This article is dedicated to providing a detailed analysis of the technical outlook for Bitcoin , Ethereum , and Solana. For those interested in delving into the fundamental prospects of key cryptocurrencies, be sure to download our comprehensive Q2 trading guide!

Bitcoin, Ethereum, and Solana Technical Analysis

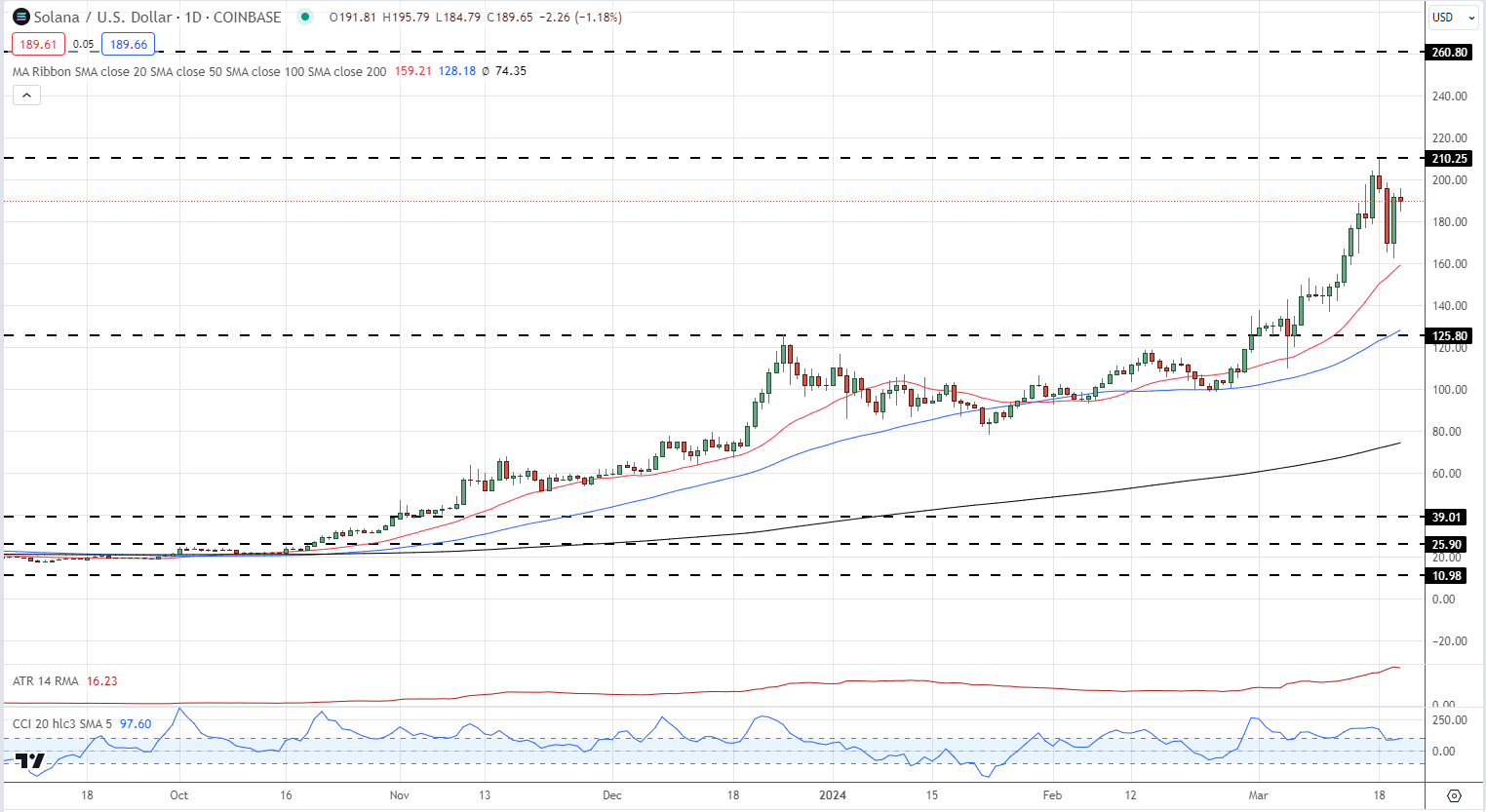

The technical outlook for Bitcoin, and Ethereum, looks positive but with bouts of volatility expected in the coming months. The positive drivers – described in the Fundamental Outlook – drove BTC/ USD to a fresh high in mid-March before a small retracement drove Bitcoin back to its previous ATH. Looking at the daily chart, Bitcoin looks set to press higher over the coming weeks with the current spot price above all three simple moving averages – just in the case of the 20-day sma – while the CCI indicator shows BTC/USD as oversold. The Average True Range (ATR) indicator is at levels last seen in mid-2021 and highlights the current level of volatility in the space. Bitcoin is set to move higher but sharp downturns along the way are to be expected.

Bitcoin Daily Price Chart

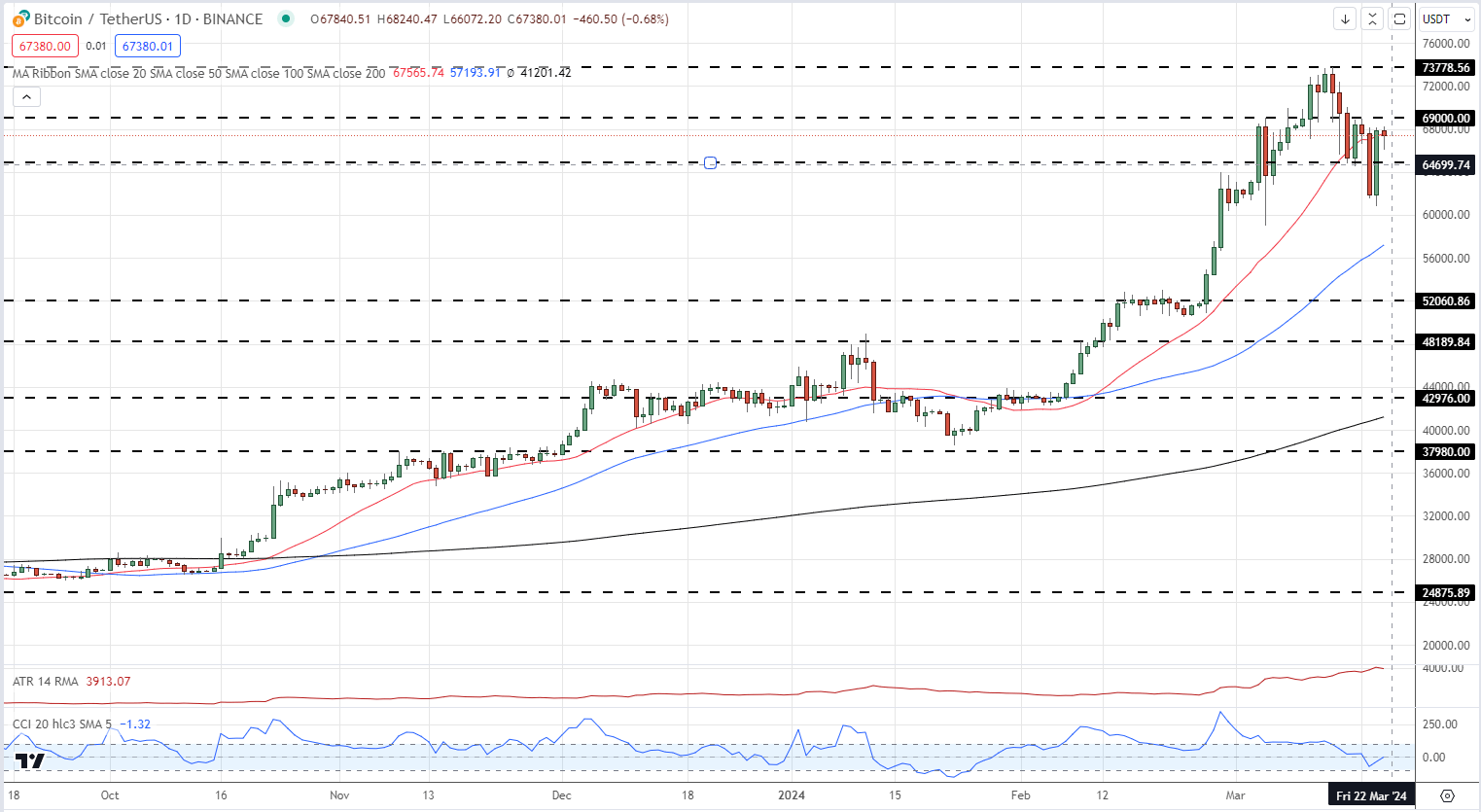

The Q2 outlook for Ethereum also looks positive, with a very similar daily chart to Bitcoin. While Bitcoin has made a fresh all-time high this year, Ethereum is still a way below the November 2021 ATH at $4,860. The recent triple-top at just under $4,100 is the next upside target and if this is broken then $4,400 and the November 2021 ATH will come into play. Ethereum is currently oversold, using the CCI indicator, and volatility is at multi-month high levels. A fresh all-time high may prove difficult in the second quarter but a pushback above $4k looks likely for Ethereum.

Ethereum Daily Price Chart

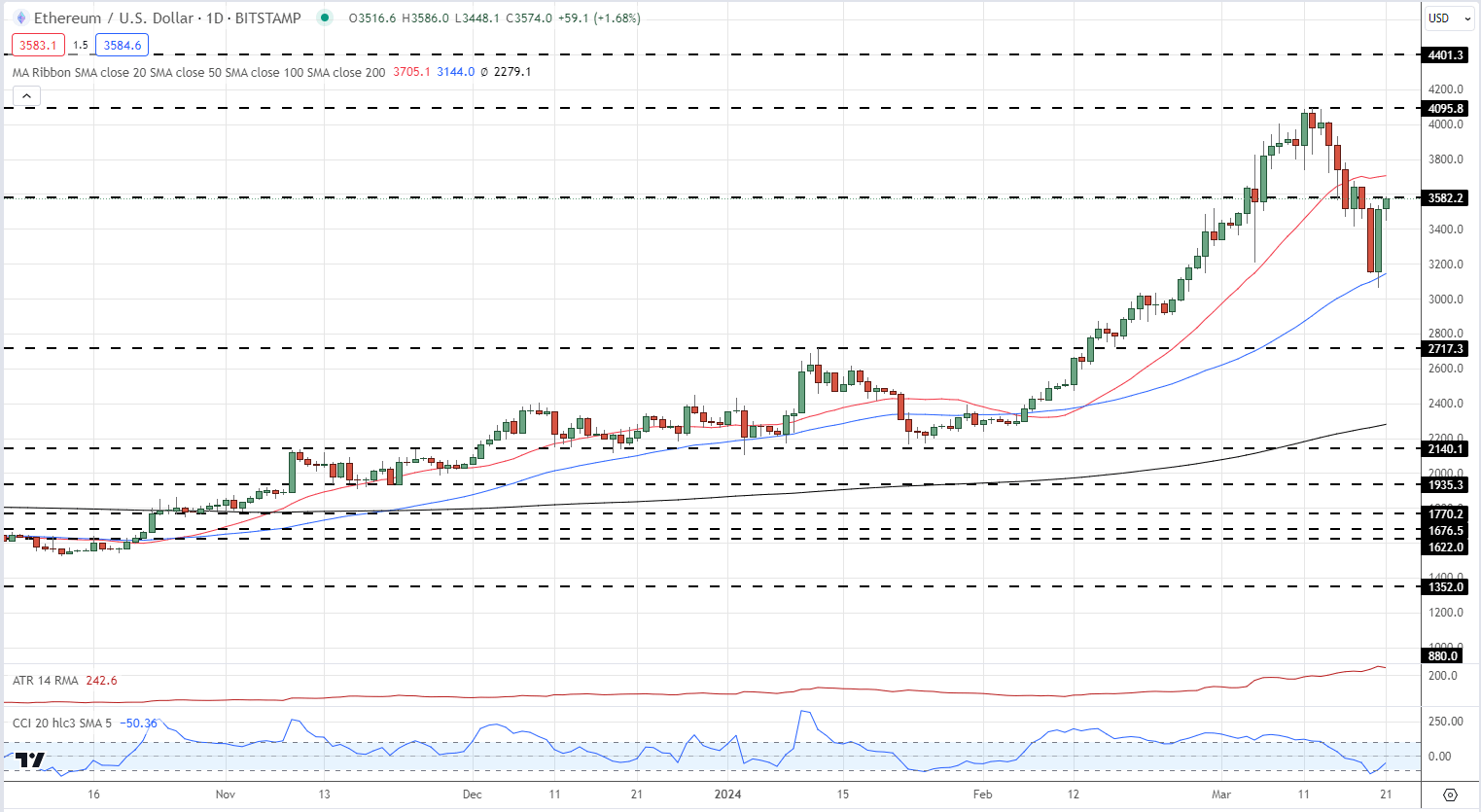

Solana traders have had a wild ride of late with the L1 coin rallying from the mid-teens in September 2023 to a recent $210 high. Increased Solana network activity due to renewed market enthusiasm for a range of meme coins has boosted the Solana share price by nearly 10x in six months. Interest for Solana remains high in the current market, and this should see the recent $210 high re-taken in the coming weeks. The all-time high around $260 may prove trickier in the coming quarter, although bullish traders will point to Solana being above all three simple moving averages.

Solana Daily Price Chart