Gold (XAU/USD) News and Analysis

- Geopolitical tensions add to gold ’s allure despite rise in the dollar, US yields

- Gold breaks another all-time high with the psychological $2300 marker in sight

- See what our analysts foresee for gold in the second quarter by reading our fresh Q2 Gold Forecast:

Geopolitical Tensions Rise in Eastern Europe and the Middle East

In a concerted effort to cut off the Kremlin’s main source of funding for the war, Ukraine has been targeting oil infrastructure in Russia to the displeasure of US president Joe Biden, who says it could have far reaching consequences to global oil prices .

The most recent attack took place 1,300 kilometers from the front lines and involved one of Russia’s largest oil refineries. The damage is being reported as ‘not significant’ but will keep Russia on high alert to guard its main source of financing.

Additionally, a targeted attack on the Iranian embassy in Damascus resulted in the death of high-ranking commanders of Iran’s Revolutionary Guard. Iran vowed to respond, seeking “punishment and revenge”. This is the latest escalation that risks seeing Iran enter the conflict in a more direct manner. Thus far Iran’s involvement has mainly been as financier of the Lebanese militant group Hamas.

Both escalations only serve to support the recent gold surge – helping the safe haven metal surge to another all-time high.

Gold prices are heavily influenced by fundamental factors like demand and supply, as well as geopolitical tensions. learn the essentials that all gold traders should know:

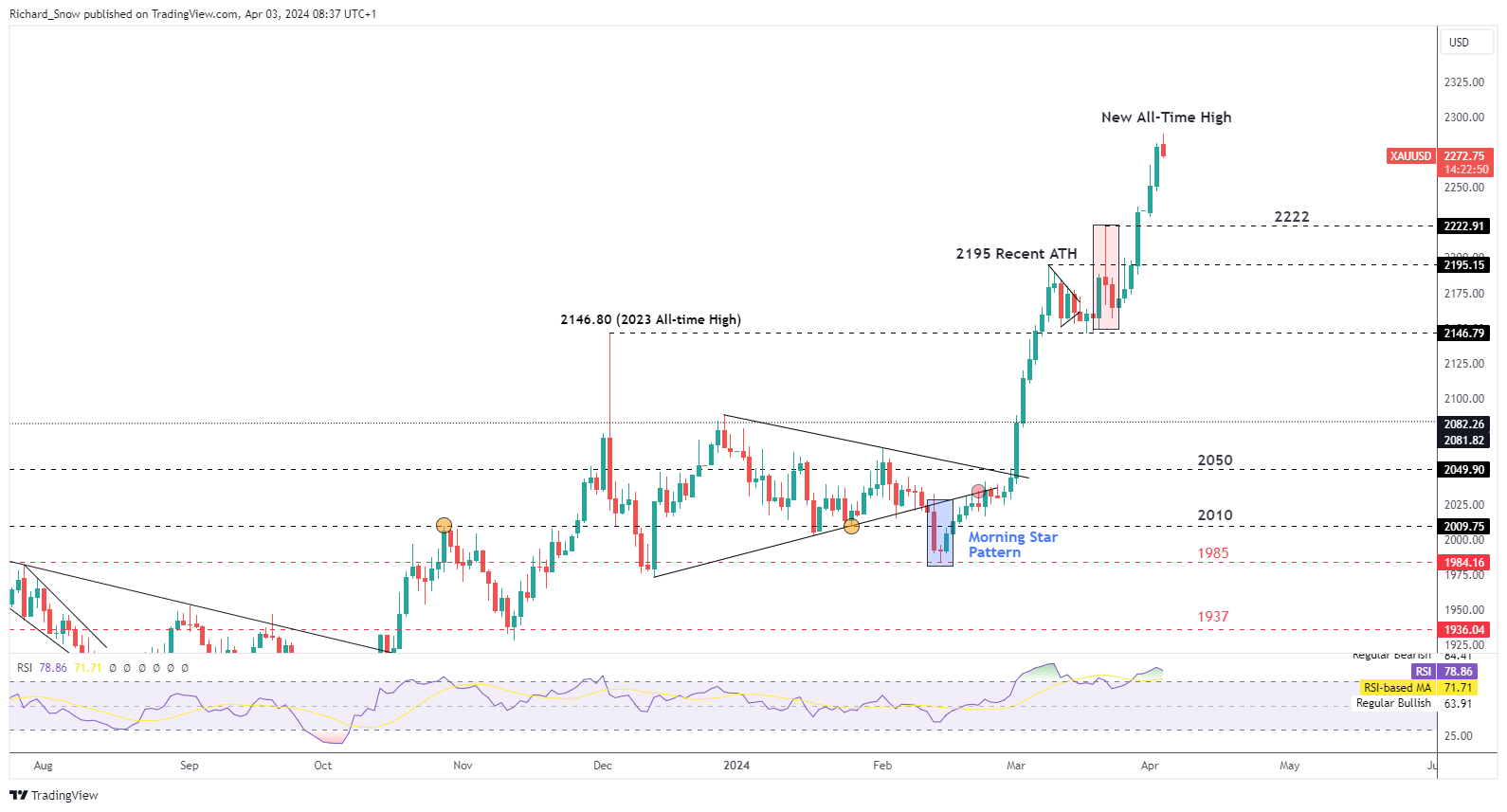

Gold Reaches Another All-Time High with $2300 Resistance Ahead

Gold’s rise has been nothing short of astonishing, showing little regard for the rising dollar and the shorter-term lift in US yields after inflation data failed to show solid progress on Friday.

The bullish move remained in the works as long as prices could hold support at the prior 2023 high of $2146.80. Signs of a bearish pullback emerged but ultimately failed as the safe haven metal surged higher. Central banks have been purchasing the metal, most notably the People’s Bank of China, despite month-on-month purchases dropping in February. Chinese citizens are also piling into gold as a way to combat a beleaguered property sector and a weakening currency, as well as the growing trend of protectionism and the move away from globalization.

The $2300 mark serves as the next significant level of resistance but intra-day price action has retreated from the high. Gold remains well into overbought territory, threatening a pullback after a meteoric rise. The prior high of $2222 serves as the next level of support and helps to keep the bullish outlook constructive.

Gold Daily Chart

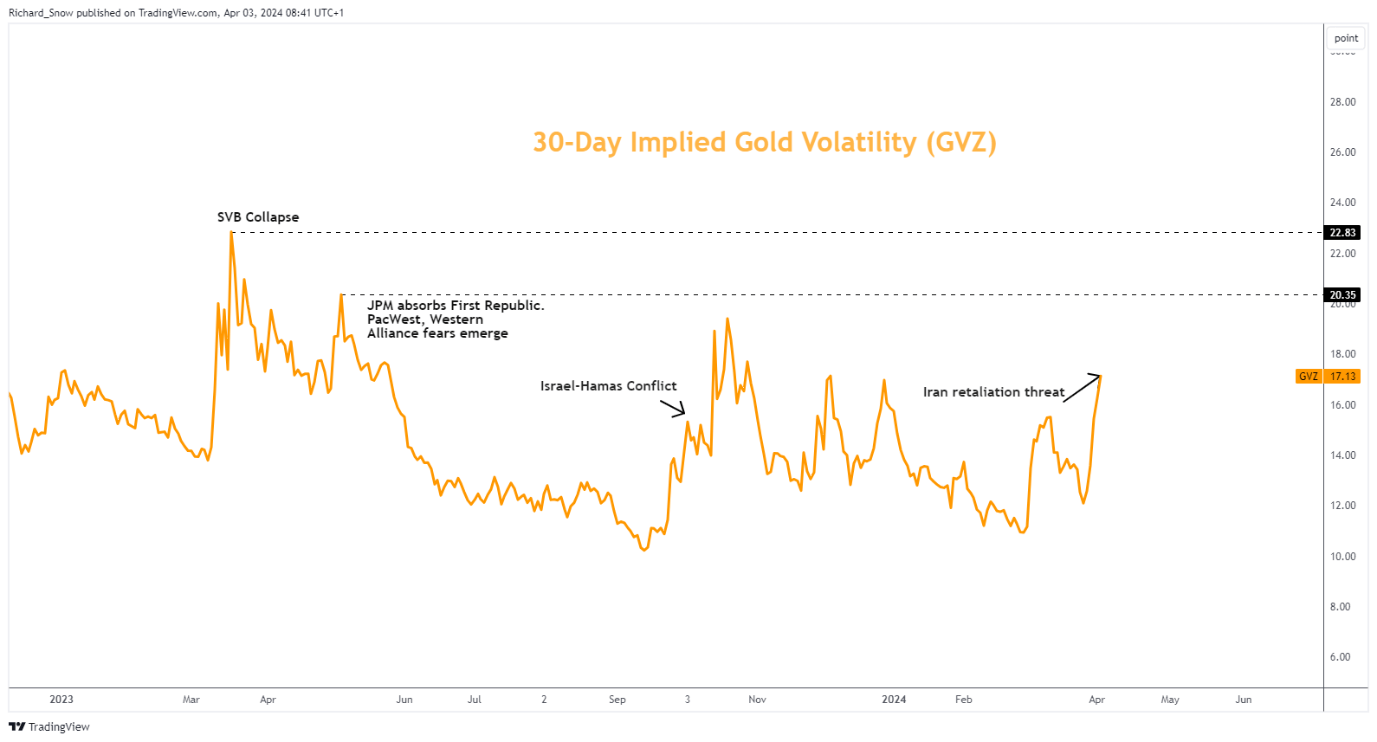

Gold volatility had perked up in recent days and weeks as central banks bid up the price of the metal at a time when they are seriously considering interest rate cuts – something that makes the non-yielding metal more appealing. However, a hot US economy suggests such rate cuts are likely to be delayed. The next indicators of US economic performance emerge later today with the services PMI print and Friday’s jobs numbers.

Gold 30-Day Implied Volatility