Q1 Review and the Fed Maintains its Outlook on Interest Rates

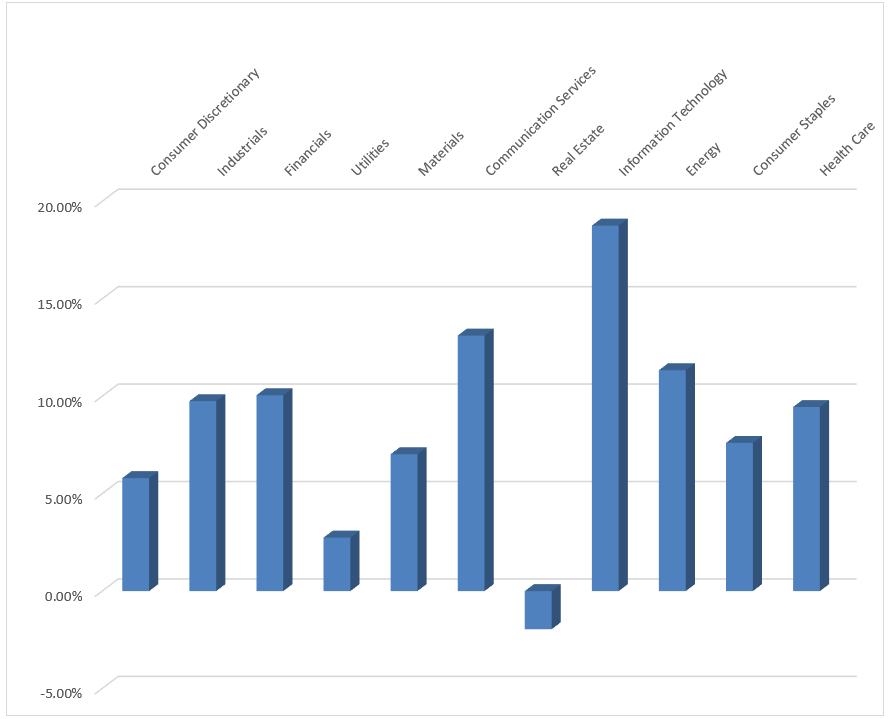

Q1 2024 has US indices setting new all-time highs as the AI hype skyrocketed a handful of AI stocks to dizzying heights, but gains weren’t just limited to your ‘mega cap’ stocks as the majority of US sectors witnessed gains. The graph below shows the widespread performance for each sector for the S&P 500 up until the time of writing (19 March). The only sector failing to advance was the real estate sector.

Graph 1: S&P 500 Sector Performance Q1

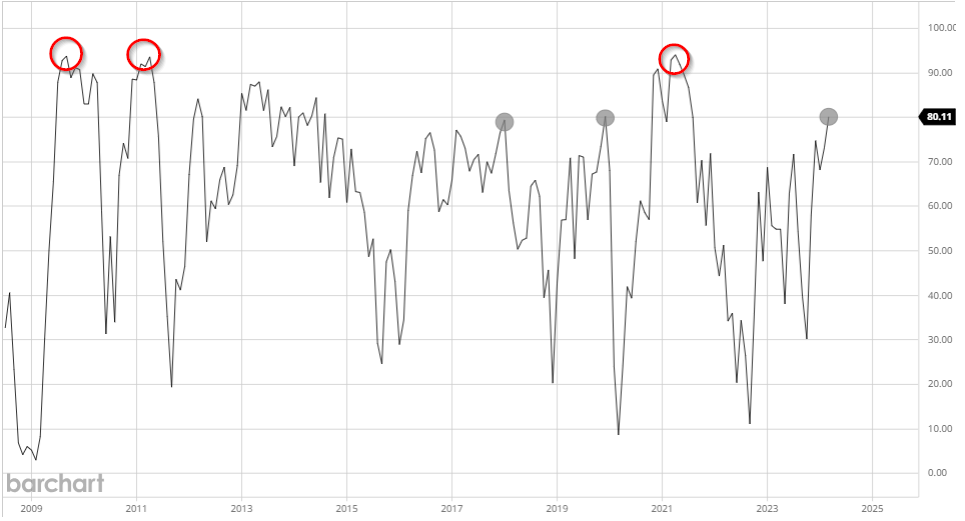

A greater percentage of S&P 500 stocks benefitted from the bull market in Q1. Over 80% of the index traded above their respective 200-day simple moving averages. Looking at the graph below, it is clear to see that when the equity rallies have been fruitful for so many, a turn in fortunes was never too far away. Prior turning points around the 80% mark are highlighted in grey, while even more inclusive rallies registering over 90% also witnessed sharp drops in the moments that followed.

However, markets and the Fed are optimistic of guiding the economy to a soft landing when they dial back interest rates later this year, potentially as soon as June but robust data favours July based on current implied probabilities.

Graph 2: Percentage of Stocks Within the S&P 500 Trading Above Their 200 SMAs

Will the Fed Keep the Party Going?

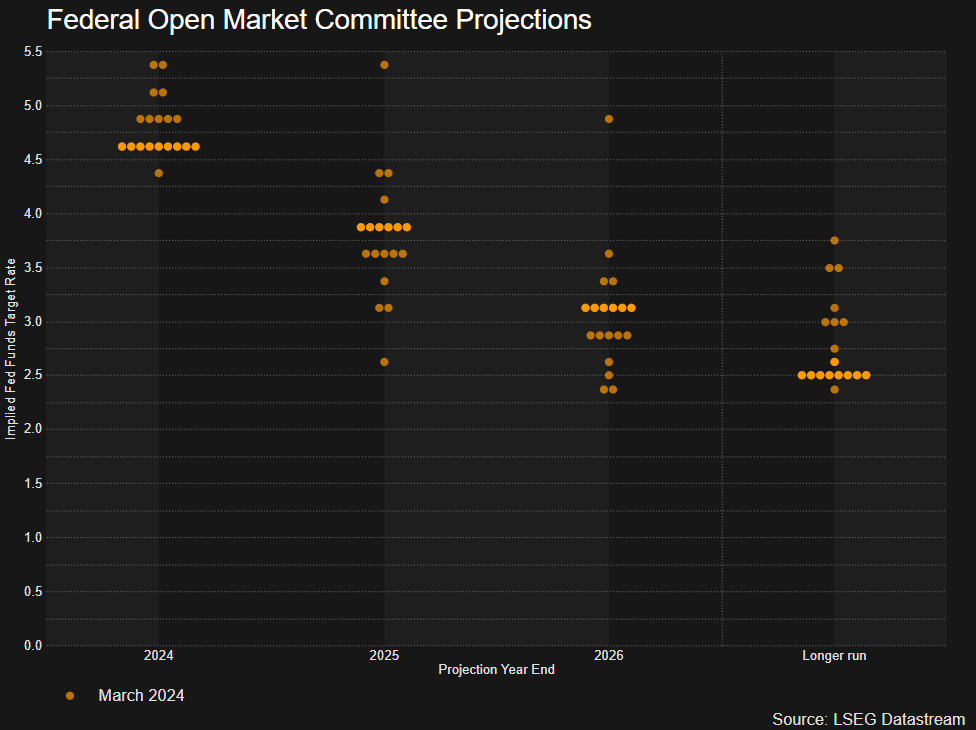

The Fed met in March and provided an updated version of its summary of economic projections for 2024, 2025, 2026 and the ‘long-run’. Officials narrowly maintained its view that the FOMC will cut the Fed funds rate three times this year, which would leave the Fed funds rate between 4.5% and 4.75%. On the balance of probabilities this appears reasonable but at the end of last year markets had anticipated the possibility of seven cuts into year end.

More notably, US growth for 2024 was revised significantly higher, from 1.4% to 2.1%, as was inflation . The upward revisions may place a floor beneath US rates moving forward as the ‘neutral rate’ is anticipated to have shifted higher.

Graph 3: Fed Dot Plot (March 2024)

A robust economy and resilient labour market could stay the Fed’s hand but equity markets appear impervious to elevated interest rates in the wake of the AI boom. As long as the labour market avoids a sharp deterioration, the status quo appears to remain intact. Consumer confidence appears to be driven by broad job security which supports healthy levels of retail spending and consumption. Global Demand for generative AI and large language models are unlikely to fade, and in contrast, is more likely to accelerate. US chip makers are likely to lead from the front in Q2 as they did in the first quarter.

Having a thorough understanding of the fundamentals impacting US equities in Q2, why not see what the technical setup suggests?

Risk Sentiment and Broader Momentum Advances at Pace

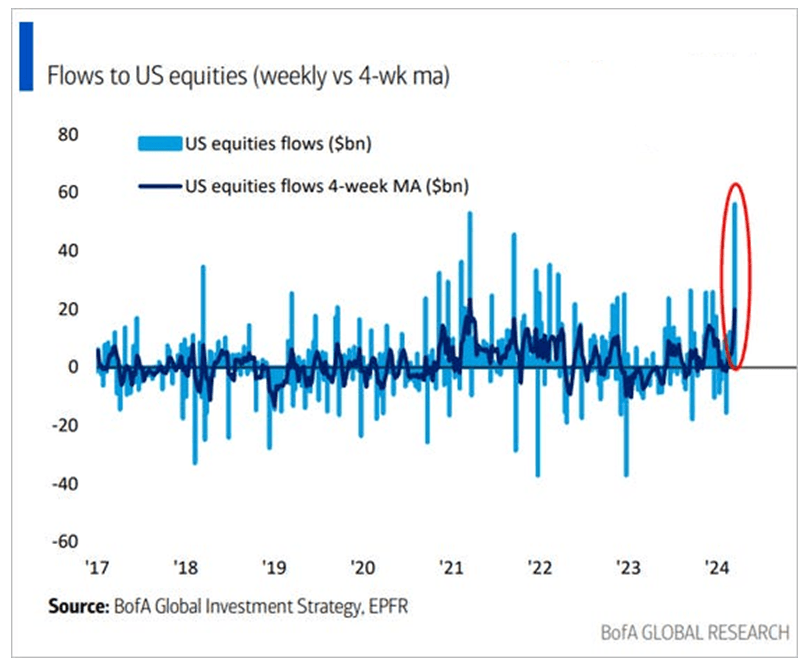

The appetite for riskier assets like stocks has accelerated and according to the Bank of America, $56.1 billion made its way into US equity funds in the week to March 13th, beating the previous record of $53 billion in March 2021. Technology funds unsurprisingly also hit a record of $22 billion over the same period.

Graph 4: Record Flows into US Equity Funds in March

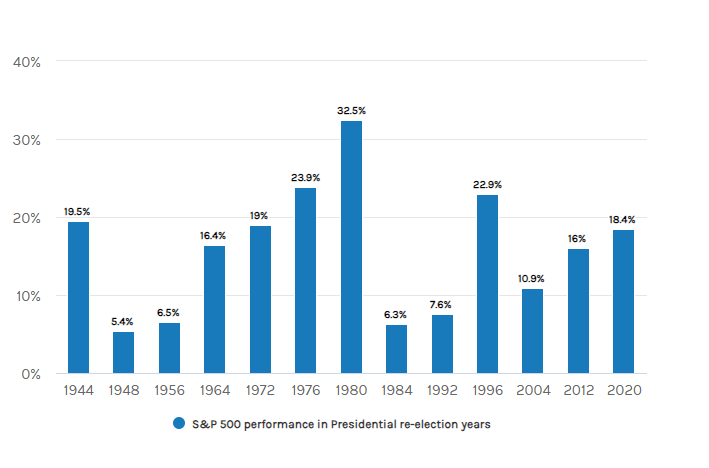

Markets are naturally forward-looking in nature which has seen stocks benefit from rising anticipation of that all important first rate cut , even if it gets delayed somewhat. Furthermore, stocks may continue to receive a boost for FY 2024 due to it being an election year.

The S&P 500 has posted some outstanding performances in election years where the sitting president is running for re-election. Since 1944, no election year where the head of state ran for re-election saw a downturn in the benchmark index – only positive returns and some really impressive years too.

Graph 5: S&P 500 Performance in Presidential Re-Election Years

Risks to the Bullish Outlook: Jobs, Credit Defaults, Geopolitics, and Inflation

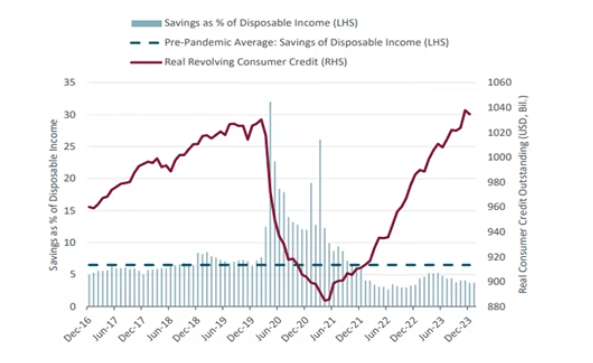

As mentioned previously, the strong jobs market is helping spur on the US economic machine but consumer savings profiles have changed for the worse. Stored up savings from stimulus checks have been drawn down but consumption remains high. This means consumption is being financed using credit that attracts high interest rates, a pattern that personal credit card data confirms below.

While it’s true that credit spending adjusted for inflation remains below that seen in 2008, high interest payments on growing balances eat away at household budgets. Savings, as a percentage of disposable income also remains below the pre- pandemic level. US households accumulated over $1 trillion worth of credit card debt in 2023. In theory, high interest rates and higher general prices ought to see less spending but a sharp drop in employment is more likely to hit consumer confidence and curtail spending which impacts company profits and reduces the need for hiring.

Graph 6: Excess Savings and Consumer Credit

Looking for actionable trading ideas? Download our top trading opportunities guide packed with insightful tips for the second quarter!

Geopolitics is a word that has been thrown around for some time now and with two major conflicts underway, the potential for new conflicts remain. Wars and economic sanctions can have a massive effect on supply chains and has the potential to impact risk appetite which could weigh on US and global equities. Another potential challenge to equity bulls is the potential for inflation to rear its ugly head as energy prices moved higher at the end of Q1 and the US experienced higher-than-expected inflation data (in some form or another) this year thus far.

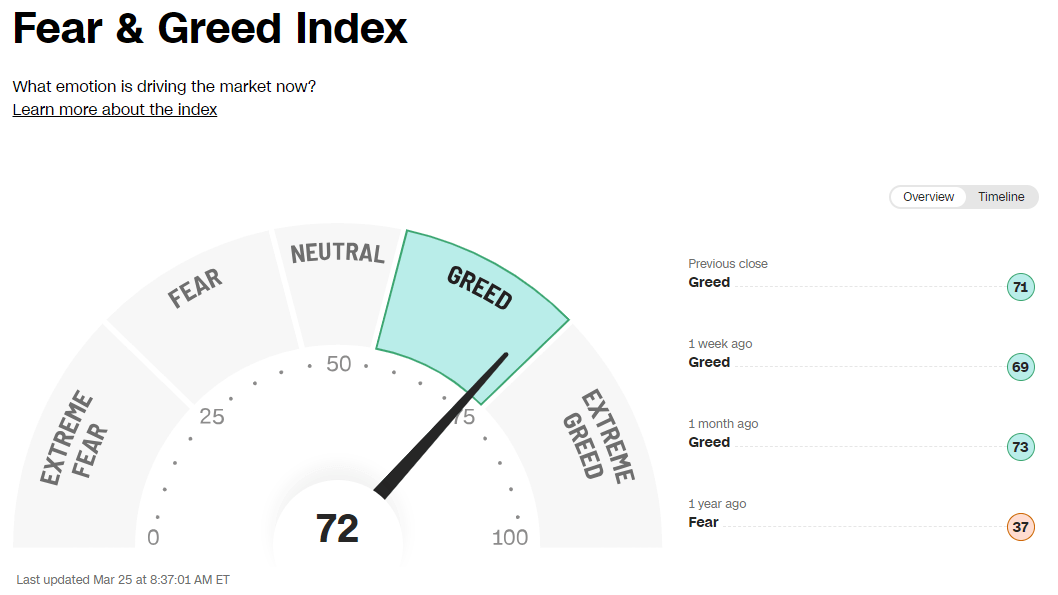

Lastly, contrarian indicators like the CNN’s Fear and Greed Index has remained at extreme levels (greed) for some time. In previous cases when markets were spurred on by greed or FOMO, a turning point eventually reveals itself. More recently the gauge has remained elevated with the S&P 500 continuing to rise unabated.

Image 1: CNN Fear and Greed Index

Source: CNN Business

Stay up to date with breaking news and market themes currently driving the market by signing up to 's weekly newsletter:

Trade Smarter - Sign up for the Newsletter

Receive timely and compelling market commentary from the team