Apple earnings – what to expect?

For its fiscal second quarter (Q2), Apple is expected to report earnings per share of $1.50 and revenue of $90.04 billion. This compares to $1.88 and $117.51 respectively. for the same quarter a year earlier.

Apple earnings – what to watch?

Apple is bracing for a weak quarter in terms of iPhone sales, which the company has warned investors to expect. Sales of its flagship product have faced significant headwinds in the crucial Chinese market due to rising competition from domestic smartphone makers as well as national security concerns.

Additionally, consumers globally are holding onto their iPhone devices for longer before upgrading, further weighing on demand and sales growth . With the iPhone representing Apple's biggest revenue driver, this anticipated iPhone sales slump is expected to negatively impact the company's overall performance for the quarter.

However, Apple's continued strong profitability, fuelled by growth in its services segment and a higher mix of consumers opting for premium iPhone models like the Pro line, should help offset some of the weaker sales numbers.

While investors are anxious for updates on Apple's artificial intelligence initiatives, no major AI announcement is expected this quarter. The lack of concrete generative AI news has pressured Apple's stock recently, though the company is predicted to unveil its own premium AI offering this summer, emulating its successful "premium follower" strategy.This approach involves letting others lead the way into new markets initially, before entering later with a differentiated, higher-end product - a playbook Apple used effectively with smartphones and virtual reality headsets.

What do the brokers say?

Of the 42 brokers currently covering Apple, 26 currently have the company on a ‘buy’ rating. 14 rate it as a ‘hold’, with just two ‘sells’.

The current median target price is $200, representing an 18% upside from the stock price as of the close on 25 April.

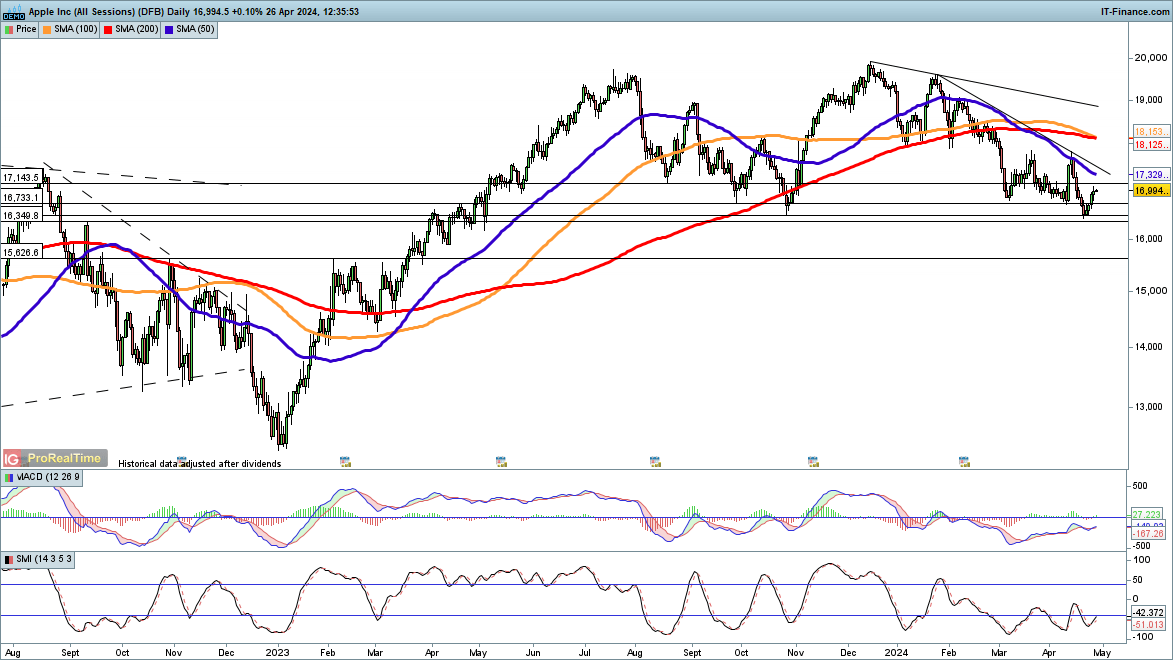

Apple stock price – technical analysis

2024 has been a grim one for Apple’s stock, which has declined sharply even while the Nasdaq 100 continued to make fresh highs in Q1.

The price has fallen from its record high in early December at $200, reaching a low of $164.08 on 19 April, a drop of 18%. However, the price closed at $164.84 low, the same level as the low hit on 26 October 2023. Since then a small rally has taken place.

In the short term, the price may head towards the declining 50-day simple moving average (SMA), that it tested earlier in the month and then fell sharply. Just above this is trendline resistance from the January lower high. A close above trendline resistance opens the way to the $178 area that marked the high in March and April.

A close below $164.08, the April low brings the September 2022 high at $163.50 into view, followed by $156.26, which marked a high in October 2022 and February 2023.

Apple price chart

(Source: IG/ProRealTime)