Gold Price Analysis and Chart

Download our brand new Q2 Gold Forecast

Most Read: Gold Breakout Nears as Bullish Pennant Pattern Forms

Wednesday’s US Services ISM data sent the US dollar lower, and gold higher, after the report showed business activity expanding in March for the 15th consecutive month but at a slower rate. The headline ISM Services PMI reading of 51.4 was lower than February’s reading of 52.6 and market expectations of a 52.7 print. As cost pressures eased, the closely followed Prices Index fell to 53.4 from 58.6 in February.

Key points from the Institute for Supply Management report include:

The Composite Index declined in March due to:

- Slower new orders growth

- Faster supplier deliveries

- Contraction in employment

The report also highlighted:

- Ongoing improvements in logistics and supply chain

- Difficulty in backfilling positions

- Controlling labor expenses

'The Prices Index reflected its lowest reading since March 2020, when the index registered 50.4 percent; however, respondents indicated that even with some prices stabilizing, inflation is still a concern.’

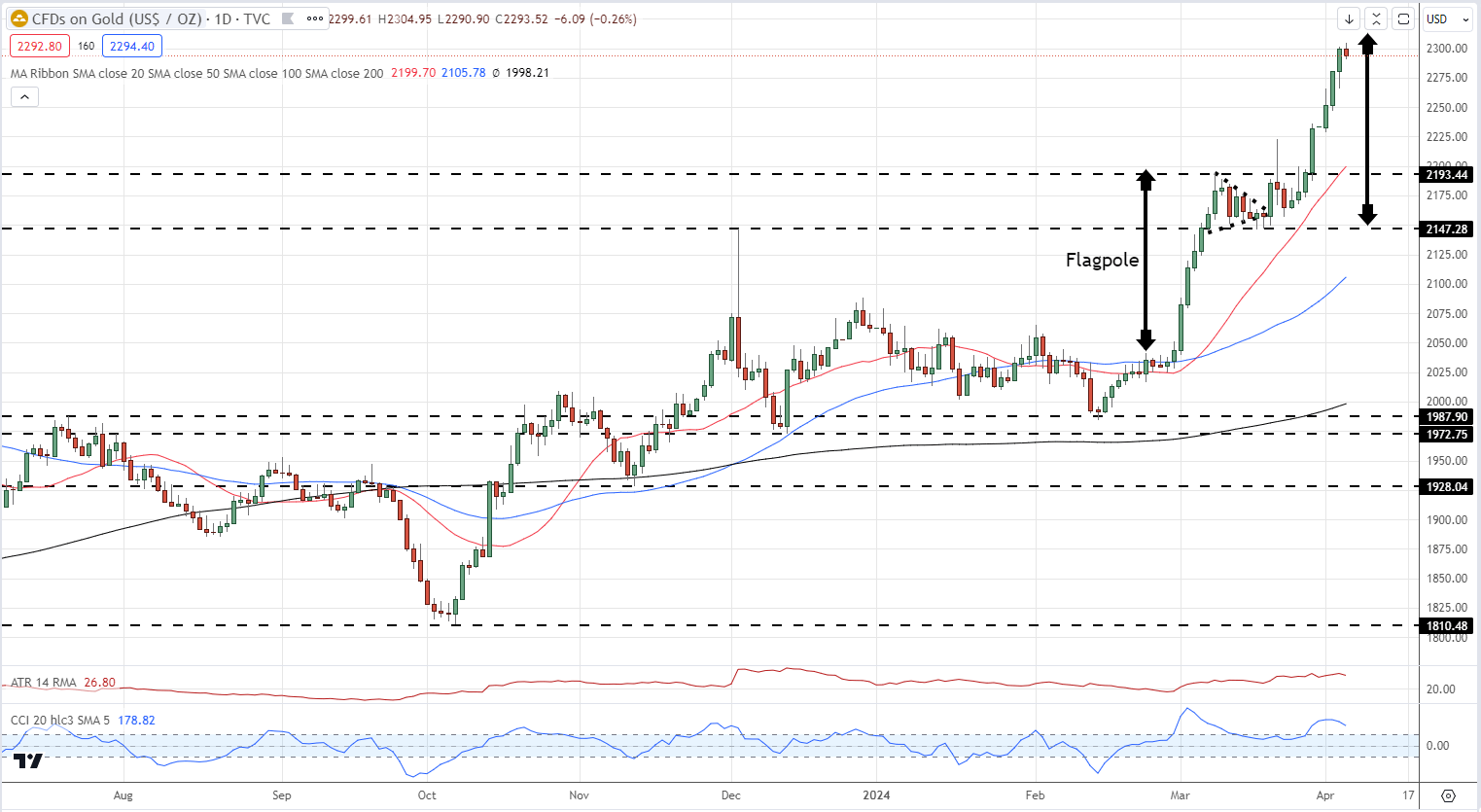

The weaker US services data and the ongoing political tensions in the Middle East combined to send gold spinning higher and to a new record high. Gold has been moving higher since mid-February with the rally being confirmed along the way by a well-known bullish pennant chart setup.

Pennant Patterns: Trading Bearish and Bullish Pennants

The flagpole of roughly $150 when added to the pennant breakout produced an upside target of around $2,300/oz. and this has now played out. Traders should be aware that Friday’s US Jobs Report can reverse some of this move, especially if NFPs show a stronger-than-expected US labor market. The first level of support is seen around the $2,194/oz. area.

Gold Daily Price Chart

Chart via TradingView

Retail trader data shows 40.90% of Gold traders are net-long with the ratio of traders short to long at 1.44 to 1.The number of traders net-long is 3.82% lower than yesterday and 6.38% lower than last week, while the number of traders net-short is 8.17% higher than yesterday and 18.05% higher than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests Gold prices may continue to rise.

| Change in | Longs | Shorts | OI |

| Daily | 7% | -7% | 0% |

| Weekly | 16% | -17% | -3% |