge edge, helping them time their entries and exits with precision, reduce risk, and maximize profits. With the Neural Index by your side, you’re no longer. reacting to the market — you’re anticipating it, putting you ahead of the game every single day.

VantagePoint Software Daily Price Range Prediction

Let’s explore the game-changing technologies that are revolutionizing the trading world: artificial intelligence (A.I.), machine learning, and neural networks. For traders aiming to pinpoint the next day’s trading range with precision, these tools are absolute must-haves. A.I. dives deep into vast oceans of historical market data, uncovering patterns, trends, and correlations that drive price movements.

Machine learning is the master at detecting these hidden patterns, while neural networks elevate forecasting to an entirely new level. Together, they empower traders to predict future price shifts with remarkable accuracy. The real-time analysis these tools provide enables traders to stay nimble, adjusting strategies on the fly as the market evolves. Defining the trading range with precision isn’t just a luxury — it’s essential for managing risk and making smart, informed decisions.

Simply put, A.I. isn’t just a tool; it’s your competitive edge, supercharging your ability to analyze data, identify opportunities, and refine your trading strategies in today’s fast-moving markets. And the first step? Understanding real-world volatility. Here’s the average trading ranges on a daily, weekly, and monthly basis:

So, we can see regardless of your favorite time frame for trading there is plenty of profit opportunity for short term trading in $TPR.

The real challenge for traders isn’t finding data — it’s knowing how to use it in real time. Every trader’s daily battle boils down to this: identifying the perfect entry and exit points before the market moves. And that’s exactly where VantagePoint’s A.I. software becomes a game-changer.

Enter the Daily Range Forecast chart — a powerful weapon in the arsenal of short-term swing traders. This isn’t just another chart; it’s a predictive powerhouse, revealing the market’s likely path for each trading day. Think of it as your personal trading GPS, guiding you through the twists and turns of the market with precision.

In the high-stakes world of trading, accuracy isn’t optional — it’s essential. That’s why VantagePoint’s A.I., driven by cutting-edge machine learning and neural networks, delivers more than just data. It deciphers the heartbeat of the market, helping traders masterfully navigate price swings and nail their entry points with confidence. In trading, staying ahead isn’t just smart — it’s survival. And with this tool, you’ll always be one step ahead.

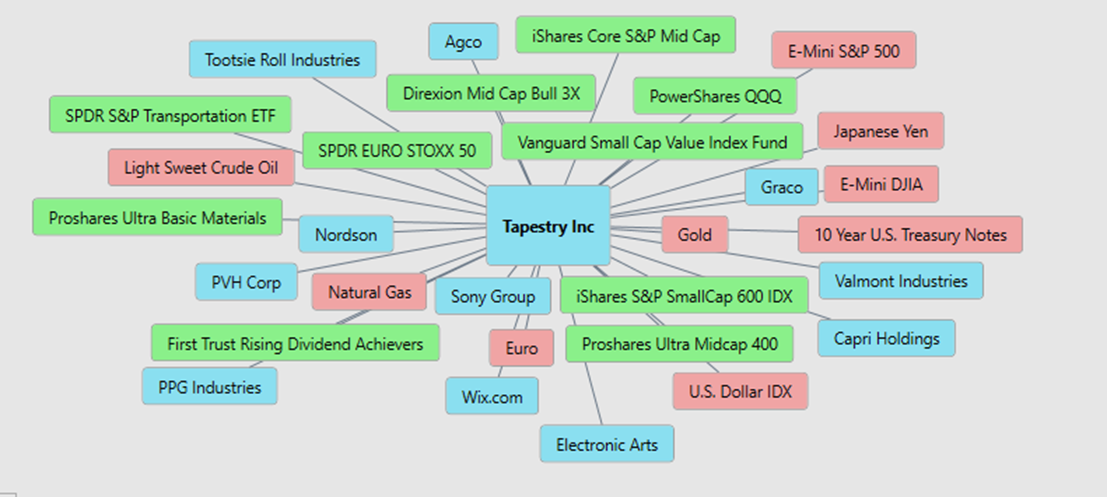

Intermarket Analysis

Intermarket analysis is the art and science of understanding how different markets interact and influence one another. It’s about connecting the dots between stocks, bonds, commodities, and currencies to uncover the relationships that drive price movements. For example, in a declining interest rate environment, investors often flock to precious metals like gold. Why? Because when financial instruments like bonds offer little to no yield, gold and related stocks become more attractive as a store of value.

By studying these interconnections, traders can gain an edge, spotting the subtle forces that impact the price of assets. For a company like Tapestry Inc. ($TPR), intermarket analysis might look at how currency fluctuations, consumer sentiment reflected in mid-cap ETFs, or rising energy prices ripple through to affect its performance. In short, this approach helps traders understand how global macroeconomic shifts create opportunities — or risks — in individual stocks.

Tapestry Inc. ($TPR) operates at the intersection of consumer discretionary spending and macroeconomic forces, making it highly sensitive to broader market trends. The interplay of key indicators such as the E-mini S&P 500 (ES), U.S. Dollar Index (DX), and energy prices shapes its price action. A strong dollar challenges international sales by reducing competitiveness abroad, while rising energy costs inflate manufacturing and logistics expenses, pressuring margins.

Intermarket analysis isn’t just about watching markets — it’s about understanding how they dance together. Imagine being able to anticipate where prices might move next, not by guessing, but by seeing the clear connections between oil, gold, bonds, and stocks. When oil prices surge, for example, it can pressure airlines while boosting energy stocks. These relationships hold the clues to smarter trading decisions.

Intermarket analysis provides traders with a powerful lens to uncover the hidden connections between financial markets—equities, bonds, commodities, and currencies. By understanding how movements in one market can ripple across others, this framework gives traders a significant edge in anticipating market shifts. Pioneers like John Murphy have demonstrated how trends in one sector often serve as early signals for changes in another, enabling traders to stay ahead of the curve.

Building on this foundation, innovators like Lou Mendelsohn have revolutionized intermarket analysis by incorporating artificial intelligence into tools like the VantagePoint software. These advancements allow traders to analyze market relationships with unparalleled precision, making it possible to navigate the complexities of modern financial markets with confidence and clarity.

In today’s hyper-connected financial world, knowing why prices change is your ticket to success. Intermarket analysis reveals the underlying forces driving market trends — whether it’s a currency shift that impacts international sales, a commodities spike that raises costs, or a bond market signal that influences risk appetite. By mastering these relationships, you’re not just trading — you’re navigating the markets with insight and confidence.

Our Suggestion

In recent earnings calls Tapestry ($TPR) highlighted robust international growth, notably in Europe and Asia, driven by increased tourist activity. However, it faced challenges in the North American market, where consumer demand remained subdued. Tapestry also emphasized its commitment to brand innovation and operational excellence, aiming to strengthen its market position amid a dynamic economic environment.

Opportunities for Tapestry include capitalizing on international market expansion and leveraging its customer engagement platform to boost global sales. The company’s focus on disciplined brand building and operational efficiency positions it to navigate current challenges effectively. However, it must address the softness in North American consumer demand and manage the complexities of a fluctuating global economy to sustain growth and profitability.

Earnings moving forward are expected to grow by 8% per year.

TPR’s next earnings call is expected on February 13, 2025. They are expected to report earnings of $1.70 per share.

Earnings will be the key catalyst moving forward.

With $TPR trading at all-time highs it deserves to be on your watchlist.

We suggest you use the daily range forecast for short-term trading opportunities.

Practice great money management on your trades.

Let’s Be Careful Out There.

It’s not magic.

It’s machine learning.

Disclaimer: THERE IS A HIGH DEGREE OF RISK INVOLVED IN TRADING. IT IS NOT PRUDENT OR ADVISABLE TO MAKE TRADING DECISIONS THAT ARE BEYOND YOUR FINANCIAL MEANS OR INVOLVE TRADING CAPITAL THAT YOU ARE NOT WILLING AND CAPABLE OF LOSING.

VANTAGEPOINT’S MARKETING CAMPAIGNS, OF ANY KIND, DO NOT CONSTITUTE TRADING ADVICE OR AN ENDORSEMENT OR RECOMMENDATION BY VANTAGEPOINT AI OR ANY ASSOCIATED AFFILIATES OF ANY TRADING METHODS, PROGRAMS, SYSTEMS OR ROUTINES. VANTAGEPOINT’S PERSONNEL ARE NOT LICENSED BROKERS OR ADVISORS AND DO NOT OFFER TRADING ADVICE.