Want to know where EUR/USD may be headed over the coming months? Explore key insights in our second-quarter forecast. Request your free trading guide now!

EUR/USD FORECAST - TECHNICAL ANALYSIS

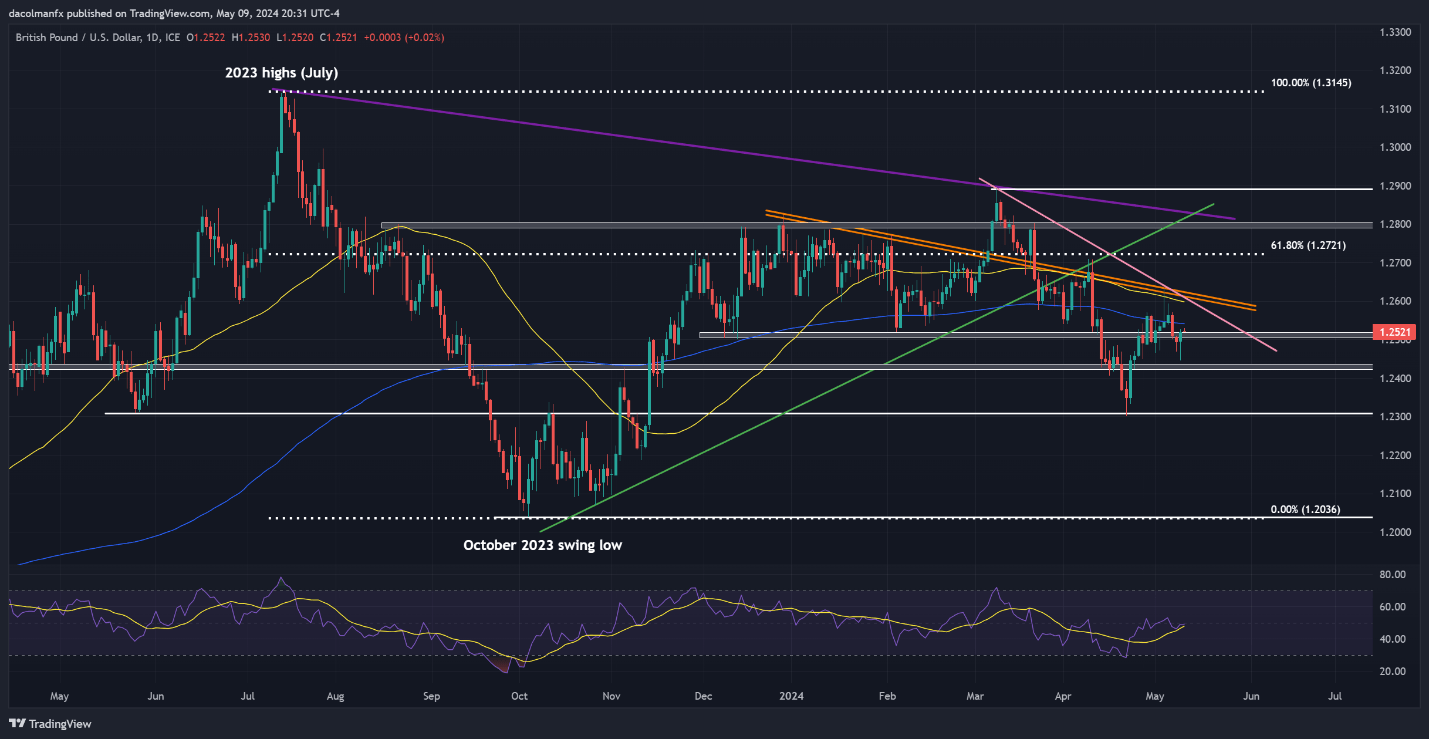

EUR / USD pushed higher on Thursday after bouncing off technical support at 1.0725, with prices challenging a key ceiling near 1.0790, where the 50-day and 200-day simple moving averages intersect. If this barrier fails to contain buyers, the next stop is likely to be trendline resistance at 1.0810. On further strength, we could see a move towards a major Fibonacci threshold at 1.0865.

Conversely, should the market undergo a reversal and pullback, initial support emerges at 1.0725, followed by 1.0695. Vigorous defense of this floor is crucial for bulls to stave off a more significant drop; failure to do so could pave the way for a descent towards 1.0645. Subsequent losses may bring into play the April lows at 1.0600.

EUR/USD PRICE ACTION CHART

EUR/USD Chart Created Using TradingView

For a complete overview of the USD/JPY ’s technical and fundamental outlook, make sure to download our complimentary quarterly forecast!

USD/JPY TECHNICAL ANALYSIS

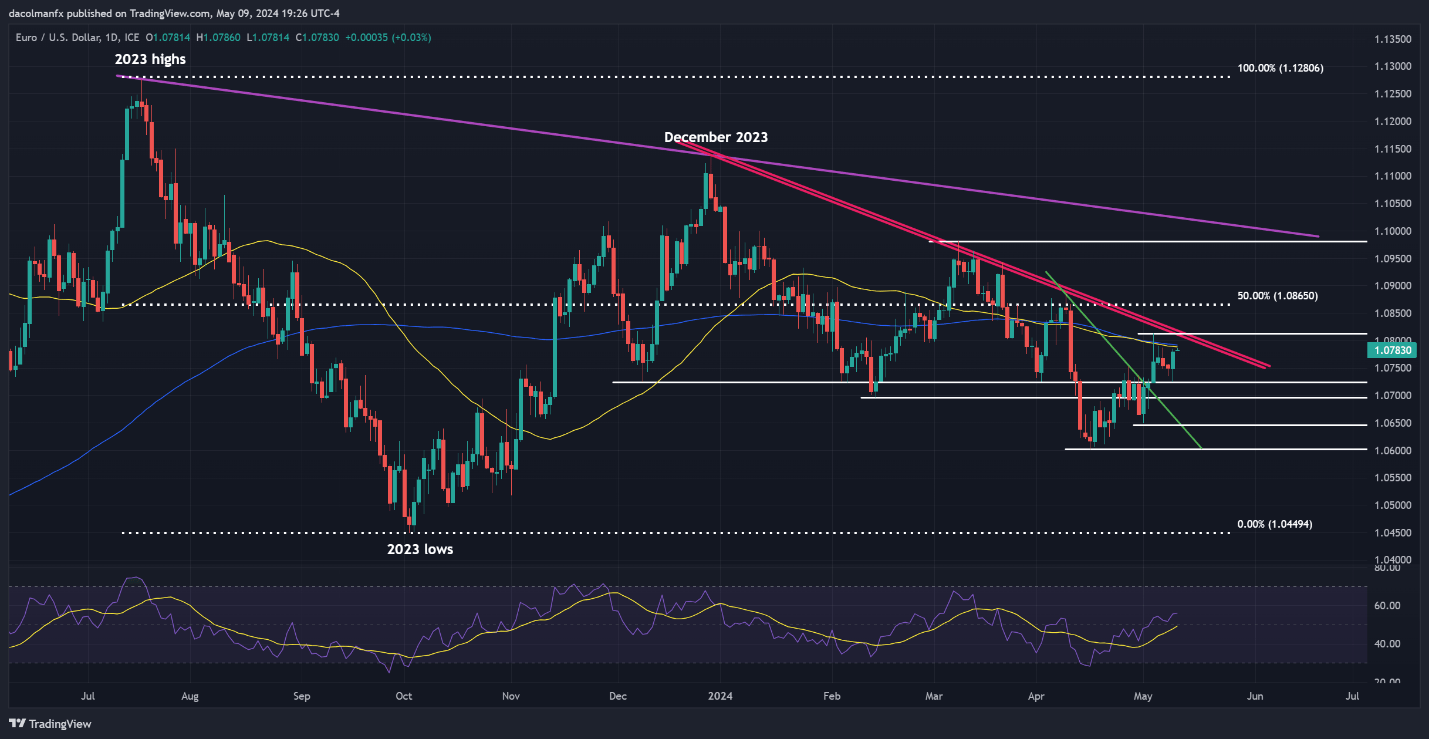

Following a robust rally earlier in the week, USD/ JPY took a breather on Thursday, displaying a lack of clear direction but maintaining a steady position above 155.00. If gains resume, resistance looms at 158.00 and 160.00 thereafter. Traders, however, must view movements towards these levels with caution, as Tokyo may step in again to support the yen, which could precipitate a swift reversal.

On the flip side, if the bullish scenario fails to materialize and prices begin to head lower, the first support to keep an eye on appears at 154.65. On continued weakness, all eyes will be on 153.15, followed by 152.30-152.00, an important technical range, where the 50-day simple moving average aligns with a medium-term ascending trendline.

USD/JPY TECHNICAL CHART

USD/JPY Chart Created Using TradingView

Interested in learning how retail positioning can offer clues about GBP/USD ’s directional bias? Our sentiment guide contains valuable insights into market psychology as a trend indicator. Download it now!

| Change in | Longs | Shorts | OI |

| Daily | -15% | 8% | -1% |

| Weekly | -10% | 9% | 2% |

GBP/USD FORECAST - TECHNICAL ANALYSIS

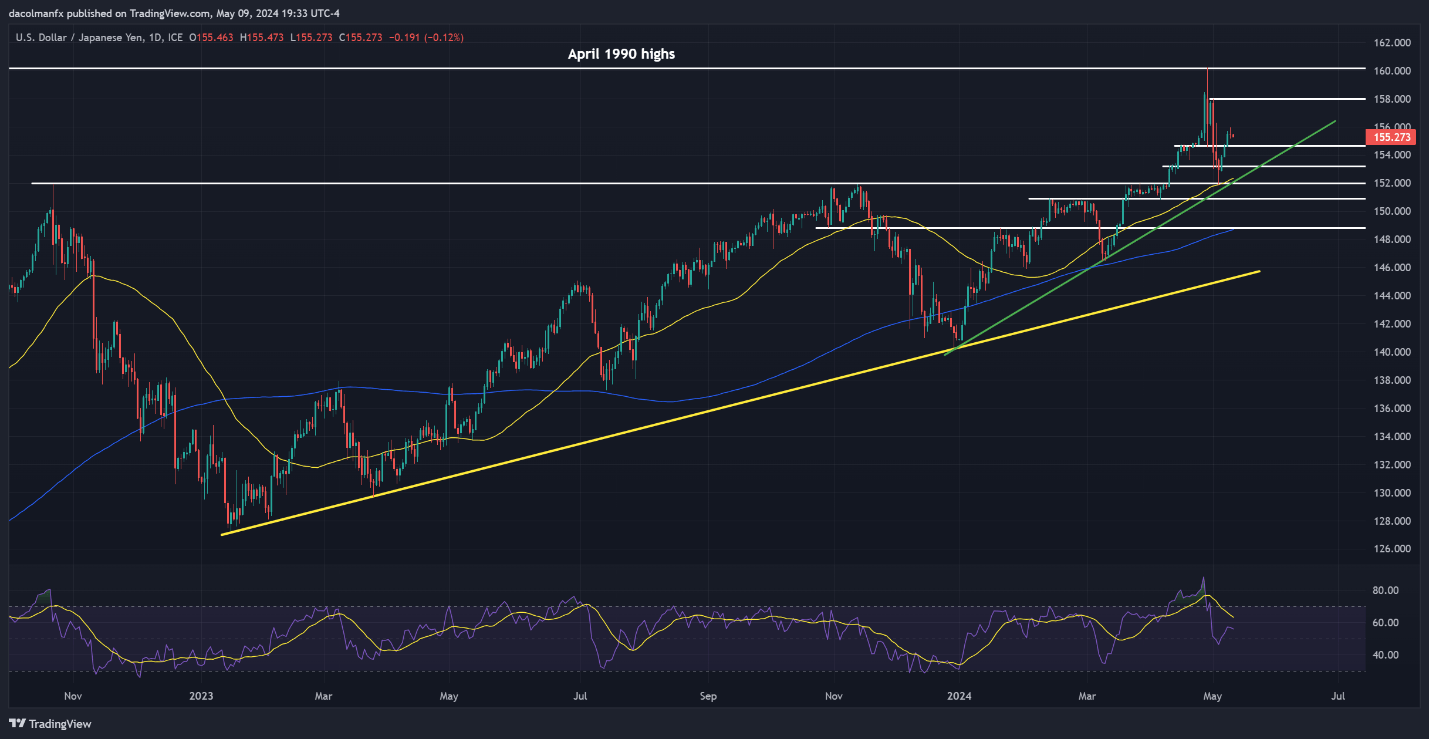

GBP /USD sold off briefly on Thursday following the Bank of England's dovish guidance at its May monetary policy meeting, but later recovered all losses and broke above the 1.2500 mark. If we see a bullish continuation in the coming days, resistance lies at 1.2540, near the 200-day simple moving average. Above that, the focus will be on the 1.2600-1.2620 range.

On the other hand, if sellers mount a comeback and drive cable lower, initial support may materialize around the 1.2500 region, followed by 1.2430. Bulls will need to defend this technical zone tooth and nail; any lapse may reinforce selling momentum, creating the right conditions for a pullback towards the April lows located around the psychological mark of 1.2300.

GBP/USD PRICE ACTION CHART