Pound Sterling (GBP) Analysis

- ONS confirms UK technical recession after final data print

- EUR/GBP heads lower, back into the prior trading range

- GBP/USD attempts to lift off of channel support

- Get your hands on the brand new Pound Sterling Q2 outlook today for exclusive insights into key market catalysts that should be on every trader's radar:

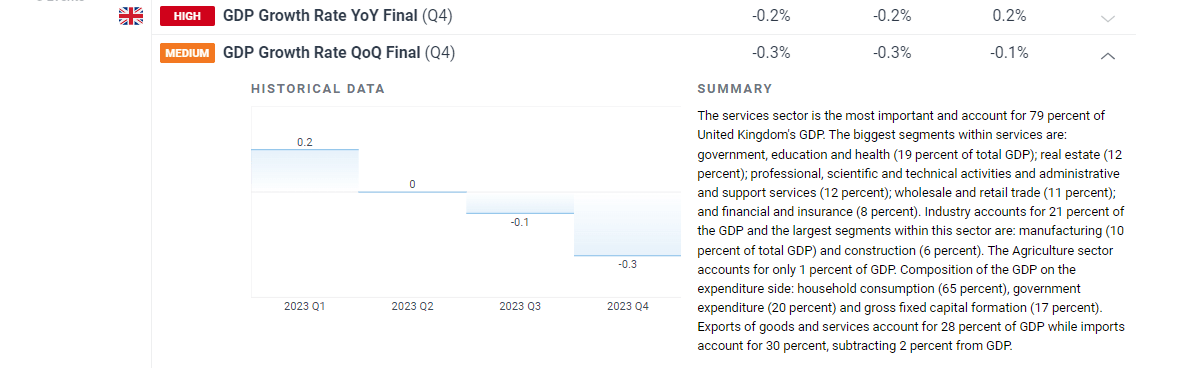

ONS Confirms UK Technical Recession after Final Data Print

The Office for National Statistics (ONS) confirmed the dire state of the UK economy as the final quarter of last year contracted 0.3% from Q3. The condition for a ‘technical recession’ is two consecutive quarters of negative GDP growth , meaning the slight 0.1% contraction in Q3 helped meet the definition.

The elevated bank rate is taking its toll on the economy, but the February CPI data revealed a broad and encouraging drop in inflationary pressures. Should this continue, as the Bank of England (BoE) suggests it will, the pound may come under pressure in the coming weeks. Central banks begin to narrow down the ideal start date for rate cuts but there are still some within the BoE’s monetary policy committee that feel expectations around rate cuts are too optimistic.

Catherine Mann is one such critic, pointing towards the fact that the UK has stronger wage growth data than both the US and EU and to align rate cut expectations with these two nations is not accurate.

Jonathan Haskel echoed the same sentiment, according to reports from the Financial Times, stating that rate cuts should be “a long way off”. Haskel also mentioned he does not think the headline inflation figures provide an accurate picture of the persistence of inflationary pressures. Mann and Haskell were the final two hawks to succumb to the broader view within the MPC to keep rate on hold.

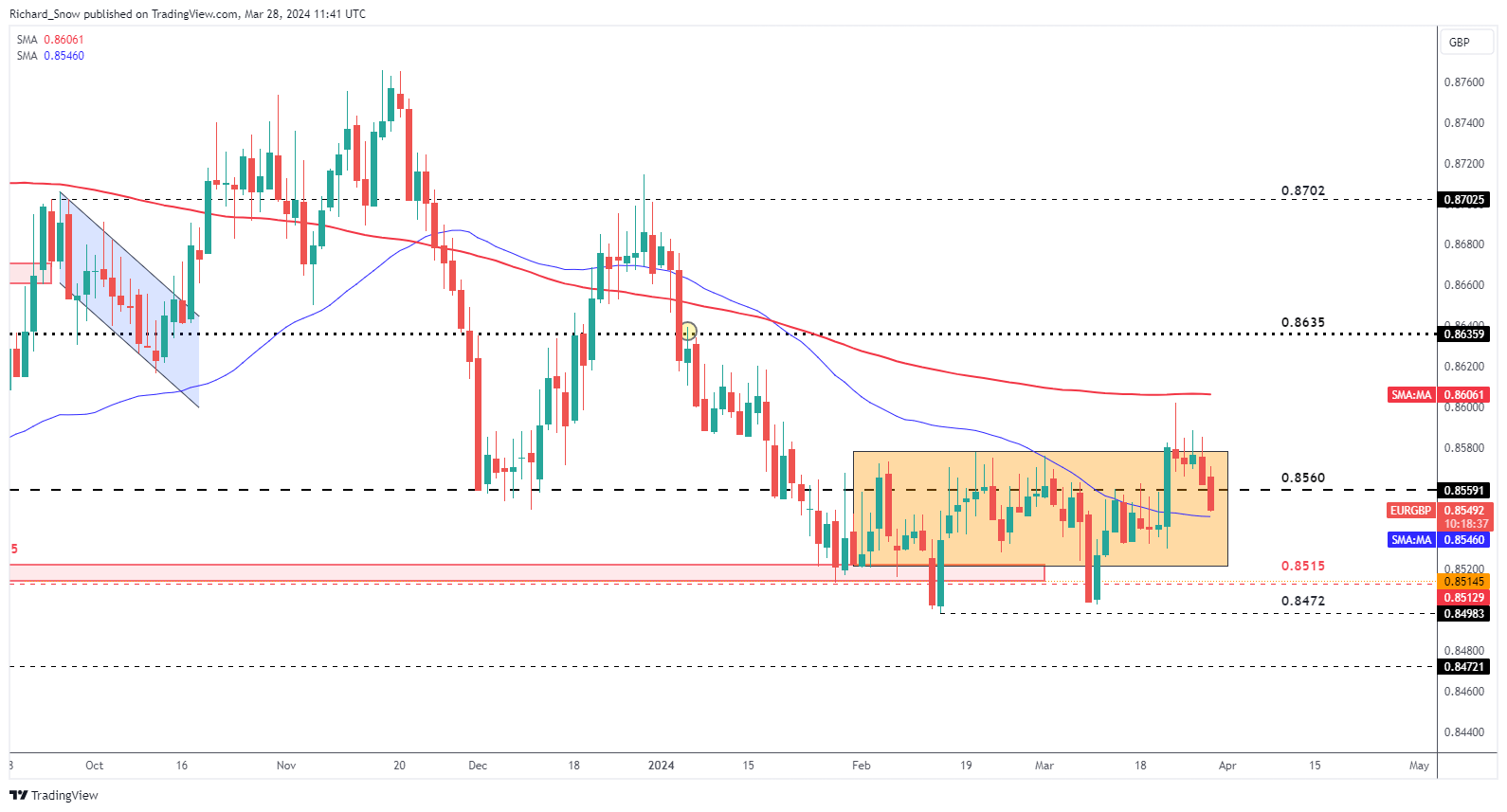

EUR/GBP Heads Lower, Back into the Prior Trading Range

EUR /GBP failed to retest the 200-day simple moving average (SMA) and subsequently dropped, so much so, that the pair is trading once more, within the broader trading channel. Numerous attempts to breakout of the channel fell short, as sufficient volatility remains a problem across the FX space.

EUR/GBP broke below 0.8560 and now tests the 50-day simple moving average, followed by channel support down at 0.8515. The euro appears weak as markets now look towards a 50% chance of a potential second 25 basis point cut in July. Multiple ECB member shave come out in recent weeks referring to the June meeting for that first rate cut.

EUR/GBP Daily Chart

GBP/ USD is one of the most liquid and most actively traded FX pairs in the world. Acquire a solid foundational knowledge that all traders should know, below:

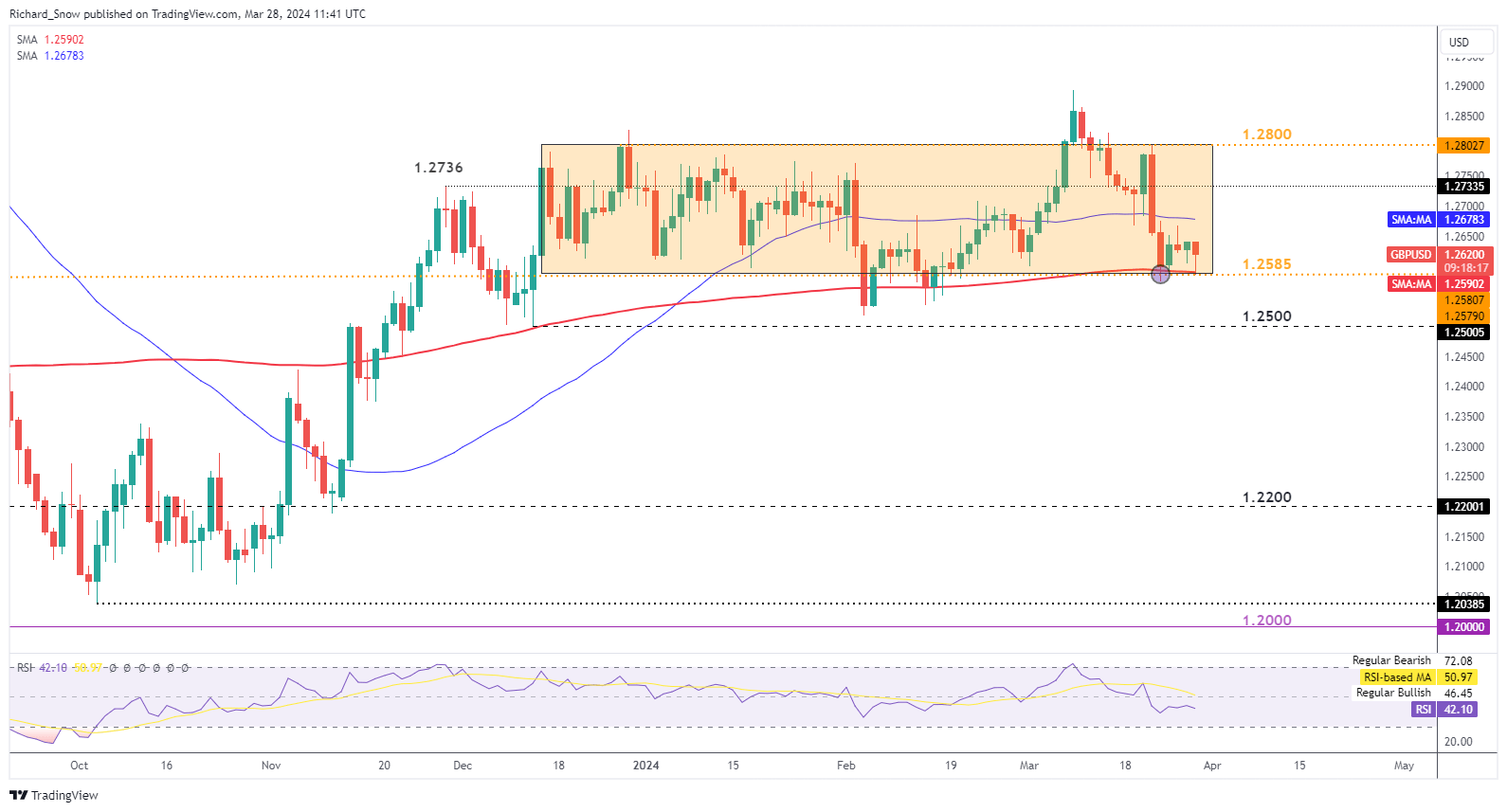

GBP/USD Attempts to Lift Off of Channel Support

GBP/USD appears to have found a short-term floor at channel support (1.2585), which also coincides with the 200 SMA. Should sterling find some strength from here, the 50 SMA is the next gauge for bulls, with 1.2736 as a potential target followed by a return to 1.2800. Support remains at 1.2585.

There is a fair amount of US data between now and next Friday. Later today we anticipate final Q4 GDP to remains the same when the final data comes in then on the Good Friday holiday, US PCE data and Jerome Powell’s speech become the focal points. Next week, US ISM services data and jobs data will be the pick of the bunch. Employment figures are anticipated to moderate slightly to 200k and of course, be mindful of a potential revision to the prior print as has been the trend.

GBP/USD Daily Chart

Stay up to date with the latest breaking news and themes driving the market by signing up to our weekly newsletter:

Trade Smarter - Sign up for the Newsletter

Receive timely and compelling market commentary from the team