The Bank of England (BoE) turned dovish in the past few days and this means that a UK interest rate cutting cycle is on the way, and perhaps sooner than financial markets originally anticipated.

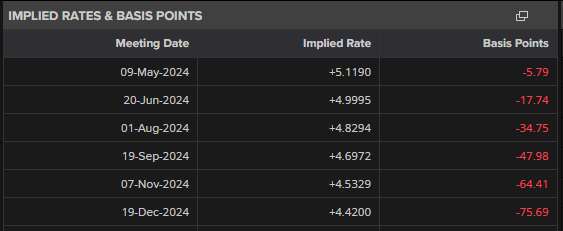

BoE Governor Andrew Bailey recently communicated that UK interest rate cuts are on the way as inflation continues to fall towards the central bank’s target. Asked recently if current market rate cut expectations are realistic, Governor Bailey not only said that current rate expectation curve looks reasonable, but also added that ‘all our meetings are in play…we take a fresh decision every time.’ This last comment means that the May 9th meeting must now be treated as live, even though market pricing is showing the June 20th meeting as the most likely starting date for UK rate cuts. Financial markets are currently pricing-in just 6 basis points of cuts at the May meeting, although these implied rates can change quickly.

Ready to maximize your trading potential in Q2? Dive into our curated list of top trading ideas with our complimentary guide – available for download now!

Implied Rates & Basis points

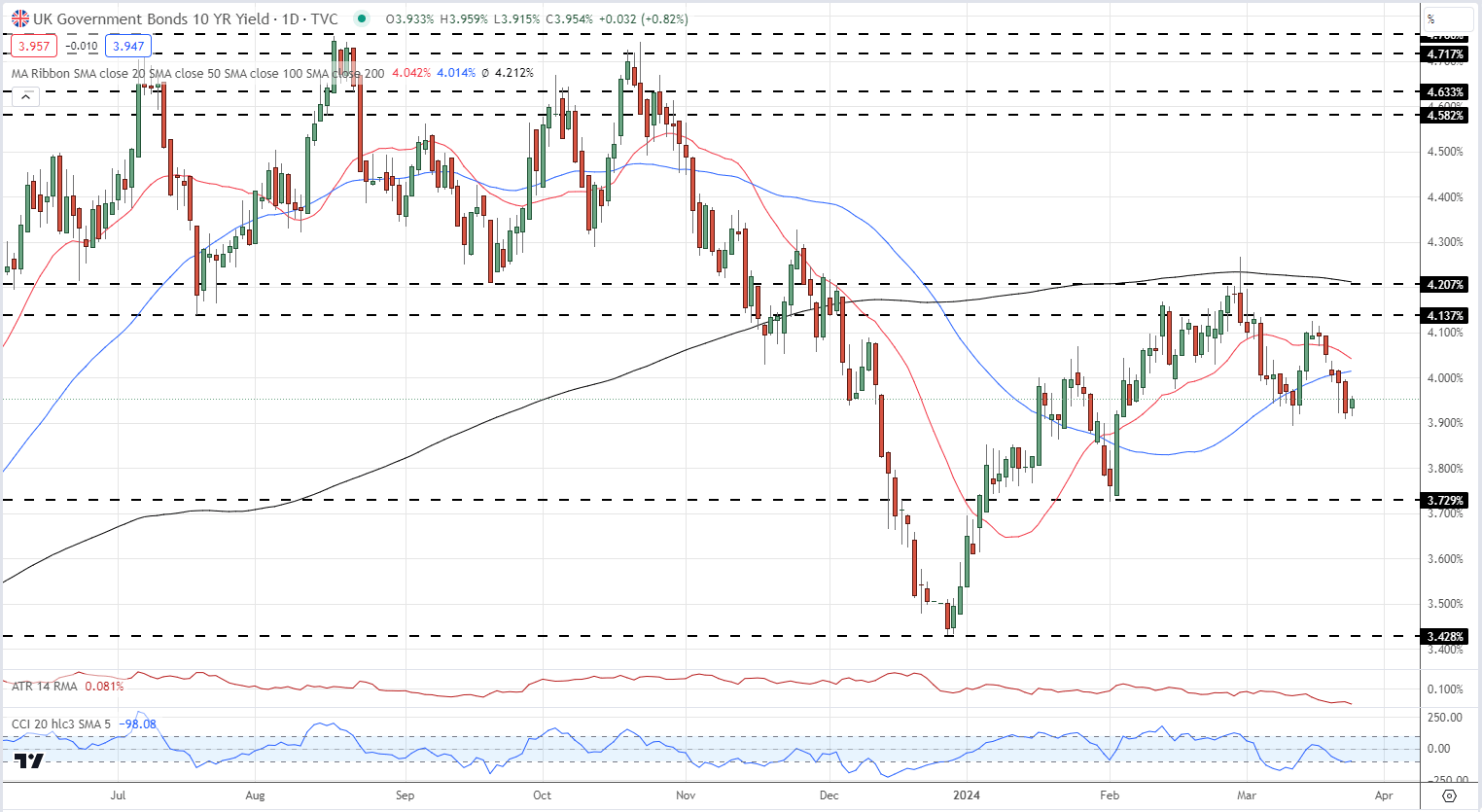

From a technical angle, 10 year UK Gilt yields now look bearish after having fallen through the 20- and 50-day simple moving averages. A series of higher highs off the December low has been broken, while a trade below 3.89% will also negate the recent trend of higher lows. The next target is 3.73% followed by a longer-term target at 3.43%. Any move higher in yields will find stiff resistance between 4.13% and 4.20%, and unless there is a sudden change in UK macro policy, these levels will prove difficult to clear. The CCI indicator suggests that UK 10 year Gilt yields are oversold and so this reading needs to be negated in the near-term to allow yields to fall further over the coming weeks.

Fine-tune your trading skills and stay proactive in your approach. Request the pound forecast for an in-depth analysis of the sterling’s fundamental and technical outlook.

10 Year UK Gilt Yield Daily Chart

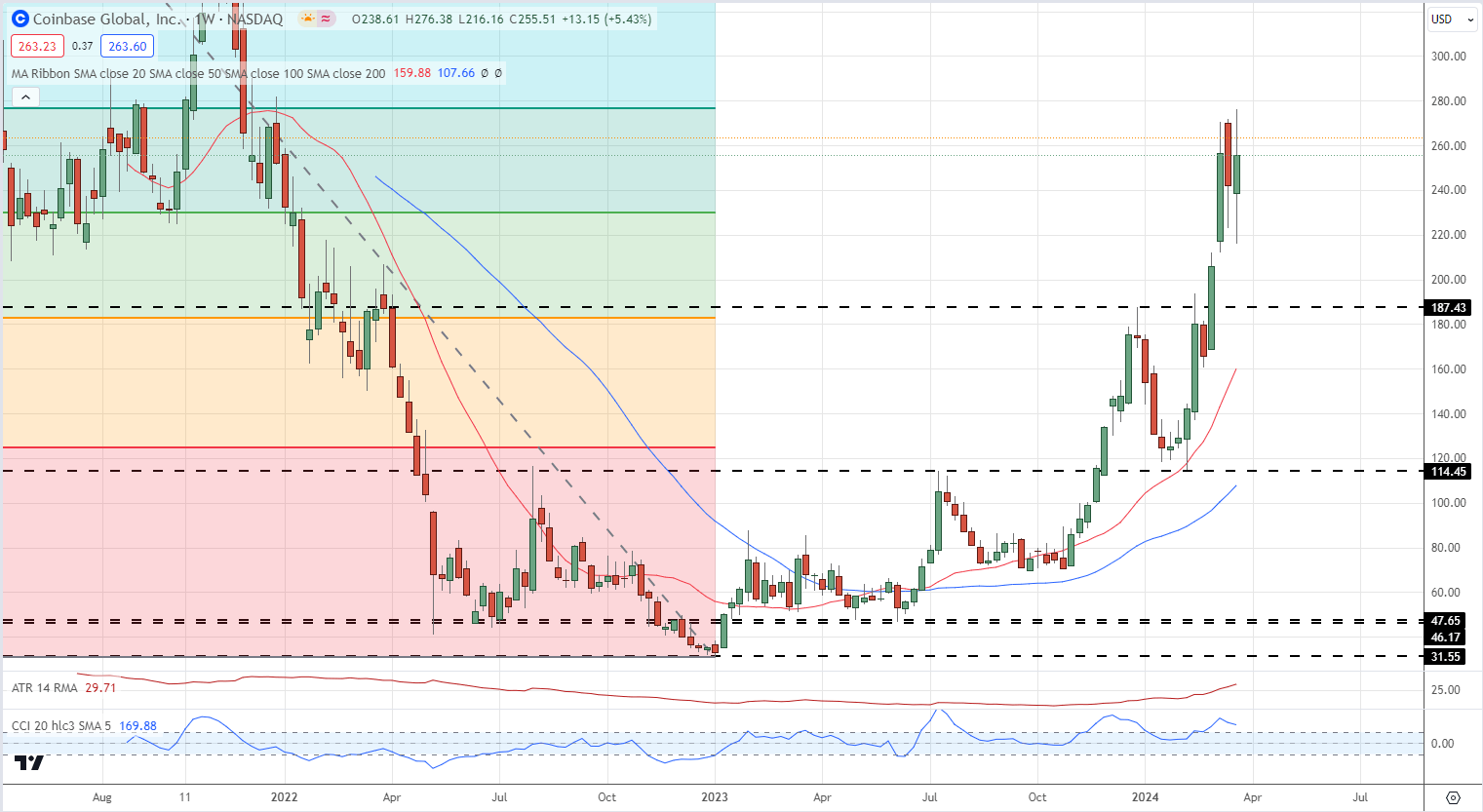

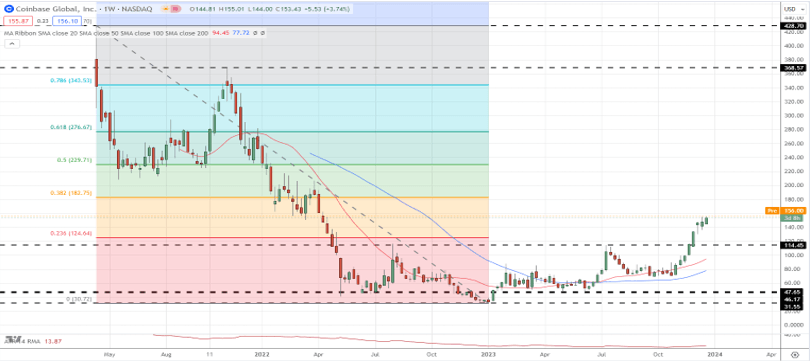

Q1 Trade Recap – Buy Coinbase (COIN)

My Q1 trade was long Coinbase, and despite a small sell-off in January, this has performed strongly and is at, or very close, to our secondary target ($278). While this trade like it may have more to go, partial profit-taking or a moving stop loss should be considered to consolidate Q1 gains.

Previous Quarter Coinbase Weekly Chart

Current Coinbase Weekly Chart