GBP/USD Price and Analysis

- GBP/USD edged back above the 1.2600 line.

- Markets are pretty sure US rates will start to fall in June.

- US Durable Goods orders will be the next trading hurdle.

The British Pound inched back above the 1.26 mark against the United States Dollar in Monday’s European session as expectations of June interest-rate cuts sent the Greenback broadly lower.

Recent commentary from the Federal Reserve has left markets pretty sure that this year will see borrowing costs fall, possibly quite substantially. The Chicago Mercantile Exchange’s ‘Fedwatch’ tool now shows markets all but certain that the starting gun will be fired on this process at June 12’s monetary policy meeting, with the probability of a rate cut then put above 70%.

There will be plenty of economic data between then and now, of course, and any move will likely depend on continued durable falls for inflation . But, for now, at least, markets are taking the Fed at its word.

For its part the Bank of England has also suggested that its own rates may well have peaked, but sticky inflation strongly suggests that it won’t be cutting them before the Fed.

The Pound may still be getting some support from credit-rating agency Fitch. It raised the UK’s AA- debt rating to ‘stable’ from ‘negative’ on Friday. That day also brought news that retail sales had been flat in January, despite some awful weather reducing in-store footfall, when economists had feared a slide.

The overall picture of the UK as an economy recovering modestly from a mild recession is not exactly spectacular but, as so often of late, at least more upbeat than initial forecasts.

Near-term GBP/ USD trading cues are likely to center around Tuesday’s release of heavyweight durable goods order numbers out of the US, but there is some UK interest this week, on Thursday when final fourth-quarter Gross Domestic Product numbers will be released.

GBP/USD Technical Analysis

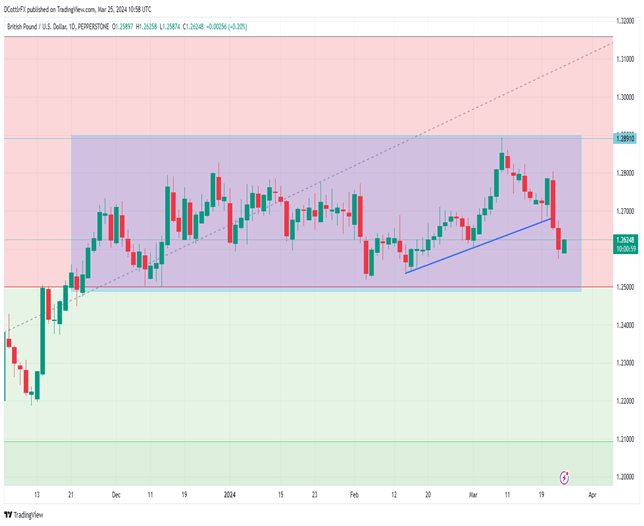

GBP/USD Daily Chart Compiled Using TradingView

Sterling has broken below an uptrend line on its daily chart which had previously supported the market since mid-February.

Bulls seem reluctant to let psychological support at the 1.26 handle go without a fight, and their ability to defend it on a daily closing basis may be key to direction this week. Falls below it would probably put the 1.2520 region in focus, where bearish efforts were stymied back in early-mid February. Failure there would be more serious and bring important retracement support at 1.2510 into play. The market hasn’t been below there since the end of November last year.

Bulls will first need to retake resistance at the former uptrend line, which comes in at 1.26716, with the 1.27150 region in focus above that.

The broad trading band between 1.28910 and 1.25010 has been surprisingly resilient and seems likely to endure at least as long as markets believe that UK interest rates will remain higher for longer than those in the US.

| Change in | Longs | Shorts | OI |

| Daily | 0% | -9% | -4% |

| Weekly | 2% | -6% | -1% |